Wealthfront Borrow Review

Are you a Wealthfront customer who was so busy investing you forgot to leave out some cash to put down on your car?

Are you getting married and your Wealthfront account is on track, but you lack cash to pay for the wedding?

Forgot to fund your emergency account, even though your Wealthfront investment account is growing?

Learn about the Wealthfront Portfolio Line of Credit, to help with those money ‘what ifs’.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Current Wealthfront Portfolio Line of Credit Interest Rate is 7.40% to 8.65% APR

Another way for Wealthfront customers to build up cash is to open a high yield cash account. There are no fees and FDIC insurance through partner banks up to $2 million for an individual account and $4 million for a joint account.

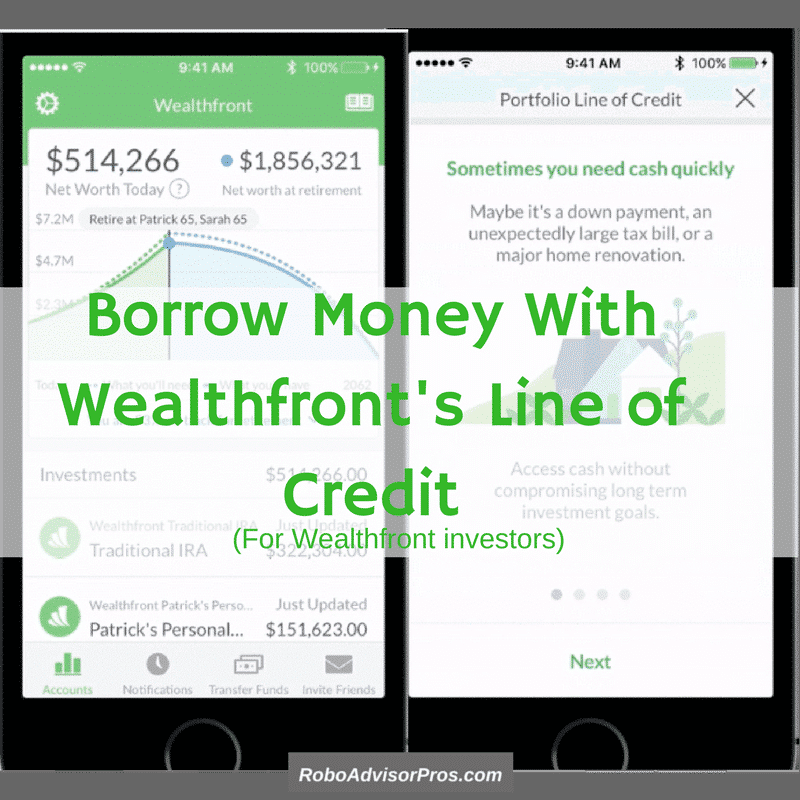

Wealthfront’s Portfolio Line of Credit Can Help

I was skeptical at first. Wealthfront, the robo-advisor for 30 to 40 year olds is now offering a lending solution. I wondered why an investment advisor is offering loans. What were they thinking?

After meeting with a Wealthfront spokesperson, I now understand. The company is not attempting to become SoFi or a standard lender, but the firm is responding to their customers’ needs.

Imagine that you’re saving $1,000 per month in your Wealthfront investment account, and your account value is growing. After a couple of years, you’ve built up a low six figure account balance. Then, your car dies and you need the down payment for a new one. Although you have the money, you’d need to withdraw it from your Wealthfront investment account, and miss out on the future returns those funds would earn.

Wealthfront came up with an alternative so that your money could remain invested in the account and you could borrow the ready cash that you need, for a low interest rate.

What is the Wealthfront Portfolio Line of Credit?

The portfolio line of credit is a margin loan, which means that your Wealthfront securities serve as collateral for your Wealthfront Borrow loan. The loan is available for Wealthfront clients only.

If you sign up for Wealthfront – you’ll receive a special promotion, with the link below.

Wealthfront Borrow Beats a Margin Account and Home Equity Line of Credit

- No credit check

- No application fee

- You can use the money for anything

- No payback schedule – pay it back whenever you want

- Money available within one to three days

- Borrow up to 30% of your account value (available for accounts worth more than $25,000)

Current Wealthfront Portfolio Line of Credit Interest Rate is 7.40% to 8.65% APR

Wealthfront claims that the money fulfills a void for the investor who needs ready cash and has an account balance greater than $25,000.

Although it’s a good idea to keep money in cash or a money market account for short and intermediate needs, some investors missed that lesson! And, if you’re a Wealthfront customer, the robo-advisor is here to help. Of course, Wealthfront also offers a high yield cash account, great for your emergency savings.

So, how does the new Wealthfront Portfolio Line of Credit work?

Quick and Easy Cash for the $25,000+ Wealthfront Investor

Wealthfront borrow requires no application process and no credit check.

If you’re a Wealthfront customer with an individual, trust, or joint investment account worth more than $25,000, you’re automatically eligible for the Wealthfront Portfolio Line of Credit.

Best of all, there’s no credit check or impact on your credit score.

If you meet the above criteria, you’re eligible for the Wealthfront loan. You can borrow up to 30% of the value of your Wealthfront account. So, if your account balance is $100,000, you can borrow approximately $30,000.

Click on “Borrow” at the top of the Wealthfront home page and request the money. The money will be transferred into your account within several days with no additional fees or paperwork!

Of course, there’s an interest rate on the loan. The interest rate is tied to the value of your Wealthfront account. Higher balance accounts receive lower interest rates.

The Wealthfront Portfolio Line of Credit interest rates vary, along with the market interest rates. These rates are subject to change and are influenced by market interest rates.

Current Wealthfront Portfolio Line of Credit Interest Rate is 7.40% to 8.65% APR

The Wealthfront line of credit is usually more affordable than carrying a balance on your credit card or securing a personal loan.

Open a Wealthfront investment account and receive a promotion.

Read our complete Wealthfront Review – Is Wealthfront Worth It? to find out if this robo-advisor is a good fit for you.

What’s the Risk With the Wealthfront Line of Credit?

First off, it’s a loan. That means you need to pay the money back. The Wealthfront Portfolio Line of Credit is not free money!

The longer you maintain the debt, the more interest you’ll pay.

It can be tempting to take out a loan and blow the money, but don’t do that. As with any debt product, be responsible, and use the money for something important. And, pay back the loan as quickly as possible.

Like a typical margin loan, should the value of your investments decline below the threshold, due to normal market fluctuations, you might be forced to repay a portion of the loan. And, you might be forced to add additional funds to your investment account, to avoid the forced sale of securities.

Wealthfront can increase the required maintenance above 30% of your account value, without prior notice.

For those without a Wealthfront account… You can sign up here and receive a special promotion too.

Highlights from the Wealthfront Robo-Advisor

If you don’t have an investment account with Wealthfront, here’s a taste of several of their features:

- A PhD level research supported digital investment advisor with low fees and the best index matching returns for your individual risk profile.

- Access to 100’s of ETFs, including several Grayscale crypto funds. Use these as add ons for your existing portfolio, or create a new one, for Wealthfront to manage.

- A $500 minimum deposit.

- Free sign up promotion.

- A low 0.25% management fee.

- Path financial planner included. Helps you decide how much to save for retirement and what you can or can’t afford in the meantime (plus many more features).

- Many available account types, including a 529 College Savings Plan account.

- Tailored transfers – move your investments into the Wealthfront platform without selling all assets at once in a manner that minimizes taxes.

Wealthfront Review – Is Wealthfront Worth It?

Related

- Wealthfront Cash Account Review

- Wealthfront vs. Vanguard

- Wealthfront vs. Betterment vs. M1 Finance

- Wealthfront vs. Fidelity Go

- Wealthfront vs Schwab

- Is Wealthfront Safe?

- 10 Best Robo Advisors For IRA

Sources

- https://www.wealthfront.com/portfolio-line-of-credit

- https://www.wealthfront.com/static/documents/wbc/margin_handbook.pdf

- https://blog.wealthfront.com/portfolio-line-of-credit-25k/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.