Both Fidelity and Vanguard offer two robo-advisory levels – an all digital and a hybrid model with financial advisors and digital investment management.

Fidelity Go is fee-free and all digital up until your account reaches $25,000 AUM. Accounts worth more than $25,000 charge a 0.35% AUM fee and provide financial coaching to all investors.

Vanguard’s robo-advisors – Digital Advisor and Personal Advisor Services also serve clients seeking no frills digital investment management for a low, 0.20% AUM fee and wealthier investors. Those with more than $50,000 seeking a hybrid investment management plan with advisors will pay a fee of 0.30% AUM.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

With a growing number of digital investment managers, narrowing down your choice can be a challenge. Fidelity and Vanguard are two of the biggest finance and investment firms. That said, you’ll find enough distinctions between their robo investing offers to make your decision clear.

Here, you’ll get comparisons between each platform.

Both of these robo-advisors come with reasonable account management fees, though their minimum investment requirements might surprise you, as the Wealthfront Hybrid model is designed for wealthier investors.

What are the Vanguard Robo Advisors?

Vanguard Personal Advisor Services is a large human-supported robo-advisor, withamong the greatest number assets under management in their robo-advisor alone! This hybrid robo-advisor is part of the Vanguard family, the financial giant with a myriad of financial products and services. The Vanguard hybrid robo-advisor uses human financial advisors to support the investment process, requires a $50,000 minimum, includes financial advisors and charges a reasonable 0.30% AUM fee.

The Vanguard Digital Advisor recently expanded to add actively managed funds to the existing stable of passively managed index funds. The plan includes only four Vanguard index funds, Vanguard Digital has a retirement planning focus. The 0.20% management fee is reasonable.

Consider that SoFI Automated Investing and Schwab Intelligent Portfolios each offer fee-free investment management and greater diversification for their platforms.

| Vanguard Digital Advisor | Vanguard Personal Advisor Services | |

|---|---|---|

| Overview | Computerized investment investment advisor. | Hybrid human financial planners and digital investment management. |

| Minimum Investment Amount | $3,000 | $50,000 |

| Fee Structure | 0.20% AUM | 0.35% AUM |

| Top Features | Low-fee Vanguard ETFs. Active and passive investing. Retirement planning focus. Considers all investments. | Personal Advisor-Human financial advisor drives the entire process. Together, you and the advisor create a customized investment plan. |

| Free Services | Extensive educational resources | Extensive educational resources |

| Contact & Investing Advice | Phone M - F 8:00 am to 8:00 pm EST. No financial advisors. | Phone M - F 8:00 am to 8:00 pm EST Human financial advisor guides the process. |

| Investment Funds | Passively managed ETFs and/or actively managed funds. | Diversified mix of low fee stock and bond funds. |

| Accounts Available | Individual & joint brokerage. Roth, traditional and rollover IRAs. | Individual & joint brokerage. Roth, traditional & rollover IRAs. Trusts. |

What is Fidelity Go?

Fidelity recently consolidated it’s two robo-advisors, Fidelity Go and Fidelity Personalized Planning and Advice into one, Fidelity Go. You may already be familiar with Fidelity Investments, the large brokerage firm that boasts many financial products such as wealth management services, mutual funds, and retirement services. Fidelity Go is the company’s robo-advisor that now offers a free all-digital investment manager for accounts worth up to $25,000 and the low-fee hybrid model, with financial coaches, for those with $25,000 or more.

Fidelity Go accounts are managed by a team of Fidelity professionals and with computerized algorithms.

- Accounts valued at $25,000 or less get fee-free investment management and access to all of the tools on the Fidelity website.

- Account values greater than $25,000, charge 0.35% AUM for digital investment management and provide unlimited access to financial advisors.

This Fidelity Go vs Vanguard robo advisor comparison will give you all the information you need to choose between the two investment managers.

Top Robo-Advisors

Fidelity Go Digital (<$25,000 AUM) vs Vanguard Digital Advisors

Top Features

| Fidelity Go - All Digital (<$25,000 AUM) | Vanguard Digital Advisors | |

|---|---|---|

| Overview | For accounts worth less than $25,000: Fee-free digital investment manager | All digital investment manager |

| Minimum Investment Amount | Zero | $3,000 |

| Fee Structure | 0-$25,000 fee-free | 0.20% AUM |

| Free Services | First $25,000 managed for free. Digital financial plan and calculators. Educational resources. | Calulators and educational resources. |

| Contact & Investing Advice | Phone-24/7 trained customer service reps. Email. Chat. | Phone-24/7 trained customer servcice reps. Email. Chat. |

| Investment Funds | Fee-free stock and bond mutual funds | Passively managed US and international stock and bond index and actively managed funds |

| Accounts Available | Individual and joint taxable investment accounts; Traditional, Roth and rollover IRAs | Individual and joint taxable investment accounts; Traditional, Roth and rollover IRAs |

Fees and Minimums

Winner: For small investors, Fidelity Go is best with zero minimum and fee-free management up to $25,000.

Fidelity

Fidelity Go is good for small investors with free investment management up to $25,000 and no minimum amount to get started.

- $0-$25,000 – Free ,

- Over $25,000 – 0.35% of AUM

- Fidelity Go doesn’t have a minimum investment amount requirement, although you’ll need at least $10 to get started.

Vanguard Digital Advisors is the company’s all-digital robo advisor.

- The investment management fee is 0.20% of AUM.

- The investment minimum is $3,000, eliminating this choice from the list of low minimum robo-advisors.

The Schwab Intelligent Advisors and SoFi Automated Investing robos don’t charge management fees, for any account size. (But Schwab requires a $5,000 minimum).

While the combined robo-advisor and stock and fund investing platform, M1 Finance doesn’t charge management fees and has a $100 minimum.

Investment Funds

Winner: It’s a tie

Fidelity

Fidelity Go investor portfolios include approximately seven diversified funds. We like that muni bonds are available for taxable accounts. This platform also includes a mid- and small-cap fund for extra diversification.

Fidelity Go offers broa diversification.

| Sector | Fidelity Investment Fund | Ticker Symbol |

|---|---|---|

| U.S. Large-Cap Stocks | Fidelity Flex 500 Index | FDFIX |

| U.S. Mid-Cap Stocks | Fidelity Flex Mid-Cap Index Fund | FLAPX |

| U.S. Small-Cap Stocks | Fidelity Flex Small-Cap Index Fund | FLXSX |

| Foreign Stocks | Fidelity Flex International Index Fund | FITFX |

| Municipal Bonds | Fidelity Flex Municipal Income Fund | FUENX |

| Short-Term Municipal Bonds | Fidelity Flex Cons. Income Municipal Bond Fund | FUEMX |

| Short-Term Cash | Fidelity Government Cash Reserves | FDRXX |

Vanguard

The Vanguard core portfolio includes diversified passively managed U.S. and international stock and bond ETFs.

Vanguard recently added actively managed and sustainable ESG (environmental, sustainable and good governance) to their core portfolio.

Vanguard Digital provides a well diversified list of low fee funds.

If you’re seeking actively managed investment funds, you’ll find those at the Vanguard Digital robo advisor. For diversified index fund offers, either will suit your needs.

Features

Winner: Fidelity Go

Both platforms offer periodic rebalancing, a mainstay of all robo-advisors. This means that when the investors asset allocation or mix deviates from their initial preferences, the platform buys or sells specific assets to return the investment percentages to the users specifications.

While, neither platform offers tax-loss harvesting.

Neither platform, Vanguard Digital nor Fidelity Go Digital (AUM< $25,000), offers individual financial advisors.

Fidelity Go

Like most robo investing, users answer a few questions related to their goals and risk tolerance. Then a diversified investment portfolio is presented, designed to meet those goals.

The platform offers:

- Investments and portolios are selected by Fidelity investment professionals who monitor the financial markets and adjust the strategy, when needed.

- Zero-fee Fidelity flex funds and no management fees through $25,000 account values. This enables more dollars to go directly into the investment markets.

- Target Tracking – Investors choose a dollar amount for the portfolio to reach by a certain date. Next, Fidelity Go calculates the possibility of reaching the goal. If it seems as though you won’t reach the goal, they will offer alternatives, to help reach the goal.

Vanguard

You’ll answer a few basic planning and risk questions, to drive the portfolio construction. You can choose from the core, ESG or actively managed portfolios.

Then Vanguard creates a recommended platform, in line with the investors timeline and risk tolerance. Based upon your answers to the onboarding questions, there will be various percentages of your total investment in each fund.

The platform is a secondary offering to the more comprehensive Personal Advisor Services.

Vanguard Digital or Fidelity Go Digital (<$25,000 AUM)-Which is the Better Robo Advisor?

Winner: Fidelity Go

Up until your account value reaches $25,000, the fee-free investment management, gives Fidelity Go the upper hand. Fidelity provides a diverse investment portfolio and access to investment advisors, for all account holders with $25,000+ AUM.

Although Vanguard is well regarded, the Fidelity platform is more comprehensive. If users need other services, like individual stock investing, research, screening and educational information, we prefer Fidelity.

Those who want access to actively managed funds, would lean towards Vanguard.

That said, there are free robo-advisors available. Additionally, if you’re seeking an all digital platform, you might consider Wealthfront as well, with additional ETFs for customization, tax-loss harvesting and many more features.

Next, we’ll explore the hybrid robo advisor offerings at Fidelity and Vanguard.

Fidelity Go Hybrid (+$25,000 accounts) vs Vanguard Personal Advisor Services

The digital advice trend is leaning towards the hybrid robo-advisor model, that combines digital investment management and access to human financial planners.

Most of the big financial firms offer these blended investment services. Vanguard is the largest as measured by AUM, yet there’s more to the investment manager choice than size. While Fidelity recently transitioned to a robo advisory hybrid model, with financial advisor access, for all customers with accounts worth more than $25,000.

Top Features

| Vanguard Personal Advisor Services | Fidelity Go (+$25,000 account value) | |

| Overview | Hybrid human financial planners and digital investment management. | Digital investment management and financial coaching and multi-goal digital investing. |

| Minimum Investment Amount | $50,000 | $25,000. |

| Fee Structure | 0.30% AUM on assets up to $5 million 0.20% AUM on assets between $5-10 million 0.10% AUM on assets between $10-25 million 0.05% AUM on assets over $25 million. | 0.35% |

| Top Features | The human financial advisor drives the entire process. Together, you and the advisor create a customized investment plan. | Financial coaching and access to broad Fidelity products and services. |

| Contact & Investing Advice | Phone M – F 8:00 am to 7:00 pm EST. Scheduled visits with financial advisor. | Phone 24/7 trained financial consultants. Live chat, secure email. Scheduled visits with financial coach. |

| Investment Funds | Low fee stock & bond mutual funds and ETFs selected from among the scores of Vanguard funds. | Diversified mix of fee-free Fidelity Flex mutual funds from stock and bond asset classes. |

| Accounts Available | Individual and joint investment accounts. Roth, traditional, SEP, Simple & rollover IRAs. Trusts. | Single and joint taxable investment accounts. Roth, traditional, and rollover IRAs. |

Fees and Minimums

Winner: It’s a tie. The minimum is lower at Fidelity and the fee is lower at Vanguard.

Fidelity

Fidelity Go with financial coaching is great for smaller investors seeking a hybrid model with a $25,000 minimum.

Although, the 0.35% AUM fee is slightly higher than at Vanguard.

Vanguard

Vanguard requires $50,000 to begin investing with the Personal Advisor platform. Although, investors can include other Vanguard account balances to meet the $50,000 minimum requirement.

Vanguard Personal Advisor Services also offers a tiered fee structure, which makes it more appealing for wealthy investors. The fee structure is as follows:

- 0.30% AUM for accounts up to $5 million

- 0.20% AUM on accounts valued between $5-10 million

- 0.10% AUM on accounts valued between $10-25 million

- 0.05% AUM on accounts valued over $25 million

The 0.30% fee is quite competitive for the hybrid model.

Features and Strategy

Winner: Vanguard Personal Advisor Services

Fidelity

The Fidelity hybrid robo advisor is a digital investment manager with access to financial coaches as well as a wide range of financial planning tools and resources.

The process starts with an online questionnaire where the investor chooses a primary goal; retirement, future goal, or big purchase (like a house). The goal must be at least 3 years away.

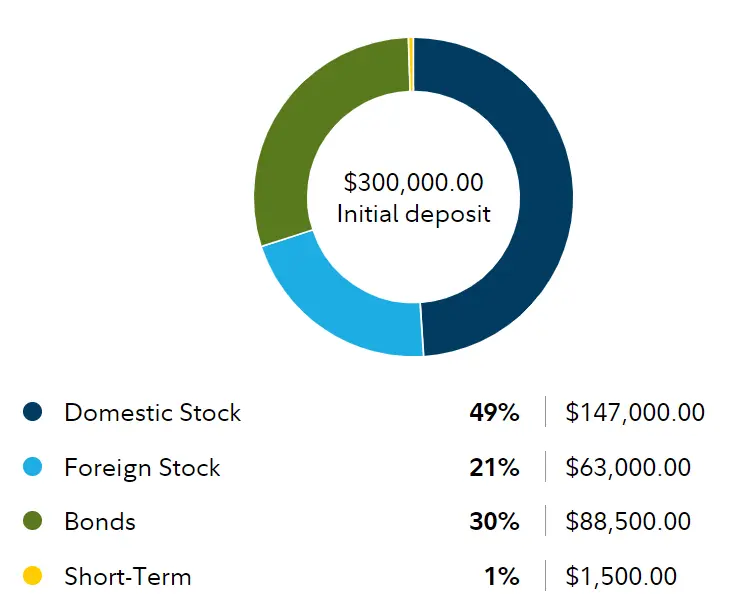

The questionnaire asks for basic info including current age, income, expected retirement age and whether the client has a partner or not. Other questions include initial contribution and monthly contribution amount. Next the platform creates an asset allocation proposal:

This model is created for someone with a 6 (out of 10) risk tolerance score.

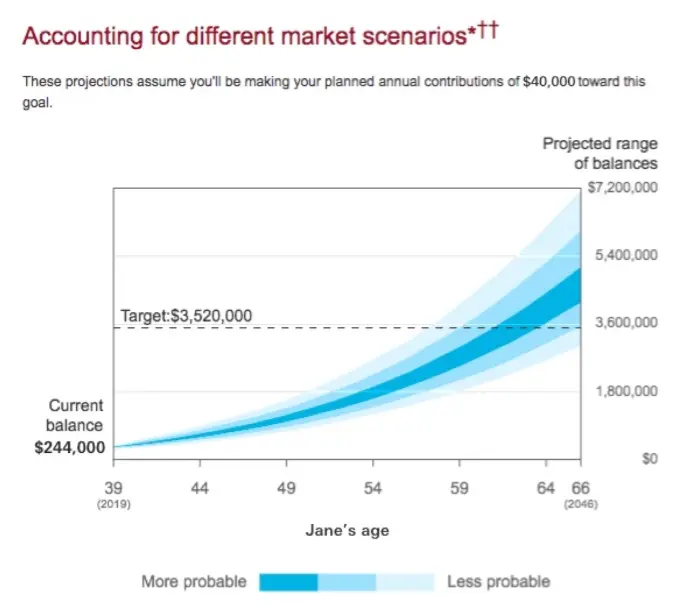

There’s also a graph outlining the likelihood of reaching the goal, including best, moderate, and worst case scenarios.

After the account is opened and funded, the client can schedule a coaching call. Although customer service representatives are available to discuss any questions or concerns, before opening the account.

Coaching sessions, with licensed financial consultants, can be scheduled at any time.

The portfolio is professionally managed, monitored and rebalanced when necessary.

The platform doesn’t mention tax-loss harvesting.

Any additional features, such as cash management, educational resources including research reports and fund screening are available through the Fidelity platform.

The 30 minute coaching sessions will focus on specific investing and finance questions. These sessions are supplemented with the Fidelity online planning tools and educational resources.

The Fidelity service doesn’t charge commissions and is compensated based upon aum.

We would prefer if potential clients could speak with a financial coach before funding the account.

Vanguard

The Vanguard Personal Advisor Services begins with a conversation between the investor and the financial planner. Together they craft a financial plan.

The portfolio typically includes Vanguard stock and bond ETFs and mutual funds, as well as other Vanguard funds, in accord with the client’s goals, financial situation and risk tolerance.

Investors can schedule appointments with their Vanguard financial advisor to discuss investing, tax consequences of their investments, estate planning and more.

Vanguard’s strategies include analyzing the likelihood of reaching investment goals, similar to Fidelity. The platform can also help analyze “what if” scenarios.

Vanguard Personal Advisor Services benefits from its combination of a robo-advisor with human financial planners. Clients may have to make a larger initial investment, but the personalized service available is a huge boon for this robo.

Vanguard clients with under $500,000 in their accounts will have access to a team of advisors, while those with more than $500,000 will have a personal financial advisor dedicated to their portfolio.

Tax-loss harvesting is available on a case-by-case basis. Since Vanguard Personal Advisor Services also has a lot of human oversight, this may be the most beneficial tax-loss harvesting model.

There are no trading commissions above the initial management fee and the financial advisor is a fiduciary. That means that he or she must act in the client’s best interest. The advisor is paid a salary and not commissions, based upon investing.

Vanguard’s Personal Advisors service provides tax-loss harvesting and appears to be somewhat more comprehensive, than Fidelity’s.

In sum, Vanguard Personal Advisor Services appears to be more comparable to a traditional financial advisor, and charges lower AUM fees than Fidelity Go.

Fidelity (+$25,000 accounts) vs Vanguard Personal Advisor Services-Which is the Better Hybrid Robo-Advisor?

Winner: Vanguard Personal Advisor

The Vanguard hybrid model, with declining fees is more comprehensive with a more personal touch. We like that the planning process is driven by the financial advisor. We also appreciate the opportunity for tax-loss harvesting. This is an important feature for taxable accounts.

The sliding fee schedule at Vanguard is optimal for wealthier investors.

It appears as though the Fidelity coaches rely on more tools and online resources and less on the financial planning aspect of the service.

FAQ

Is Vanguard Personal Advisor Services worth it?

Which is better: Vanguard or Fidelity?

That being said, Fidelity Go also offers a solid value, with fee-free investment management for account holders with less than $25,000.

Regarding the broader investment platforms, we prefer Fidelity overall as their investments, research, and tools are among the best.

Fidelity is one of our favorite platforms for self-directed investors.

Which robo-advisor is best?

Which Robo Advisor is Best – Wrap up

The reviews make it quite clear that we prefer the Fidelity Go over the Vanguard Digital offer, for investors with less than $25,000 in their account. Fidelity Go offers smaller investors greater diversity in a pure digital platform.

While we prefer the Vanguard Personal Advisor hybrid platform for those with more than $50,000. Vanguard has a more engaged financial planner, who drives the investment process. Vanguard also offers tax-loss harvesting.

The tiered fee structure at Vanguard Personal Advisors is great for larger investors.

However, if 24/7 financial consultant phone support is important, then Fidelity is for you. This is very convenient. Additionally, the Fidelity reps are very qualified to tackle a range for financial questions as most Fidelity representatives have Series 7 securities licenses. This feature is a plus for Fidelity Go clients, without access to financial coaches, with less than $25,000 AUM.

For investors who want some hands-on investment advice, but don’t want to pay an ongoing fee for a service they may not use often, Ellevest is a good option. They offer automated investing, with discounted financial planning sessions with human advisors so that clients only pay for what they use. Betterment digital also offers a computerized investment service, with pay per session for financial planning meetings.

In the last analysis, the best robo-advisor is the one that fits in with your needs and preferences.

Read the full Vanguard Robo-Advisors Review

Read the full Fidelity GO Review

Direct Access: Vanguard Personal Advisor Services and Digital Advisor

Direct Access: Fidelity Go and Personalized Planning

Related

- M1 Finance vs. Robinhood

- M1 Finance vs Vanguard

- Betterment vs Wealthfront vs Vanguard

- Wealthfront vs. Vanguard

- Betterment vs Fidelity

- Wealthfront vs Fidelity

- Best Robo Advisor For Retirement Account

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable