Our Empower (Formerly Personal Capital) vs. Mint comparison is an eye-opener that'll give you an in-depth understanding of both these apps. Empower and Mint are among the most popular online financial management platforms today. Additionally, they're free and cater to different customer types, so it's very important you read this review in full before making a decision.

Empower and Mint help you create a customized budgets to manage your finances appropriately. They allow you to synchronize your financial account in one place to categorize your spending automatically.

Although the two have nearly identical functionality at a casual glance, they also have distinct features that differentiate them. Hence, your choice depends on your financial goals and personal preferences.

This review compares and contrasts the two personal finance apps to help you pick the ideal one to achieve your financial objective. Let's dive in.

Empower (Personal Capital) Vs. Mint Overview

The general overview of Empower and Mint includes the apps' definition, how they work, the ideal users, and how they stand out in the market. Let's look at each of the apps in-depth.

Empower

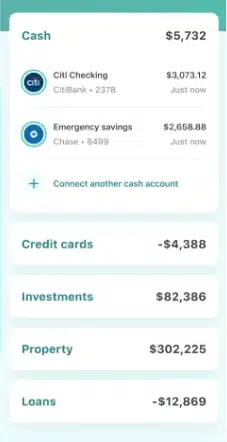

Empower is an investment tool and a budgeting app that tracks your spending and wealth by linking to your financial accounts (credit cards, bank accounts, 401(k), IRAs, loans, and mortgages).

Empower offers a tracking dashboard with your investment portfolio's breakdown, allowing you to view your personal finances in one place. Also, it has a net-worth tracker that tracks your financial situation, lets you see where your money goes, and sets a budget for you.

It categorizes your expenses but gives you a customizing option. It has a vast amount of tools, all of which are completely free for users.

Mint

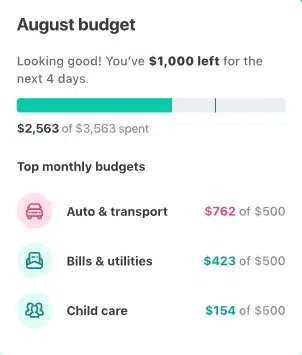

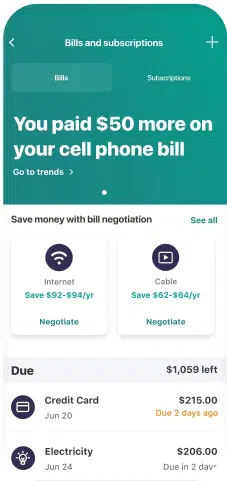

Mint is a free money manager and a robust budget-tracking app that keeps all your accounts in one place. It helps in budget planning and tracking, account balance tracking, bill negotiation, and credit monitoring. Thus, it allows you to easily craft a budget and remain on top of your bills payment.

The money management app syncs your accounts (bank accounts, IRAs, and credit cards) to track your income, savings, and spending. Its budgeting app has a daily budget planner which considers your spending to suggest budget goals.

Mint is best if you have a specific financial goal and need regular monitoring of your spending. It lets you see your recent transactions and account balance and know about forthcoming bills.

Customized over-budget alerts, bill payment reminders, and credit monitoring services are special features that make Mint outstanding. It also lets you learn about and manage your finances and spending instantly.

How can Empower and Mint both be free? What's the catch?

Both apps are free but have different ways of making money that affect the user experience.

Empower offers wealth management services. So, while their tools are robust and completely free, there will be fees if you choose to have your portfolio managed by them via something like a robo-advisor. However, there is zero obligation to do so while using its free tools. They will always be free.

On the other hand, Mint is completely free to use and has no hidden fees. The company funds its free products through ads and affiliates to generate revenue. Therefore, you'll have to pay $0.99 monthly to use the ad-free app. The app's iOS version also has a $4.99 monthly premium plan with additional trend and monitoring features.

Lets compare Empower versus Mint

Below is the breakdown of Empower and Mint on multiple levels:

Fees

Empower has two service plans: A free version (mobile and online) that provides all of the tools highlighted in this article and a paid wealth management end where you will pay a fee relative to your assets under management.

Mint, conversely, is entirely fee-free. The app offers its budget app at no cost.

Keep in mind, however, that if we're comparing these two on an apples-to-apples basis, meaning simply their tools, both are free to use.

And considering Empower's total suite of tools is more robust, I'll have to give them the edge here.

Winner: Empower

Linking Financial Accounts

Empower and Mint link up to thousands of financial accounts, allowing you to access asset allocation, performance, and value of your portfolios and accounts. However, Empower differs slightly from Mint as it will enable you to interact with your investments.

Both apps can link to your bank accounts, credit cards, 401(k), IRAs, loans, and mortgages.

Winner: Empower (Narrowly though)

Financial Dashboard

Empower and Mint have financial dashboards that give you a high-level view of your investments.

Empower's dashboard (shown above) has budget planning tools but focuses more on wealth management. It shows the following:

- Spending Reports and upcoming bills

- Account balances and transactions

- Spending by account (category)

- Investment portfolio balances

- Projected investment fees

- Top gainers and losers

- Retirement savings

- Portfolio allocations

- Investment returns

- Emergency funds

- Key holdings

- Cash flow

- Bet worth

- Budget

On the other hand, Mint's dashboard displays:

- Monthly budget

- Upcoming bills

- Free credit score

- Investments

- Spending

- Goals

Overall, Empower's dashboard is more robust and contains many more features for those who don't necessarily want to focus on budgeting and credit scores. It casts a wider net, and is likely more useful to many people than Mint.

Winner: Empower, by quite a bit

Budgeting Capabilities

Both apps can connect to your financial accounts, such as bank accounts, credit cards, investment accounts, and loans. Thus, you can easily track the fluctuation of your assets and liabilities. Also, the apps feature a budget-tracking interface and net-worth tracker.

Empower informs you of how close you are to reaching your monthly budget or if you're overspending. Conversely, Mint allows you to create different categories of spending goals.

Although both apps try to assign each transaction's category, they allow you to edit them if not done correctly. However, Empower can only monitor cash flow, it can't craft a budget.

Additionally, Empower offers an investment portfolio breakdown, and as mentioned, investment management services for a fee. Also, it has an 'Investment Checkup' feature that allows you to earn more with your investment portfolio. You can access financial advisor support on how to customize your investment strategy.

As a result, Empower leans more toward wealth management than tracking your expenses. On the other hand, Mint is geared towards spending guidance and detailed budgeting tools, making it the winner for this functionality.

Winner: Mint

Investment Management

Although the two platforms offer investment tracking tools, Empower's are much more robust. It offers several critical features lacking in Mint. Empower shows you asset allocation details and your specific investments. Also, the app automatically calculates your investment costs and how they'll affect your wealth over time. The app analyzes your investment portfolio and uses your risk tolerance to make recommendations.

You can see the image below, highlighting some of the robust features of Empower's Investment Checkup tool.

Winner: Empower

Mobile Apps

Empower (Personal Capital) and Mint offer apps for Google Android and Apple iOS. Thus, you can use them on your tablets, smartphones, and Apple smartwatch. However, there are exclusive features to the website or mobile app for each service, allowing you to utilize the service to its fullest.

Both are ideal for Millennials as they use mobile phones as their primary or only devices.

Tie: Equal capability

Bill Tracking

Empower and Mint track your bills and alert you on upcoming bills. However, Mint captures more alerts and reports upcoming bills more accurately. Also, the app alerts you of any pending bills via email.

Contrastingly, Empower misses many bills. Hence, Mint has more reliable billing alerts.

Winner: Mint

Security Measures

The two apps have robust security features, safe for your use. While Mint has two-factor authentication, Empower requires the registration of your device to use it. A pin is sent to your email or phone for the registration, and you can only log in after registering.

Additionally, Empower and Mint are read-only: You can't transact (funds transfer from a checking account) through the services, and the downloaded data has no identification information like an account number. Therefore, there's no security risk in case of an account being compromised. Also, the apps offer a fingerprint login option on all supportive iOS devices.

Winner: A tie

User Experience

The two financial management apps are user-friendly as they display complex information with simplicity: Easy-to-understand and straightforward dashboards.

Mint has customizable dashboards, allowing you to select how features appear according to your needs.

However, Empower has a smoother user experience: It uses easy-to-digest graphs and charts. In my opinion, it's the much smoother customer experience.

Winner: Empower

Retirement Planning

Empower offers a retirement planner to help you determine the amount of money you must save for your retirement within a short time. Thus, you can estimate your retirement readiness: Plan for income (via pension or social security) and expenses (vacation, monthly expenses, or home purchase). Also, you can create and run multiple retirement scenarios against each other.

Conversely, Mint offers no retirement planning feature. Therefore, Empower is the clear winner here.

Winner: Empower

Synchronization

Both apps have a pretty similar synchronization process to aggregate financial data. However, Empower is more satisfying, according to users' reports.

Empower uses Yodlee for synchronization – a more stable and reliable service. On the other hand, Mint uses Intuit's synchronization service – an in-house system– to link to financial institutions.

Winner: Empower

Empower (Personal Capital) Pros & Cons

Pros:

- Ease of use: Provides information in user-friendly charts that are easy to understand.

- Budgeting tools: Empower has a spending tool allowing you to monitor your spending habits.

- Free app download: You don't need to pay any fees to download the app.

- Financial advisors: The platform's dedicated financial experts offer advice to its users.

- Account monitoring: Empower allows you to monitor all financial accounts from one place.

- Retirement and investment planning: Offers free, comprehensive retirement and investment management tools.

- Robust set of completely free tools: The company gives its users the ability to access many tools without obligation to sign up for wealth management services.

Cons

- No credit monitoring: The lack of this feature keeps you unaware of your financial fitness.

- Not as good of a budgeting tool: Compared to Mint, its budgeting capabilities are inferior

Mint Pros & Cons

Pros

- Fee-free services: The basic version of Mint is free to use if you don't mind the ads that come with it.

- Tight security: Mint is safe and has bank-grade security to protect your personal and financial information.

- Synchronization: It can link to various financial accounts such as credit cards, bank accounts, loans, and mortgages.

- Alert and reminder tools: The app keeps you on top of your bills by alerting you of upcoming bills.

- Credit monitoring: Mint offers free credit report monitoring services, allowing you to keep your financial health in check.

Cons

- Incorrect assignment: The app's categories may assign incorrectly.

- Connection issues: When linking the app to your financial accounts, you may face occasional account connection issues.

- Lack of ads removal option: You can only for an ad-free experience as there is no option to remove them when using the basic version.

- An inferior set of total tools: Empower's overall suite of tools is much more robust unless you're specifically looking for a budgeting tool.

Empower Vs. Mint, which one is better?

Empower and Mint are great financial management tools, each in its own way.

If you're looking strictly for a budgeting tool, it's hard not to like Mint.

However, if you want a budgeting tool that's a little more simplistic but is paired up with some of the most robust financial planning tools available for free on the internet, then Empower is a no-brainer.

You could consider using Mint for its budgeting and Empower for its financial planning simultaneously for a comprehensive financial management plan. Both are cloud-based and read-only services.

FAQs

Is Mint Good for my personal finances?

Yes, Mint is good for personal finance. It's one of the ideal budgeting tools to monitor your spending to achieve your financial goals regularly. The app shows your recent transactions and account balance, alerts you on upcoming bills, and monitors your spending.

Is the Empower app worth it?

Yes, the Empower app is worth it. The app offers excellent robo-advice, private client, and wealth management services. Therefore, you can track your spending and wealth by connecting the app to your financial accounts. Utilize their tools for free, and if you'd like, take a peek at their wealth management services.

Is Empower (Personal Capital) Better than Mint?

Yes, Empower is better than Mint in most areas of functionality. The key elements that make the platform better include:

- Fewer reported synchronization issues.

- Access to a detailed breakdown of your investments.

- Super valuable retirement features.

- Inferior but still completely usable budgeting tools.

Also, Empower offers a smoother user experience and better customer service.

Why is Empower Better than Mint?

Empower is better than Mint as it focuses more on investment tracking, but still allows people to utilize it for budgeting. Mint, on the other hand, is strictly a budgeting tool.

In addition to controlling your finances, Empower provides a way for them to grow (investing). Moreover, its budgeting tools are more cashflow-based, focusing more on your overall income and not the small expenses.

Can I Trust Mint Budgeting?

Yes, you can trust Mint budgeting. The platform has detailed budgeting tools and offers spending guidance. Also, it allows you to craft a budget by category and track your spending across each group's subcategories. Mint lets you link offline and online bills and automatically notify you of upcoming bills. It's an excellent overspending curbing tool.

Is It Safe to Connect Your Bank Account to Mint?

Yes, it's safe to connect your bank account to Mint. The app is safe to use and has bank-grade security, which is reliable for personal and financial information protection. Hence, it cannot access your key data when connecting to your financial accounts. Also, it stores your username and password in an encrypted software and multilayered hardware-protected database.