Investors, whether they’re in Canada or the United States, need the best portfolio trackers to monitor their mutual and exchange traded funds, individual stocks, and bonds for many reasons.

You want to examine your investment returns, fees, asset allocation, as well as plan for retirement and more. And you need the best personal investment software to do it right!

Of course you can create your own portfolio construction tools with an investment tracking spreadsheet, but with the excellent investment portfolio management software available, why bother?

From free investment software, to a one-time payment or on-going fees, there has never been a better selection of investment software or stock portfolio tracking on the market. Both price and features matter and we’ll explore both.

Looking for the TL;DR of the article? Lets get right to the point

Empower's free tools are in a league of their own when it comes to portfolio management software. The combination of the tools being free along with the sheer quality of the tools themselves make them a rock-solid option for any investor, saver, or budgeter.

I had access to one of the most comprehensive suite of tools available, within ten minutes of signing up. Investment tracking, net worth calculations, fee analyzers, budgeters, cash flow tools, the whole deal.

If you're short on time and simply want the best, click below to get started with Empower.

If you've got some time, lets dive into the 7 best portfolio management software's available for investors today

We’ll start out with the free portfolio trackers and investment management software for individuals, next the investment and stock portfolio trackers that charge an ongoing fee.

Embedded in many of the platforms is asset allocation software, to keep your investments in line with your goals and risk tolerance. Some portfolio management solutions also provide comprehensive financial planning software.

The best portfolio analyzer is one that meets your investing portfolio management, tracking and budget needs. We’ll cover investment tracking software, able to handle stock tracking, ETF and mutual funds.

What are the best portfolio management software tools right now?

- Empower (formerly named Personal Capital)

- Ziggma

- Quicken

- Mint

- Investment Account Manager

- Morningstar Investor

- SigFig Portfolio Tracker

Empower (Formerly Personal Capital)

Empower is our top free investment and portfolio management software for individuals.

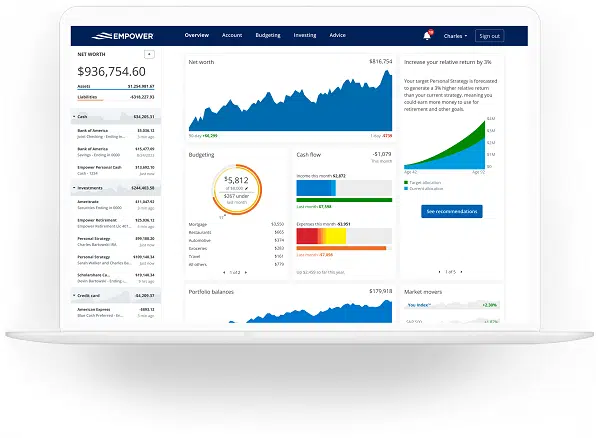

The platform, with mobile and desktop computer access has a load of features. It takes just a few minutes to sync your accounts after which your personalized dashboard is available.

The Empower finance dashboard incorporates all of your bank, credit card and investment accounts and gives you a 360 degree view of how your investments are performing along with other useful money information like saving and budgeting.

The Empower portfolio tracking software and tools for portfolio management will help you:

- Analyze your cash flow including both income and expenses

- Calculate your net worth – including updated home values via live real estate data

- Check on and analyze your investments

- Plan for retirement

- Analyze your account fees

- Perform an investment check up

- Review your asset allocation

Of note, we have a in-depth review on every one of Empower's free tools, located here.

The investment check-up offers priceless tools – on par or even better than what many full-service brokerages offer.

The overriding question that the investment check-up answers is “Could your portfolio give you greater or equal returns for less risk?”

The program answers this question by comparing your current asset allocation to the recommended target, and recommending improvements.

The retirement planner calculator tells you best and worst case retirement scenarios. It shows how much monthly spending your current portfolio will allow throughout retirement.

This is my “go to” resource to check on and analyze my investment performance, and income versus spending. It’s easy to use and automatically updates, unlike Quicken, (which I also use) where you must request an update to my portfolio.

The net worth calculator even maintains an updated value of your home. And, while on the go – the portfolio management app is ideal for a quick check of your investment returns.

One of the best aspects of Empower is how fast and seamlessly your accounts are linked! You can be up and running in under ten minutes.

I was amazed at how fast my complicated investment portfolio was uploaded and analyzed. Even when I had 10+ accounts with multiple investments in each, it had my account fully analyzed in a very short amount of time. Here is a snapshot of the dashboard.

I recently completed a retirement analysis and increased my annual spending projections. The new retirement analysis showed that I’m still fine at the new spending level. It was fast and easy, and I know now I have more disposable income and can spend a few more bucks, thanks to this completely free tool.

The only downfall with this tool is that you may need to field a call from an Empower representative.

Other than that, the tools are free to use. I consider Empower a top contender for the best investment software. I appreciate how all of the accounts auto-populate so that I don’t need to input data. If you're interested in Empower's tools, just click the button below to get started.

2. Ziggma

Moving all the way up to number 2 on our list of best portfolio management softwares is Ziggma. Keep in mind, much like the next platform on this list in Quicken, Ziggma is a subscription service. You'll pay $9.99 per month for the premium plan. So if you're a stickler for paying, Empower will definitely be your best bet.

However, don't give up on this platform just because it's a paid service. It packs a huge punch.

I would argue that Ziggma is more suited for investors looking to not only have their portfolios tracked, but utilize tools like stock research, portfolio simulations, and custom stock scores to build their portfolio.

Platforms like Empower and Quicken don't offer things like stock research or stock scoring. So, if this is what you're looking for, I'd say give the platform a test, they do have a 7 day free trial you can get here.

Investors can analyze their existing portfolio with advanced analytics, screen for new assets, and perform stock research, all within one platform. What sets Ziggma apart are its innovative features tailored to offer an in-depth understanding of one’s portfolio, going beyond just the basic sector and geography breakdowns.

Like all of the best financial planning tools, you link your accounts or you can start with a virtual portfolio.

Unlike competitors, Ziggma gives you sophisticated metrics about your portfolio including the “Ziggma Score,” Beta, ESG Score, Yield, Return on Assets and Revenue Growth.

Overall, Ziggma is going to be suited to those who are not only looking for portfolio management tools, but a strong suite of tools for researching particular investments that may be right for their portfolios.

3. Quicken Premier 2023

Quicken has been the go to resource for investors as a portfolio management software for decades. And the best part, it can be used in combination with Empower to get the maximum results out of your investment portfolios, budgeting, and saving.

The reason why I'd choose Empower over Quicken right now? The company switched to a subscription fee model, and you'll need to renew the subscription annually. Keep in mind, the features are more robust. However, I've found that most investors would find Empower comprehensive enough and doesn't cost anything.

But, if you're willing to pay, this is the top-tier platform, no doubt. If you don’t renew, you’ll forfeit software updates. The program also has an online portfolio tracker app for on-the-go money management.

Similar to Empower, after syncing your checking, saving, debt and investment accounts, you have a comprehensive financial management portal.

The Quicken Premier financial planning software tools are both basic money management, budgeting, debt tracking and cash management software as well as a comprehensive investment portfolio management program.

The stock portfolio management software synchs with real time stock quotes and the Morningstar ® X Ray analysis tool.

Quicken premier investment management features include:

- Multiple money and investment management reports with deep level customization options

- Investment account downloading and tracking including income, dividends, fees and more

- Reports include; capital gains, rate of return, performance versus the market, investment transactions, cost basis, tax reports and more

- Risk/return analysis

- Retirement planner tool

- Portfolio X-Ray tool from Morningstar® with a detailed drill down into your overall diversification and portfolio characteristics

- Option trade tracking

In addition to the investment capabilities there are robust income, expense, budgeting and money management tools. If you're looking for alternatives, some of them free, check out these Quicken substitutes.

4. Mint

“Compare your portfolio to market benchmarks, and instantly see your asset allocation across all your investment accounts like 401(k), mutual funds, brokerage accounts, and even IRAs.” ~Mint free investment tracker

The popular and free Mint.com investment and money management web-based software has a lot going for it.

With quick linking to your accounts, similar to Empower (read our comparison here), you get a quick overview of your financial picture.

Mint tracks all of your financial accounts including credit, banking, investment and retirement. Mint also highlights your fees, so that you know how much of your money is being eaten up by pesky fees.

Mint offers these financial tools:

- Income and expense categorization and tracking

- Budgeting

- Investment tracking

- Free Credit Score

- Alerts

- Bill pay

Mint claims to help “Get the right tools for your investment style.”

The online portal offers tips and advice for both active and passive investors.

The Mint investment and portfolio tracking software is satisfactory for beginning investors seeking a free basic money management, saving, spending, budgeting, and tracking tool.

Intermediate or sophisticated investors might prefer advanced stock portfolio tracking and management apps like Empower or Quicken. We don’t consider Mint investment portfolio accounting software.

5. Investment Account Manager

Investment Account Manager software is highly sophisticated investment accounting software. The product was designed by professional money managers and used by investors globally since 1985.

The goal of the software is to help you understand and manage your investment portfolios. The investment accounting software for individuals is suitable for both newbies and seasoned investors.

Investment Account Manager is designed for stock portfolio tracking and investment management, not budgeting, debt or other financial management tasks. If your sole purpose is to track your portfolio and you're willing to pay, it's certainly one to look at.

You can track an unlimited number of portfolios. Each investment portfolio is handled individually and transactions are segregated by account. This helps the investor to create portfolios by objective and track according to distinct parameters.

The reports section allows you to customize reports and even create reports that combine portfolios. For example, Investment Account Manager allows you to combine all portfolios and review your overall asset allocation (stocks, bonds, cash and other) and on a granular level by stock sector and size.

The data helps you determine if you’re meeting your investment goals. The reports given by the platform include detailed cost basis data to customizable income reports and more.

As this software is for investment tracking only, you’ll find specific data for many types of assets including; cash, money market funds, US Government, agencies, and tax-exempt bonds, corporate bonds, preferred stocks, mutual funds, exchange traded funds, common stocks, options, and other investments.

Within the asset library, there’s detailed security data including:

- Security Type

- Security Symbol and description

- Price

- High price alert

- Low price alert

- Dividends

- Earnings

- Projected dividends and earnings

- Book value

- Cash flow

- Beta

- Bond specific data

- and More

You can download the data from your broker or input manually.

The rebalancing feature makes it easy to see if your portfolio is out of balance and what securities need to bought or sold to return to your preferred allocation. There’s even a sector weight allocation option.

Two more of my favorite features are benchmark comparisons and for individual stock owners, fundamental ratio analysis tools. Additionally, Investment Account Manager also offers a professional version of the software for financial advisors.

There is so much meat in this software, that the casual investor will likely feel overwhelmed, and better off suited with a more basic, yet still robust, platform like Empower or Ziggma.

The investment management software is compatible with the Windows operating system, and users can run the software on a Mac with windows emulating software.

You also get a 60 day free trial, which is quite generous! After the trial, the reduced fee is $99 per year and includes QuoteMedia data feed. Or, if you’d prefer not to renew annually, you can continue to use the software indefinitely, without access to program updates, tech support or the QuoteMedia data feed.

6. Morningstar Investor (Formerly) Portfolio Manager

This freemium portfolio analyzer allows investors to import or manually enter their holdings and gain valuable insights. The free Morningstar portfolio x-ray is one of the best investment tools and shows stock style diversification, sector and style breakdowns, geographical distributing and a summary of fees and expenses.

This feature is also available through a Quicken membership, and the securities are already imported.

The Morningstar Portfolio Investor offers a free trial and then you’ll need to sign up for Morningstar premium, for continuing access. Overall, it's one of the more expensive trackers on this list, and is why it finds itself near the bottom.

The free Morningstar Portfolio Manager includes:

- Investment tracking of all stocks, bonds and cash. You can either manually input or import the securities, number of shares, purchase date and commission.

- To track your portfolio, click the “Tracking” tab. This tab shows price, percentage change, share information, market value, asset allocation percent and Morningstar fund rating. For the portfolio analysis report, you must sign up for the premium service.

- The “my performance” tab graphically shows how your portfolio performed and compares it with a designated index.

- The Morningstar X Ray uncovers how your investments in aggregate are positioned, including asset allocation, stock sector, stock type. More in depth analysis is available with the Premium subscription.

The premium investing portfolio management includes scores of features including: fund and stock screening, fundamental analysis ratios, portfolio x ray interpretation with style, financial ratio, and expense analysis.

It certainly does pack a punch, and for more advanced investors, the premium subscription could be worth it. What I would do personally is sign up for a free tool or a cheaper alternative and if you find yourself wanting more, take it for a 14 day trial run.

After that, the annual fee is $249 or $34.99 per month.

7. SigFig Portfolio Tracker Software

SigFig is a robo-advisor with a free online portfolio tracker. Although less comprehensive than Empower, I still find it worthy of inclusion on this list. The free portfolio tracker offers:

- Investment account sync

- Portfolio Tracker

- Reporting Dashboards

- External Portfolio Analysis-SigFig Guidance

- Live Chat/Phone Support

Anyone can use the free SigFig investment manager. The tool offers mutual fund trackers and stock tracking software.

If you want to try their robo-advisory investment manager, SigFig is a competitive service and charges 0.25% AUM. Many low-fee robo-advisors require you to move all of your assets into the company account.

SigFig offers portfolio management for investors with existing Fidelity, Schwab, or TD Ameritrade accounts. This is a convenient feature, especially if you have a larger portfolios and want to avoid the tax implications and complications of transferring your existing investments.

Our SigFig Review drills into this independent portfolio optimization platform that helps everyday investors track over $350 billion in assets. Through its partnerships with Fidelity and Schwab, the company’s algorithmic investment strategies work to analyze, monitor and improve any portfolio, automatically balancing and diversifying investments, while reducing risk and minimizing fees.

SigFig’s Asset Management technology instantly analyzes your current investments, learns about your goals and risk tolerance, and tailors an individualized portfolio strategy. The automated systems constantly monitor and optimize your investments while reducing management fees.

SigFig’s investment portfolio management services require investors to invest a minimum of $2,000 and offers free service to all accounts valued less than $10,000. For investors with accounts valued at more than $10,000, the annual 0.25% fee of assets under management (AUM) covers these services:

Investment Portfolio Tracking Software – Honorable Mentions

The best portfolio tracker is the one that works for you. Personal investment tracking apps and investment management platforms should handle a growing portfolio, but setting up investment tracker software takes time. So, I hope you can make your decision after a thorough review.

You might need a complete portfolio analysis tool. In that case, look to Ziggma or Investment Account Manager.

While for many a simple portfolio tracker app like Empower (free) or Quicken (paid) is just fine.

The following is a list of more investing and stock portfolio management software:

YahooFinance Portfolio Tracker – This free investment portfolio tracker allows you to import from a spreadsheet or manually input your portfolio. The portfolio analyzer offers a list of investments with details including fundamentals, performance, news, and risk analysis.

Ticker app – Available for iOS and android devices, offers the opportunity to monitor multiple portfolio with colorful charts and graphs. The free stock tracking app shows positions, profits, losses, and news. Holdings must be manually input.

PortfolioVisualizer.com – Although, this free investment software is not a stock portfolio tracker but a sophsiticated investment analysis tool. We use it regularly to analyze our investment portfolios. The online portfolio analysis tools include; backtesting, Monte Carlo simulation, tactical asset allocation and optimization and more.

Sharesight.com – This free stock portfolio tracker is pervect for new investors with a few positions. Sharesight is a portfolio tracker with automatic holding updates, tax, and performance reporting. The first ten holdings are free. Sharesight, this investing portfolio management software also checks your dividends and stock splits, providing accurate performance data.

FAQ

What is investment management software or portfolio management software?

Investment management software is a computer program or tracker that allows you to view details about your investments.

Features include purchases, sales, dividends, capital gains, and price data. The software enables you to analyze your investments and find out which are preforming best and those that are lagging.

What is the best portfolio tracker app?

The best portfolio tracker app depends upon your own personal needs. In fact, many investment brokers offer their own tracker apps. Although to look at your investments that are owned in several accounts, we like the free portfolio tracker app from Empower, due to the vast number of features. I did an in-depth review on these features here.

What is the best investment tool?

The broad category of investment tools includes many money management apps that span the budgeting, saving, and investing software sphere.

Mint is a great starter investment tool. For budgeting, YNAB is quite popular. To begin investing and learn, consider investigating the best robo advisors.

Which is better – Empower (Personal Capital) or Mint?

They’re both free investment management and tracking software, so why not try both? When it comes to sophisticated investment portfolio analysis tools – Empoer is best. For basic budgeting and money management, Mint is best.

I wrote an in-depth review on the two platforms here

What is the best free portfolio management software?

Empower (formerly Personal Capital) is our best free investment management software recommendation.

After linking your accounts, you’ll get access to one of the best retirement calculators, investment check up, fee analyzer, and many more financial insights. Although the firm would like you to sign up for their paid investment management services, the free tools are available to anyone. Although, Ziggma is a close second

The Best Portfolio Analysis Software Takeaway

Investment portfolio analysis software is useful to track returns, asset allocations and individual investment performance. From DIY spreadsheets to robo-advisors, there are many available options.

Choosing an investment management system ultimately depends upon the features you’re seeking. Regardless of which option you choose, the free Personal capital dashboard provides excellent investment insights and is quick to set up. It’s worth signing up for Personal Capital, whether you choose another option or not, because of the detailed investment tracking and it’s free.