Which Robo-Advisor Is For You: Schwab Intelligent Portfolios or Betterment?

There is no shortage of robo-advisor options available to the public now, which is great news for those looking to invest! The bad news is that sometimes the multiple options can be overwhelming. Schwab Intelligent Portfolios vs Betterment is a difficult choice, as we recommend and like both robo-advisors.

It’s easier, in theory, to visit a human financial planner and just have them tell you how to invest instead of choosing a robo-advisor all on your own… right?

Not necessarily. While there are many similar robo-advisors on the market, we’ll help you decipher the difference between them. Following we’ll delve into Schwab Intelligent Portfolios vs. Betterment, including their similarities and differences.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

While only you can decide which financial moves are right for you, this Betterment vs Schwab Intelligent Portfolios overview will help you determine which robo-advisor best fits your financial situation.

Betterment vs Schwab Intelligent Portfolios — Overview

Both Schwab Intelligent Portfolios and Betterment are goals-based robo-advisors, which makes them seem more similar than they are. Goals-based robo-advisors ask potential investors questions to determine the client’s risk tolerance, any target retirement dates, or other lifestyle milestones that may impact the client’s financial needs.

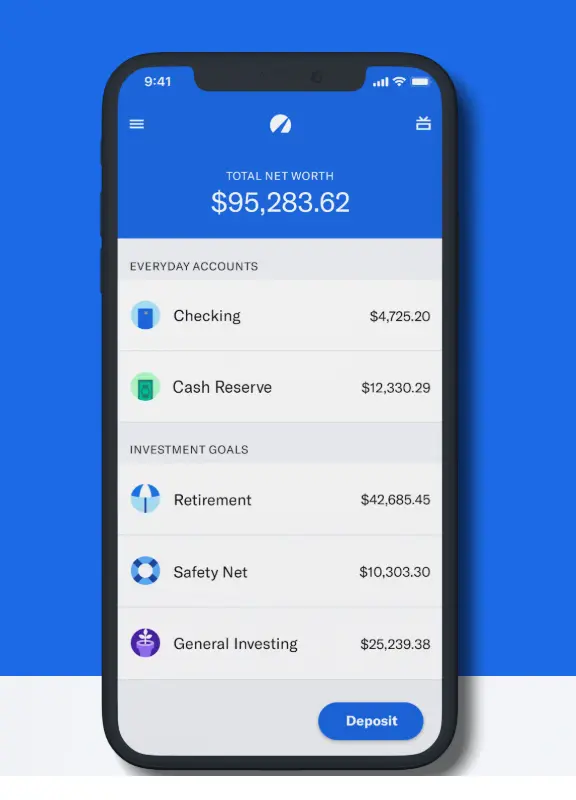

These robo-advisors also craft personalized portfolios based on the responses to these initial questions. The goals that you’re saving for will impact the types of investments each robo-advisor recommends. Betterment just instituted the “Cash Reserve” option for emergency funds and short term goals. While Schwab typically includes a cash allocation in each investment portfolio.

This means that while your risk tolerance is taken into account, the robo-advisors might also recommend additional investment opportunities outside your preferred risk level that would help you meet your financial goals.

Visit the Robo-Advisor Selection Wizard, answer 4 questions, and find out which robo-advisor is the right one for you.

Schwab Intelligent Portfolios and Betterment each provide their clients with access to human financial planners, for additional fees. The deep dive section delves into the financial planner options at both Schwab and Betterment and the fee schedules.

Betterment vs Schwab Intelligent Portfolios — Top Features

Schwab Intelligent Portfolios and Betterment have a lot in common. Both offer tax-loss harvesting and portfolio rebalancing, while simultaneously offering goals-based portfolio options.

Betterment Top Features Overview:

- Goals-based investing (opportunity for multiple goals)

- Tax-loss harvesting

- Diversified stock, bond and crypto investment options

- Alternate investing strategies including; socially responsible, smart beta and target income portfolios

- Access to human financial planners at all account levels, for additional fees.

- Fee-free checking and high yield cash reserve with Betterment Cash

Schwab Intelligent Portfolios Top Features Overview:

- Goals-based investing

- Diversified stock, bond, real estate and alternative investment options

- All portfolios include an allocation to cash

- Tax-loss harvesting (accounts over $50,000)

- 24/7 phone access to human assistance, every day of the year and branch availability for in-person meetings

- Free, no management fee, investment management

- Fee-based Schwab Intelligent Portfolios Premium offers access to financial advisors

Read: Robo-Advisor FAQ for explanations of these terms.

While many of these top features overlap, Betterment offers alternative strategy investing, while the basic Schwab Intelligent Portfolios robo-advisor doesn’t charge a management fee.

Schwab Intelligent Portfolios vs Betterment — Who Benefits?

Investors looking for a robo-advisor with a low initial financial requirement, either because they want to get their feet wet or do not have the finances available for a large up-front investment, will benefit from Betterment’s services. With no initial minimum investment requirement and $10 to begin investing, Betterment clients can start investing without a hefty cash outlay.

Bonus; 6 Robo-Advisors with the Lowest Fees – Low Cost Investing

While Schwab Intelligent Portfolios has the backing and services of the Schwab Investment Company. And Schwab Intelligent Portfolios doesn’t charge a management fee. Although all Schwab robo advisor portfolios require an 8 to 10% cash allocation.

For a fee, both robo-advisors offer access to human financial advisors.

While Betterment offers a wider range of human advisor access, including fee=based financial planning packages for digital investors. Schwab has the benefit of 24/7 customer service and branch access.

Quick Summary

- Betterment is best if you have less than $5,000 to invest and want crypto, smart beta or income portfolios.

- Schwab is best if you want free investment management and are okay with having part of your investment in cash.

- Both offer financial advisor access for additional fees.

Fees and Minimums

Fees Winner: Schwab Intelligent Portfolios wins with zero account management fees.

Minimums Winner: Betterment wins with no minimum initial investment required and $10 to begin investing.

With a minimum initial investment of $5,000 Schwab Intelligent Portfolios has a higher minimum balance than many robo-advisors, with quite a few often coming in at $100 or less for initial investments. Betterment is one such robo.

Betterment is more immediately accessible with no minimum initial investment required to start using their services.

When it comes to fees, however, Schwab seems to be the easy victor. Schwab Intelligent Portfolios has no account management fees! For many investors, this makes up for the $5,000 initial investment required to get started. However, for more advanced financial advising there is a fees:

- Schwab Intelligent Portfolios Premium combines the Schwab robo-advisor service with a human financial planner for a $300 one time set up fee and $30 per month, regardless of account balance.

Betterment, on the other hand, has a more complex fee structure depending on the account type:

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Overall, both robo-advisors offer reasonable fees.

Access to Human Financial Planners

Winner: Betterment wins with low fee a la carte financial planning packages for Digital clients. Although both Schwab Intelligent Portfolios Premium and Betterment Premium both have Certified Financial Planners available for reasonable fee structures.

This is a big one for robo-advisor investors. When you need professional advice, where will you turn? Both of these robo-advisors offer access to human financial planners, but in varying degrees.

Betterment offers greater financial advisory choices:

- Betterment Premium members, with a minimum account balance of $100,000, have unlimited access to Certified Financial Planners for a management fee of 0.40% of AUM, with reduced fees as assets grow.

- If the $100,000 minimum is too steep, clients can opt for a low-fee financial planning package that includes help with specific financial goals. From “Getting Started”, “Financial Checkup”, “College and Marriage” Planning to the “Retirement Planning Package.” The fees for individual packages, which include chats with a financial advisor are reasonably priced.

See how Betterment Compares with M1 Finance Robo-Advisor

At Schwab you can talk with a human at a branch although financial advice from a Certified Financial Planner is usually only available with the Schwab Intelligent Portfolios Premium Plan.

- The basic Schwab Intelligent Portfolios robo-advisor, doesn’t provide official financial advisor access, but you can visit a branch and discuss how to use the platform with a representative.

- The Schwab Intelligent Portfolios plan charges a $300 set up fee and $30 er month and requires a minimum of $25,000 AUM. This entitles you to certified financial planners to consult with by phone or video chat. Each of these salaried CFPs claims an average of 10 years of experience and uses the same planning software. This creates consistency across the platform.

Account Types

Winner: It’s a tie. Both Schwab and Betterment offer many account types.

There’s not much competition in the account department.

Schwab Intelligent Portfolios and Betterment offer the same basic investment accounts that one would expect from a robo-advisor, including individual or joint investment accounts, and IRAs (Roth, traditional, or rollover). Both Schwab and Betterment also offer trust accounts.

For small business owners, Betterment adds SEP IRAs while Schwab has a SIMPLE IRA.

Investment Funds

Winner: It’s a tie.

Both Betterment and Schwab offer superb diversity in investment funds covering the U.S. and international equity markets and a variety of fixed income bond funds.

Schwab also offers real estate investment trusts, gold and fundamental ETFs. Schwab offers a greater number of fund choices than Betterment in the core offer.

In addition to the basic stock and bond index funds, Betterment offers several value-oriented equity funds, along with the previously mentioned socially responsible, smart beta and target income portfolios.

Check out; Betterment vs Axos Invest

Both robo-advisors use low fee, highly liquid diversified exchange traded funds from a variety of providers.

Realistically, an investor would have sufficient diversification with either of these robo-advisors.

The greatest differentiator is the crypto portfolios, which are only available at Betterment.

Ultimately, there’s no guarantee that a greater number of funds or various strategies correlate with higher investment returns.

Tax Loss Harvesting

Winner: Betterment offers tax-loss harvesting for all taxable investment accounts.

Only available in taxable accounts, this is the process of selling losing funds and replacing them with similar funds. This process is done to lower your taxes, which may ultimately boost your investment returns.

Schwab offers tax-loss harvesting for their taxable accounts valued at more than $50,000. You must enroll in this service.

While Betterment offers tax-loss harvesting to all clients.

Retirement Planning

Winner: Betterment wins, by a thin margin.

Betterment has a robust retirement planning calculator that answers questions such as:

- Am I saving enough for retirement?

- When can I retire?

- What will my retirement look like if I don’t boost my savings?

- What are the financial implications of moving to a different place for retirement?

- Are there better ways to invest for retirement?

Schwab has a decent retirement planning calculator on their website, although it’s not specific to the intelligent advisor robo-advisors.

Although Betterment’s retirement planning tool is better, this isn’t necessarily a deal breaker. There are a lot of solid “free” or low-fee retirement planning calculator available online.

FAQ

Is Schwab Intelligent Portfolios good?

Is Vanguard better than Schwab?

Is Betterment a good investment?

Betterment vs Schwab Intelligent Portfolios Robo-Advisors Takeaway

Although their fee structures and minimum investment amounts make these two robo-advisors appear quite different, they actually have more in common than meets the eye! Both are goals-based robo-advisors, and offer tax-loss harvesting, portfolio rebalancing, as well as a variety of account types. Both also offer income portfolios.

Apart from their minimums and fee structures another differentiating factor is their access to human financial planners, which varies depending on account type and the fees. However, neither robo-advisor will leave their clients completely alone; customer services is readily available through each robo seven days per week.

While Betterment is the more easily accessible robo-advisor, with no minimum initial investment and low account management fees, Schwab’s $5,000 minimum initial investment is offset by its free account management services. Both robo-advisors are equipped to provide quality portfolio management services while ensuring their clients are putting more of their money into their investments—not into account management fees.

Finally, both hold a spot on the coveted “Robo-Advisors with the Most Assets Under Management” list.

Depending upon your specific needs, you might prefer one over the other.

You can’t go wrong with either robo-advisor as each offer robust investment options, access to financial advisors and are well-regarded companies.

For more information:

Read the Complete Betterment Review

Read the Complete Schwab Intelligent Portfolios Review

More Robo-Advisor Comparisons

- Robinhood vs. Acorns vs. M1 Finance – How to Choose the Best Investment App

- Personal Capital vs Betterment – Robo-Advisor Comparison

- Betterment vs Ellevest – Which Robo-Advisor is Best for You

- Ally Invest vs Betterment vs Wealthfront – Robo-Advisor Comparison

- M1 Finance vs Charles Schwab – Robo-Advisor Comparison

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Disclosure: Barbara A. Friedberg, website owner has a Schwab Intelligent Portfolios SIMPLE IRA account.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.