Digital Advisor and Personal Advisor Services – Pros, Cons and Features

The Vanguard robo-advisors take the win for the largest robo-advisors with $231 billion assets under management. Vanguard Digital Advisor and Personal Advisor Services are part of the Vanguard Group, the world’s largest mutual fund company, and the second largest provider of exchange-traded funds (ETFs). The Vanguard Group has over $7.2 trillion in assets under management (AUM) and was founded by John C. Bogle, creator of first index fund.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Vanguard Robo-Advisors Review

Name: Vanguard Digital Advisor and Personal Advisor Services

Description: Low fee leader Vanguard offers two digital investment managers, Digital Advisors for hands-off investing and Personal Advisor Services for wealthier investors and includes financial advisors.

-

Fees

(5)

-

Investment Choices

(4)

-

Ease of Use

(4.5)

-

Tool & Resources

(4.5)

Summary

The Vanguard robo-advisors offer digital only and investment management with financial advisors. Best for:

- Existing Vanguard customers.

- Investors seeking low fee investment management.

Pros

- Low management fees on both Personal Advisor Services and Digital.

- High minimums.

- Part of top-notch Vanguard Group investment firm.

Cons

- Only Vanguard funds.

- Vanguard Personal Advisor Services requires $50,000 minimum investment.

The Vanguard robo advisors offer 2 investment options – each with passive and active management options:

- Vanguard Digital Advisor – Low-fee digital investment management driven by your risk tolerance level and goals.

- Vanguard Personal Advisor Services – A robo-advisor that integrates computerized investment management with human financial advisor guidance.

Vanguard Digital and Personal Advisor Service – Features at a Glance

| Vanguard Digital Advisor | Vanguard Personal Advisor Services | |

|---|---|---|

| Overview | Computerized investment investment advisor. | Hybrid human financial planners and digital investment management. |

| Minimum Investment Amount | $3,000 | $50,000 |

| Fee Structure | 0.20% AUM | 0.35% AUM |

| Top Features | Low-fee Vanguard ETFs. Active and passive investing. Retirement planning focus. Considers all investments. | Personal Advisor-Human financial advisor drives the entire process. Together, you and the advisor create a customized investment plan. |

| Free Services | Extensive educational resources | Extensive educational resources |

| Contact & Investing Advice | Phone M - F 8:00 am to 8:00 pm EST. No financial advisors. | Phone M - F 8:00 am to 8:00 pm EST Human financial advisor guides the process. |

| Investment Funds | Passively managed ETFs and/or actively managed funds. | Diversified mix of low fee stock and bond funds. |

| Accounts Available | Individual & joint brokerage. Roth, traditional and rollover IRAs. | Individual & joint brokerage. Roth, traditional & rollover IRAs. Trusts. |

What are the Vanguard Digital Advisor and Personal Advisor Services?

Vanguard Digital Advisor

The Vanguard Digital Advisor managed portfolio is an affordable option for those who want an investment portfolio created with their goals, age and risk tolerance in mind.

- Low 0.20% gross advisory fee.

- Option for all index ETF or index and actively managed ETFs (for a higher management fee)

- Retirement planning feature which shows how to reach your goals.

- Use of low-fee Vanguard ETFs (exchange traded funds).

- Access to the well-established Vanguard brand.

- Debt payoff tool.

Vanguard Personal Advisor Services

For investors with a minimum of $50,000 investors receive a hybrid robo-advisor which includes unlimited access to a Vanguard advisor. The annual net advisory fee of 0.35% AUM for passively managed and 0.40% for actively managed portfolios is among the most affordable hybrid robo-advisors. SoFi might be the only platform to beat this pricing with zero investment management fees and access to financial advisors. This managed Vanguard account is driven primarily by your conversations with the financial advisor. The Vanguard funds are managed in accord with your goals, timeline and risk tolerance level.

- Financial advisor access.

- Personalized financial plan.

- Investment coaching and ongoing investment advice.

- Real-time goal tracking.

Robo-Advisors with Human Financial Planner Access

Who are the Vanguard Robo-Advisors Best For?

Vanguard Digital Advisor

These investors will benefit from the Vanguard Digital Advisor:

- Existing Vanguard clients seeking low-fee, well-researched investment management.

- Investors seeking debt payoff strategies along with digital investing.

- Younger investors.

- Those comfortable with an all digital platform.

Wealthfront is a Vanguard Digital Advisor alternative with broader services including cash management, lending, and a comprehensive digital financial advisor (visit the Wealthfront website now).

Vanguard Personal Advisor Services

Existing Vanguard customers seeking a financial advisor to chat with and guide them, will appreciate the easy access. This can be especially comforting during those times when the financial markets are not cooperating with your long-term plans. When market’s crash, it’s helpful to have someone to talk you off a ledge.

Those who want to plan for future financial goals like retirement or a child’s education and access regular monitoring will find what they need at the Vanguard group. This service is great if you want a comprehensive financial plan to maximize retirement income, Social Security and minimize market volatility.

The other major group who can benefit from this service are larger investors. The basic fee structure of 0.35% is competitive, but it gets even better as your portfolio grows. With the tiered pricing structure, a person with at least $10 million will pay a fee of just 0.10%. That fee level can’t be beat by traditional financial advisors.

If you’re seeking a Vanguard alternative with a zero investment minimum, SoFi is the only digital investment manager we follow with financial advisors, no minimums and no management fee. Visit the SoFi website now.

Vanguard Digital Advisor Features

Next, you’ll get a description of the digital advisor features.

Digital Fees and Investment Minimum

Users need $3,000 to begin investing. This is a barrier for beginner investors who might prefer SoFi with no minimum required or other low-minimum robo-advisors.

The annual net advisory fee is 0.20% of assets managed for an all digital portfolio is lower than many digital advisor competitors. So if you invest $3,000, you’ll pay $6 per year. Although, if you’re willing to take on the rebalancing your self. you could buy these four Vanguard ETFs on your own and eliminate the management fee. A slightly higher management fee applies for actively managed digital portfolios.

Apart from the investment management fee, every ETF has a low fund expense ratio. Vanguard is known for among the lowest-fee funds available.

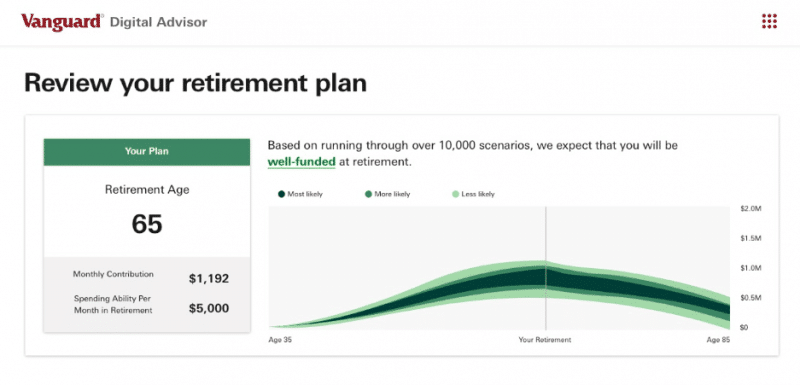

Vanguard Digital Advisor Retirement Planning

Digital Advisor Sign up

First, you need to create a Vanguard account. Next, you’re asked nearly a dozen questions to discern your financial status, debt level, retirement date and expected retirement spending. You’re encouraged to link outside accounts, which will enable the computerized algorithm to accurately project your retirement probabilities.

The detailed questions yield a picture of your retirement glidepath and the probability of your funds lasting. If your projections aren’t what you like, then you can make changes to create a more favorable outcome. For example, you could cut projected retirement spending assumptions or increase saving amounts.

Then you ‘ll be encouraged to choose an account type and fund the account.

Investors in or within a year or two of retirement are discouraged from choosing the Digital Advisor.

Vanguard Digital Investments – Low Fee ETFs

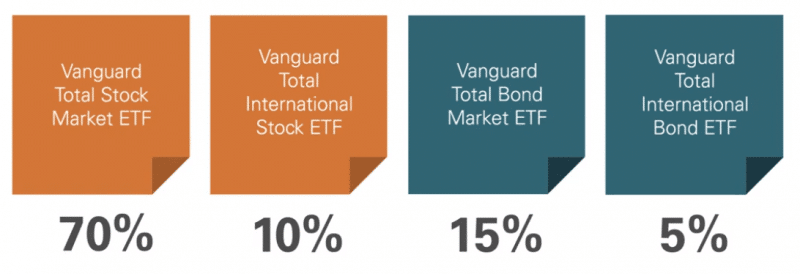

Digital Investment Strategy

Vanguard Digital invests your money in four Vanguard funds for the passively-managed option, U.S. and international stock and bond funds. This is sufficient diversification for most, but those seeking additional asset classes might look elsewhere. For example, Schwab Intelligent Portfolios has more than 10 distinct asset classes and also offers fee-free investment management.

- Vanguard Total Stock Market ETF (VTI), expense ratio 0.03%

- Vanguard Total International Stock ETF (VXUS), expense ratio 0.08%

- Vanguard Total Bond Market ETF (BND), expense ratio 0.035%

- Vanguard Total International Bond Market ETF (BNDX), expense ratio 0.08%

The percent invested in each fund is derived from your answers to the initial goals and risk quiz. Although the quiz leans towards a retirement goal focus, you can change your goal and target asset allocation later. If you’re young and comfortable with a higher degree of volatility, your portfolio will own greater percentages of stock funds and lesser amounts of the bond funds.

Those who prefer to add in actively managed Vanguard ETFs, you’ll have an opportunity to beat the market.

Rebalancing

Rebalancing usually occurs quarterly. When the percentages in each fund deviate from the target, the computer algorithm will buy or sell appropriate amounts to return the asset mix to the goal. This is the one commonality among all robo-advisors. The benefit of rebalancing is to reduce your portfolios volatility. The process automates adding to undervalued funds and reducing shares in those that have grown more quickly.

Tax-loss Harvesting

Tax-loss harvesting is is available in Digital Plan when needed. Although, Vanguard claims that it will consider the tax consequences when selling funds.

Financial Advisors

Unlike the Personal Advisors option, digital users don’t have access to financial advisors. But, customer service representatives are typically well qualified to answer basic platform questions.

Digital Account Types

The basic account types are suitable for most investors. Although those seeking trust, business or custodial accounts might look at other digital investment advisors.

Available account types:

- Individual and joint brokerage accounts

- Traditional, Roth and Rollover IRAs

Vanguard Personal Advisor Services Features

Personal Advisor Fees and Investment Minimum

Users need $50,000 to enroll in the Personal Advisor Services offer. Although, hefty for beginners, this minimum is lower than at Betterment or Empower’s hybrid robo-advisor offers. The 0.35% management fee is among the lowest for platform’s that also offer human financial advice. With 0.40% AUM for combination index and active management approaches and financial advisor access. ESG sustainable portfolios are also available. A sliding fee schedule is available as your account value increases.

Personal Advisor Service Sign-up

The Vanguard personal advisor services has a simple online sign-up process that you can complete in about 10 to 15 minutes. You’ll answer basic questions spanning personal details. income, risk tolerance, and tax status. You can link outside accounts as well, which will aid in the goal planning calculations.

Once you have completed the initial questionnaire, you will have a telephone conference call with a Vanguard Advisor. After that, the service will take several days to set up another conference call – which can be done either by telephone or by video. The second meeting is where you’ll receive the comprehensive customized investment plan. At this point, you can choose to sign up for the platform, or not. We like that you can test drive the service before funding an account.

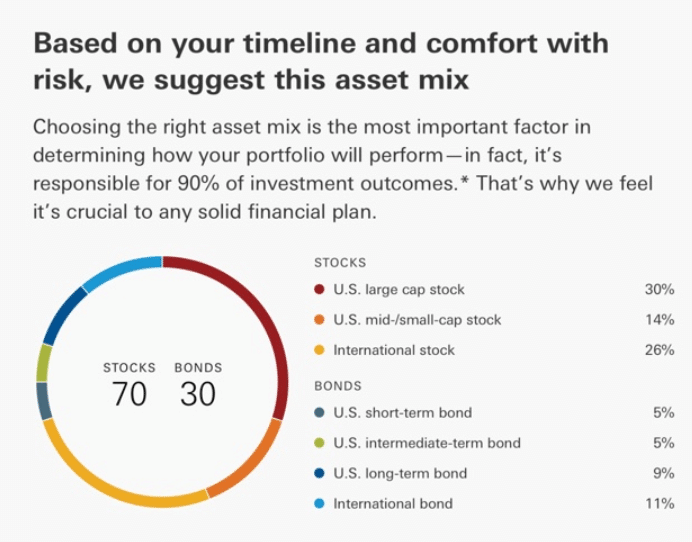

Vanguard Personal Advisor Services – Asset Allocation Example

Personal Advisors Investment Strategy

The Personal Advisors investment strategy is driven by your relationship with a financial advisor. Together, you’ll craft an investment portfolio that fits your needs. You can be as involved as you wish, or not. You portfolio is customized o fit your personal goals and can be adjusted as circumstances change. You have a choice of three investment strategies:

- Core – Passively managed index ETFs

- Active and Passive – Actively managed and passive index fund ETFs

- ESG – ESG stock and bond ETFs only

The percentages in each fund will vary, according to your time horizon, goal and risk tolerance level.

The Core Investing Passive index portfolio includes these ETFS:

- Total Stock Market ETF (VTI)

- Total International Stock ETF (VTXUS)

- Total Bond Market ETF (BND)

- Total International Bond ETF (BNDX)

The Active Investing Portfolio includes these mutual funds and ETFS:

The ESG Investing Passive index portfolio includes these ETFS:

- ESG US Stock ETF (ESGV)

- ESG International Stock ETF (VSGX)

- ESG US Corporate Bond ETF (VCEB)

- Total International Bond ETF (BNDX)

Personal Advisors Rebalancing

Vanguard Personal Advisor Services performs rebalancing on a quarterly basis. Your investments will be rebalanced when your portfolio deviates from the target allocation by more than 5% in any position. We don’t believe the frequency in rebalancing matters too much.

Tax-loss Harvesting

Tax-loss harvesting is available on a case by case basis. You can discuss with your financial advisor whether this is the best approach for your taxable account. Tax efficient investments, like municipal bond funds are available for taxable brokerage accounts.

Financial Advisors

The financial advisors are at the center of the Personal Advisors option. From advice and coaching on simple questions to more in depth guidance on retirement and college planning, the financial advisors are trained to provide answers to your most important financial and life planning questions. You can schedule video or phone meetings at your convenience.

Now, on to the features that each of the robo-advisory platforms have in common.

Personal Advisor Account Types

Since Personal Advisor is a higher level service, you’ll have access to more account types than offered by the Digital version. The basic account types should fit most wealthier investors.

Available account types:

- Individual and joint brokerage accounts

- Traditional, Roth and Rollover IRAs

- Trusts

Vanguard Robo-Advisors Performance

You know the drill, “Past performance is no indication of future performance.”

The performance for the digital advisor and personal advisor services aligns with the returns of the underlying funds. This is similar to all robo-advisors.

One way to understand how your portfolio might perform, consider the returns of the underlying funds. For example, if your entire portfolio was invested in two funds: the Vanguard 500 Index Fund and the Vanguard Total Bond Market Index Fund in a 50% – 50% mix, then your returns would correspond to the returns of the investment funds. So, if the stock fund gained 10% in one year and the bond fund returned 3%, then your annual return would be a bit less than 6.5%, to account for the management fee.

Given that different asset classes will rise or fall during various periods, we believe in investing in a broadly diversified portfolio. Choosing a digital investment manager based on performance is unlikely to yield optimal results in the long term. The ultimate goal of an investment manager is to grow your funds in order to meet your financial goals.

The Vanguard Digital Advisor is a standard robo-advisor with a reasonable fee. For robo-advisors with zero management fees you might consider M1 Finance, or SoFi Invest.

Vanguard Digital Advisor and Personal Advisor Services – Pros and Cons

Both the Vanguard Personal Advisors and the Digital Advisors are part of the low-fee and well-respected Vanguard family. This gives each robo-advisor immediate credibility as demonstrated by the wide adoption of the Vanguard robos.

Pros

- The Vanguard Digital fees of 0.20% – 0.25% is reasonable when compared with the digital investment robo-advisors.

- The option to add in actively managed Vanguard Funds is a good addition for investors seeking more than the typical passively-managed robo advisor.

- Your account is invested primarily in Vanguard funds, which are some of the best funds available (Vanguard’s average expense ratio is 0.12%, compared with the industry average of 0.62% for mutual funds and even lower for the digital ETF investments).

- The Vanguard Advisory Services management fee of 0.35% to 0.40% is well below the 1.00% – 1.50% charged by traditional investment managers.

- The Personal Advisor Services account is managed by live advisors, using robo-advisor tools.

- For very large advisory investors, the sliding fee scale is generous.

- The Vanguard Advisor clients have a financial professional to speak with which is helpful, especially during market downturns, and can save you from selling or buying into the market at the wrong times.

- External accounts are considered in retirement projections.

Cons

- The Vanguard Digital robo-advisor fees are not the lowest.

- Your account is invested primarily in Vanguard funds, which may or may not be a problem.

- The Vanguard Digital initial investment minimum is higher than most competitors and excludes smaller investors. Wealthfront has a $500 minimum, while Betterment has no minimum, and requires only $10 to ionvest.

- Vanguard’s robo-advisor doesn’t offer an automatic tax-harvesting feature – it is on a case-by-case basis.

FAQ

Are Vanguard advisors any good?

Can you meet with a Vanguard Advisor?

Is the Vanguard robo-advisor IRA good?

What are the Vanguard robo-advisor ETFs?

Is Vanguard Digital Advisor only for retirement accounts?

Vanguard Robo Advisor Review Wrap Up

Vanguard is among the most trusted names in mutual funds, and they have brought their expertise to robo-advising through Vanguard Personal Advisor Services and Vanguard Digital. The Vanguard advisor offers professional management at a reasonable fee, although it is most advantageous for larger investors who can take advantage of the lower Vanguard management fees.

Vanguard Personal Advisor Services has a lot going for it in an increasingly competitive industry with financial advisors and low fees as stand out features.

We like the Vanguard Personal Advisor Services for wealthier investors, and the newer addition of actively managed funds to the Digital product. The four fund core portfolios are a bit light on strategy diversification. There are no value, small cap, or growth focused ETFs in Vanguard Digital.

Although, if you’re interested in a digital investment manager with human financial advisors, a unique free investment management dashboard, tax-loss harvesting and the opportunity to invest in individual stocks as well, check out Empower (Even if you don’t hire this investment manager, their free financial management tools are outstanding.).

Ultimately, your investment management choice depends on your own personal financial situation as well as your goals and preferences. To help make your decision easier, please enjoy our complimentary robo-advisor comparison chart.

Click here to visit the Vanguard Personal Advisor robo site.

Click here to visit the Vanguard Digital Advisor site.

Compare to Other Robo-advisors:

| Empower (formerly Personal Capital) | Betterment | Schwab Intelligent Portfolios | |

| Overview | Free investment management tools for all. The service provides comprehensive financial management and human advisors. | Goals based automated investment advisor. Offers a variety of human financial planning options and strategy portfolios. | Intelligent Portfolios-basic offers free investment management. Intelligent Portfolios Premium offers financial advisors and more services. |

| Fees and Investment Minimums | Zero fees for access to free investment management tracking & recommendations. Paid investment management charges graduated fees. For assets between $1,000,0000-$3,000,000 .89% of AUM. Fee drops to 0.49% for accounts over $10,000,000. | Digital-Zero minimum-$10 to invest. 0.25% AUM: $25,000 AUM or more. $4 per month: $25,000 AUM or less. Premium-$100,000 minimum. 0.40% AUM-Includes unlimited access to CFP. Low cost a la carte financial planning packages. |

Intelligent Portfolios – $0.00 management fees – $5,000 minimum. Intelligent Portfolios Premium – $25,000 minimum – One time $300 set up fee and a $30 per month subscription fee. |

| Best for: | Free investment tracking and planning great for investors anyone. Empower Advisors good for investors with at least $100,000 seeking comprehensive financial planning services. |

Digital investment management for beginners to advanced investors. Small investors seeking zero minimum. Investors seeking financial advisor and cash management. |

Cost conscious investors. Investors seeking free digital investment management and subscription pricing for large accounts. Those seeking branch access. |

| Visit: | Empower website. | Betterment website. | Schwab website. |

Comparison Articles:

- Wealthfront vs Vanguard

- M1 Finance vs Vanguard Personal Advisor Services

- Betterment vs Wealthsimple vs Vanguard Comparison

- M1 Finance vs Vanguard Personal Advisor Services – Should I Pay for a Robo-Advisor?

- Fidelity vs Vanguard

- Robo Advisor Comparison Chart

- Best Robo Advisors for IRA Retirement Account

Sources

- https://personal.vanguard.com/pdf/vanguard-digital-advice-brochure.pdf

- https://personal.vanguard.com/pdf/vpabroc.pdf

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.