SoFi Invest and Acorns are two of the biggest players in the fintech money and robo-advisor industry. Both are solid choices for investors who want to automate their investing via online, hands-off methods. Small and newer investors will like the zero investment minimums.

But, not only are SoFi and Acorns automated investment platforms, they each offer additional financial products and services. SoFi’s range of stocks, ETFs, cryptocurrency, and robo-advisory products offer investments for most people. But these two popular investment apps and websites are more different than they are alike.

This SoFi Invest and Acorns review taps the features, pros and cons to help you determine which is the better platform for you.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

SoFi Invest vs Acorns: Top Features

Quick Overview

- SoFi provides financial advisors and career consultants to all users.

- SoFi has a wide range of products and services to meet your financial needs including investing in stocks, ETFs, crypto and an automated investment manager.

- Acorns is designed to small investors to start investing by transferring debit card “round ups” to an investment account.

- Acorns’ and SoFi’s robo-advisors are quite good.

- SoFi’s investing is commission free (except crypto) while Acorns charges monthly subscription pricing.

What Is SoFi Invest?

SoFi Invest is an investment platform with features for active and passive investors. For the active investor, SoFi Invest is essentially an investment broker, allowing you to trade stocks and ETFs directly. For the passive investor, SoFi Automated Investing is an automated investment manager, or robo advisor that invests and manages your money in a diversified portfolio of stock and bond exchange traded funds, or ETFs, based upon your goals and risk tolerance level.

SoFi Invest doesn’t charge commissions or management fees. All SoFi members also have access to financial advisors and career counselors.

“SoFi” stands for “social finance.” It should not be a surprise that the platform encourages social interaction among users. If you invest via SoFi Invest, you’ll also have access to specialty member events and a huge slate of lending products.

SoFi Top Features:

- Fee-free investing in stocks, ETFs, and automated robo investing

- Access to human financial advisors

- Phone customer support

- Cryptocurrency investing

What Is Acorns?

Acorns is a beginners saving and investment app to help users save more money and grow their wealth through investing and added bonuses. Acorns users also get a checking account and debit card. Acorns is great for those new to the money management world and want to up their savings and start investing for their future.

The heart of Acorns is the round up feature where every dollar you spend with the Acorns debit card is rounded up to the next dollar amount and the spare change is transferred to an investment account. Spend $7.25 on a sandwich and $0.75 goes into your investment portfolio. You can boost round ups to save and invest more quickly.

The investment dollars at Acorns go into an automated robo investing account comprised of diversified stock and bond ETFs, based upon your goals and risk tolerance. The robo investing at both SoFi and Acorns is similar.

Unlike Sofi, Acorns charges a monthly subscription fee of $3 or $5, depending on the features you prefer. Acorns doesn’t offer crypto or active investing.

Acorns Top Features:

- Round-ups transfer excess cash into investment accounts – Up to 10x round ups

- Diversified robo investing platform

- Acorns Earn awards users bonus investment cash when shopping

SoFi Invest vs. Acorns: Who Benefits?

In a head to head, beginner to intermediate investors would benefit from SoFi Invest. With the fee-free self directed and robo investing plus financial advisory access the platform is robust. SoFi stands alone as the only free robo-advisor with access to financial advisors. Finally, the high yield checking account is a welcome benefit for cash investors.

Those seeking fee-free automated investing and meetings with financial advisors should check out SoFi invest.

Acorns is a beginner saving and investment app. It’s appropriate for those who need a boost to begin saving and investing. If Acorns users rely solely on the round up feature to fund their investment account, it’ll take a long time to build meaningful wealth. Auto-deposits into the Acorns robo-advisor improves the viability of the investment app. Somewhat counterproductive, the “Earn” feature, relies on spending, to earn added cash.

Sign up with Acorns, and get a $20 bonus!

Acorns is more of a newbies-first-robo-advisor, while SoFi Invest could be seen as a one-stop shop for investing, whether you want to passively invest via robo advisors or invest directly with your own choices. SoFi Invest is less comprehensive than traditional brokerage firms like Schwab and Fidelity who offer bonds, mutual funds, options and trading platforms required by sophisticated traders.

Overall, SoFi Invest is a good choice for beginners to intermediate investors seeking a well-rounded bank/brokerage with a mix of passive and active investing, whereas Acorns is an entry-level micro investing app for those moving beyond a bank account for financial growth.

SoFi Invest vs. Acorns – Fees and Minimums

SoFi Invest and Acorns differ in their fee structures.

SoFi Invest

SoFi Invest offers fee-free investment management and active investing along with SoFi ETFs that waive management costs. SoFi makes money on their lending products, commissions on cryptocurrency transactions, and lending out balances in cash accounts.

SoFi charges a 1.25% commission to buy and sell cryptocurrency.

Sofi does not have a required investment minimum.

Acorns Personal vs Acorns Family Plans

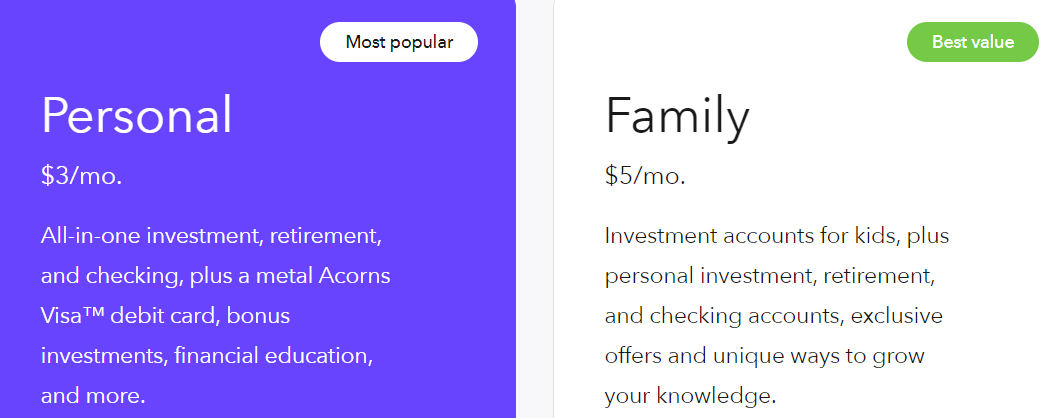

Acorns offers two tiers of subscription pricing:

- Acorns Personal – $3 per month

- Individual investment, retirement and checking accounts

- Fee-free banking and round up debit card

- Earn bonuses while shopping

- Acorns Family – $5 per month

- All the features of Acorns Personal plus childrens UGMA/UTMA custodial accounts

Acorns doesn’t require a minimum either, but you’ll need $5 to begin investing.

Sign up with Acorns, and get a $20 bonus!

SoFi wins the category with fee-free investing. Acorns costs are low, but with a small account balance, you’ll pay a higher percent of your assets under management in fees. If you have difficulty saving, Acorns might be best, to get you in the habit of saving and investing.

Whether you choose Sofi Invest of Acorns, you’ll maximize the benefits of your saving and investing by choosing to automatically transfer a set amount each month into the account.

SoFi Invest vs. Acorns – Deep Dive

SoFi Invest vs. Acorns – Round ups

Rounds ups are at the center of the Acorns app. But wait, while SoFi Invest does not have a roundup feature, SoFi Money enables round ups when you pay with your SoFi debit card. So, you could employ SoFi Money’s Round ups and then transfer that money into your SoFi Invest portfolio, essentially mimicking Acorn’s roundup feature. To simplify even more, you could set up an auto transfer from the SoFi checking account into the investment account.

The problem with round ups is that this feature might encourage poor spending habits. When you begin to adopt the mindset that all your purchases are investments, you could easily find yourself overspending and making unnecessary purchases.

Sign up with Acorns, and get a $20 bonus!

SoFi Invest vs. Acorns – Human Financial Planners

SoFi provides all members with 30 minute meetings with Certified financial planners. Moreover, just as with the platform itself, this feature is free. The idea with Acorns is that you don’t need access to a certified financial advisor because everything is automated anyhow. That might be true for the investment-choosing side of things, but money management (i.e., how much and how often you add capital to your portfolios) is also an important factor in investing. Acorns offers no support in this regard.

We believe that even beginning investors could benefit with a brief meeting or two with a financial advisor. The financial advisor access makes Sofi difficult to beat in the Human Financial Planner category.

SoFi Invest vs. Acorns – Investments

SoFi Invest assets are appropriate for most investors and include stocks, ETFs, crypto, high yield cash and Automated Investing. SoFi also created a list of proprietary SoFi ETFs and several are currently waiving management fees on several funds. Small investors can even purchase fractional shares through Stock Bits and Initial Public Offerings (IPOs) of stocks as well.

The SoFi Automated Investing robo-advisor creates a diversified portfolio of four to nine stock and bond exchange traded funds in line with your financial goals and risk tolerance. These portfolios range from conservative to aggressive and include U.S. and international companies.

Acorns robo advisor is solid, with diversified U.S. and international stock ETFs, bond ETFs and a real estate or REIT fund. The Acorns robo-advisor asset allocation, or percentages of stock vs bond ETFs is also apportioned according to your goals and risk tolerance level.

The differences between SoFi Invest’s and Acorns’ portfolios are subtle. In portfolio construction, SoFi uses a mix of its own ETFs and popular ETFs, while Acorns uses exclusively popular ETFs. Nevertheless, both Acorns and SoFi robo portfolios are well diversified. In fact, the stock asset allocation or mix, of SoFi and Acorns moderate robo advisor ETFs is nearly identical.

Ultimately, these two companies’ robo-advisor automated investing portfolios should produce roughly the same results. The main difference is that Acorns is charging you a monthly subscription fee, while SoFi is not. This fact places SoFi a notch ahead of Acorns in the automated investment category.

Clearly, SoFi has a larger corral of available assets and is superior to Acorns for those who want to buy and sell stocks, ETFs and cryptocurrency.

Yet, when it comes to the automated investing at each site, the asset allocation, asset classes and ETFs are a tie, with both platforms offering a decent digital investment managers.

SoFi Invest vs Acorns – Account Types

Both platforms come with checking accounts. Both platforms allow you to start investing via retirement accounts. While SoFi offers a SEP IRA for your business and Acorns Family, which costs $5 per month, offers custodial accounts, and SoFi doesn’t.

SoFi account types:

- Individual and joint investment accounts

- SoFi Money has transitioned to the SoFi Checking and SoFi Savings Accounts and debit card

The SoFi retirement accounts include:

- SoFi Traditional IRA

- SoFi Roth IRA

- SoFi Rollover IRA

- SoFi SEP IRA

Acorns offers individual investment accounts and UGMA/UTMA Custodial accounts through the Family Plan. The checking account with debit card offers a variety of ways to earn extra cash for investing.

Acorns account types:

- Individual investment accounts

- UGMA/UTMA custodial accounts

- Checking account with debit card

The Acorns retirement accounts include:

- Acorns Traditional IRA

- Acorns Roth IRA

- Acorns Rollover IRA

If you’re seeking a custodial account, then Acorns is your choice. Otherwise, SoFi offers a larger range of account types than Acorns.

SoFi Invest vs Acorns: Pros and Cons

SoFi Pros and Cons

SoFi Pros

- Fee-free investing

- Both active and passive investing choices

- Can buy fractional shares

- Free access to certified financial advisors

- Good card rewards system (e.g., 3% cash-back for a year) and ATM reimbursement fees (e.g., no foreign transaction fees)

- SoFi Checking and Savings accounts offer high yields. Direct deposits earn higher interest payments.

- Good customer service; can speak to representatives on the phone

SoFi Cons

- User interface is behind the times

- SoFi Active Investing lacks sophisticated products such as, bonds and options, available at larger investment brokerage firms like Fidelity or Vanguard.

Acorns Pros and Cons

Pros

- Automated investing tools are good: Recurring investments and roundups available

- Forced saving and investing as you spend

- Nice, user-friendly user interface

Sign up with Acorns, and get a $20 bonus!

Cons

- Fees are a high percent of smaller accounts

- No joint accounts

- Roundups might encourage poor spending habits and are rarely enough money to yield a meaningful amount of wealth

SoFi Invest vs. Acorns – Which is Best? Takeaway

Just by looking at the pros and cons above, you might guess that we prefer SoFi Invest to Acorns. The main issue here is that SoFi offers the same as Acorns – and more – for free. Moreover, Acorn’s fee is unreasonable from a few perspectives.

The average user with a $200 account value is paying 18% of their account annually to use Acorns, which makes it the most expensive robo advisor without having advantages to compensate for this flaw. Another way to understand why Acorns’ fee is expensive for the little guy is to consider it in terms of the roundup system. Although, as your investment account grows, the fee as a percent of your investments, declines.

On average, the roundup feature will take 50 cents from your primary checking account and place it in Acorns. However, with an monthly fee of $3, it will take you six purchases – on average – to pay off that fee. In other words, the first six purchases of each month do not go to your account but to the pockets of Acorns’ executives. If you’re making one roundup purchase per day, it will take you one week of each month to pay off the fees before the roundup feature starts working in your favor.

In any case, for small accounts, we believe that the fees Acorns charges simply are not justified by Acorns features. SoFi does everything Acorns does better, with the exceptions of ease-of-use (both for roundup and for the app’s interface).

Overall, SoFi is the superior choice for most investors deciding between SoFi Invest and Acorns.

Related

- SoFi Automated Investing Review

- SoFi Active Investing Review

- Acorns Review

- M1 Finance vs Sofi Robo Advisor

- Wealthfront vs Acorns Review

- Betterment vs SoFi Invest

- Robinhood vs Betterment vs Acorns

- Qapital vs Acorns

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable