Which Robo-Advisor is Best For You?

There are two common reasons people like robo-advisors. And Ally Robo Portfolios, Betterment and Wealthfront fulfill them!

First, they provide lower cost investment management than their human counterparts, which immediately puts more money in your pocket.

Second, many have lower minimum investment requirements than traditional investment options do.

Both of these trends make robo-advisors more affordable and more appealing than traditional advisors, for both new and experienced investors alike.

The three robos we’ll compare today – Ally Robo Portfolios vs. Betterment vs. Wealthfront – are low-fee, low-minimum balance robo-advisors that offer quality services and have strong track records as safe, reliable companies.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Features at a Glance

Ally Robo Portfolios vs. Betterment vs. Wealthfront – Overview

What is Ally Robo Portfolios?

Ally Robo-Portfolios (aka Ally Invest Robo Portfolios) was founded in 2016 when Ally Bank acquired TradeKing. As Ally Invest grew, they reimagined the TradeKing automated portfolio into a new robo-advisor that offers a variety of investment options. Investors can choose from core, income, tax optimized and socially responsible portfolios.

Because Ally Robo Portfolios is part of the Ally Bank family, this robo-advisor is in the same camp as Fidelity Go and Schwab Intelligent Portfolios. But with Ally’s low minimum investment requirement and zero management fees (as long as your portfolio maintains a 30% cash allocation), it’s really competitive with independent robos like Betterment and Wealthfront.

And the Ally Savings Account is known to pay among the highest interest rates.

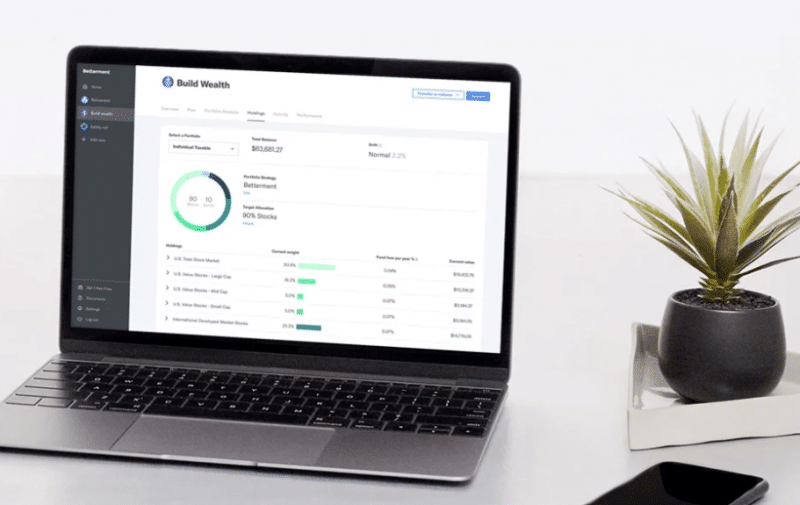

What is Betterment?

Betterment was founded in 2008, which makes it one of the pioneer robo-advisors on the market. In comparison to other independent robo-advisors, Betterment has dominated the charts for among the most assets under management. Betterment shines with access to human financial advisors for all clients – for an additional fee.

It is also a goals-based advisor that offers financial advisors, cash management and many tools to help you manage your money.

What is Wealthfront?

Wealthfront is another early player in the robo-advising market, and, like Betterment, Wealthfront also boasts a top seat in terms of assets under management. This robo-advisor is known for providing additional services to clients, like loans, fee-free individual stock and ETF investing, and hundreds of ETFs for portfolio customization.

Wealthfront recently jumped ahead of peers by allowing customers to invest in two Greyscale cryptocurrency funds and to customize portfolios with ETFs of their own choosing. Wealthfront customers can choose from more than 100 ETFs and either create new portfolios, which Wealthfront will manage, or add additional ETFs to an existing account.

Despite it’s “all digital” claim, Wealthfront’s customer service reps are licensed and the PATH financial advisor is hands-down the most comprehensive digital financial advisor online.

Ally Robo Portfolios vs. Betterment vs. Wealthfront – Top Features

Ally Robo Portfolios Top Features

- Goals-based robo-advisor

- Access to Ally Bank

- Diverse investment options

- Socially responsible investments

- Tax-optimization portfolios

- 24/7 customer service

Betterment Top Features

- Access to human financial planners via video chat for Premium clients (with 0.40% management fee) with more than $100,000 invested.

- Financial planning packages available for life milestones for Digital clients – for additional fees.

- Socially responsible investments

- Smart Beta portfolios.

- Crypto currency portfolios.

Wealthfront Top Features

- Path digital financial planner

- Tax-loss harvesting on a daily basis

- Loans available

- High-yield cash savings accounts

- Cryptocurrency funds and 100+ ETFs for added customization

- Fee-free stock and ETF trading

Anyone can use the Path digital financial planner tool, whether they are a Wealthfront customer or not.

Ally Robo Portfolios vs. Betterment vs. Wealthfront – Who Benefits?

All 3 Robo’s are Best for:

Investors who want a small startup cost, rebalancing and manageable low fees will benefit from all three robo-advisors on this list.

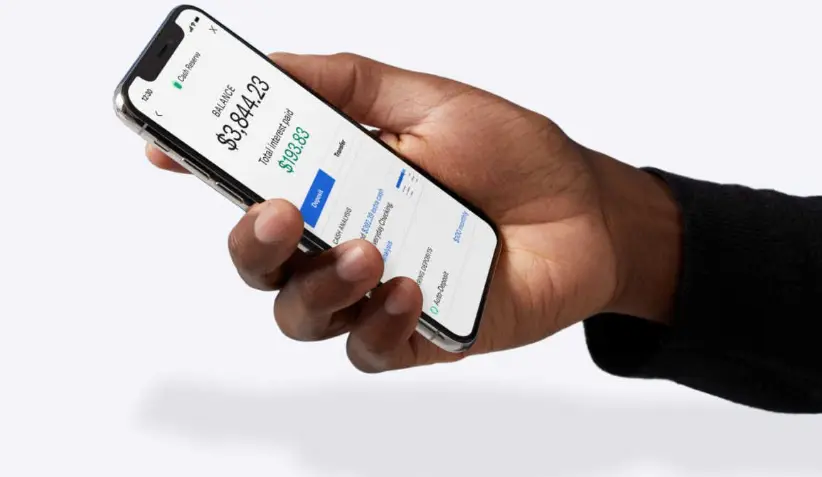

Each of the robo-advisors offer high yield cash accounts and debit cards. Betterment offers checking and high yield savings accounts, through partner banks, while Wealthfront offers high-yield cash accounts, also through partner banks, and loans. Ally Robo Portfolios is a part of the full-service Ally bank with Ally’s high yield savings account.

Betterment is Best for:

Investors who want access to human financial planners, for added fees, will benefit most from Betterment. Whether you have a Digital or Premium package, you’ll be able to access financial planners (for an additional fee). Also good for investors seeking income and socially responsible portfolios.

Wealthfront is Best for:

Tech savvy investors seeking all-digital platform with daily tax-loss harvesting, crypto, customization options. Those seeking cash management and borrowing too.

Ally Robo Portfolios is Best for:

Those seeking a robo-advisor with fee-free investment management (as long as you agree to a 30% cash position in your portfolio) that is part of a financial firm. Ally Robo Portfolios also offers income, tax minimization and socially responsible choices.

Ally has the added benefit of being part of the Ally Bank family, meaning that clients can use the same company for all their financial needs.

Ally Robo Investing vs. Betterment vs. Wealthfront – Deep Dive

Fees and Minimums

Minimums Winner: Betterment is the minimums winner with no minimum investment required and only $10 to begin investing.

Fees Winner: This category is more difficult. If you’re comfortable with 30% of your portfolio invested in cash, then Ally Invest is the winner. If not, then Betterment and Wealthfront win with a 0.25% AUM fund management fee.

Ally Fees and Minimums

Ally Invest has a low minimum investment requirement of $100, making it much more affordable than several robo-advisors by other large banks.

Another selling point is that Ally Invest does not charge any account management fees for clients whose portfolios have a minimum of 30% cash assets. The fee is 0.30% AUM for portfolios who do not meet this cash asset minimum. We believe that 30% cash allocation is high for most investors who are not in or nearing retirement.

Betterment Fees and Minimums

Betterment Digital does not require any minimum investment. You’ll need $10 to begin investing

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Wealthfront Fees and Minimums

Wealthfront has a minimum investment requirement of $500. Clients will pay 0.25% AUM for account management.

Sign up with this link for $5,000 free investment management:

Human Financial Planners

Winner: Betterment with a la carte financial planning packages for Digital customers and Certified Financial Planners for Premium clients (for additional fees.)

Although Ally Invest Managed Portfolios sounds like they’re more hands-on than a normal robo-advisor, the title is a little misleading. A team of financial professionals does help to assemble your portfolio, but the portfolio itself is managed by the robo-advisor algorithms.

Betterment takes the top spot with unlimited access to human financial planners for Premium customers (with a higher investment management fee). Also, Betterment Digital clients can purchase a variety of goal-based financial planning packages for additional per package fees.

Wealthfront does not provide human financial planning services to clients. Although, their customer service representatives are licensed financial professionals. Wealthfront’s Path, digital financial planner, is designed to answer up to 10,000 investment and money-related questoins.

Tax-Loss Harvesting

Winner: It’s a tie between Betterment and Wealthfront.

Betterment and Wealthfront offer tax-loss harvesting. Ally Invest offers tax-advantaged portfolios which include municipal bond funds.

Wealthfront may have a slight advantage in this category because they offer daily tax-loss harvesting; however, the jury is still out on whether more frequent tax-loss harvesting is necessary. Still, Wealthfront claims that their more frequent tax-loss harvesting strategy gives investors a chance to save even more money on tax payments.

Investments

Winner: Wealthfront, with hundreds of ETfs and fee-free stock and ETF trading.

Each platform offers various strategy funds like smart beta and ESG. Visit the Betterment, Wealthfront, and Ally, to learn more.

Following is a sample of the investments held within the platforms’ Core Portfolios:

Betterment Investments

- U.S. Total Stock Market

- U.S. Large-Cap, Mid-Cap, and Small-Cap Values

- International: Developed and Emerging Market

- U.S. High Quality Bonds

- U.S. Inflation-Protected Bonds

- U.S. Short-Term Treasury and Investment Grade Bonds

- International Developed and Emerging Market Bonds

Wealthfront Investments

- U.S. Total Stock Market

- Foreign Stock – Developed and Emerging Markets

- Dividend Appreciation Stock

- U.S. Treasury Inflation Protected Bonds (TIPs)

- U.S. Government Bonds

- Municipal Bonds

- U.S. Corporate Bonds

- Foreign-Emerging Market Bonds

- Real Estate

- Natural Resources (Energy)

Wealthfront also offers hundreds of ETFs investors can use to customize existing or to create new investment portfolios. Clients can also purchase Greystone cryptocurrency funds, typically only available to accredited investors.

Ally Invest Investments

- U.S. Stocks, including S&P 500, Mid-Cap, and Small-Cap

- International Developed and Emerging Market Stocks

- U.S. Treasury Bonds

- U.S. Intermediate Credit Bonds

- Vanguard Mortgage-Backed Securities ETF

- International Bonds

- Cash

FAQ

Which is better Wealthfront or Betterment?

Which robo-advisor is the best?

How does Ally Robo Investing Portfolio work?

Ally Robo Portfolios vs. Betterment vs. Wealthfront – Which is Best? Wrap up

Each of these robo-advisors have many benefits that might appeal to a wide range of investors. Investors should be careful to pick the robo that best aligns with their goals. Each robo-advisor offers investment management including rebalancing and cash management.

Betterment or Wealthfront might be for you if you like the idea of a standalone robo-advisor with a long history. These are among the earliest robo advisory platforms. Betterment offers socially responsible investment options and has a Smart Beta portfolio, which has the potential to outperform the market. While Wealthfront provides wide latitude for customization across various strategies and investment styles. Both offer crypto investing access. The Betterment Digital clients might enjoy the low fee financial planning packages available for a portfolio review, college planning, or other money goals. Wealthier individuals will appreciate Betterment Premium with access to Certified Financial Planners, for an additional fee.

Wealthfront might be for you if you want an all digital robo-advisor for a reasonable 0.25% AUM management fee. Wealthfront comes with a $500 minimum investment. Investors seeking to customize their investments and add a crypto fund will choose Wealthfront.

For new investors, Wealthfront’s $500 minimum might be a deterrent. There are other robo’s with low minimums who offer ways to invest with little money.

Ally Robo Investing might be for you if you want a robo-advisor backed by a larger financial company. This has the unique benefit of giving you a relationship with Ally Bank, which in turn can provide additional financial services. We like that Ally offers both socially responsible investing and income portfolios. This is great for conservative investors. Although, SoFi Invest also offers a robo advisor, DIY investing, lending and banking, includes financial advisors and has zero management fee.

You might not appreciate Ally Invest if you’re uncomfortable with keeping 30% of your assets in a high yield cash investment , however. Ally Invest only offers free account management to clients who meet this thresh hold; those who have less than 30% assets in cash will pay a 0.30% AUM fee.

Ultimately, we like each of these robo-advisors and believe you can’t go wrong with any of the three.

Read the Wealthfront Review.

Read the Betterment Review.

Read the Ally Robo Advisor Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.