Betterment vs. Wealthfront vs. M1 Finance – What Are the Differences Between These Robo-Advisors?

Sometimes it seems like robo-advisors are all just variations of one another: there are multiple free robo-advisors on the market, and many offer affordable minimum balances. So how do you choose from a list of three similar robo-advisors – Betterment vs. Wealthfront vs. M1 Finance Robo-Advisor?

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Instead of drawing names out of a hat, this comparison of Betterment vs Wealthfront vs M1 Finance will help you see the differences between these three robo-advisors so you can make an educated choice.

Betterment vs Wealthfront vs M1 Finance

Overview

These three robo-advisors are all low-fee, relatively low-minimum investment robos. Actually, M1 Finance does not charge investment management fees for its basic service.

They’re also all highly ranked robo-advisors on Robo-Advisor Pros and show up frequently on lists like best robo-advisors for millennials. They do have some differences, however, and one of the ways they differ is in what they choose to emphasize for their clients.

Betterment is a goals-based robo-advisor. Investors can set up multiple goals depending on their financial needs (such as retirement, a wedding, or sending a child to college). Betterment also offers different account levels; Digital clients get basic robo-advisor services, while Premium clients are able to meet with human financial advisors.

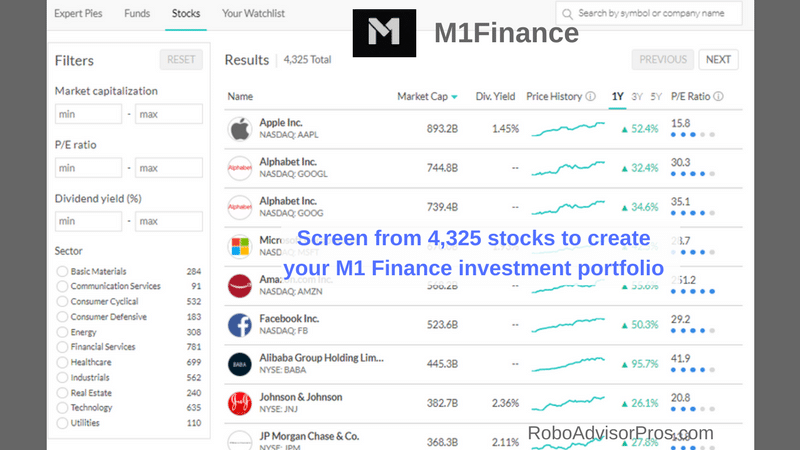

M1 Finance is a customizable robo-advisor that makes it easy for investors to curate their investment portfolios. This free robo-advisor offers pre-made portfolios for those who want to go with a simpler option; however, investors who want full control of their investments will find that M1 Finance offers over 5,000 stocks and diversified ETFs.

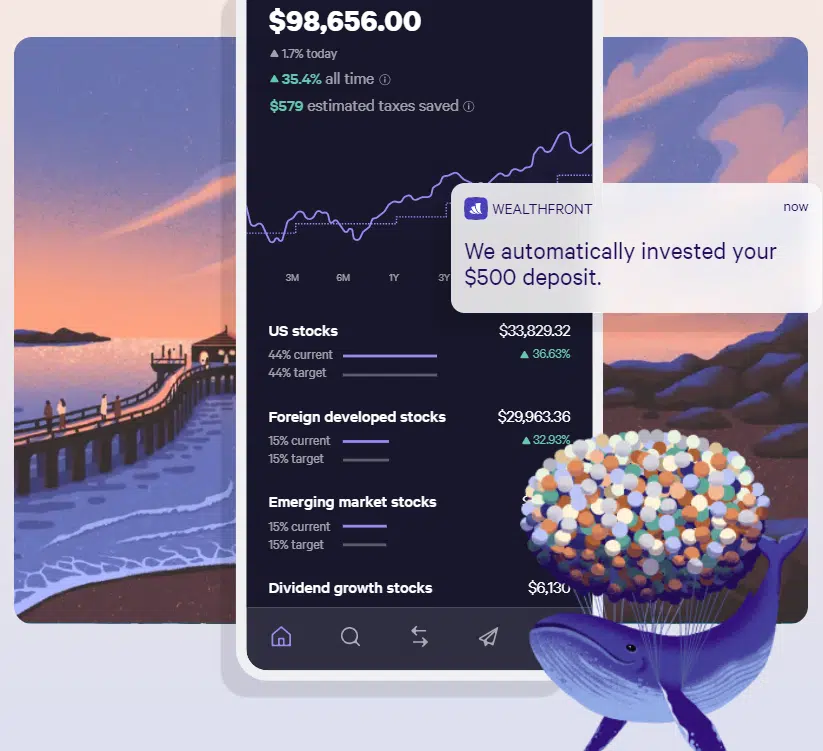

Wealthfront focuses on ensuring its clients are making the most of their money through daily tax-loss harvesting and portfolio review. This robo-advisor makes use of automated investment management, and artificial intelligence powered advice with a comprehensive digital financial planner. Wealthfront also offers you the chance to change out some of the funds in your portfolio or create your own investment mix from more than 200 ETFs. And, Wealthfront recently added two cryptocurrency funds so investors can now invest in bitcoin and ethereum. Or, craft your own ETF portfolio, for Wealthfront to management.

Of course, all three robo-advisors are secure and offer regular investment rebalancing.

Betterment vs. Wealthfront vs. M1 Finance Top Features

In the Betterment vs. Wealthfront vs. M1 Finance debate, it’s easy to see that each robo is a good value for investors. However, they differ in some of their top features.

Betterment:

- Goals-based investing strategies.

- Tax-loss harvesting.

- Access to human financial planners.

- Smart beta, income and socially responsible investing.

- Betterment Savings Account – High Yield Cash Management, through partner banks.

- Zero account minimum, with $10 to start investing.

Wealthfront:

- Path Financial Advisor helps with life changes and future planning.

- Tax-optimized direct investing in individual stocks (for investors with over $100k).

- Daily tax-loss harvesting.

- Create your own investment portfolio or tweak the recommended one.

- Wealthfront Borrow – line of Credit

- Wealthfront high yield cash account

- Access to 200+ additional ETFs and 2 Crypto funds

- Fee-free stock trading account

M1 Finance:

- Free investment management

- Pre-made portfolios for investing, retirement, income, hedge fund model and more.

- Portfolio customization-can design own portfolio and choose from 1,000’s of stocks and ETFS.

- Borrowing and cash management for customers.

- Cryptocurrency, digital coin investing.

- M1 Plus offers more features for investors (for $125 per year).

Bonus: M1 Finance Promo Codes

Betterment vs. Wealthfront vs. M1 Finance Who Benefits?

M1 Finance is best for:

- DIY investors who want to create their own portfolios and have M1 manage the investments.

- Those seeking pre-made investment portfolios and investment management.

- Diversified investors seeking access to crypto.

- Cost conscious clients looking for fee-free investment management.

- Those who want borrowing and cash management.

M1 Finance is an ideal robo-advisor for individuals who want access to both pre-made investment portfolios and the ability to customize their portfolios. Users can make their portfolios as personalized or simple as they’d like! This is the only robo-advisor which allows investors to buy individual stocks and funds. Like Wealthfront, M1 Finance also offers a loan feature.

Betterment is best for:

- Investors seeking diversified, goal based investment portfolios.

- Anyone who wants access to financial advisors, for an additional fee.

- Those seeking tax-loss harvesting.

- Investors seeking ready-made cryptocurrency portfolios.

- Investors who want socially responsible and smart-beta portfolios.

Betterment makes it easy for investors to visualize their path to their goals. Those with more than $100,000 will appreciate the premium program with access to Certified Financial Planners, for an additional fee. Digital customers can purchase low cost financial planning meetings for specific questions like retirement or college planning. If you’re just getting started, Betterment has no investment minimum with only $10 to begin investing. If you need cash flow, you can select an income portfolio.

Wealthfront is best for:

- Investors seeking an all digital platform with the opportunity to customize portfolios or create their own-including access to cryptocurrency.

- Those who would like a risk parity fund or individual ETFs and crypto funds.

- Those comfortable with an all-digital platform with exceptional online financial planning guidance.

- Individuals who want access to cash management and borrowing.

- Investors who also want a 529 college planning account.

- Investors who want individual stock trading along with managed robo-advisory portfolios.

Wealthfront markets themselves to millennials, and it’s easy to see why. This robo-advisor boasts low fees, and emphasizes helping users save on taxes through tax-optimization strategies and tax-loss harvesting. The Path digital financial planner is comprehensive and ideal for the tech-savvy investor who’s happy with an all-digital investment manager. The Wealthfront portfolio line of credit is handy if you need cash and don’t want to sell investments. M1 Finance also offers a loan feature.

Fees and Minimums

Fees

Winner: M1 Finance.

All three of these robo-advisors are in the top four robo-advisors with the lowest fees, which is great news for investors who want to use Betterment, Wealthfront, or M1 Finance for their investment needs.

M1 Finance is the leader in terms of fees; this robo-advisor offers zero account management fees. There is a low-fee premium M1 Plus available with added features.

Wealthfront and Betterment Digital aren’t too far behind, charging only 0.25% AUM on their accounts. With fee-free cash management, through partner banks.

Betterment charges 0.25% AUM for their Digital accounts, and 0.40% for Premium clients with $100,000 or more. The Premium account provides access to financial advisors, while Digital clients can pay a few hundred dollars for targeted financial planning packages. Fee free cash management through partner banks is also available.

Minimum Investment Amounts

Winner: Betterment, with M1 Finance a close second.

When it comes to minimum investment amounts, Betterment doesn’t have a minimum investment amount and requires only $10 to begin investing..

M1 Finance investors need a $100 minimum balance.

Wealthfront investors will need $500 to start a portfolio,

Since these three robos vary in terms of fees and minimum balance requirements, it is difficult to rank them in terms of value; each brings something unique to the table while still offering affordable service.

Although if you’re seeking free investment management, and have $100, then M1 Finance might be for you.

Betterment vs. Wealthfront vs. M1 Finance Deep Dive

Learn the details of where each platform shines or falls short. Review this information with an eye towards the features that you find most important.

Socially-Responsible Investments

Winners: It’s a tie.

All three platforms have access to socially responsible investments. In fact, wealthfront just added several new sustainable, socially responsible ETFs.

Wealthfront has several distinct strategy-oriented ESG platforms. While M1 Finance has a variety of pre-made socially-responsible portfolios or you can craft your own. Betterment also offers a socially responsible investment option.

Tax Optimization

Winner: Wealthfront

Wealthfront offers daily tax loss harvesting. For investors with large accounts Wealthfront goes beyond basic tax-loss harvesting offered by other robos; Wealthfront’s US direct investing for clients with portfolios valued over $100,000 claims to increase returns through strategic TLH.

Betterment also offers tax loss harvesting.

Human Financial Planners

Winner: Betterment

Digital customers have access to a variety of low-fee financial planning meetings for retirement, college, or a portfolio review conversation.

Premium customers, with $100,000 or more to invest get unlimited access to Certified Financial Planners for more in depth finance and investment advice, for a reasonable fee.

Although the Wealthfront Path is a digital financial planner, it is programmed to answer more than 10,000 money and investing questions. Wealthfront Path is the closest software that we’ve encountered to emulate a human financial advisor. It’s also available to the public, free of charge.

High Yield Cash Account

Winner: Wealthfront

We all need cash to cover emergencies and short term goals. High interest rate cash accounts benefit your saving efforts with higher interest payments. Betterment, Wealthfront and M1 Finance offer fee-free high yield cash accounts. To earn the highest yields at M1 Spend, you’ll need to sign up for the M1 Plus account.

Wealthfront Cash Account

- Fee-free cash account with debit card, checking (individual accounts only) and bill pay.

- Joint accounts are available.

- The Wealthfront Cash Account is safe and protects your cash from loss with Wealthfront FDIC insurance through partner banks up $4 million for joint accounts and $2 million for individual accounts.

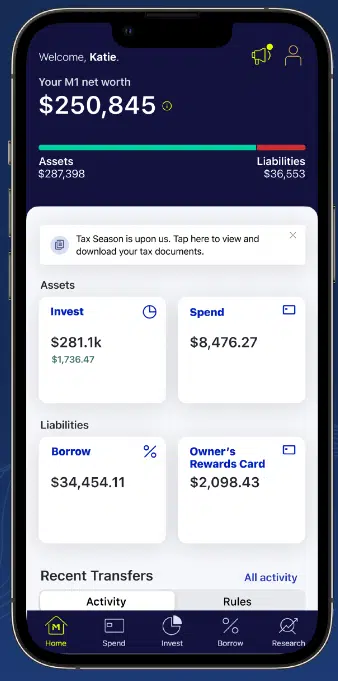

M1 Spend

- M1 Finance Spend – Basic is fee free. The interest-bearing checking account and cash back debit card do not offer interest on your cash or cash back on the debit card.

- While M1 Plus (with $125 annual fee waived for the first three months), offers enticing features like a 1% cash back debit card and high interest paid on your cash balance. Four fee-free monthly ATM withdrawals per month is also a benefit.

M1 High Yield Interest Rate – 5.0% APY*

*For M1 Plus clients.

Betterment Cash Reserve and Checking Accounts

Both Betterment cash accounts are serviced through partner banks.

- Fee free debit card, joint accounts available, FDIC insurance through program banks up to $1 million.

- Checking account – For your day-to-day financial transactions.

- Cash reserve account – A high yield cash account that offers high returns for the ready cash that you’ll need in the short and intermediate term.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

College Savings Plans

Winner: Wealthfront.

Wealthfront is the only one of these robo-advisors to offer College 529 accounts. While Betterment and M1 Finance certainly offer a large spread of account types (including business accounts, IRAs, and trusts), investors who want to help finance their children’s education will be drawn to this unique offering.

FAQ

Is Betterment Better Than Wealthfront?

Is M1 Finance Legit?

Do You Have a Robo-Advisor Quiz?

Betterment vs. Wealthfront vs. M1 Finance Comparison: The Takeaway

These three robo-advisors are much different than they seem on the surface. Each one is affordable, with low (or no!) management fees and minimum required investments of no more than $500.

However, each robo-advisor has a unique emphasis that makes them appealing to diverse groups of investors:

Betterment is best for new investors with little money and those seeking financial advisor access, for additional fees.

M1 Finance is best for investors seeking fee free investment management and access to thousands of individual investments and pre-made portfolios.

Wealthfront is best for those seeking to customize their investments-including cryptocurrency-with hundreds of additional ETFs and daily tax-loss harvesting.

Before choosing Betterment vs. M1 Finance vs. Wealthfront for your financial needs, it’s crucial to look closely at these differences to determine which of the three robo-advisors is most likely to help you reach your goals.

In sum, we like each of these robo-advisors and the best way to make your decision is to consider what you are seeking in an investment manager.

Read the expert robo-advisor reviews or go directly to the individual websites:

For Free Investment Management:

Anyone can use the Path digital financial planner tool, whether they are a Wealthfront customer or not.

Read the Complete Betterment Review

Read the Complete M1 Finance Review

Read the Complete Wealthfront Review

Related

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.