Wealthfront vs Vanguard Digital and Personal Advisor Services

This comparison of Wealthfront vs. Vanguard Digital and Personal Advisor Services showcases two powerful robo-advisors.

In this review find out whether Wealthfront or Vanguard is for you?

The Vanguard robo advisors and Wealthfront have some vast differences, most notably target clientele, live advisors, cryptocurrency access, and fees. But both are well-known names in the financial sector, with solid historical performance and a knack for appealing to their clients’ needs.

[toc]*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Currently, Vanguard owns the title of robo-advisor with the most assets under management, and Wealthfront is also in the top list of 5 free standing robo advisors.

Wealthfront vs. Vanguard—Top Features

Wealthfront vs. Vanguard—Overview

What are Vanguard Digital and Personal Advisor Services?

Vanguard, well-known for low fee index mutual funds, is the powerhouse behind the 2 Vanguard robo-advisors:

- Digital Advisor Services – Automated investment manager with passive and passive + active management options

- Personal Advisor Services – Comprehensive hybrid with live and digital investment management and advice.

Vanguard Digital Advisor

Like many of its robo-advisor competitors the digital advisor creates a well-balanced investment portfolio that reflects your goals, age, and risk level. The Vanguard Digital Advisor is a basic robo advisor investment manager with rebalancing and goal-based investing.

Vanguard Personal Advisor

The Personal Advisor robo-advisor begins the investment process with a human financial advisor, who acts as the point person in establishing your account. The investment strategy is broader with the Personal Advisor and includes access to both passive and active investment strategies.

With the Personal Advisor Services, you can expect a complete financial plan.

Because of its connection to the larger Vanguard company, the Vanguard robo-advisors offers its clients a host of benefits and services, including access to professional financial advisors for Personal Advisor customers and lower account management fees than most traditional financial advisors.

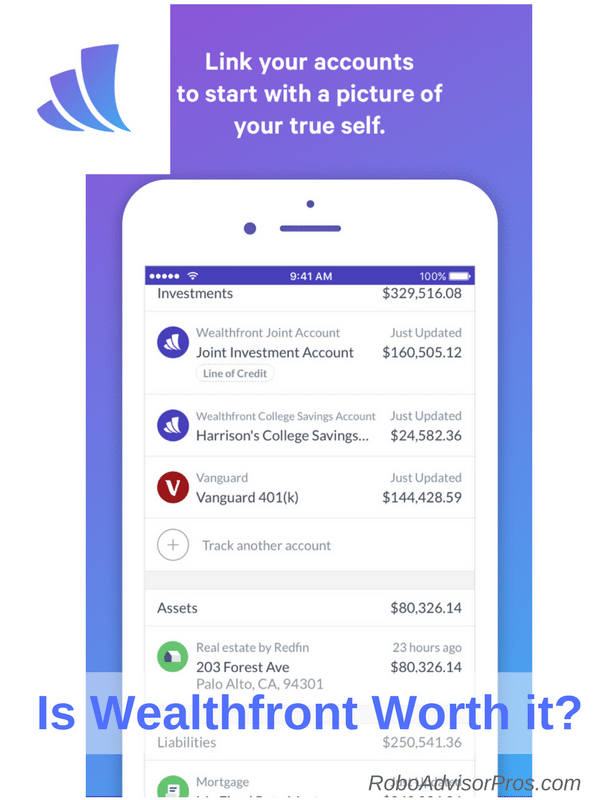

What is Wealthfront?

Wealthfront may not be part of a larger financial company, but you shouldn’t underestimate it. Wealthfront is one of the earliest and largest stand-alone robo-advisors, so it has longevity and experience on its side.

With low investment management fees, Wealthfront employs state of the art research to craft their efficient, diversified investment portfolio.

This means that your investments are managed in a comparable way to a high fee financial advisor, for a fraction of the cost.

Wealthfront recently added customization features to it’s platform. If investors choose to add individual funds to their pre-made portfolio or create their own, diversified ETF mix, then Wealthfront will manage the account including rebalancing and tax-loss harvesting. The customization options include access to over 100 ETFs and two Greyscale cryptocurrency funds for investors seeking bitcoin and ethereum investments. Or, you can craft your own ETF portfolio for Wealthfront to manage.

Sign up for Wealthfront below and receive a free cash bonus:

Investors with Wealthfront can expect a combination of DIY investing and professional digital support—a nice middle ground for investors who feel confident in their risk tolerance and financial goals. Wealthfront offers a range of digital services for investors at all stages of their financial journey. And their product specialists, available by phone, are all licensed financial professionals.

Wealthfront Top Features:

- Fee free stock and ETF trading

- Automated bond-only fund for higher yields

- Socially responsible investment portfolios

- Daily tax-loss harvesting

- Path digital financial planner

- High-yield cash account – no fees

- Wealthfront Borrow – Loans

- Wealthfront Risk Parity Fund and Smart Beta

- Customization with cryptocurrency funds and individual ETFs

Vanguard Top Features:

Digital Advisor

- Low average 0.20% investment management fee (fee varies based upon portfolio).

- Retirement planning feature which shows how to reach your goals

- Invests in low-fee Vanguard ETFs (exchange traded funds)- both passive and actively managed.

- Access to the well-established Vanguard brand

Personal Advisor Services

- Financial advisors for all account holders – for Vanguard Personal Advisor Services

- Index and actively managed ETFs and mutual funds – for Vanguard Personal Advisor Services

- Tiered fees, which range from 0.30% for accounts under $5 million to 0.10% for accounts over $10 million – for Vanguard Personal Advisor Services

Wealthfront vs. Vanguard—Who Benefits?

Seeking a digital automated investment advisor? Choose Wealthfront

Wealthfront is an affordable and efficient robo-advisor that benefits novice and expert investors alike. Wealthfront is ideal for the investor who’s comfortable with an all-digital investment manager.

Wealthfront is also appropriate for investors seeking lending, cash management, and vast investment portfolio customization.

The Wealthfront portfolios are more broadly diversified than those at Vanguard Digital. Wealthfront also offers investment customization with hundreds of additional ETFs and tax loss harvesting.

Vanguard Digital Advisor is appropriate for existing Vanguard clients with at least $3,000 to invest. If you want basic digital investment management for a low management fee, then Vanguard is suitable. Although there are other free and low priced digital investment advisors as well. Schwab Intelligent Investors and SoFi Automated Investing both offer fee-free investment management. SoFi also offers 1/2 hour financial consultant meetings for all clients.

For an all digital advisor-we prefer Wealthfront due to their “extras”, low investment minimum, and comprehensive Path online financial advisor.

Need a Financial Advisor? Vanguard Personal Advisor Services

Vanguard Personal Advisor Services offers live financial advisors, but you need $50,000 to invest.

Pick Vanguard Personal Advisor Services if you want investment management and a combination digital and human financial advisor.

Low on Cash? Wealthfront

Beginner investors with a small minimum investment amount benefit from Wealthfront. At only $500, this investment amount is within reach of most investors—even those just starting out.

Wealthfront is the clear winner with only $500 to get started.

Tax-Loss Harvesting – Wealthfront or Vanguard

Wealthfront will benefit anyone who wants frequent tax-loss harvesting. Wealthfront’s daily tax-loss harvesting offering is much more frequent than other robos on the market.

Vanguard also offers tax-loss harvesting for the Personal Advisors and Digital Advisors. There’s not a lot of detail regarding the frequency of Vanguard’s tax-loss harvesting.

Either platform is find, if you’re seeking tax-loss harvesting.

Fees and Minimums – It’s a tie

Wealthfront wins the minimums race with only $500 needed to get started, in contrast with Vanguard Digital’s $3,000 required minimum.

For the all-digital plan, Vanguard’s fees might be lower or tied with Wealthfront, depending upon which Vanguard Digital portfolio that you choose.

The Vanguard Personal Advisor, with financial advisor access costs 0.30% AUM for your first $5 million. But, you must have at least $50,000 to get started.

Vanguard Digital Advisors wins the “basic robo-advisor” fee contest with a base expense ratio of 0.20% of AUM.

Wealthfront vs Vanguard—Deep Dive

Aside from the higher minimums and the live advisors with Vanguard, you are likely wondering what else sets these two robo-advisors apart. This deep dive will showcase other important differences and help you decide between Wealthfront or Vanguard robo advisors.

Fees and Minimums

Winner: It’s a tie. Fee’s for Vanguard Digital might be lower than Wealthfront, but minimums for Wealthfront are the lowest.

Vanguard Personal Advisor Services

A $50,000 minimum is required for the Vanguard Personal Advisor robo-advisor and comes with a tiered fee system:

- .30% AUM for accounts under $5 million

- .20% AUM for accounts over $5 mil and under $10 mil

- .10% AUM for accounts over $10 mil and under $15 mil

If you have a lot of money to invest, this tiered fee scale is extremely attractive—.20% AUM fee is practically unheard of.

Vanguard Personal Advisor Services has one of the highest minimums of any robo we feature here on Robo-Advisor Pros at $50,000. But, this amount can be spread out over other non-robo Vanguard accounts. Although it is lower than Personal Capital’s $100,000 minimum for their investment Advisory services (remember: Personal Capital has free retirement planning options).

Vanguard Digital Advisor

The Vanguard Digital Advisor requires $3,000 to invest and charges a 0.20% AUM fee. If you elect for the passive and actively managed portfolio option, you might pay 0.25% AUM, comparable with Wealthfront.

Wealthfront Fees and Minimums

Wealthfront fees and minimums, on the other hand, require only a $500 minimum and charge a low management fee of 0.25% AUM regardless of the size of your investment portfolio.

Investors who are looking for robo-advisors with low minimum investment requirements or account management fees more in line with Wealthfront might consider tossing robo-advisors like Betterment or M1 Finance into the running.

Account Types

Winner: It depends. Both offer a variety of account types, but if you’re seeking a 529 account, choose Wealthfront.

Vanguard Personal Advisors

- Individual and joint investment accounts

- Roth, traditional, SEP, Simple and Rollover IRAs

- Trusts

Vanguard Digital Advisor

- Individual and joint investment accounts

- Roth, traditional, SEP, Simple and Rollover IRAs

This is a relatively limited account selection for a basic robo. You’ll find greater account choices at many comparison robo advisors.

Although you can access a high yield money market fund at Vanguard, you’ll need to set up a separate account, outside of the robo-advisors.

Wealthfront

- Individual and joint investment accounts

- Roth, traditional, SEP, Simple and Rollover IRAs

- Trusts

- 529 College Savings Plan

- High Yield Cash Account

Wealthfront is the only robo-advisor that offers the 529 College Savings account, that we are aware of. This is a big offer for those seeking to invest for a child’s education.

Human Financial Planners

Winner – Vanguard Personal Advisors

Vanguard

Vanguard Personal Advisor Services pulls ahead in this category. All portfolios are managed by a combination of human financial planners and algorithm-based robo-advisors. This platform allows you to collaborate as much or as little as you would like.

Vanguard Personal Advisor portfolios valued under $500,000 have access to the team of advisors who manage other accounts as well. Investors with accounts over $500,000 have a designated personal advisor for their portfolios.

Vanguard Digital advisor doesn’t offer financial planner access, although you can talk to a Vanguard service representative for general questions.

Wealthfront

Wealthfront doesn’t offer human financial advisors, publicly. That said, nearly all Wealthfront customers service representatives have basic Series 7 broker licenses and able to assist with many investment-related questions. The Wealthfront Path financial advisor is the best digital version of a financial planner that we’ve seen. The Wealthfront Path software is programmed to answer 10,000+ quesitons.

Although, with a low 0.25% investment management fee, Wealthfront users in need of financial planning might consider hiring a fee only financial planner for specific money-related questions and concerns.

Tax-Loss Harvesting

Winner – It’s a tie.

Both Wealthfront and Vanguard robo advisors offer tax loss harvesting. This can potentially, cut down on your overall tax bill. But TLH is only appropriate for taxable investment accounts. Money within a retirement account isn’t taxed, so won’t benefit from tax-loss harvesting.

Investments

Winner – Wealthfront wins the digital and cryptocurrency contest. It’s a tie for Vanguard Personal Advisors vs. Wealthfront.

Wealthfront’s core portfolios are more diversified than the four fund Vanguard Digital Advisor. The addition of additional ETFs including socially responsible or sustainable investments and strategy ETFs is a sound recommendation for Wealthfront. Wealthfront investors who elect to add ETFs to the classic portfolio, or even create a new one for Wealthfront to manage can add tremendous diversification.

Although Vanguard Digital Advisor recently added actively managed investments, we don’t believe that the offer can compete with Wealthfront, when it comes to the number and variety of available investments.

Vanguard Personal Advisor Services

The hybrid Personal Advisor Services offers both index and actively managed funds. Because the investment process is directed by a live financial advisor, you have the opportunity for greater customization and personalization.

The core holdings include Vanguard’s low-cost Admiral Shares:

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTIAX |

| Total Bond Market Index Fund | VBTLX |

| Total International Bond Index Fund | VTABX |

| Intermediate-Term Investment Grade Fund | VFIDX |

| Short-term Investment Grade Fund | VFSUX |

| Intermediate-Term Tax-Exempt Fund (taxable accts only) | VWIUX |

There are additional investment funds available to all of the Vanguard Personal Portfolio robo advisor clients.

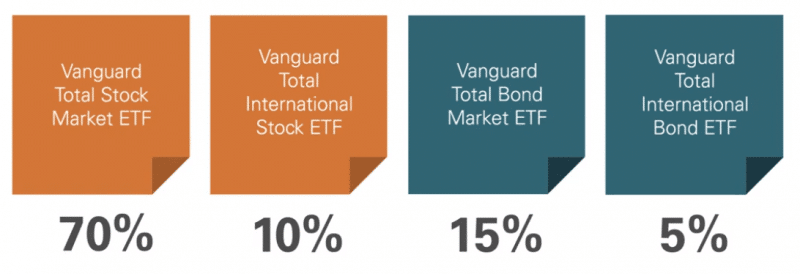

Vanguard Digital Advisors

Vanguards Digital Advisor offers four basic Vanguard ETFs, in proportions that reflect your risk level and goals. If you want more than four funds this one isn’t for you.

The following four Vanguard ETFs encompass the US and International stock and bond markets.

*Funds are subject to change.

We were impressed with how the portfolios are crafted at Vanguard. They use a risk quiz that is designed by Trueprofile.com, a company that uses economic science to design the risk questionnaire. The tool reveals a true risk tolerance, loss aversion score that will likely lead to the best possible asset allocation.

These four ETFs cover nearly the entire stock and bond markets in the US and internationally. Although Vanguard lacks style funds or other asset classes like real estate or commodities in the digital plan.

Additional actively managed Vanguard funds are also available.

Wealthfront Investments

Wealthfront’s portfolios are also crafted to fit with specific risk levels. Depending upon your risk tolerance level – from conservative to aggressive – you’ll have varying percentages of stock ETFs vs. bond ETFs. The best way to vary your Wealthfront asset mix is to change your risk tolerance or to add additional ETFs or a cryptocurrency fund.

We really like Wealthfront’s fund choices, and their chief investment advisor, Burton Malkiel, author of A Random Walk Down Wall Street, is one of the greatest investing minds of the past 50 years.

Wealthfront’s core fund choices are divided among broadly diversified, low-fee stock, bond and alternative exchange traded funds:

| Investment Fund Category | Index Fund Ticker Symbol |

|---|---|

| US Total Stock Market | VTI and SCHB |

| Foreign Stock - Developed Market | VEA and SCHF |

| Foreign Stock - Emerging Market | VWO and IEMG |

| Dividend Appreciation Stock | VIG and SCHD |

| US Treasury Inflation Protected Bond (TIPs) | SCHP and VTIP |

| US Government Bond | BND and BIV |

| Municipal Bond | VTEB and TFI |

| US Corporate Bond | LQD |

| Foreign-Emerging Market Bond | EMB |

| Real Estate | VNQ and SCHH |

| Natural Resources (Energy) | XLE and VDE |

For a nod to active investing, Wealthfront also offers a risk parity fund and smart beta investing options in addition to the individual ETFs, crypto fund and pre-made portfolios.

The newest additions to the Wealthfront line up are a professionally managed bond chose and individual stock and ETF trading.

While Wealthfront investors have access to the Wealthfront Cash Account. There are no fees levied against investments in the Wealthfront Cash Account.

Goal Setting and Retirement Planning

Winner – Digital win goes to Wealthfront. Personal Planning comes in quite close.

Vanguard

The Vanguard Personal Advisor with live advice can help you navigate all of your future goals, including retirement planning.

The Digital advisor focuses predominantly on the retirement goal.

For DIY calculators and planning, the Vanguard website offers a goals page with tools and calculators to help you plan for a variety of savings goals, emergency fund, and college.

Wealthfront

The Wealthfront Path Digital financial planner is programed to answer 10,000+ financial, investing and money-related questions. We haven’t found another digital planner that’s as comprehensive as Path.

The Wealthfront Path goal setting assistance answers questions like:

- Can I buy a home-in this city?

- Am I on track for early retirement?

- Can I take a year off for retirement?

- Can I send my kid to college?

- Project your net worth over time

- Understand the tradeoffs when you make a financial decision

Wealthfront vs. Vanguard—Loans

Winner-Wealthfront

Vanguard’s robo-advisors don’t offer lending options.

Wealthfront Borrow – Portfolio Line of Credit has no application fees and is available for all customers with an individual, trust, or joint investment account worth $25,000 or more. The loan is available quickly with a low interest rate. It’s a helpful feature to pay for expenses like a vacation or wedding, when you don’t want to sell investments to free up cash.

Borrowers can access up to 30% of their account value, with a minimum $25,000 AUM.

Security

Winner – It’s a tie. Both platforms are secure.

Vanguard

Vanguard has been around a long time and has well honed security protocols.

Client funds are covered by SIPC (Securities Investor Protection Corporation) and excess insurance. The site uses state of the arti 256-bin SSL encryptioin and provides two-factor authentication.

Wealthfront

Wealthfront partners with expert security companies to create and maintain secure, read-only links. These firms use bank-grade security and employ state of the art data protection. Wealthfront does not store your account password. Read more about Wealthfront Security here.

The Wealthfront Cash account is FDIC insured through partner banks for up to $2 million for individual accounts and $4 million for joint accounts.

Vanguard vs Wealthfront Promotions

Sign up for Wealthfront with this link and you’ll receive $5,000 managed for free.

Get $5,000 managed for free when you sign up for Wealthfront below:

Wealthfront Invite

Once you are a Wealthfront customer, you’re eligible for free investment management. When a friend signs up and funds their account, you get $5,000 managed for free. And your friend also gets $5,000 managed for free! It’s a win – win.

Vanguard

Vanguard Digital currently has a management fee waiver promotion. As of June 2023, Digital Advisors clients get 90 days of free investment management.

FAQ

Is Wealthfront better than Vanguard?

Is Wealthfront worth the fee?

Is investing with Vanguard a good idea?

Wealthfront vs. Vanguard — Wrap up

Choosing between Vanguard vs. Wealthfront boils down to what you’re seeking in an investment manager. Each platform is distinct, so the decision between Wealthfront or Vanguard shouldn’t be difficult.

Both robo-advisors have performed well over the last few years and have demonstrated over time their stability and commitment to their clients. However, that’s about where their similarities end.

For digital investment advice Wealthfront wins hands down.

Despite not being part of a larger financial institution, Wealthfront is a solid choice. This robo-advisor packs a lot of value into one affordable package. The Path financial advisor is only one of Wealthfront’s offerings that demonstrates the power of a robo-advisor to help keep investors on track for their professional goals. Although, anyone can link their accounts and access Path, regardless of whether you’re a client or not.

Since digital investing is Wealthfront’s jam, they do it exceptionally well!

Wealthfront wins the access competition for new and small investors. Unless you have $3,000 for the Digital Advisors and $50,000 available to invest in the Personal Advisor, Vanguard may be out of the question.

In fact, even if you don’t open a Wealthfront investment account, the high yield cash account is a solid choice for emergency and short-term cash needs.

Wealthfront’s new automated Bond Portfolio is ideal for conservative investors and those seeking regular cash flow.

For live financial advisors you’ll choose Vanguard Personal Advisors.

When considering Wealthfront or Vanguard, and seeking someone to guide the process, Vanguard is the only choice. We like how the advisor guides the process and fees are quite low when compared with traditional financial advisors.

Bit, if you lack the $50,000 minimum investment amount and want a low-fee robo-advisor with access to financial advisors, and a low minimum investment amount SoFi Invest is worth a look. SoFi offers fee-free investment management and live financial advisors.

Read the Complete: Wealthfront Review

Read the Complete: Vanguard Robo-Advisor Review

Related

- Betterment vs. Vanguard vs. Wealthsimple

- Empower vs. Mint. vs. Quicken

- Wealthfront vs. Fidelity Go

- Betterment vs. Fidelity Go

- Betterment vs Wealthfront vs Vanguard Comparison

- M1 Finance vs Vanguard Robo Advisors

Sources:

- https://personal.vanguard.com/pdf/vanguard-digital-advice-brochure.pdf

- https://personal.vanguard.com/pdf/vpabroc.pdf

- https://www.wealthfront.com/legal/disclosure

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.