Most robo-advisors are created to benefit a wide range of people. Some robo-advisors, however, are specialists: they tailor their services toward a specific clientele. Many people wonder, when does it make sense to go with a niche robo-advisor? Will the general robo-advisor meet my unique needs?

Today, we are comparing the for-everyone robo-advisor, Betterment, with the more specialized, female-focused robo-advisor, Ellevest. Both Ellevest and Betterment are excellent robo-advisor financial managers with many planning, saving, investing, and advising features.

This Ellevest vs. Betterment Review will arm you with the information to decide which investment manager is best for you.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Ellevest vs. Betterment—Overview

Both robo-advisors offer a wealth of services at various price points, making them customizable and accessible to a range of clients. However, these robo-advisors also have several distinctions.

What is Betterment?

Betterment has been in business since 2010, and holds a steady third place for assets under management. This places Betterment above all other independently-owned robo-advisors; only Schwab and Vanguard robo-advisors have more AUM.

Betterment is designed to work for any type of investor, from beginner to advanced. Betterment uses a goals-based model for determining portfolio allocations, so it is customizable for young first-time homebuyers and those approaching retirement alike. In addition to helping clients target their goals, Betterment also employs a host of investment strategies, ranging from more “hands-off,” passive investments and actively managed accounts like smart-beta investing and socially responsible portfolios. Betterment also offers crypto portfolios, for the more risk tolerant investor.

Their financial planning options, for an additional fee, make Betterment appropriate for the investor seeking Certified Financial Planner guidance to the newbie who wants to make sure her investing is on the right track.

Betterment recently introduced Betterment Checking and Cash Reserve with high return cash management features, through partner banks, including no fee ATMs.

What is Ellevest?

Ellevest is a robo-advisor and money membership designed for and by women. While people of all gender identities are more than welcome to invest with Ellevest, the robo-advisor is built to “close the gender money gap” that women tend to face. This robo-advisor recognizes the unique financial and career challenges many women encounter: lost time and income due to childbearing and rearing, lower wages than their male counterparts, and an industry that has traditionally been built and maintained for and by men.

In keeping with the idea that women already have enough challenges, Ellevest is designed to make investing simple and thorough. Client goals and risk are assessed along with market forecasting to create diverse and comprehensive portfolios.

Although both Betterment and Ellevest offer financial advisor access for additional fees, Ellevest also provides career consultants for its clients. Both platforms charge reasonable fees for financial advice.

Betterment vs. Ellevest—Top Features

Betterment Top Features

- Smart Beta, socially responsible, and income investment options

- Financial advisors available for all plans, for additional fees

- Tax-loss harvesting

- High yield cash management, banking services, and fee-free debit card available through partner banks

- Multiple goal investing at all levels

- Cryptocurrency portfolios

Ellevest Top Features

- Female-focused platform

- Financial planners and career consultants for discounted fees

- Impact investing

- Claims to offer more realistic future projections, including taxes, down markets and more

Betterment vs. Ellevest—Who Benefits

Winner: Both Betterment and Ellevest are replete with features and picking an overall winner for “Who Benefits?” boils down to what you’re looking for. We like both platforms – a lot – and are comfortable recommending either, depending upon your personal situation.

Minimum Balance

Investors who want to start off slowly with no minimum balance requirement (Betterment requires $10 to begin investing) will benefit from both Betterment and Ellevest. Both robo-advisors offer affordable Digital portfolio options to clients regardless of how much money the clients have to invest. This is great news for users who want to try out robo-advisors or may not have much money available for a large up-front deposit.

Goals

At the basic digital level, Betterment offers the opportunity for multiple goals including retirement. This is a significant positive in Betterment’s court, as many investors want the option of investing for multiple goals.

The Ellevest Plus plan includes two goals – build wealth and retirement. The Executive includes multi-goal investing in addition like saving for a home or saving for kids. While the Ellevest Essential level only offers one goal, which could be a disadvantage for the bare bones level.

Fees

Both Betterment and Ellevest are low fee robo-advisors. Ellevest provides a subscription based model with the option for discounted financial planning packages.

Betterment charges low management fees and offers a variety of ways to access financial advisors, for additional fees.

For additional fee breakdown, continue reading. In general, fee-conscious investors will find low fees at both Betterment and Ellevest.

Financial Advisors

Both Betterment and Ellevest offer access to Certified Financial Planners for an additional fee.

If you’re seeking career guidance, you’ll have to go with Ellevest.

Ellevest and Betterment Each Offer Many Benefits

Women will, of course, benefit most from using Ellevest. The platform is designed to take their needs into consideration as portfolios are generated and managed. However, anyone who wants to tailor their investments to support women-led businesses and communities will also like Ellevest’s impact investing options.

If you’re seeking a broader array of investment funds, you might lean towards Ellevest, with 21 diverse ETFs versus, Betterment’s 14 funds. Although greater number of funds doesn’t necessarily mean better returns.

If you’re seeking crypto and cash management (through partner banks), then you’ll need to choose Betterment.

In the “Who Benefits” match up, the portfolios have subtle distinctions, which, depending upon your needs will lead you to choose one over the other.

Betterment vs. Ellevest—Fees and Minimums

Winner: It’s a tie.

Betterment Fees and Minimums

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Ellevest Fees and Minimums

Ellevest has three subscription levels, plus extra services for wealthier investors.

Ellevest vs. Betterment—Top Features Deep Dive

Which robo-advisor best fits your needs: Ellevest vs. Betterment? If you are still unclear, this deep dive may help illustrate some more important differences.

Betterment vs. Ellevest—Human Financial Planners

Winner: It’s a tie.

If your assets surpass $100,000 and you have a complex financial situation you might opt for Betterment Premium, which costs 0.40% AUM. Although, depending upon the value of your assets, Ellevest’s 50% discount on financial advisor access might make the $9 per month Executive option suitable.

Ultimately, both robo-advisors offer access to human financial planners, although they do so with varying degrees of access.

Betterment

For those with $100,000 or more, seeking unlimited access to financial advisors, Betterment Premium, might be a good choice. The a la carte pay for service financial planning packages are a good choice for those with limited financial planning questions.

Ellevest

While the membership pricing does not include access to financial advisors, it does include the Ellevest Concerge Team to help with all aspects of the platform, and rollovers for retirement accounts.

But investors can schedule meetings with financial advisors and career coaches at discounted fees. The discount varies based upon the membership level. The discounts range from 20% off at the Basic Level to 50% off at the Executive level.

We like this approach as you only pay for the services that you need.

In fact, anyone can schedule a meeting with the advisors for the retail fee.

Ellevest App vs. Betterment App

Winner: Betterment – with Ellevest as a close second.

Both Ellevest and Betterment offer mobile apps for iOs and android. Both apps are well regarded, although the Ellevest android app is newer.

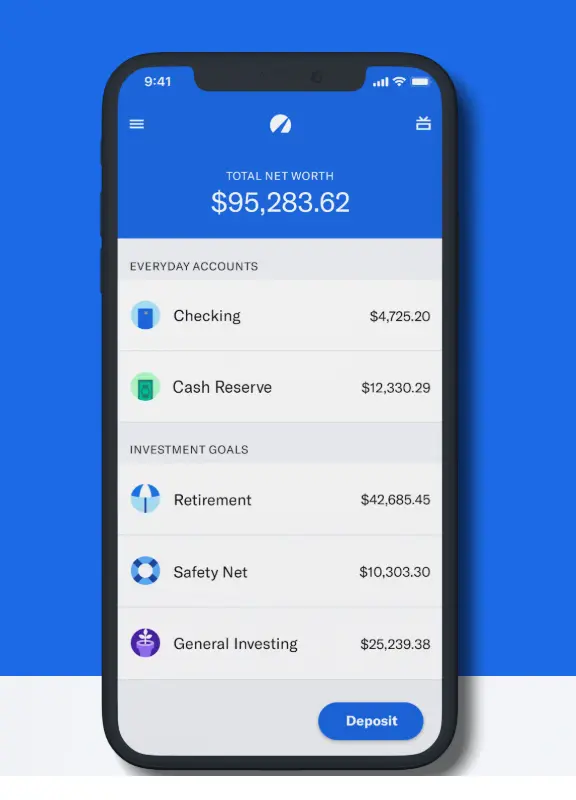

The Betterment app was recently redesigned and turned into a hub for your financial life. Not only does the app help you manage your financial life, but focuses on your life goals as well.

Both are well-regarded, and are a decent addition to the desk top platforms. Since both Betterment and Ellevest are desktop first financial management platforms, we would be comfortable with either app.

Betterment vs. Ellevest—Tax-Loss Harvesting

Winner: Betterment

Like many robo-advisors on the market, Betterment offers tax-loss harvesting on their portfolios. This is quickly becoming standard for many robos, though not all have followed suit yet.

While Ellevest does not specifically offer tax-loss harvesting, they do boast a tax-minimization strategy that functions in a similar way. This includes diversifying taxable and non-taxable accounts within your portfolio and, whenever possible, minimizing taxable gains while maximizing taxable losses.

Please be aware that tax-loss harvesting only applies to taxable accounts.

Betterment vs. Ellevest—Investments

Winner: It’s a tie. Both platforms offer a wide range of diverse investments.

As this Betterment Review vs. Ellevest Review demonstrates, both are committed to providing clients with good investment options. While Betterment’s are certainly well-rounded, Ellevest offers a more diverse pool of stocks, bonds, and other investment funds.

Cryptocurrency investors will need to choose Betterment.

If you’re seeking cash management then pick Betterment. Betterment Cash Reserve, through partner banks offers higher interest rates.

Betterment Investments

- US Small-cap stocks

- US Mid-cap stocks

- US Large-cap stocks

- International Emerging Market stocks and bonds

- International Developed Market stocks and bonds

- High Quality bonds

- Municipal bonds

- Inflation-Protected bonds

- High-yield corporate bonds

- Short-term treasury bonds

- Short-term investment-grade bonds

Betterment also offers smart beta portfolios, income portfolios, socially responsible options and cryptocurrency portfolios for investors seeking broader investment styles.

Ellevest Investments

- US Large Cap Value

- US Mid Cap

- US Small Cap

- US Small Cap Value

- International Developed markets

- International Emerging Markets

- International Total Bond

- US Dollar Emerging Market Bond

- Local Currency Emerging Markets Bonds

- US Total Bond

- US Short Term Bond

- US Mid Cap Value

- High Yield Bond

- US TIPS (treasury inflation protected) Bond

- US High Yield Municipal Bond

- US Short Term Municipal Bond

- US Municipal Bond

- FDIC Cash

- US REIT – Real Estate Fund

- International REIT – Real Estate Fund

Ellevest investing has thousands of unique portfolios, that are tailored to women’s specific goals and timelines. Like Betterment, the Ellvest Impact Portfolios are good for those seeking to invest with their values.

In the Ellevest Investments vs Betterment Investments competition, the best choice depends upon your personal preferences. We believe both platforms offer sufficient funds for adequate diversification.

Ellevest vs. Betterment – Account Types

Winner: This was a close one, but Betterment wins with the addition of trust accounts.

Ellevest account types:

- Individual and joint taxable investment accounts.

- Traditional and Roth IRAs

- SEP IRAs for business owners

Betterment account types:

- Individual and joint taxable investment accounts.

- Traditional, Roth, and rollover IRAs

- SEP IRAs for business owners

- Trust accounts

FAQ

Can I lose money with Betterment?

But, the benefit of investing in financial markets is that for long-term investing (more than five to seven years) is that the returns tend to be significantly higher. Historical stock market returns have averaged roughly 9% annually over the last 100 years while bond investments have averaged about 5%.

Although, there is no guarantee that past returns will repeat in the future and it’s typical that in the short term your investments might lose money.

Should I use Ellevest?

Is Betterment the Best?

We like both Ellevest and Betterment and provide non-biased information to help you make the best investment decision for you.

Ellevest vs. Betterment—Which is Best? Takeaway

Deciding who wins in the Betterment vs. Ellevest faceoff is harder than it looks.

Both robo-advisors try to minimize clients’ taxable losses through tax-loss harvesting or tax-minimization strategies. They also seek to provide affordable account management.

Both Ellevest and Betterment offer affordable financial advisor access.

For that reason, both robo-advisors are strong contenders for any investor, regardless of income level or experience with investing.

Bonus: Best Robo-Advisors for Women

However, the two robo-advisors start to diverge when it comes to other key features.

Only Ellevest offers career coaches. Although this may or may not be an ongoing need for you.

Betterment offers unlimited financial advisor access. This comes at the Premium level with the $100,000 minimum investment amount and 0.40% expense ratio.

While Ellevest Private Wealth Management clients can expect the royal treatment in terms of human account management, the account requires a minimum of $1 million in investments and does not disclose its account management fees.

For banking services including a high yield cash account through partner banks, Betterment is a sound choice.

Ultimately, determine which features are most important to you and invest accordingly. We believe that both Betterment and Ellevest are sound robo-advisors.

Read the complete Betterment Review

Read the complete Ellevest Review

More Comparison Articles

- M1 Finance vs. Robinhood

- Wealthfront vs. Vanguard

- Betterment vs. E*TRADE

- Betterment vs. Vanguard Personal Advisors

- Betterment Socially Responsible Investing Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.