Consumers rejoice! In a race to the bottom, investment management fees are shrinking. And if low fees aren’t enough, there are a handful of robo-advisors that offer free robo-advisor investment management.

The best free robo-advisors typically invest your money in stocks, bonds and other exchange traded funds in alignment with your risk tolerance.

Each free robo-advisor will rebalance your account to keep your preferred asset allocation in line with your initial preferences.

Today, we'll go over some of the best free-robo advisors you can get signed up with today. However, lets first go over if free is really "free."

Are the best free robo-advisors really free?

Yes, and no. A free robo-advisor means that you won’t pay any fees to the robo-advisor firm to manage your investments. Your investments will be rebalanced for free and bought and sold for free.

But, investing is rarely 100% free.

Most robo-advisors recommend investing in exchange traded funds or ETFs. These ETFs have small management fees that go directly to the ETF, not to the robo-advisor itself.

So, a free robo-advisor means that more of your money is going directly into the investments, not into a managers pocket.

So how do free robo-advisors make money?

Don’t worry, robo-advisors still make money. Like many online platforms today, they have fee-based add on services as well as partnerships with banks and other institutions that add to their revenue.

They offer basic services for free out of the gate, and if you find the platform is lacking or you want a better experience in terms of a more robust platform or added functionality, they charge for it.

Make no mistake about it however, these free platforms are more than enough for a lot of investors. If you want more of your money to go into your investments and less to the fund manager then consider a free robo-advisor.

Free robo-advisors are appropriate for beginners and experienced investors. Lets have a peek at which ones may be right for you.

Getting down to the brass tacks

If you don't have time to read this comprehensive review of free robo-advisors, my number one free robo-advisor for investors is M1 Finance.

The platform is easy to use, ridiculously easy for even the most beginning investor to understand, and has a wide variety of paths an individual can go on in order to get what they want out of their portfolios.

Whether you're looking for a free robo-advisor via their ready-made portfolios, or looking to buy individual stocks and then have them balance them for you, it's the best option in my opinion.

They're also running a cash bonus currently. One you can claim by clicking the link below.

What are the best free robo-advisors to open an account with today?

- M1 Finance

- Sofi Invest

- Wealthfront

- Fidelity Go Robo Advisor

- Ally Robo Portfolios

- Schwab Intelligent Portfolios

1. M1 Finance

Minimum investment amount: $100

Who is M1 best for?

M1 is ideal for new investors, with their pre-made investment portfolios as well as experienced investors who want to choose their own stocks and funds. They also offer crypto investing.

The platform also offers lending and cash management for their clients, in addition to their free robo-advisor.

This robo-advisor is best for investors who want access to pre-made investing options and the opportunity to trade stocks and ETFs individually. M1 offers over 6,000 investment choices, and there is plenty here to keep investors satisfied for free.

It isn't like a traditional robo-advisor in the sense it picks multiple exchange-traded funds for your portfolio and adds to them as you contribute. Lets go over how it's different.

Free Features

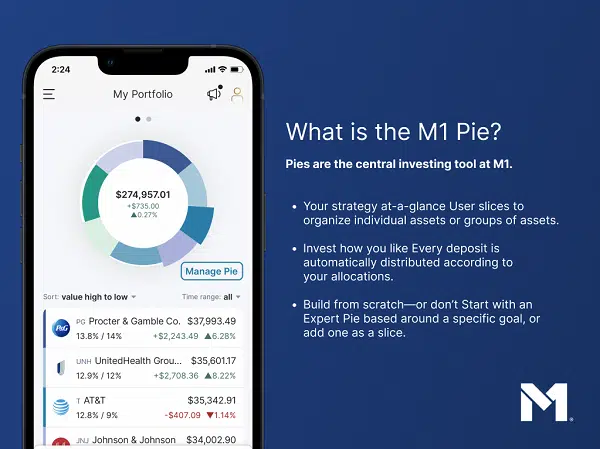

The M1 Finance free robo-advisor is unique in that you choose your investments from thousands of individual stocks and funds. You then select the percent that you want invested in each one.

Every time you add money to your account, M1 Finance automatically invests it in the holdings of your choice and aligns them with the percentages you choose. You can modify these target allocations or change up your investments at any time.

M1 "Pies" - Ready-made portfolios

If you’d prefer ready-made portfolios – M1 Finance calls them “pies” – of investments, there are many to choose from.

Similar to other robo-advisors, you can select a pre-made investment portfolio according to your risk tolerance from conservative to aggressive. Here’s a sample of the pre-made M1 Finance investment portfolio categories:

- General Investing

- Plan For Retirement

- Responsible Investing – ESG Sustainable Investing

- Income Portfolios

- Hedge Fund Followers

- Industries + Sectors

- Just Stocks and Bonds

Overall, it's really hard to argue with M1 as being the best free-robo advisor on the market. It has multiple options for investors with different strategies. If you're looking to have a hands-off approach but want a portfolio of individual stocks you like, they can provide that for you. If you're looking for a completely hands off approach and a broad-based indexing strategy, their ready-made portfolios can provide that as well.

M1 Finance $15,000 Bonus Offer - Read Below

If you're looking to earn free cash for your brokerage account, you'll want to have a peek at this offer from M1.

For a limited time, they're offering up to $15,000 to transfer an account over to M1. Yes, the threshold to earn this money is high, however any sort of cash-back program is certainly one you'll want to have a peek at.

Click the button below to head to M1, open an account, and claim your cash bonus.

If you've got some retirement accounts that are currently exposed to high fees, you may also want to check out their $5000 roll over promotion. Earn up to $5,000 when you roll over your retirement plan. Got a 401(k), 403(b) or another employer-sponsored retirement plan? Roll it over to M1 to avoid fees, consolidate funds, and earn a big investing bonus. Promotional terms and conditions apply.

2. Sofi Invest

Minimum investment amount: $1

Who is SoFi Invest best for?

SoFi is great for new investors who want a basic free robo-advisor as well as current SoFi lending customers.

Investors who want to chat with a CFP financial planner or career consultant, for no added fees will appreciate the available half-hour financial advisor consultations. SoFi is good if you want to keep all of your investing, borrowing and cash management under one roof.

SoFi is great for DIY investors including those who want to invest in cryptocurrency, stocks and ETFs.

Free Features

The SoFi Invest robo-advisor or automated investing helps you select investments and then manages them for you.

SoFi Invest incorporates several investing options for investors to choose from. You can choose your own investments, invest in crypto or even free ETFs on your own.

Here’s a list of all the free investing opportunities at SoFI:

- Crypto Investing – Cryptocurrency trading platform.

- Stock Bits – Free stock market investing, similar to Robinhood and M1 Finance.

- Active Investing – This SoFi stock investing platform allows you to buy shares of stock or even partial shares and get started investing on your own, for free.

- Automated Investing – The SoFi robo-advisor invests your money in diversified exchange traded funds, or ETFs and manages it for you.

- SoFi ETFs – SoFi offers four ETFs: SoFi Select 500 (SFY), SoFi Next 500 (SFYX), SoFi 50 (SFYF) and SoFi Gig Economy (GIGE).

If you're looking for a full-scale review on SoFi, we do have one here.

SoFi Invest Bonus Offer - Up to $1000 free

If you open up a SoFi investing account and fund it within 30 days, you'll receive a random deposit bonus from the company up to a total of $1000. This is the company's DIY platform.

3. Wealthfront

Minimum investment amount: $500

Who is Wealthfront Best for?

Wealthfront is ideal for investors who want a feature-rich all-digital robo-advisor. This robo investing platform also offers many types of accounts.

Wealthfront offers the best online digital financial advisor questionnaire that we’re aware of. The robo also includes lending and cash management.

Wealthfront gives you the opportunity to customize your investments by adding ETFs to your existing portfolio, or create a completely new one. Choose from 100+ ETFs and crypto funds from Greyscale. Wealthfront also offers fee-free cash management along with stock and ETF trading.

Larger investors will benefit from their cost-lowering Single Stock Diversification program, wide range of accounts including a 529 account and tax-loss harvesting (available for taxable accounts).

You can click the link below to sign up for Wealthfront Cash, it's free!

Free Features

If you sign up with the link in this article, you’ll get a free cash bonus.

After that you’ll pay a low annual fee of 0.25% of assets managed. Wealthfront’s digital PATH advisor hones in on your financial goals and situation with detailed questions about every aspect of your life This enable’s Wealthfront to craft a personalized investment portfolio.

One of the earliest robo-advisors, Wealthfront has many unique features:

- Smart Beta investing

- Risk Parity Fund

- Customize with hundreds ETFs and 2 crypto funds

- College planning guidance and 529 college planning account

- Direct indexing (for accounts worth over $100,000)

- Typical investment portfolios from conservative to aggressive

Although not completely fee-free, there are no commissions or management fees for the cash account or individual stock and ETF trading. The free cash promo for new accounts will offset any management fees for a while.

Wealthfront Bonus Offer - Open an Automated Investing Account and get $50

If you open up and fund a taxable automated investing account with at least $500, Wealthfront will deposit an extra $50 for you. It's a rock solid offer for those looking to get started.

4. Fidelity Go Robo Advisor

Minimum investment amount: $10.00 to begin investing

Who is Fidelity Go best for?

Fidelity Go is fee-free for investors with portfolios worth less than $25,000. After that, you will pay 0.35% AUM, but all account holders at the $25,000+ level also receive unlimited access to financial coaches. It's certainly a strong trade-off.

Cost conscious Investors beginning their investing journey will appreciate not only fee-free management but also portfolios populated with Fidelity Flex mutual funds, which lack the typical expense ratios that most other funds charge.

Investors who want to buy and sell stocks, bonds, ETFs and other assets will benefit from the Fidelity self-directed brokerage offers including some of the best in the business research and screening tools.

Free Features

- Free investment management for portfolios worth less than $25,000

- Portfolios populated with many fee-free Fidelity Flex mutual funds

- Abundant free research, financial planning tools

- Free educational resources

We produced a full-scale Fidelity Go review, which you can read here if you'd like more information.

5. Ally Robo Portfolios

Minimum investment amount: $100

Who is Ally Robo Portfolios (formerly Ally Invest) best for?

If you’re seeking free investment management, then Ally Invest is best for individuals who are comfortable with holding 30% of their portfolio in cash. (If you want less cash, then you’ll need to pay a small management fee.) The cash portion of your portfolio earns a high interest rate.

Ally is good for any investor who also wants a one-stop shop for robo advisory management, DIY investing, banking, and lending services.

Ally Invest is great for investors seeking socially responsible investment portfolios and excellent diversification among ETFs.

Free Features

Ally shines among the free robo advisors with a well diversified portfolio of ETFs. Like M1 Finance, you can also choose to have part of your portfolio professionally managed and trade stocks, bonds, and ETFs through Ally self-directed trading.

Ally Invest features include:

- No advisory fees, annual charges or rebalancing fees when you maintain 30% of your portfolio in high-yield cash assets. (0.30% AUM management fee with less than 30% cash allotment.)

- Four distinct types of investment portfolios: core, socially responsible, income, tax-optimized.

- Access to all the well-regarded features at Ally Bank including loans, mortgages, CDs and DIY investing.

If you're interested in Ally more, we do have a full review here.

6. Schwab Intelligent Portfolios

Minimum investment amount: $5,000

Who is Schwab Intelligent Portfolios best for?

Schwab is best for investors from beginners to advanced with at least $5,000.

Schwab also has a wide range of account types.

Cost-conscious investors seeking a robo advisor with one of the big financial firms might choose Schwab Intelligent Portfolios, as most of the other large financial firms charge an investment management fee.

Free Features

The Schwab Intelligent Portfolios robo-advisor offering has a lot going for it. They are similar to to many other robo’s and begin your investment process with an online questionnaire to determine your risk tolerance levels.

Schwab creates your personalized investment mix by integrating your goals and risk comfort level. Using your responses to a brief questionnaire, the platform recommends a diversified investment portfolio, in accordance with your preferred risk level.

Unlike M1 Finance, with access to thousands of investments, Schwab crafts your investment mix from a pool of approximately 30 diversified funds. It even includes a small allotment to gold, which we haven’t seen in other robo investing platforms.

Unique features include:

- Gold and commodity ETFs included in portfolios.

- Cash of approximately 8% included which stabilizes the portfolio volatility and makes it easier to rebalance.

- With Schwab’s large branch network, it’s easy to contact a representative for questions about the platform. Although for detailed advisory investment guidance, you’ll need to sign up for the paid plan, Schwab Intelligent Advisory.

- 24/7 phone support.

You can read our full review of Schwab Intelligent Portfolios here.

Best free robo advisors wrap up

Choosing the best robo-advisor for you involves understanding your own financial goals and and the type of platform that you’re most comfortable with.

Management fees are one piece of the investment selection puzzle. Other considerations also include features like tax loss harvesting, high yield checking accounts and cash management.

Overall, M1 Finance provides the best experience in my opinion and is going to be suited for the vast majority of investors seeking out a free robo-advisor. The platform is robust, visually appealing, and it's app and even desktop platform run so smoothly.

With the constant promotions they give for new accounts, along with how easy it is to use for new investors, it's hard to look at anything else. You can click below to claim a cash bonus with M1.

Outside of M1, if you’re seeking to invest with your values, than look for a robo with socially responsible investments.

If you want a robo that is part of a big investment firm, then there’s a free choice for you. If you’re seeking live financial advisor access along with a robo-advisor, then consider the hybrid robo advisor. Many offer complete financial plans.

There’s no right or wrong decision. Each of these digital investment managers are from safe and responsible firms.

The key is to get started investing now, so you have more time for your money to work for you.

FAQ

What is a robo-advisor?

A robo-advisor is an investment manager that will help you select appropriate investments according to your goals and risk tolerance. Most robo-advisors charge lower fees than traditional financial advisors and offer a variety of services. To learn more read our robo-advisor FAQ.

How does a robo-advisor work?

Robo-advisors work by asking you a few questions about your goals, financial situation, and comfort with risk. In this case, risk means falling investment prices. Robo-advisors aren’t all the same and vary according to fees, minimum investments, features. Learn more in this article, “How do robo-advisor work?“

How should you choose a robo-advisor?

First, list the features that are important to you. Then examine minimum investment amounts and fees. Then choose the best robo-advisor for you. Use our robo-advisor wizard to help you choose.