SigFig vs. Empower (formerly Personal Capital) —Overview

Sometimes the choice between robo-advisors is cut and dried. Maybe two robos are evenly matched in terms of services, but one is free. Or maybe there’s one key feature you’re looking for — like a robo-advisor specifically for women — that makes your choice easy. But if you’re looking for free portfolio trackers with an option for paid investment management, today’s showdown between SigFig and Empower (Personal Capital) might be a little too close to call.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is SigFig?

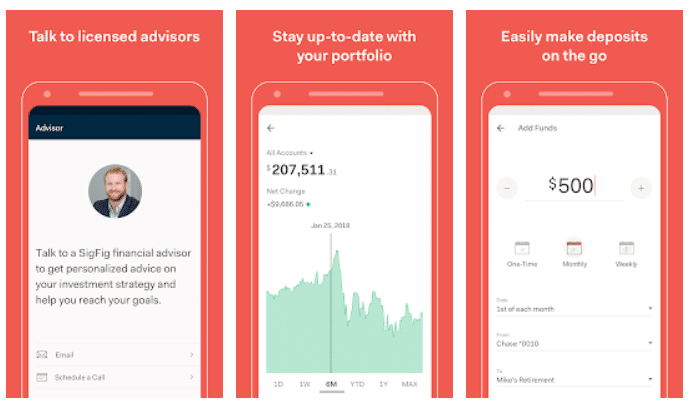

SigFig is an investment management platform for clients who have assets at Fidelity or Charles Schwab.

There are two key product offerings available at SigFig: a free portfolio tracker and a paid financial management offering.

The portfolio tracker option is free to all clients, regardless of whether they also have managed assets with SigFig.

SigFig is unique as it offers account management for clients whose assets are held elsewhere, not with SigFig . Unlike other robos, which require clients to open financial accounts held with the robo-advisor in question, SigFig simply links to your account at Fidelity or Charles Schwab, and oversees the investment management from there.

Even though accounts are held at Schwab or Fidelity, clients receive investment management and investment advice from a SigFig financial advisor. SigFig’s wealth management tools also make recommendations for investment strategies that are aligned with your goals, time horizon and risk tolerance level.

What is Empower (Personal Capital)?

Empower is an automated investment manager or robo-advisor, designed to manage assets for wealthy investors. While it does not provide wealth management for accounts held at different brokerage firms, Empower does have a comprehensive free tracker to help clients keep an eye on their financial goals and track how well their current investments are meeting those goals. The Empower dashboard and free investment management tools include retirement planning, fee analysis, investment check up, spending and saving guidance.

As far as free asset management tools goes, the tools available at Empower stand out.

Empower offers professional wealth management as well. Empower clients benefit from human financial advisors, cash management, and tax optimization — but it comes with a hefty account minimum and higher fees than most robo-advisors on the market today, yet still below fees charged by traditional financial advisors. That said, you’ll get access to Certified Financial Planners and top-notch financial planning advice. Wealthier investors also receive tax, estate and comprehensive wealth management services including access to private equity and hedge funds.

SigFig vs. Empower —Top Features

Empower Top Features

- Free investment tracker for all, which can be linked to bank accounts, retirement accounts, and more

- Free comprehensive retirement planning tools

- Managed assets must be $100,000 at minimum

- Account management fees decrease as account value goes up; 0.89% AUM for accounts valued between $1M and $2.9M to 0.49% AUM for accounts valued over $10M.

- Unlimited access to Certified Financial Planners

- Full financial plan with diverse asset allocation

- Tax-loss harvesting

Empower Free Investment and Financial Management Tools

SigFig Top Features

- Free investment tracker, which can be linked to existing accounts at multiple investment firms

- Free portfolio management for accounts ranging from $2,000 to $10,000; 0.25% AUM for accounts over $10,000

- Unlimited access to human advisors

- Assets held at Fidelity or Charles Schwab – no need to transfer them

- Tax-loss harvesting

SigFig vs. Empower — Who Benefits?

Which robo-advisor you choose will depend on how much money you have to invest upfront. SigFig requires only $2,000 to get started. While this is out of reach of some new investors, it is much more affordable than Empower: Empower clients will need to invest at least $100,000 to get started with the financial management.

For free investment management tools, Empower is the best and most comprehensive choice. The Empower free tools link all of your financial accounts, including banking, lending, and investment and offers more comprehensive reporting and recommendations. There are no fees or investment minimums to access the free financial toolkit.

For account management, SigFig is also more affordable. Clients pay no account management fees until their accounts are worth more than $10,000; after that point, clients will pay 0.25% AUM.

However, wealthier investors might benefit from Empower. Wealthier individuals receive complete financial planning services, like you get at a traditional financial advisor, although for lower fees.

These two robo-advisors are similar in two categories: they both give clients access to human financial planners, and they both have free financial tools that let clients oversee their many investments, regardless of where those investments are held. Although Empower’s free tools are more comprehensive than SigFig’s, and Empower offers more comprehensive financial planning services than SigFig.

SigFig might be better for investors at the beginning of their financial journey, while Empower excels with higher net worth clientele.

Quick Summary:

- Clients with large investment portfolios benefit most from Empower, especially if their accounts have high enough values to take advantage of Empower’s reduced AUM fees.

- If you want access to a financial advisor, for basic investment questions then either robo-advisor will work for you. For complete financial planning, choose Empower.

- Clients who want a basic free portfolio tracker will like either option. For comprehensive financial tracking tools, choose Empower.

- Those who are just getting started and seeking low minimum, low fee financial management, SigFig is more accessible; their $2,000 investment minimum is much lower than Empower’s $100,000 minimum.

- If you appreciate low fees, SigFig is for you. They offer free asset management for accounts valued up to $10,000. After that, fees are only 0.25% AUM.

Fees and Minimums

There are very big differences between these two robos in terms of fees and investment minimums.

SigFig Fees and Minimums

There is no account minimum or fees required to use the financial tools, such as the investment tracker.

The minimum required to open an account is $2,000. Account management is free up to $10,000. Clients will pay 0.25% AUM on managed assets after that point.

Empower Fees and Minimums

Like SigFig, Empower offers comprehensive free, no-minimum balance required financial tools.

The account minimum to become a Empower client is $100,000. They have a tiered fee structure that changes as your portfolio balance rises. Fees start at 0.89% AUM for $100,000 to $2.99 million under their Investment Services and Wealth Management plans. After that, investors are moved to the Private Client plan, with the following fee structure:

- 0.79% AUM (first $3M)

- 0.69% AUM (next $2M)

- 0.59% AUM (next $5M)

- 0.49% AUM (over $10M)

SigFig vs. Empower — Deep Dive

Besides fees and minimums, what sets these two robos apart?

SigFig vs. Empower — Free Tools

Both sites offer two services: free investment management and analysis tools and paid investment management.

The free tools across both platforms offer a view of your investment portfolio. They both allow you to sync accounts, so that you’re looking at near-live time updates on your account values, although only Empower syncs bank and lending accounts. Of the two, Empower offers the most bells and whistles.

SigFig vs. Empower — Human Financial Planners

Both robo-advisors offer their clients access to a human financial advisor (or team of advisors). Quite a few robo-advisors have financial advisors as well.

Empower financial advisors are CFPs and offer complete financial planning to paid users. While SigFig’s financial advisors are best suited for basic money questions. SigFig lack’s comprehensive financial planning services.

Wealthier individuals with more complex financial planning needs and seeking personalized planning guidance will be better served by Empower’s CFP financial advisors.

SigFig vs. Empower — Tax-Loss Harvesting

Empower and SigFig both offer tax-loss harvesting. This is also a common feature among robo-advisors and can save you some money when tax time rolls around.

SigFig vs. Empower — Investment Types

These two robos aim to help clients diversify their investments. Both platforms offer the basic six main asset classes. Asset allocations depend on your risk tolerance and goals. In general, you will receive sufficient diversification from either robo-advisor.

SigFig Investments

SigFig invests your portfolio in ETFs from these asset classes: U.S. stocks and bonds, developed and emerging market stocks, U.S. Treasury securities (short-term), bonds and real estate.

Empower Investments

Empower offers a wider breadth of investment choices. Beyond stock and bond ETFs Empower offers private equity and hedge funds, depending upon the account size. Smaller accounts will include ETFs from these asset classes: stocks and bonds (U.S. and International), cash, and alternatives such as real estate, gold, energy, and other commodities.

SigFig vs. Empower — Dividend Reinvestment

Another common feature shared between Empower and SigFig is that both offer dividend reinvestment. If you want to keep your money growing, this is a quick way to do so.

SigFig vs. Empower — Account Types

When it comes to the sort of account you can open, Empower account types are more extensive.

Empower account types include:

- Taxable accounts (individual and joint)

- Traditional, Roth, rollover, and SEP IRAs

- Trusts

- Cash accounts

While you cannot open a 529 plan or 401(k) through Empower, your financial planner may advise on these accounts if you hold them elsewhere.

SigFig account types include:

- Taxable accounts (individual and joint)

- Traditional, Roth, SEP, rollover, and Simple IRAs

SigFig’s website indicates that they are working on providing clients with 401(k) and 529 plan support in the future.

SigFig vs. Empower — Socially Responsible Investing

Here’s one area where Empower shines: they offer Socially Responsible Investing, or SRI.

If you’re looking for a more affordable robo for beginners, M1 Finance, which also offers SRI, might be a better option, with FREE investment management for all users.

SigFig vs. Empower — Security

Both of these robos take security very seriously. Clients are protected with 256-bit encryption, for example. Two-factor authentication and fingerprint security options are available as well.

Clients can also rest assured that SIPC —the Securities Investor Protection Corporation — insures their investments against corporate malfeasance and closure.

SigFig vs. Empower — Which is Best? The Takeaway

These two options are very evenly matched in some important ways. Both offer tax-loss harvesting, account rebalancing, and dividend reinvesting. They also give access to human financial advisors, so clients have a person to talk to when they have questions or need advice.

Where they differ, however, is in their target clientele. Empower focuses on higher valued accounts. Their target investor has at least $100,000 to invest immediately, and those with larger accounts receive a range of additional benefits and services.

SigFig, on the other hand, is appealing to investors with between $2,000 and $10,000 because of their free account management. They’re on our list of lowest fee robos, too, because their 0.25% AUM fees on accounts over $10,000 is very reasonable.

Finally, both options offer free portfolio tracking tools which give clients a look at their investment accounts over time. These tools are available to investors who don’t pay for account management, too, which might be appealing for those who want to try out one of these platforms without moving their investments over.

All things considered, the real deciding factor may be how much you have to invest and whether you’re willing to pay higher fees for premium advice and investment management.

Read the reviews:

Related

- Empower vs. Mint vs. Quicken

- Empower vs. Betterment

- SoFi Invest vs. Wealthfront

- Empower vs. Wealthfront

- Empower Cash Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.