Which Free Trading App is For Me?

Robinhood vs M1 Finance is a battle of two of the most popular free stock investment apps.

M1 investors can choose from stocks, ETFs, crypto and pre-made portfolios called expert pies.

Robinhood investments include stocks, ETFs, options and crypto trading, Robinhood also offers a matching contribution Robinhood IRA.

The Robinhood app allows users to invest and trade from their phones but does not offer money management or portfolio monitoring options like M1. Instead, Robinhood sticks to the basics of investing: buying and selling stocks, cryptocurrency, options, and funds.

This M1 Finance vs. Robinhood Review delves into the pros and cons of each app for investors seeking free stock and fund trading.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

The M1 Finance robo-advisor goes head-to-head with Robinhood, an investment trading app that isn’t technically a robo-advisor.

Comparison Chart

For both new and experienced investors there’s a lot to like about both platforms, learn if the M1 Finance app or Robinhood app is right for you (or both).

Overview

How Does M1 Work?

M1 Finance is a free DIY robo-advisor. You can access your investments through the mobile app or desktop version.

Choose from thousands of stocks and exchange traded funds to invest. Each portfolio you create is composed of specific investments in the percentages you choose.

M1 calls each portfolio a pie, with the funds or stocks considered slices of pie. You can customize an Investment pie with up to 100 slices of stocks and etfs.

If you prefer a pre-made expert pie of investments, M1 Finance also offers pre-designed portfolio pies created for specific investment needs (like retirement). Or you can focus on specific options like, socially responsible investments or a pre-designed stock and bond portfolio.

Pre-made expert pies include:

- General Investing – perfect for well-balanced investments that match up with your risk level

- Plan for Retirement

- Responsible Investing (Socially Conscious)

- Income Portfolios

- Hedge Fund Followers

- Industries + Sectors

- Just Stocks and Bonds

- Other Strategies

We really like the pre-made investment pies. There is an investment strategy available for a multitude of investment strategies!

Investors who want an easy, intelligently designed investment portfolio then then M1 is ideal.

After you’ve selected your investments or chosen an expert pie, then M1 rebalances the investments back to your preferred investment mix, or asset allocation. This is a good strategy to keep your investments consistent.

M1 Finance also offers M1 Spend, M1 Borrow and M1 Plus features, described below.

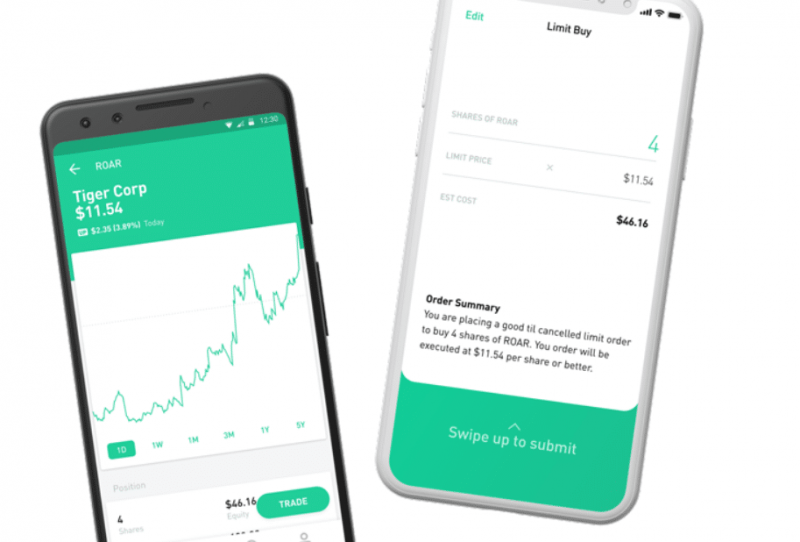

How Does Robinhood Work?

Robinhood is akin to an app-based stock brokerage account. It’s popular with millennials and now has over millions of users and a slick web-based interface.

Robinhood offers commission free trading to help you get started investing, whether you’re new to the game or an experienced investor.

Robinhood is fully a customizable self-directed trading app; investors can choose from thousands of investments.

Robinhood isn’t a robo-advisor and doesn’t offer automated rebalancing.

To trade just download the app (or create an account on your computer), input a company or fund name, click “search” and the security populates, along with the price and basic company information. To buy or sell, click “trade”.

Robinhood allows you to trade stocks, options, etfs and crypto.

The Robinhood app supports various types of trades:

- Market orders

- Limit orders

- Stop-limit orders

- Stop orders with good-for-the-day or good-till-cancelled options

Robinhood vs M1 Finance similarities include commission free trading.

The two have a few other features in common, too. Both offer sustainable investment options, though M1 Finance makes it easier to choose these options by dedicating an entire pre-built portfolio to socially conscious investing. Both Robinhood and M1 Finance also offer crypto investing.

Top Features

M1 Finance Top Features:

- Pre-built investment portfolios or M1 expert pies

- Stock and fund investing

- Extremely customizable

- Account rebalancing

- Multiple account types

- M1 Spend – cash management

- M1 Borrow – low interest rate loans

- Commission free trading

- Borrowing and high yield cash account

M1 High Yield Interest Rate – 5.0% APY*

Robinhood Top Features:

- Simple and intuitive app for Android or iOS

- Stock, fund, Cryptocurrency and options trading available

- Extended-hours trading

- Ability to upgrade to Robinhood Gold for more features

- Commission free trading

- 24/7 trading

- Robinhood IRA with 1% cash match

- High yield cash account

Who Benefits?

If you like to customize your portfolio, you might choose either. DIY, self-directed investors would benefit from both options. M1 Finance and Robinhood each offer an extensive array of investment options which can be assembled into a portfolio as unique as each investor. Each platform offers borrowing and high yield cash accounts as well.

Although, for options trading, Robinhood is best.

If you like to take money matters into your own hands, you might like Robinhood. As we said before, Robinhood isn’t a robo-advisor. This means that investors are on their own to rebalance and manage their portfolios. If you prefer to rebalance your investments, keep an eye on tax efficient investing and trade throughout the day, then choose Robinhood a free trading app will save you money on trading commissions—you just need to be proactive about monitoring your account.

If you’re a frequent trader and want access to stocks, funds, options and crpyto, then Robinhood is for you.

If you like investment portfolio management, you might like M1 Finance. The service rebalances your portfolio when you add money or click the rebalancing button.

For access to pre-made portfolios, M1 Finance is for you.

In the Robinhood vs M1 Finance race, M1 wins if you’re seeking trust, business or joint accounts. This service is also more suited to long term investing.

Neither account offers live financial planners, so you’ll have to look elsewhere for more live advice.

M1 Finance vs. Robinhood—Deep Dive

Fees and Minimums

Winner: It’s a tie.

Good news for investors: M1 Finance and Robinhood are almost equally matched in the fees department. In fact, you can use either service for virtually nothing!

M1 Finance

M1 Finance is a free service which means it does not charge trading or commission fees.

The account minimum to start investing with M1 Finance is only $100. This puts M1 Finance on the low end of minimums for robo-advisors, bested only by those who boast no minimum investment requirement.

M1 Plus is a higher level service for investors and offers additional features:

- Lower borrowing costs

- Two daily trading windows, instead of one

- High yield checking account and debit card with 1% cash back

- 4 ATM withdrawal fees reimbursed per month

- Premier M1 Owners Rewards Card – up to 10% cash back on select merchants

The fee for M1 Plus is a reasonable $95 per year.

Robinhood

Robinhood Instant, the basic account type, is also free. You can trade investments for free.

Robinhood Gold, a premium service costs a flat fee of $5 per month and offers these features:

- Access to Morningstar premium research and Level II Market data

- Larger instant deposits

- Margin investing

Robinhood has a slight advantage for investors looking to start small, because the platform does not have a minimum investment requirement. Investors simply fund their account with enough money to purchase the investments they are interested in, including fractional shares.

Account Types

Winner: M1 Finance

M1 Finance

M1 offers a wide range of accounts which is important for more seasoned investors.

Account Types:

- Individual and joint investment accounts

- Traditional. ROTH, and rollover IRAs

- Business, LLC, corporate, and trust accounts

Robinhood

Currently, Robinhood offers individual investment accounts with margin and IRA accounts.

Robinhood Account Type:

Individual investment account with margin. This account is broken into three options:

- Robinhood Instant – Basic investment account with margin.

- Robinhood Gold – Basic investment account with higher margin limits (you can borrow more to invest)

- Robinhood Cash – Lowest level account with commission free trades. Excludes instant deposits or settlements.

- Robinhood IRA with 1% match

It is important to understand the risks of investing on margin or borrowed money. This strategy is not for beginners.

If the stock you buy on margin declines in value, you must add additional funds to your account to cover the margin call. So, make sure that you can afford a “worst case scenario” when investing on margin.

Trading Windows

Winner: Robinhood

M1 Finance markets itself as “a long-term investing vehicle.” As such, they only trade during a specific time each day, unless you purchase M1 Plus.

“The M1 Finance trading window begins at 9 am CT everyday the NYSE market is open and runs until all orders have been completed,” ~M1 Finance website

This helps M1 Finance keep costs low, but it is also a way of helping investors look long-term. M1 isn’t for investors seeking to trade throughout the day.

For a nominal $95 per year, the M1 Plus service offers a second trading window in the afternoon.

Robinhood

On the other hand, Robinhood offers more flexibility in terms of trades. After all, trading is what they do!

Robinhood 24 Hour Market is available from Sunday 8 PM ET through Friday 8 PM ET. Orders entered for the 24 Hour Market generally might be executed12 AM-8 PM ET on the next full trading day

We aren’t advocates of frequent trading, but understand that some investors like to trade frequently, and for those investors, Robinhood fits the bill.

Visit the Robo-Advisor Selection Wizard, take a quick quiz, and find out which robo-advisor is the right one for you.

Reinvest Dividends – DRIP and Fractional Shares

Winner: It’s a tie – kind of.

For small investors, seeking to invest in fractional shares, either platform is fine.

M1 Finance

All M1dividends are received in cash.

If you have the ‘automate’ feature turned on, then once the cash balance reaches $25.00, M1 will reinvest the dividends into your M1 pie or portfolio in line with your preferred asset mix.

For example, let’s say you’re investing in the “Just stocks and bond” 60% stock 40% bond pie. And due to the stock market increasing in value, your asset allocation drifts to 65% stock and 35% bonds.

The dividend will be invested in the bond fund, up to the point that the asset allocation returns to 60% stock – 40% bond.

M1 Finance offers the opportunity to invest in a fractional share which is a partial share of stock or fund. For example, you could invest $100 in Apple stock (AAPL), which is trading at $113.69 today. You would then own roughly 88% of a share of Apple!

Robinhood

Robinhood offers both fractional share investing and dividend reinvestment. Both must be enabled on the mobile app.

Safety

Winner: Slight edge to M1 Finance.

M1 Finance

Is M1 Finance Safe? Yes – as safe as any financial institution.

Your money is insured by SIPC (Securities Investor Protection Corporation) against loss of cash and securities from a brokers failure. It does not protect against normal investment price declines.

M1 Spend and M1 Plus accounts are further insured through Lincoln Savings Bank.

Apex Clearing Corporation is M1’s clearing firm and custodial bank. Apex is a well-known firm and provides similar functions for many of the world’s largest institutional and retail brokers.

The firm employs top level security. Your data isn’t stored on any device and all information is encrypted in transit between your computer and M1 as well as on their servers.

Robinhood

Is Robinhood Safe? Yes

Robinhood is a SEC-registered broker-dealer and member of the Securities Investor Protection Corporation (SIPC). Stocks and options (not cryptocurrency) are protected up to $500,000. Robinhood also purchases additional insurance should the SIPC insurance run out. This additional insurance should cover any expected losses due to platform malfeasance or closure. This insurance is not for changes in the market value of your account.

Your account is protected by the high level BCrypt hashing algorithm and never stored in plaintext. Sensitive details are encrypted before stored. The apps use TLS protocol ad banking credientials are only acessed once, during initial set up.

Two factor authentication, touchID, FaceID or custom pin codes are also available.

Although, there have been a few reported incidents of Robinhood hacks and scams.

Automated Rebalancing

Winner: M1 Finance

Automated rebalancing was touched upon above and has been shown to be an excellent way to “buy low and sell high”.

The rebalancing concept begins with choosing your preferred asset allocation or asset mix. That is simple the percent that you choose to invest in each individual stock or fund. Learn more about rebalancing in the FAQ.

M1 Finance

M1 Finance offers automated rebalancing, which is a feature that saves the DIY investor a lot of time and hassle.

This can be enabled in the mobile app or on the web platform. When dividends and new money comes into the account, it will automatically be allocated to reach the preferred asset allocation.

Additionally, at any time you can initiate a “rebalance” of your account on the platform.

Robinhood

Robinhood does not offer automated rebalancing. If you want to rebalance your account, you need to do it manually by buying and selling shares within the account.

Tax-Loss Harvesting

Winner: M1 Finance

Tax loss harvesting allows investors to reduce taxes and improve investment returns when selling a security. A losing security is sold, and the loss is used on the tax return to offset investment gains. A similar, although not identical security is bought to replace the one that was sold.

M1 Finance

M1 finance offers tax-optimization. That means that when a security is sold, M1 chooses to sell the shares with the smallest tax consequences.

M1 doesn’t offer tax-loss harvesting.

Robinhood

Robinhood does not offer tax-loss harvesting.

Customer Service

Winner: Robiinhood

M1 Finance

Phone customer support is available when the stock market is open. Email is available 24/7.

M1 customer service offers a special IRA rollover concierge.

Robinhood

Robinhood offers 24/7 phone call back and live chat service.

Email is also available.

Pros and Cons

M1 Finance Pros

- 6,000+ stocks and funds for investing

- Can invest in pre-made investment expert pies or portfolios

- Rebalancing

- High yield cash management available – M1 Spend

- Low interest rate borrowing available – M1 Borrow

- Multiple account types

- Borrowing and Cash Management

- Cash back credit card

M1 Finance Cons

- Doesn’t offer live advisors like some other robo-advisors

- Doesn’t offer bond or options investing

- Maximum – 2 trading windows

Robinhood Pros

- 24/7 trading hours

- 1% cash match IRA account

- Access to stocks, funds, options and crypto

- High level investment research

Robinhood Cons

- Might make trading and margin investing too easy and encourage less experienced investors to get in over their heads.

- No rebalancing or tax loss harvesting

- Limited account types

FAQ

Which is better M1 Finance or Robinhood?

Is M1 Finance Safe?

Can you day trade with M1 Finance or Robinhood?

Robinhood accounts valued at less than $25,000 are limited to no more than three day trades in a five day trading day period. Accounts valued at more than $25,000 can day trade.

How do I open a Robinhood account and get free stock?

Is M1 better than Robinhood?

Can you trade options on M1?

Which is Better M1 Finance or Robinhood — The Takeaway?

M1 Finance has most of the bells and whistles investors want out of a robo-advisor, including multiple account types and portfolio rebalancing. This robo is also extremely customizable; investors can choose from pre-made investment “pies” or create their own mix of investments as they see fit. M1 Finance also offers margin through M1 Borrow. M1 Spend is a good cash management system with a debit card and high yield cash account. The M1 Owners Reward cash back credit card has advantages as well.

If you are looking for straightforward, investing options, Robinhood is a good tool. You’ll have 24/7 access to your investments on your phone or computer and have a wide range of investments from which to choose including options and cryptocurrency. Through Robinhood, you can create a fully customizable investment portfolio all on your own, without any account management fees.

Robinhood is designed for the stock, ETF, options and crypto investor.

If you have to choose just one platform, M1 Finance wins hands down with investing, pre-made investment portfolios, rebalancing, lending and cash management.

Both platforms, although newer than the traditional Vanguard, Fidelity and Schwab platforms have substantial adoption.

Because both platforms are free with low or no account minimum initial investment requirement, investors can try the platforms without the high upfront cost of some larger robo-advisors that require greater amounts of money to get started.

In fact, you might fund an account at each to find out which platform you prefer.

Read the complete M1 Finance Review

More Comparisons:

- M1 Finance vs. Personal Capital – Robo-Advisor Comparison Analysis

- Personal Capital vs. Betterment Comparison Review

- M1 Finance vs. Wealthfront vs. Betterment – Robo-Advisor Comparison

- SoFi vs Robinhood Comparison

- M1 Finance vs Stash

*Disclosures: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

*I have a funded account at M1 Finance – Barbara Friedberg.