Ally Invest Robo Portfolios is Free*!

Best known as one of the top online banking platforms, Ally Bank acquired TradeKing in 2016, forming Ally Invest. This division serves as Ally’s investment arm, offering a robo-advisor platform along with self-directed investing that includes stocks, bonds, mutual funds, ETFs, options, Forex and futures.

The TradeKing robo-advisor was restructured into Ally Invest Robo Portfolios (originally named Ally Invest Advisors). But Ally Robo Portfolios isn’t simply TradeKing Advisors renamed.

Ally Invest Robo Portfolios has revamped nearly every corner of the original platform, essentially creating a new robo-advisor.

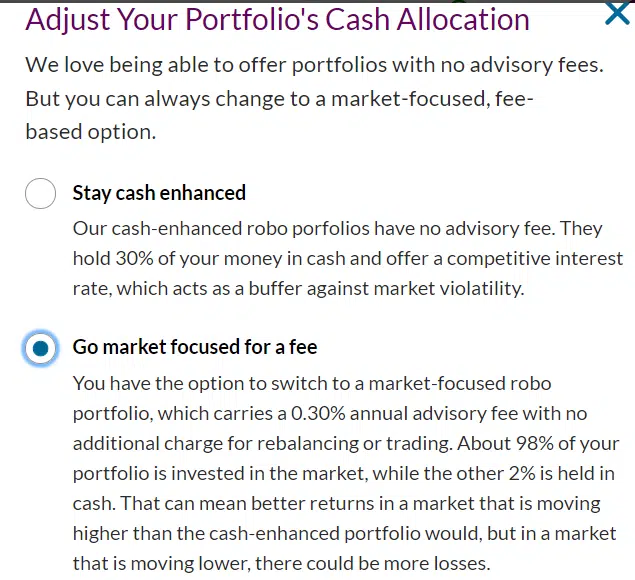

*To be eligible for the fee-free investment management your portfolio must include a 30% cash cushion.

Ally Invest Cash-Enhanced Managed Portfolios Review

Name: Ally Invest

Description: Free robo-advisory investment manager with access to stock trading and more financial services through Ally Bank.

-

Fees

(3.75)

-

Investment Choices

(4.5)

-

Ease of Use

(5)

-

Tool & Resources

(4.8)

Summary

Best for:

- Investors seeking one home for all money matters – banking, managed investing and self-directed trading.

- Beginning investors seeking low fee investment management.

- Retirees seeking income portfolio.

Pros

- Low-fee diversified fund choices, including SRI

- Conservative income portfolios available

- Low minimum investment amount

Cons

- To get free investment management you must agree to a 30% cash allocation.

- No dedicated managed portfolios app.

Ally Invest Robo Portfolio Review (Formerly Ally Invest Managed Portfolio) Latest News:

- ZERO account management fees (must maintain 30% cash allocation).

- Minimum investment amount lowered to $100

- Tax optimized offering available

- Socially responsible investments

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Ally Invest Robo Portfolios Features at a Glance

| Overview | Automated investment management robo-advisor platform |

| Minimum Investment Amount | $100 |

| Fee Structure | Zero management fees for portfolios with 30% cash. cash assets. 0.30% AUM for fully invested portfolios. |

| Top Features | Goal-based robo-advisor with access to Ally Bank and Ally Invest self-directed investing. Low-fee diversified. ESG and tax-optimized portfolios. |

| Contact & Investing Advice | 24/7 phone customer service, chat, email. |

| Investment Funds | Low-cost US and global stock and bond ETFs. |

| Accounts Available | Individual and joint taxable accounts; Traditional, Roth and Rollover IRAs; custodial accounts. |

| Promotions and website | Visit Ally. None for the robo-advisor. Self directed investors have promotions at Ally Invest.Visit Ally. None for the robo-advisor. Self directed investors have promotions at Ally Invest. |

What is an Ally Managed Portfolio?

So, you may be wondering “How do Managed Portfolios Work?”

Before we get into the Ally Invest Robo Porfolios Review, it’s helpful to understand managed portfolios.

An investment portfolio is simply the stocks, bonds, mutual and exchange traded funds that you own. If you select these financial assets on your own, then you are managing your own portfolio.

Yet, if you prefer to have your investments selected and managed for you, then a robo-advisor or managed portfolio will select the investments, in line with your preferences and rebalance according to your wishes.

Read this Ally robo-advisor review and learn all about how it works and who the Ally Invest Robo Portfolios are best for.

What Differentiates Ally Invest Robo From Competitors

Ally Invest Managed Portfolios is distinct in its investment fund offerings. The Ally robo-advisor offers excellent diversification with eight or nine funds. We like the addition of three market cap stock funds; large, medium and small cap ETFs. Additionally, their bond ETF offerings are good, with access to mortgage backed bonds and a global bond ETF in addition to the typical fixed income funds.

Ally Invest Robo Portfolios also offers tax-optimized portfolios. This is beneficial for taxable accounts and may reduce taxes and maximize returns. Although, this is not the same as tax-loss harvesting, which can further lower taxes.

Further, Ally Invest Robo Portfolios belongs to the Ally family. This places Ally Invest Robo Portfolios in a similar camp as, Chase You Invest and US Bank Automated Investor robo advisors that belong to a financial services company.

Ally offers an entire suite of financial services:

- Ally Invest. Ally Invest is a do-it-yourself investment platform, with a wide range of investment options. They also offer fee-free stock and ETF trading. Fees for bonds and other assets are also reasonable.

- Ally Bank. The bank offers some of the very highest interest rates for online savings accounts and certificates of deposit. They’re known for their interest-bearing checking account – with an ATM card. Ally Bank earned a “Best Online Bank” ranking from Money Magazine in 2018.

- Loans. They offer a Visa card through TD Bank and provide home mortgages. But on the lending side, their specialty is auto loans. As the successor to General Motors Acceptance Corporation (GMAC), Ally Bank offers a wide range of both loans and leases.

If you’re seeking a one-stop financial management portal with managed accounts, banking and self-directed investing then Ally should be considered.

What are the Ally Invest Managed Portfolio Fees?

The advisory fee is zero as long as you hold a 30% cash allocation. If you prefer to be fully invested, then the fee is .30% of assets under management and is charged within the first 10 days of the month for the previous month. There are no trading fees charged for buying and selling asset positions.

As is the case with most exchange traded funds, there is a small management fee that is charged by the specific fund. Ally’s average ETF expense ratio is a low 0.06% and paid directly to the fund.

The 0.30% Ally Invest Managed Portfolios fee is a bit higher than competitors although the zero management fee is on par with M1 Finance, Schwab and Axos Invest.

The minimum investment amount is an affordable $100, making it accessible to most investors.

Who Benefits from the Ally Invest Robo Portfolios Robo-Advisor?

If you’re wondering, “Who should consider Ally Invest Robo Portfolios,” here’s your answer.

The Ally robo-advisor might be a fit for investors who lack either the experience or the motivation to manage their own investments. You’ll have the opportunity for professional investment management at a fraction of the cost for traditional human investment managers.

If you are willing to hold a 30% cash allotment in your portfolio, invested in a high yield cash account, then there are zero account management fees.

For those who prefer a lower cash allocation the advisory fee is 0.30%. This means that a $100,000 portfolio can be professionally managed for zero management fees with a 30% cash allocation or $300 per year with a lower or no cash allotment. This is in the mid-range of the robo-advisor fee spectrum. You will find lower management fees at Betterment, Wealthfront, and Schwab Intelligent Portfolios.

And beyond the robo-advisor service itself, working with Ally gives you direct access to Ally Invest for self-directed investing, and Ally Bank, for both high interest savings accounts and innovative loan programs.

If you want 24/7 phone customer service then the Ally Invest Robo Portfolios might fit the bill! The chat and email access round out the accessible customer service.

Existing Ally customers who want a one stop shop for both managed robo-advisor investing and access to DIY investment tools and banking might consider the platform. Check out this Ally robo-advisor review to answer all of you questions.

Sign up for best investment and money management software. It’s free!

Is Ally Invest good for beginners?

The Ally Invest Managed Portfolios might be suitable for beginning investors. You can start with the managed Ally Invest robo-advisor to oversee your investments. Beginners who choose the zero fee investment management option need to understand that this choice yields a more conservative portfolio. We’ll explain more in the Investments section.

As your experience grows, you can try your hand at investing on your own with the Ally Invest stock, bond and fund investment options.

Just be aware that for robo investing, there are other platforms with zero or low management fees such as M1 Finance, Schwab, Betterment and Wealthfront that don’t require a 30% cash allocation.

Ally Invest Robo Portfolios Features

Ally Invest Robo Portfolios provides a professionally managed, fully automated investment service. Your portfolio is based on your specific needs, risk tolerance, investment goals and time horizon. Portfolios are constructed from a number of diversified low-cost index funds.

You also have the ability to influence your asset allocation. Your asset allocation is the percent invested in stock funds vs. bond funds. You can do this by making changes in your investor profile at any time. As is the case with most robo-advisors, you cannot place any trades within your account.

Ally joins Schwab Intelligent Portfolios in a commitment to a cash allocation. To benefit from the zero fee option, your investment portfolio will own 30% cash assets. Although Schwab’s cash allocation is typically under 10%.

A cash position is seen as a form of diversification and acts as a buffer for rebalancing. Ally supports maintaining a cash position as a stabilizing influence on your portfolio. Although, in advancing markets when stock and bond values are growing, the cash cushion will depress returns, when compared with fully invested portfolios.

Investment Strategies

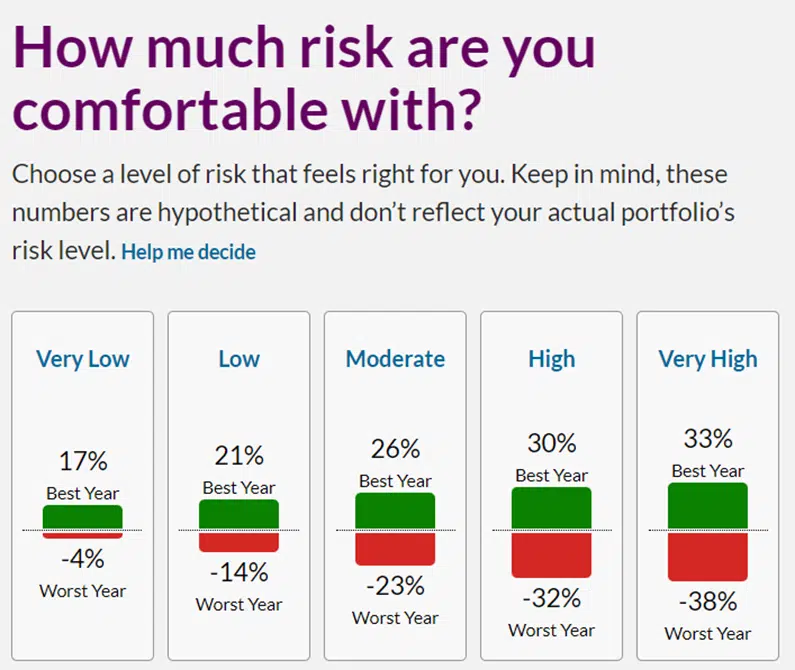

The Ally robo-advisor offers four investment strategies and five risk levels. Each portfolio is crafted to align with your answers to the initial quiz, which considers your financial situation and risk tolerance.

The Ally Robo Portfolios investment style choices are:

Core-This is a basic diversified global stock and bond portfolio.

Income-This portfolio owns more fixed assets and favors income over growth. Lower returns are projected with this more conservative choice.

Tax optimized-This portfolio, for taxable accounts, is geared towards inventors in higher tax brackets, seeking to minimize taxes.

Socially responsible-For investors passionate about ESG – environment, social justice, strong governance – some of the Core ETFs are replaced with socially responsible funds.

The available risk levels target conservative to aggressive investors. The aggressive portfolios own greater percentages of stocks and lesser amounts of fixed bonds and cash. While conservative portfolios project lower returns with less volatility by owning more fixed assets.

Risk vs Return Projections

Each risk level has a specific percent of stock vs bond funds. After completing the initial questionnaire, you’ll receive a portfolio in line with your responses to the quiz. Included will be projected returns along with best and worst case scenarios.

The portfolios are suitable for all types of investors from the most risk-averse, conservative folks to those who are willing to some added volatility while pursuing higher returns.

The most conservative – Income Portfolio is designed to preserve your capital and provide income. This option is designed for retirees or those seeking cash flow from their investments.

Another aspect we like is that you can change your asset allocation at any time, should your needs or risk tolerance change.

Take the no obligation risk quiz to get a glimpse of your recommended portfolio:

Investment Funds

Ally Invest Robo Portfolios uses ETFs issued by well-regarded investment companies, Vanguard and iShares.

The funds are low-fee, diversified and liquid (that means that they’re easy to buy and sell). The diversification helps to minimize losses should one sector fall out of favor.

Funds represent the following asset classes:

- US Stocks

- International Stocks

- US Bonds

- International Bonds

- Cash

US Stocks

- iShares Core S&P 500 ETF (IVV)

- iShares Core S&P Midcap ETF (IJH)

- iShares Core S&P Small-Cap ETF (IJR)

International Stocks

- Vanguard FTSE Developed Markets ETF (VEA)

- Vanguard FTSE Emerging Markets ETF (VWO)

US Bonds

- iShares 7-10 Year Treasury Bond ETF (IEF)

- iShares Intermediate Credit Bond ETF (IGIB)

- Vanguard Mortgage-Backed Securities ETF (VMBS)

- iShares National Muni Bond ETF (MUB)

International Bonds

- Vanguard Total International Bond ETF (BNDX)

Socially Responsible Investing

For investors who want to invest with their values and still grow their wealth, Ally offers socially responsible investment funds. The standard stock invetment funds are replaced with SRI funds like:

SRI US Stock Funds

- iShares ESG MSCI USA ETF (ESGM)

- iShares ESG MSCI USA Small-Cap ETF (ESML)

SRI International Stock Funds

- iShares ESG MSCI EAFE ETF (ESGD)

- iShares ESG MSCI EM ETF (ESGE)

Take a look around the platform and find out your recommended investment portfolio with no sign up obligation.

The same portfolio strategy and risk level offers two distinct asset allocations, risk level and returns, based upon your fee choice-fee free or 0.30% AUM fee.

Core Growth Portfolio – Zero Fee vs 0.30% AUM Fee

This section breaks down the differences between the Core Growth Portfolio with the 30% cash cushion and 30% cash and the Core Growth Portfolio fully invested with a 0.30% AUM fee.

The Core Growth portfolio projected returns with zero management fee:

- Average annual return – 5.67%

- Best year – 21.62%

- Worst year – (22.84%)

The Core Growth portfolio projected returns with 0.30% AUM fee:

- Average annual return – 6.91%

- Best year – 30.05%

- Worst year – (31.61%)

Notice that the Core Growth Portfolio with zero management fee and 30% cash projects nearly 1.24% lower returns than the portfolio with the 0.30% management fee.

Next, the asset allocation for the Core Growth Portfolio with and without the 30% cash cushion.

Core Growth portfolio asset allocation with 30% cash and zero management fee:

56% Stocks vs 44% Fixed (bonds and cash)

Core Growth portfolio asset allocation fully invested and 0.30% AUM fee:

78% stocks vs 22% fixed (bonds and cash)

| Zero Fee Management | 0.30% AUM Fee | ||

| Stocks | Weight | Stocks | Weight |

| iShares Core S&P 500-IVV | 20.00% | iShares Core S&P 500-IVV | 28.00% |

| Vanguard FTSE Dev. Mkts. ETF-VEA | 18.00% | Vanguard FTSE Dev. Mkts. ETF-VEA | 25.00% |

| iShares Core S&P Mid-Cap-IJH | 10.00% | iShares Core S&P Mid-Cap-IJH | 14.00% |

| Vanguard FTSE Emerging Markets-VWO | 05.00% | Vanguard FTSE Emerging Markets-VWO | 06.00% |

| iShares Core S&P Small-Cap-IJR | 03.00% | iShares Core S&P Small-Cap-IJR | 05.00% |

| Bonds | Bonds | ||

| iShares 7-10 Year Treas. Bond-IEF | 04.00% | iShares 7-10 Year Treas. Bond-IEF | 06.00% |

| Vanguard Total Intl. Bond-BNDX | 04.00% | Vanguard Total Intl. Bond-BNDX | 06.00% |

| iShares Intermediate Credit Bond-IGIB | 03.00% | iShares Intermediate Credit Bond-IGIB | 04.00% |

| Vanguard Mort-Backed Sec.-VMBS | 03.00% | Vanguard Mort-Backed Sec.-VMBS | 04.00% |

| Cash | Cash | ||

| Cash | 30.00% | Cash | 02.00% |

There’s a problem with the name of cash-enhanced fee-free portfolio. A 56% stock vs 44% fixed portfolio would be better named a moderate growth portfolio and not a growth portfolio. These two options one with a management fee and the other with 30% cash, are for two different types of investors. The cash enhanced option is a much more conservative option while the fully invested choice might even be called moderately aggressive growth with 78% fixed vs. 22% fixed assets.

In conversation with a company representative, he claims that the name ie Core Growth, for the 30% cash portfolio aligns with it’s designation, when the cash is subtracted from the allocation. In this case, removing all but 2% from the cash allocation it is an 78% stock vs. 22% fixed portfolio, just like it’s fee based counterpart.

Investors need to understand these distinctions before investing. Fortunately, the projected risk and return projections reflect the inclusion of the 30% cash cushion in the fee free option.

Extremely conservative investors will gain greater benefit from the fee-free, cash enhanced portfolios.

The best way to choose the appropriate portfolio is to review the projected returns along with the worst and best case scenarios. Then you can determine which asset allocation and fee-structure makes sense for you.

Take a look around the platform and find out your recommended investment portfolio with no sign up obligation.

Automatic Rebalancing

Automatic rebalancing is key feature of all robo-advisors, including Ally. When your investment mix deviates from your preferred asset allocation percentages, the robo-advisor sells the over-performing assets and buys more of those that have fallen in value.

That will return your investment mix to the one you originally selected. This keeps your returns and risk in line with your expectations.

Ally Mobile App

Ally has one general app that enables you to access your accounts with Ally Bank, Ally Invest and Ally Invest Robo Portfolios. There is no mobile app specific to Ally Bank Managed Portfolios.

The app is available for Apple iPhone, iPad, Touch ID and Apple Watch, as well as for Android and Windows Phones. You can make deposits, move money between accounts, pay bills and access cash through your Ally Bank account.

Are Ally Invest Robo Portfolios Safe?

You can be confident that your investment at Ally is safe and follows all of the legal requirements of financial institutions. Plus, they have additional insurance to cover broker failure.

Clearing agency. Ally Managed Portfolios are offered by Ally Invest Securities, LLC. Apex Clearing, Inc. clears and settles trades. Both agencies are members of FINRA and SIPIC.

Account protection. Accounts are protected against broker failure by SIPC, which provides coverage of up to $500,000, including $250,000 in cash. Apex Clearing also maintains additional insurance through a group of London underwriters, for up to $37.5 million in aggregate, including up to $900,000 in cash.

Of course, all investments are subject to the market volatility which means that your investment returns will go up and down.

Tax Loss Harvesting

Ally robo-advisor offers tax optimized investing for taxable accounts. The tax optimization includes the addition of municipal bonds in taxable accounts. Ally doesn’t offer tax loss harvesting which sells securities with losses to offset gains in other assets. Then a similar investment is purchased to replace the one that was sold, to maintain the client’s asset allocation. Tax loss harvesting is used by Personal Capital, Wealthfront, and Betterment.

Sign-up Process

The Ally robo signup is easy.

Requirements:

- Be a citizen or a legal permanent resident of the United States (accounts are not available for nonresident aliens)

- Be at least 18 years old

- Have a Social Security number or, if you’re opening a bank account, your Taxpayer Identification number

- Have a U.S. street address

The sign-up process starts when you click the “Create Your Plan” button. You’ll answer several questions regarding your goals, time horizon from less than 5 to more than 21 years, financial situation, and your risk level-from among five choices. Next, you’re presented with a choice of four portfolio types including Core, Tax Optimized, Socially Responsible or Income.

After choosing your preferred portfolio, you’re presented with the recommended asset allocation which includes a breakdown of specific ETFs and the percent invested in each. You can view the sample Core Growth Portfolio details above.

You’re always shown the zero-fee with 30% cash option and given the opportunity to view the fully invested portfolio which charges a 0.30% AUM fee.

We appreciate the opportunity to view multiple portfolios before signing up.

Once you’re satisfied with your choice, you can choose your account and complete the sign up process.

The account types include:

- Individual

- Joint

- Custodial

- Traditional IRA

- Roth IRA

- Rollover IRA

Learn more about the Ally Invest Robo Portfolios features.

Ally Managed Portfolio Performance

As would be expected, The Ally robo-advisor returns vary based upon the type of portfolio selected. The conservative portfolios are expected to yield lower returns, with less risk. While over the long term, it’s expected that higher risk portfolios will offer higher returns.

One investing rule of thumb is that with higher risk, you can expect your investment values to jump around more than with conservative portfolios. That means that you will typically experience greater highs and lows in the short term with a more aggressive portfolio.

Until 2019, Ally Robo Portfolios showed performance data for each of the five risk tolerance levels. They have since removed that data from their website. Other sources calculate the returns and over the past three years, Ally’s 60% stock and 40% bond portfolio garnered in approximately a 9+% return, in line with many competitors.

We don’t believe that choosing a robo-advisor based upon performance is the best way to go. Especially when it it passively managed and owns index ETFs. That is because your returns will approximate those of the underlying market sectors in the percentages invested. As sectors go in and out of favor, it’s expected that robo-advisor return positions will wax and wane.

In general, the goal of investing with a robo-advisor, unless it is using active management strategies like T.Rowe Price ActivePlus Portfolios, is to match the market returns. Since over the last 100 years of so, a diversified stock portfolio will earn roughly 9% per year and a diversified bond portfolio will earn near 5% per year, most investors will be satisfied with that level of growth.

As previously discussed, in comparison with common investing theory, the Ally Invest Robo Portfolios are allocated significantly more conservatively than comparable portfolios with the same risk levels when examining the fee-free, 30% cash option. Thus investors in these portfolios will expect lower returns in advancing markets and smaller losses when market values decline.

Compare: Ally Invest vs Betterment vs Betterment

Ally Invest Robo-Advisor Pros and Cons

Advantages

- The diversified ETF selection is superior to some competitors’ more vanilla fund choices.

- The low $100 minimum investment amount makes it easy to get started investing.

- Socially-responsible investing increases the competitiveness of the Ally Managed Portfolios platform.

- If you also have an account with Ally Invest, you can have part of your portfolio professionally managed, while still maintaining a self-directed portfolio.

- The Ally Bank tie-in is tough to beat as it’s one of the very best online banks available.

- 24/7 customer service is a welcome bonus.

Disadvantages

- The zero management fee is compelling, but the exected lower returns from the required 30% cash position could offset any savings from the lack of a management fee.

- For those investors who opt-out of the free management in exchange for a lower cash allocation, there are lower fee stand-alone robo-advisors with more features. Betterment and Wealthfront charge just 0.25%. Among competing large broker robo-advisors, Charles Schwab Intelligent Portfolios has no management fee at all.

- The Ally Managed Portfolios doesn’t have its own app, but is part of the Ally Invest app.

How Ally Managed Portfolios Compares

Ally Robo-Advisor vs. DIY Self-Directed Investing

If you’re an experienced investor and enjoy choosing your stocks, bonds and funds, then investing on your own might be the best path for you. The only fees you pay with investing on your own are the low underlying ETF fund management fees.

If you prefer the hands-off approach to investing, then consider Ally Invest Robo Portfolios. You’ll pay a zero or low management fee, and know that your investments are aligned with your goals, time-line and risk tolerance.

Whichever approach you prefer, Ally offers the tools. You can even have part of your investments in Ally Managed Portfolios and the rest in your own investment brokerage account.

Ally Managed Portfolios vs. Betterment

The Ally Robo-advisor has many similarities and a few distinctions with Betterment

Look at this Ally vs Betterment comparison chart to see how these two robo-advisors match up.

| Betterment | Ally Invest Robo Portfolios | |

|---|---|---|

| Overview | Goals based automated investment advisor with added services. including human financial advisors. | Goals based automated investment advisor with fee-free management option. |

| Minimum Investment Amount | Digital - $0.00 Premium - $100,000 | $100 |

| Fee Structure | Digital-0.25% AUM Premium-0.40% AUM | $0.00 fees for investment management with 30% cash allocation. .30% AUM - fully invested portfolio. |

| Top Features | Goal-based ETF investment portfolio. Rebalancing. Tax-loss harvesting. SRI, smart beta + income portfolios. Human financial advisor. Cash management. | Goal-based robo-advisor with SRI and Income Portfolios. Access to Ally Bank and Ally Invest. |

| Contact & Investing Advice | Weekday phone and email support, | 24/7 phone support, chat and email. |

| Investment Funds | Low-cost, diversified, commission-free ETFs. | Low-cost, diversified, commission-free ETFs. |

| Accounts Available | Single + joint Taxable brokerage. Roth, Traditional, Rollover + SEP IRA. Trust. | Taxable brokerage. Roth, Traditional, Rollover IRA. Custodial. |

FAQ

Is a managed portfolio worth it?

Is Ally Invest trustworthy and legit?

Should I sign up for Ally Invest?

Does Ally have financial advisors.

Ally Invest Managed Portfolios Robo-Advisor Review Wrap Up

As a relative newcomer on the robo-advisor scene, Ally Invest Managed Portfolios’ is competitive with other robo’s with broad ETF choices, socially responsible-SRI investing, tax-optimized portfolios and a $100 minimum investment amount.

The opportunity to change your asset allocation at will is useful should your goals change. The slider and historical returns data is great, and quite transparent.

I am perplexed at the requirement to hold 30% cash in order to get free management. I’m a conservative investor and nearing retirement and even I don’t hold that much cash in my investment portfolio. In fact, the requirement to hold a 30% cash position in order to qualify for free investment management is my only complaint about the platform.

I like the Ally Investent choices. The website is top-notch, easy to navigate with a great user experience. For a taxable account, the cash could be viable if you are an extremely conservative investor. Or, you could opt for less cash and pay the .30% management fee.

The most compelling feature of this Ally Invest robo-advisor review is access to the broad suite of Ally products. Ally Bank offers some of the best in online banking services, including very high interest rates on savings products (in fact, the Ally Bank interest rates are superior to most other banks and investment firms) and a full suite of auto loan leasing programs.

Ally Invest Robo Portfolios may be best suited for investors who already work with either Ally Invest or Ally Bank, to take advantage of the crossover services. Alternatively, it will work well for those who want a robo-advisor service, and plan to take advantage of Ally’s other product offerings.

Related:

- Is Wealthfront Worth It?

- M1 finance vs Betterment

- Ellevest Review

- Betterment vs Acorns

- Best Robo Advisors For High Net Worth Investors

*Disclosure: Please note that this article contains affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.