Betterment Financial Advice and Planning – CFPs for all Investors

Hybrid robo-advisors that offer both digital investment management and financial planning advice frequently require high minimum investments or higher management fees. That’s a barrier for those who just have a few financial planning questions like, Is my portfolio on track?, How should I plan for retirement? or How can I invest for my child’s college education? Betterment’s fee-based financial advice packages are a solution for investors that don’t need regular financial planning, but want a fiduciary Certified Financial Planner to speak with about specific topics. Rarely found among robo-advisors, these a la carte financial advice packages give Betterment Digital customer live investment advice, for reasonable fees. You only pay for the financial planning services that you need.

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

[toc]

For those with complex or ongoing financial planning needs, Betterment Premium, with unlimited financial advice is a reasonably priced solution. Like Personal Capital and Schwab Intelligent Advisors, Betterment Premium is a robo-advisor with a financial planner.

What is Betterment?

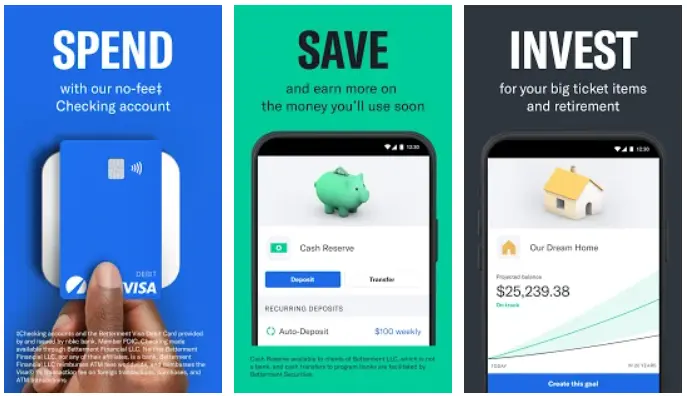

Betterment is a financial advisory firm that helps investors of all types manage their money to meet their future goals. Through a combination of both digital investment management, based on well-respected Modern Portfolio Theory and access to human financial planners-for an additional fee, clients receive premier service for a lower cost than that of typical traditional financial planners.

Betterment is currently the largest stand-alone robo-advisor. In addition to their superb digital financial planning, the financial advice packages, designed for life milestones, are ideal for the consumer with specific financial questions and a limited budget. In this review, you’ll learn about Betterment’s financial advice packages and find out of Betterment fit’s your investment management needs.

Before we get into the financial advice packages, here’s a quick overview of Betterment Premium and Betterment Digital services.

Betterment Digital

- Minimum investment: $0.00, $10 to begin nvesting.

- Management fee: 0.25% for accounts worth more than $20,000 or those with a $250 per month auto deposit.

- $4 per month for accounts worth less than $20,000.

- Goal-based, diversified investment manager designed to achieve strong returns for your individual risk level.

- Automatic rebalancing.

- Tax-loss harvesting.

- Synch outside accounts with your Betterment account.

- Zero minimum balance required – $10 to begin investing.

- Tax-loss harvesting, integrated with spouses accounts.

- Opportunity to choose socially responsible, smart beta, income portfolios and crypto.

- High yield cash and checking accounts available through partner banks.

If you want unlimited access to a Certified Financial Planner, Betterment Premium might be for you. It’s just right if you’re seeking a robo-advisor with unlimited financial planner access, for an additional fee.

Betterment Premium

Minimum investment: $100,000

Management fee: 0.40% of AUM

For those with greater financial planning needs and $100,000 to invest, you might consider the Betterment Premium plan.

Betterment premium includes all of the Digital services and more. This service gives you unlimited access to a team of licensed Certified Financial Planners (CFP®). These financial experts monitor your accounts and give year round advice and financial planning. The fee for the Betterment Premium tier is 0.40% of AUM. Fees are reduced to 0.30% at $2,000,000.

Betterment Premium can help with any life or financial planning question:

- Marriage

- Having a child

- Receiving company stock options

- Retirement

- Investment decisions impacting accounts outside of Betterment

- and More

Betterment Premium is great if you want a robo advisor and unlimited access to Certified Financial Planners for a reasonable 0.40% AUM fee.

Betterment robo advisor Digital clients, with money questions can schedule targeted meetings with Certified Financial Planners through the fee-based financial advice packages. Betterment’s Financial Planners offer Planning Packages help you tackle specific investment and money questions. And don’t worry if your planning questions go beyond the five offers, just call to discuss how to receive guidance with other financial planning questions.

Betterment Financial Planner Advice Packages

If you’re seeking occasional financial advisor conversations, Betterment offers specialized advice packages. All packages include access to a video call with a Certified Financial Planner. You need to be a Betterment client to use these financial advice packages. So, open a Betterment account if you want to try the Betterment Financial Advice Service.

The programs are designed for specific investor’s goals with distinct fee-for-service price tags. (Packages and pricing is subject to change.)

Getting Started – $299

Designed for new investors who want a call with a financial planner and help setting up and optimizing their Betterment account.

Financial Checkup Package – $399

Receive a professional opinion of your current financial situation and investments, with recommendations to help you meet your money goals.

College Planning Package – $399

Those with kids can get a handle on future college expenses with the College Planning Package. The CFP will review your current financial situation and help you plan for future college expenses including how much to save and in what type of accounts.

Marriage Planning Package – $399

The marriage planning package is for couples who need help with budgeting, planning, debt and financial management. You’ll also get direction with merging your finances.

Retirement Planning Package – $399

This package reviews all client financial accounts and guides clients towards retirement-readiness. In addition to a 60-minute call with a CFP, the investors receive one month of free email access to Betterment financial experts for follow-up questions and advice.

Crypto Planning – $399

This 45-minute call with a CFP guides you on how to invest in Betterment’s crypto portfolios and helps you determine if crypto is right for you.

The Betterment Financial Planning Packages are ideal for clients seeking help with specific money questions. The one-time-fees are not widely available within the robo-advisory world.

Betterment Investment Advisor Concierge Team

If you’re considering signing up for Betterment or are an existing customer, you have access to complimentary guidance as long as you have at least $100,000. Licensed Investment Advisors are available to help you with the transfer of your assets to Betterment, or to better understand Betterment’s features, services and platform.

The concierge team helps you:

- Review your current situation, accounts and investments to make sure they’re aligned with your goals and risk level.

- Create a plan to transfer assets, while minimizing taxes and fees.

- Make sure the Betterment account is set up properly, and then execute the plan.

If you have an extremely complex financial situation, the Betterment Advisor Network will partner you with just the right financial advisor. This CFP® is a fully vetted, dedicated independent financial advisor. The fees for this individualized service depend upon the specific advisory partner. You can contact Betterment for more details on this service.

Betterment is so confident that you’ll appreciate their services that they offer a Satisfaction guarantee – a 90-day fee remittance if you’re dissatisfied.

Betterment For Advisors Network – Automated Portfolio Management for Financial Planners

If you’re a financial advisor, seeking a dedicated robo-advisor for your practice, you might check out the Betterment for Advisors. Betterment handles the back-office and investing responsibilities, while you manage your client’s questions.

FAQ

What’s the difference; Betterment vs Financial Advisor

Betterment is a comprehensive investment manager. Under the Betterment umbrella you can choose an all-digital investment manager, and sign up for the Betterment Financial Planner advice packages.

If you sign up for the Premium service, you’ll pay the Betterment Advisory Fee of 0.40% AUM and have access to unlimited meetings with CFP financial advisors.

In sum, the Betterment robo advisor is an investment management company that offers various ways to receive human financial advise from well-qualified Financial Advisors.

Is Betterment worth the fee?

Betterment CFP Advice Packages Wrap up

If you want a well managed investment portfolio for a low fee, then Betterment is worth a look. When you need financial guidance from a Certified Financial Planner, Betterment’s Advice packages are ideal. You only pay for the advice that you need. If your financial questions go beyond the scope of the available packages, contact Betterment to discuss whether a CFP consultation might help. Wealthier investors, with ongoing planning needs can chat with a Betterment concierge financial consultant to decide if Premium, with unlimited financial advisor access is a good fit. Other robo-advisors with financial planners include SoFi (free investment management), Schwab, SigFig, Vanguard and more.

Related

- Betterment vs Wealthfront vs M1 Finance

- Personal Capital vs Betterment

- Betterment vs M1 Finance Robo-Advisor

- Robo-Advisors With Financial Advisors

- Socially Responsible Robo-Advisors

- How To Choose A Robo Advisor

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.