Cryptocurrency: the money of the future, or a fad sure to bankrupt its many investors?

Cryptocurrency investing is hot. But navigating the asset, without a cryptocurrency advisor, is a challenge. Sure, you could utilize something like M1 Finance’s crypto platform. But, it’s still tough to know what to buy.

In light of the crypto investing fanfare, investors are clamoring for help navigating this emerging digital asset class. Makara, the first crypto robo advisor was recently acquired By Betterment. But, the demand for other cryptocurrency robo advisors continues to grow. In fact, Domain Money is the newest entrant into the crypto advisor app arena.

Wealthfront was the first legacy robo-advisor that offers clients Greyscale bitcoin and ethereum funds within their managed portfolios. But we have a hunch that more robo-advisors will be adding cryptocurrencies to their line ups.

Bitcoin, the most well-known cryptocurrency, seems to be the latest great investment opportunity, coming in at a value between $29,000 and of $68,00.00 USD to every one bitcoin during the past year. So, it’s about time for easier access to a crypto advisor app.

[toc]

Bitcoin Price Chart – January 31, 2022 to January 31, 2023

Just a quick glance at this one-year bitcoin chart shows the volatility of this digital asset.

(Please realize that this chart will be out of date very quickly, due to the rapid price movements in the cryptocurrency world!)

Just like any investment, you might want to consider a cryptocurrency advisor, robo-advisor, or fund for your cryptocurrency.

During 20108 and 2019, you could have picked up one Bitcoin for roughly $4,000. While today, $23,000 per coin appears like a bargain to those who paid $60,000 for one digital coin. It makes sense that a robo-advisor would make investing in cryptocurrency so much easier, and more affordable, since you could purchase fractional shares of a diversified crypto fund.

Today, you can buy bitcoin or other cryptocurrency from a variety of sources. Even the Robinhood trading app offers cryptocurrency investing. You can expect the number of crypto and bitcoin robo advisors to continue to grow.

Wouldn’t it be so much easier to buy a cryptocurrency fund or robo-advisor?

And so, you might be wondering: Can I use a digital advisor to manage my cryptocurrency money? Does a bitcoin robo-advisor exist?

What Is Cryptocurrency?

If you think about it, most of our money is just a series of numbers moving between accounts. We don’t (usually!) pay for a house in physical cash, instead choosing to move our money around through a series of agreements and electronic payments.

Cryptocurrency, like bitcoin, functions in a similar way, except that bitcoin and digital currency represented by a physical bills and coins; it is completely electronic.

Now, the way cryptocurrency works is extremely technical. Basically, each bitcoin is specially coded so that it has an individual identifier. Bitcoins and other digital currencies are kept in electronic “wallets” that are unique to the individual who owns the wallet. The codes make these bitcoins easy to trace when they are used for payment or in transfer from one wallet to another.

Bitcoin can be used to make purchases online or to make payments between individuals, so it is a legitimate currency. All currency values fluctuate to some extent, yet bitcoin does so very rapidly. Because of the rapid price changes, cryptocurrency must be considered a speculative investment.

Just like other financial products, cryptocurrency can be managed. A cryptocurrency robo-advisor might make investing in bitcoin, ethereum, altcoin, and other digital assets, so much easier.

Why Should I Invest in Bitcoin?

Bitcoin came into being in 2009. The primary benefit of this cryptocurrency is to circumvent the need for a traditional bank. Bitcoin is unregulated and largely untraceable—it functions as a purely peer-to-peer payment system without the need for governmental or bank intervention.

And blockchain is the technology that facilitates cryptocurrency transactions.

The lack of big business intervention is certainly appealing, although steps have been taken since its creation to ensure that bitcoin is taxed as an asset.

Cryptocurrency such as bitcoin can be an attractive investment. While some investors are skeptical over the long-term promise of bitcoin. After all, the cryptocurrency price is extremely volatile. With such high prices for initial investments, those looking to get rich through bitcoin should be cautious.

The bitcoin proponents state that due to limited supply of 21 million bitcoins, greater demand for the earliest cryptocurrency will drive prices higher and higher. Unless, the current supply limit is lifted.

Free; Robo-Advisor Comparison Chart

Although the currency has seen value fluctuations, many investment professionals see cryptocurrency as a currency of the future and predict substantial growth over the next few years.

Is There a Robo-Advisor for Cryptocurrency?

Yes. Betterment, Titan Invest and M1 Finance include cryptocurrency robo-advisor options. Although robo-advisors have been exploding in popularity for traditional investment options, cryptocurrency is still relatively new, as is the market for bitcoin robo-advisors. Still, a few companies have risen to the need.

Currently, there are roughly six crypto robo-advisors on the market; five are designed for consumers to use on their own, while one is structured to help traditional financial advisors assist their clients with cryptocurrency investments. Legacy players, Wealthfront and Betterment robo-advisors are now offering crypto access along with several others.

Cryptocurrency Robo-Advisors

1. Wealthfront | Bitcoin and Ethereum

Wealthfront recently pivoted from a pure robo-advisor to one that also offers the ability to customize your portfolio. In addition to automated pre-made digital portfolios, Wealthfront Crypto enables users to invest directly in the best cryptocurrency funds available today in the US.

Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust (ETHE) are available to all Wealthfront customers.

To invest in GBTC or ETHE at Wealthfront, first open an account. After answering a series of questions, you can select “edit portfolio” on the investment account dashboard and follow the prompts to “add investment”.

Wealthfront crypto robo-advisor features include:

- Rebalancing-to keep investments in line with your preferred risk tolerance score.

- Tax minimization-in taxable accounts trades strive to reduce the tax impact.

Wealthfront also offers cash management, smart beta, individual stocks, ETFs and risk parity investing.

Wealthfront has a $100 minimum and charges a 0.25% AUM fee.

Read the Wealthfront Review

2. Titan Invest | Active Crypto Management and Hedge Funds

Titan Invest, the robo-advisor known for hedge-fund like investing recently launched an actively managed crypto fund. Unlike the Greyscale Funds, available through either Wealthfront of their own site, for accredited investors, the Titan Invest Crypto offer invests in five to 10 coins. The crypto choices are selected based upon fundamental research and expected to outperform their peers during the upcoming three to five years. The fund balances risk and returns and is rebalanced to maintain a reasonable risk and reward balance.

The investment minimum is $100. For accounts valued at less than $10,000 the fee is $5 per month. Accounts worth more than $10,000 are charged 1.0% AUM.

Read the Titan Invest Review

3. Betterment (acquired Makara Crypto Robo-Advisor)

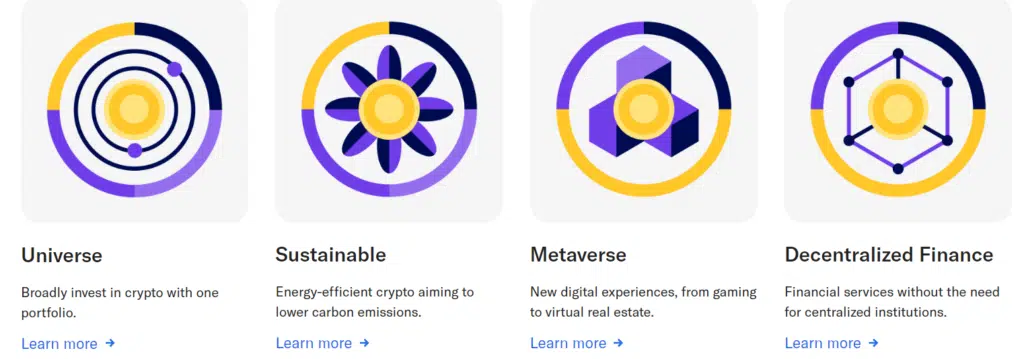

Betterment offers four managed cryptocurrency portfolios. Each includes various digital coins in line with the portfolio’s stated strategy.

- Universe: Risk-weighted exposure to a diversified collection of cryptocurrencies. This fund includes Bitcoin and Ethereum, along with coins from decentralized finance, the metaverse and more.

- Sustainable: The Sustainable cryptocurrencies strive to reduce energy consumption and lower carbon emissions.

- Metaverse: The Metaverse portfolio invests in cryptocurrencies helping to create a immersive digital experiences including NFTs and other virtual worlds.

- Decentralized Finance (DeFi) Basket: These DeFi assets use blockchain technology to further peer-to-peer lending, borrowing, trading and other financial transactions.

Betterment also offers a library of educational resources to learn about cryptocurrencies.

Betterment has no minimum requirement, but requires $10 to start investing. Crypto fees are 1.00% AUM and may levy other fees as well.

4. M1 Finance

The free robo-advisor, M1 Finance recently launched it’s crypto currency offer. M1 Finance cryptocurrency is currently rolling out it’s complete digital coin offers. You can buy and sell up to 10 digital coins. These coins are held in a digital wallet, powered by Apex Crypto. Now you can add the digital coins to your “pies” or portfolios. Very soon you’ll also be able to select expert pies comprised of various crypto strategies:

- DeFi

- Web3

- Large-cap crypto

M1 Finance allows you to select your own investments from thousands of stocks, funds and now digital assets. After funding your account, you choose your desired investment holdings, and invest your preferred amount of money in each stock, fund or digital coin. Then, M1 handles the future management and rebalancing of your entire portfolio – in the same way that a typical robo-advisor works.

You can also add cryptocurrency and blockchain ETFs to your M1 Finance account.

Cryptocurrency and Block Chain ETFs

There are several newer cryptocurrency-related ETFs (exchange traded funds) that recently launched including Amplify Transformational Data Sharing ETF (BLOK), Reality Shares Nasdaq NexGen Economy ETF (BLCN), First Trust Index, and Innovative Transaction & Process ETF (NASDAQ:LEGR).

These investments are considered “blockchain funds” and so aren’t pure crypto-asset funds.

M1 Finance requires a $100 minimum. There is no commission charge to buy or sell cryptocurrencies on M1 Finance, although other fees may apply. Your crypto assets are held in a custodial wallet with the secure Apex Crypto. See the M1 Finance platform for detailed fee information.

Read the M1 Finance Robo-Advisor Review

5. Domain Money | Actively Managed Crypto Advisor

Launched in 2022, Domain Money offers investment portfolios comprised of stocks and cryptocurrencies. They use active management strategies with the goal of long-term growth. While not a robo-advisor, Domain Money does offer stock and cryptocurrency investment portfolios. There are four actively managed strategies, three that combine stocks and crypto and one that contains only digital assets. The actively managed funds are run by former Goldman Sachs executives and focused on the fastest growing segments of the markets. A differentiating feature for Domain customers is the availability of live customer service representatives.

Domain Money Invest Funds:

- Domain Edge: 100% cryptocurrency

- Domain Metaverse: Companies, tools, and platforms that support the NFT-universe.

- Domain Balanced: 50% stock and 50% cryptocurrency

- Domain Access: 80% stock and 20% cryptocurrency

Domain has a $100 to $500 investment minimum. The 1.0% management fee is in line with Titan Invest.

6. Empirica | Bitcoin Robo-Advisor for Financial Professionals

Even if you like the idea of sticking with a traditional financial advisor, you can still reap the benefits of a robo-advisor’s algorithms.

Empirica Crypto Advisor is a bitcoin robo-advisor platform designed to supplement a traditional financial advisor’s capabilities. The platform allows financial advisors to create thoughtful profiles for customers based on risk tolerance and financial goals, just like any other robo-advisor.

Empirica also offers fully automated algorithmic trades. This helps traditional financial advisors to offer timely trades and portfolio rebalancing based on live-time market fluctuations.

Of course, in order to benefit from this bitcoin robo-advisor and financial professional hybrid, your financial advisor will need to adopt the software.

Crypto Robo-Advisor Alternatives

Invest in Cryptocurrency and Bitcoin on Your Own

There are other ways to invest in cryptocurrency on your own.

Pure Cryptocurrency Funds

At present, these are the only pure cryptocurrency funds available, although it’s only a matter of time before competitors join the fray.

You’ll need to invest in these funds through an investment broker who offers access to over-the-counter markets. This includes all the major brokerage firms.

Bitwise 10 Crypto Index Fund

A new index cryptocurrency fund recently launched called the Bitwise 10 Crypto Index Fund (BITW). The fund offers diversified exposure to a group of digital assets including Bitcoin, Ethereum and others. The fund tracks the Bitwise market-cap-weighted index of the 10 largest crypto assets, which are screened for liquidity, custody, and other risks. The fund is rebalanced monthly, according to Bitwise.

So, if you want a cryptocurrency robo-advisor, you might consider investing a few dollars in this fund. Just be aware that the management fee has an expense ratio of 2.5%, which is higher than most stock and bond funds.

The fund trades on the OTCQX U.S. which is and over the counter market. It is the highest quality over-the-counter trading market.

Grayscale Cryptocurrency Funds

For affluent crypto investors, Grayscale is a company devoted to creating ways for investors to participate in the cryptocurrency opportunities.

Bitcoin Trust (OTC:GBTC) is available to accredited investors, or those who meet certain income, net worth, or investment knowledge criteria. This fund invests in bitcoin and can be bought and sold through an investment brokerage account.

Grayscale also offers six other funds that invest in other digital currencies. It’s important to note that the fund might be trading at a premium to net asset value, or a discount.

You could add one or more of these funds to your M1 Finance investment portfolio and then the platform would manage and rebalance them, along with your other holdings. That’s how you would create your own cryptocurrency or bitcoin robo-advisor

Cryptocurrency Direct Investing

There are a wealth of apps and ways to trade crypto on your own. It involves wallets and keys and keeping track of your digital assets! Proceed with caution.

Before diving into the volatile cryptocurrency market, decide if investments in cryptocurrency are in line with your risk tolerance. If you like the thrill of a high-risk, possibly high-reward investment, choosing the right bitcoin management option is essential.

Bitcoin and other crypto asset values fluctuate frequently, and a cryptocurrency fund or bitcoin robo-advisor might be a great investment management strategy for those who want to cash in on the growing popularity of cryptocurrency.

Here are a few sites for crypto investing:

- SoFi Active Investing

- Titan Invest

- Coinbase

- Binance.us

- eToro

- Robinhood

- BlockFi

Check out Wealthfront, and invest in the Grayscale cryptocurrency funds..

Best Crypto Robo-Advisor | Wrap up

The options for a bitcoin robo advisors and crypto investing are growing. The demand is great, despite the fact that cryptocurrencies have yet to be considered a legitimate asset class.

Canada recently launched several cryptocurrency ETFs including the Purpose ETF offers. US companies like VanEck, are still fighting with regulators to launch their own cryptocurrency ETFs. Other financial firms are launching blockchain-related ETFs to capture the massive demand for digital currency.

Be advised, that although there’s an abundance of cryptocurrency hype, bitcoin and the other digital currencies are new and speculative investments. Don’t invest in this technology without realizing that cryptocurrency values are volatile. That means that investments in cryptocurrency have massive swings in value, are unregulated, and unproven investments.

Realize that crypto investing involves substantial risk, so it’s best diversify and add cash assets, fixed, and stock funds to your investment portfolio.

Our rule of thumb for speculative investments is to limit the percentage of your risky assets to 5% of your total investment portfolio.

Related

- Do Any Robo-Advisors Focus on Downside Risk Protection?

- Free Portfolio Management Software

- Best Robo-Advisors for Millennials

- SoFi vs Robinhood

- M1 Finance vs Robinhood

- M1 Finance vs Stash

- Best Financial Planning Apps

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable