This SoFi Active Investing review, will cover key features and help you decide if the fee-free SoFi Brokerage account is best for you.

Who can resist a good deal, right? We appear to be programmed to chase deals and snap bargains.

When it comes to investing, we must scrutinize all fees and features to decide whether or not it is right for you.

We critically examine investment platforms to help you can make up your mind. You’ll get a 360 degree view of the SoFi Invest Active Investing features which encompasses a SoFi Stock Trading Review as well. This SoFi Invest product tempts by offering commission and fee-free stock, options and ETFs trading along with access to financial advisors.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Read on to find out ‘How to Invest in SoFi?’, and whether it’s the right service for you.

SoFi Active Investing

-

Fees

(5)

-

Investment Choices

(4.5)

-

Ease of Use

(4.5)

-

Tool & Resources

(3.5)

Summary

Best for:

- Beginning to intermediate investors

- Current SoFi customers

Pros

- Free stock, ETF and options trading

- Cryptocurrency trading

- $1 minimum investment

- Free financial and career advisors

Cons

- Basic account types account types only

- Not geared for sophisticated investors who need advanced order types

What is SoFi Active Investing?

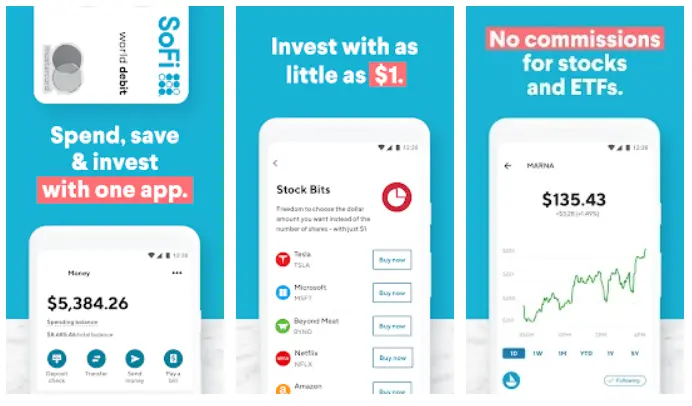

SoFi Active Investing is an investment brokerage service provided by the SoFi Invest platform. Unlike the SoFi Automated Investing robo-advisor, it boasts hands-on investing in stocks, ETFs, IPOs, crypto and options. You’ll have access to community activities in major cities and financial advisors as well. SoFi trading fees are zero, except for crypto, which charges a 1.25% markup per trade.

SoFi Active Investing is primarily aimed at young and beginner investors who prefer to trade stocks, crypto and ETFs, on their own. This intent underpins the ‘learn by doing’ and community foci.

It is part of the SoFi family, which includes lending, insurance, automated investing, and self-directed trading.

How Does SoFi Active Investing Work?

SoFi Active works like any stock and ETF, trading platform offering fractional shares and zero commission fee trading. Although, SoFi trading only includes market and limit orders, not stop-loss orders.

After opening a SoFi account, you can trade stocks, ETFs and long options with no commissions and no-account minimum. SoFi Active also offers cryptocurrency trading through the same platform used to trade stocks and shares.

SoFi Active Investing Features at a Glance

Who is SoFi Active Investing Best For?

SoFi Active Investing is best for young and new investors who wish to begin trading stocks and investing in ETFs and cryptocurrency. It is also a good option for investors who are strapped for cash and can benefit from the $1 minimum and opportunity to trade fractional shares.

SoFi is good for those who don’t need mutual funds, a sophisticated trading platform or advanced order types.

SoFi Invest is good for those who prefer lending, a managed investment account and active investing options, all under one roof.

To speed up the video, click on the “settings” gear at the bottom of the video. Choose “playback speed”. Select your speed (I prefer 1.5).

SoFi Invest Active Investing Drill Down

SoFi Invest Fees

Currently, most brokerages offer zero fees and low-cost investing options. SoFi Active Investing joins the lowest fee investment platforms.

Their fee structure and transparent and straightforward.

- $0 SoFi stock trading fee or commission.

- $0 Options trading fees

- $0 account fee.

- 1.25% per crypto trade

- $75 outgoing fee (the same fee applies whether you transfer some or all of your investment).

Investments

SoFi Active offers:

- Stocks

- Stock Bits-Stock trading, including fractional shares

- Initial Public Offerings

- ETFs investing

- Cryptocurrencies trading

- Options – long puts and calls

SoFi also offers margin loans for traders looking for additional investment buying power.

Orders

SoFi offers market and limit orders. A market order means you will buy or sell the stock or ETF at the going price.

A buy limit order states that when the security falls to the specified price, the order will be placed. If it doesn’t reach the limit price, no transaction will occur.

The platform lacks stop loss orders, which may be of interest to intermediate and advanced investors to curtail losses. Stop loss orders allow users a maximum or minimum price to buy or sell a security. The order converts to a market order when a stock reaches to a certain price and the security is automatically or bought.

Options traders can buy and sell long puts and calls.

Minimum Investment

Officially there is no account minimum, and you can open an account with $1.

Although, you’ll need at least a few bucks to begin building wealth for the future with investing.

Mobile App

SoFi has an ‘all in one’ app that is easy to use and serves as a home base for its financial products and services, including Active Investing. SoFi app is available for Android and iOS and has a high rating. On the positive, customers extoll the ‘phenomenal’ customer service, the SoFi app’s efficiency, and the money management options.

As a downside, SoFi customers have reported difficulties regarding depositing checks and slow access to their money.

Membership and Community

When you open an account with SoFi, you become a member of their community. You gain access to the SoFi community, offers, and qualify for local meetings and SoFi events.

That seems a valuable feature of SoFi, and Active Investing, given that the learning resources are rather basic and there is no direct guidance and recommendation about stocks and ETFs selection.

Investing Support and Advice

One of the best features of the platform is the opportunity to set up a meeting with a CFP Financial Planner. Members go to a special link, select the topic to discuss, and choose a time slot for the meeting.

Meetings are also available with career coaches.

The customer support and advice, by all appearances, is excellent. While he investment guidance is best for beginning and intermediate investors.

SoFi Educational Resources

While styling itself as an investing platform, the firms educational resources are adequate. A standout educational feature are the basic Options articles. The “On the Money” blog provides a wealth of lending, investing, market, real estate and news articles.

The learning resources under the Investing 101 Center cover the basic terminology and principles of investing. Still, these don’t stretch far enough to educate a young investor to the level of medium to high competence.

Investors seeking more comprehensive investment education need to look elsewhere.

Accounts

- Traditional brokerage accounts.

- SoFi Traditional IRA

- SoFi Roth IRA

- SEP-IRAs

- Rollover IRAs

However, it doesn’t offer Simle IRAs, trusts or other account types in which you may be interested.

SoFi Invest Promos

SoFi free stock and free crypto promotions are currently available.

SoFi is continually rotating it’s promotional offers and incentives.

Those looking for a SoFi Promo deal should stop by the website and determine whether the offers are suitable for you:

SoFi Active Investment Pros and Cons

SoFi Active Investing is a contender in the low-cost, no-frills investment platform offerings that Robinhood pioneered. Like most trading platforms in this class, SoFi Active comes with apparent pros and cons.

Pros

Here is what we like about SoFi Active:

- Free investment advice-and career coaching.

- Commission-free stock, ETF and options trading.

- Cryptocurrency trading.

- Fractional shares are available.

- Initial public offerings.

- No account minimum.

- Automatic dividend reinvestment.

- SoFi community and events access.

- Sleek and functional mobile app.

- Member discounts for other SoFi products and services.

Cons

Here are the SoFi Active features on which we are not very keen:

- Basic learning resources.

- No access to stock research and tools.

- Lacks advanced stock, ETF and options orders.

There are several cautions when investing without commissions. It can make buying and selling too easy, which can be expensive. The selection of trades is left entirely to you. You need considerable knowledge and experience in stocks selection to excel at stock picking. Failing that and not being offered stock selection guidance and advice may lead you to incur unjustified losses.

For that reason, we suggest also exploring the SoFi Invest Automated Investing offer. This offer evaluates your financial situation, risk tolerance, and goals and then creates an index fund investment portfolio in line with your preferences – for FREE management fees.

SoFi Active Investing Alternatives

SoFi stock bits is a great start for beginners, but there are several additional low-fee alternatives.

Here are several of the SoFi Invest Active competitors for low-cost investing platforms targeted at young investors with big dreams and shallow pockets:

- M1 Finance: Free investment robo-advisor with the option to buy and sell individual stocks and funds or pre-made investment portfolios. There is a $100 minimum investment amount.

- Robinhood: Robinhood is a commission-free micro-investing platform offering access to US stocks and ETFs traded on the NYSE and Nasdaq. While Robinhood does not appear to take from the rich to feed the poor, this commission-free micro-investing app has set out to empower the investing underdog, e.g., people who have little money to invest.

- Schwab Stock Slices: Part of the huge Schwab investment offering, Stock Slices allows clients to invest $5 in list of many popular firms. You’ll also have access to Schwab’s range of products including their Intelligent Portfolios Robo-Advisors.

FAQ

Is SoFi a good investment?

Is SoFi Free?

How does SoFi Make Money?

Is SoFi Safe?

SoFi Active Investment Wrap Up

SoFi Active Investing is a low-cost option that has some advantages compared with other providers (e.g., financial planners, self directed retirement accounts, cryptocurrency trading, links to a community, and eligibility to attend investing events). If you like the community, and are already a member, you might try the Active Investing opportunity.

The platform also has comparative downsides like offering a limited range of accounts, limited trading options, and elementary learning resources with no stock selection advice.

Our opinion is that SoFi Active Investing is a solid offering for those that like the “community” and basic features. And, the lack of trading fees is compelling.

It boasts ‘learning through doing’, for example, but appears to leave you to learn mainly from your own investment mistakes.

Newbies might want to explore M1 Finance with over 6,000 investment options, pre-made portfolios and automatic rebalancing.

For those seeking to start investing, make sure to do some preliminary learning. There are several free and low-fee platforms available.

Finally, new investors may enjoy the upsides to using SoFi Active Investing including access to many financial products, student loans, SoFi Money and more.

Ultimately, evaluate your own needs and choose the stock trading site that best fits your needs.

Learn more about Sofi trading, Stock bits, IRAs, and all products and services:

Related

Lowest to Highest Fee Robo-Advisors

10 Best Financial Planning Apps

Sources:

- https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/20230103-Securities_CRS-1.pdf

- https://www.sofi.com/invest/buy-cryptocurrency/

- https://www.sofi.com/invest/margin-trading/

- https://www.sofi.com/wealth/assets/documents/sofi-invest-fee-schedule.pdf

- https://www.sofi.com/faq/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable