M1 Finance vs. Charles Schwab — Which is Best for You?

When it comes to big names in the financial world, Charles Schwab stands out as a major investment brokerage firm. On the independent robo-advisor front, however, M1 Finance is a well-known competitor. Both of these investment platforms offer quality service, affordable account management, and multiple investment options. Find out who’s the best for you in this M1 Finance vs. Schwab comparison.

[toc]*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

What is M1 Finance?

M1 Finance is one of the best-known free robo-advisors and investment apps. Their portfolios are set up like “pies”: every investment in the portfolio takes up a slice of the pie, so you can have up to 100 unique investments!

Clients can create their own investment portfolios with fractional shares from over 6,000 individual stocks and exchange traded funds (ETFs), or they can choose one of the pre-made investment portfolio options. M1 Finance offers socially responsible investment options as well.

This platform offers multiple account types — such as retirement accounts, taxable accounts, business accounts — as well as banking and lending options.

M1 Finance rebalances all accounts back to your desired asset allocation, either when you add money or at will.

While free accounts only get one trading window, M1 Plus clients have two.

What is Schwab?

Schwab offers both a robo-advisor and traditional brokerage services. The name Charles Schwab means a lot in the financial world; they frequently win awards for their customer service and investment advice. Charles Schwab is a discount brokerage firm with a slate of investments, managed portfolios, banking, and the acquirer of TD Ameritrade.

Although Charles Schwab offers traditional human investment management, they also offer two robo-advisor options, Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium.

Charles Schwab’s Intelligent Portfolios, the basic robo-advisor is a no-fee, goal-driven robo-advisor. Using a fairly traditional questionnaire, the robo-advisor will create portfolios based on potential clients’ risk tolerance, investment timeline, and goals.

While Schwab Intelligent Portfolios Premium is a subscription-based digital investment manager with unlimited access to Certified Financial Planners.

Charles Schwab vs. M1 Finance Summary

| Schwab Intelligent Portfolios | M1 Finance | |

|---|---|---|

| Overview | Free automated investment service with basic and premium options. | An investment app with pre-made portfolios, stocks, ETFs, and crypto. |

| Minimum Investment Amount | $5,000 for basic $25,000 for premium Zero for brokerage acct. | $100 |

| Fee Structure | Zero management fees for basic. $30/month + $300 setup fee for Schwab Intelligent Advisory | Zero for basic. $95 for Plus with added features. |

| Top Features | Widely diversified robo-advisory investment portfolio. Rebalancing. Access to Schwab services. | Pre-made portfolios, stock and ETF investments. Rebalancing. Lending. Cash Management. |

| Free Services | Zero account management fees for Schwab Intelligent Portfolios. Requires 6%+ cash allocation | Free investment management for M1 Finance Basic |

| Contact & Investing Advice | Branch access. CFPs for Premium clients. Phone - 24/7, 365 days a year. Email | Email and Phone 9-4 ET Mon-Fri. |

| Investments | Stocks, ETF and mutual funds, bonds, options, fractional shares, and more. | Stocks, ETFs and crypto. |

| Robo Investments | Low fee stock, bond, real estate & precious metals ETFs for robos. | Low-cost, commission-free ETFs and crypto for premade portfolios. |

| Accounts Available | Brokerage, retirement, trusts, custodial, and more. | Brokerage, retirement, trusts, custodial. |

| More Information | Schwab Review | Sign up |

M1 Finance vs. Schwab — Top Features

M1 Finance Top Features

- Low account minimums. The minimum balance for investment accounts is $100, or $500 for retirement accounts.

- Zero fees for account management. M1 Plus is $95/year.

- Retirement account (Traditional, SEP, Rollover, and Roth IRA) and taxable account options.

- Fractional shares.

- Fee-free stock and ETF trading.

- Customized portfolios

- High yield cash account.

- M1 Borrow-low fee margin account.

M1 High Yield Interest Rate – 5.0% APY*

*Available with M1 Plus account.

Schwab Top Features

- Low management fees for the robo-advisor options: no management fees for the basic account (Schwab Intelligent Portfolios) or $30/month for Intelligent Portfolios Premium (plus a one-time $300 planning fee).

- Connection to the Charles Schwab family of financial products, so you can keep your finances under one roof.

- Low-fee exchange traded funds from 20 different asset classes for the Intelligent Portfolios robo-advisors.

- Premium account holders get unlimited access to Certified Financial Planners.

- Vast array of financial services and products including branches, insurance, mortgages, bonds, options, stocks, and CDs.

This Charles Schwab vs M1 Finance review will focus on the robo-advisors, with a brief nod to Schwab’s other features.

M1 Finance vs. Schwab — Who Benefits?

Between these two robo-advisors, there’s something for everyone. All investors, from the beginner investor to the more experienced, can benefit from one or more features these investment tools offer.

Both robo-advisors offer one investment option with no management fee — the basic plan at M1 Finance and Intelligent Portfolios from Charles Schwab. Because of this, potential investors who are looking for a zero management fee investment option will benefit from either platform. However, M1 Finance is more affordable for small investors: their minimum account balance is $100, which is a sharp contrast to the $5,000 required at Charles Schwab.

Of the two, only Charles Schwab offers contact with human financial planners. Schwab customers who use the traditional brokerage services or Intelligent Portfolios Premium will have access to a certified financial planner to help them make sound investment decisions.

Schwab also offers branch access and more access to customer service personnel.

Self directed investors will appreciate M1 Finance because of their DIY accounts. However, even beginner investors can get started easily because M1 Finance or Schwab’s Intelligent Portfolio option both offer suggested portfolio allocations as well.

While M1 Finance has a low minimum required investment of $100, those who can afford higher account minimums will benefit from the Premium portfolio option, with a $25,000 minimum, at Charles Schwab. The Premium account type offers unlimited consultations with CFPs as well as other benefits.

Quick Summary

- The basic M1 plan and Schwab Intelligent Portfolios offer free account management — this makes them great for those who want a managed investment portfolios without spending an arm and a leg on fees.

- If you want support on your investment journey, Intelligent Portfolios Premium or a more traditional brokerage account with Charles Schwab would be great for you.

- If you’re looking for a more DIY approach along with a managed investment portfolio, M1 Finance would be a good fit.

- Smaller investors will love M1 Finance’s $100 minimum. However, wealthier investors — those who have over $25,000 to invest — will benefit from Intelligent Portfolios Premium from Charles Schwab.

- Do-it-yourself investors would benefit from either M1 Finance or Charles Schwab brokerage services, if you’re seeking a wide range of investment assets. Both are good picks for investors who want to try their hands at investing on their own, and need a low-minimum account (a Schwab brokerage account doesn’t require a minimum investment amount).

Fees and Minimums

Although M1 Finance is well known as a free robo-advisor, Schwab is right behind them. Both robos offer affordable basic investment plans with myriad account types as well as premium offerings.

M1 Finance Fees and Minimums

Clients can open an investment account with only $100, or a retirement account for $500 at M1 Finance. This is fairly affordable for a robo-advisor,

Where M1 really stands out, however, is in their fees — or lack thereof. Basic M1 Finance accounts are completely free, including no trading fees.

Investors who are looking for something extra, like two trading windows and high yield cash management account, extra low interest rate margin accounts might prefer M1 Plus.

Schwab Fees and Minimums

Charles Schwab offers comprehensive brokerage services, from human-guided investments to self-directed investing options. The account minimums and fees vary depending on what features investors need.

The basic Schwab Intelligent Portfolio option requires a minimum account value of at least $5,000. While this is on the higher end for robo-advisor minimums, this option comes with no advisory fees or commission charges. The catch is that all Schwab robo advisory portfolios contain roughly 6% to 10% in an interest bearing cash account. This comes in handy during declining markets, and might be a drag on returns when stock assets are booming.

Schwab customers can benefit from 24/7 support and dynamic rebalancing.

For wealthier investors, Schwab’s premium portfolio requires a $25,000 minimum investment. Despite the higher minimum investment, premium clients will pay only $30 per month in advisory fees, plus a one-time $300 planning fee. Under this plan, Schwab customers receive unlimited one-on-one consultations with a CFP.

Of course, some Schwab customers want to go beyond online brokerages and meet face-to-face with a financial advisor. For investors with at least $1 million, Schwab offers Private Client investing.

Schwab does not charge commissions for any online trades of ETFs, stocks, or Schwab mutual funds. Additional charges apply with broker-assisted, option, bond, and mutual fund trades.

Schwab vs M1 Finance Margin Rates

M1 Plus clients generally generally receive lower rates than Schwab. But, these rates tend to vary based on current market interest rates.

M1 Finance vs. Schwab — Deep Dive

What sets these investment brokers apart? While both options have a wide variety of services, available investments, and account types, there are key differences in their offerings.

Human Financial Planners

Schwab is the easy victor here, though access to human CFPs will cost you: their Premium accounts, reserved for clients with at least $25,000 in their account, can speak with CFPs whenever they choose.

M1 Finance does not offer contact with human financial planners. While the platform does have pre-made portfolios, which can make choosing investments easier, this doesn’t make up for the lack of human assistance for more unsure investors.

Investors who can’t meet the hefty minimum investment at Schwab might consider Betterment, which allows customers at all levels to text with human financial planners.

Tax-Loss Harvesting

Schwab’s tax-loss harvesting strategy is more comprehensive than M1 Finance’s. At Schwab, clients can expect that tax-loss harvesting and rebalancing will go hand-in-hand to ensure that their investments are tax optimized.

M1 Finance, on the other hand, will automatically rebalance accounts and consider tax efficiency, but does not offer tax-loss harvesting.

Tax-loss harvesting is applicable for taxable accounts, not retirement accounts, and might reduce tax payments, thereby increasing investment returns.

Investments

Both robo-advisors offer a wide variety of diversified funds across a range of distinct asset classes.

Both platforms offer fractional shares as well, although Schwab stock bits must be purchased through a brokerage account, not the robo-advisor.

Schwab ultimately offers more investment variety including, stocks, funds, bonds and options, in a brokerage account. Although the robo-advisory services are are fairly evenly matched.

M1 Finance Investments

M1 Finance offers more than 30 pre-made investment portfolios (pies) across a range of categories and 6,000+ stocks and ETFs.

- US Large, Mid, and Small Cap

- Developed and Emerging Markets

- Total, Developed, Corporate, and Municipal Bonds

- Short Term Treasuries

- TIPs

- Real Estate

- Bond ETFs

- Crypto digital coins

M1 Finance Expert Pies

M1 Finance clients who want a managed investment portfolio can choose from M1 expert pre-made pies based on their risk tolerance:

- Ultra Conservative (10% stocks/90% bonds)

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

- Ultra Aggressive (99% stocks/1% bonds)

Other types of expert pies include; income portfolios, socially responsible investing, hedge fund look a likes, and retirement.

With such a wide variety of portfolios available, clients are sure to find something that matches their goals and risk tolerance. One downside, however, is that you need to have an account with M1 Finance before you can access more thorough information about these expert pies.

Schwab Investments

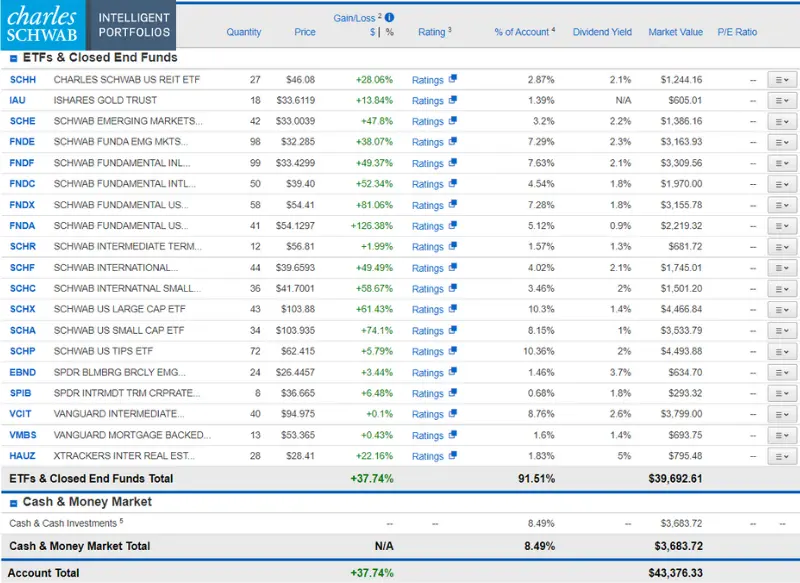

The Schwab Intelligent Portfolios robo-advisors include exchange traded funds, while investors with a separate brokerage account can invest in most any available security from stocks to bonds, options and CDs.

- U.S. Large and Small Company Stocks

- International Developed and Emerging Stocks

- U.S. and International Exchange-Traded REITs

- U.S. and International High-Dividend Stocks

- U.S. Treasuries

- U.S. Bonds (Investment Grade, Securitized, Inflation Protected, and Corporate High Yield)

- International Developed and Emerging Bonds

- Bank Loans

- Gold and Precious Metals

- FDIC-Insured Cash

Schwab Risk Assessment

Rather than pre-created portfolios, Schwab starts with a questionnaire designed to help understand potential investors’ risk tolerance, investment knowledge, and goals. From there, the robo-advisor suggests an asset allocation that is likely to help the investor meet their financial goals. One benefit of this tool is that they do not ask for personal information right off the bat; this allows would-be clients to do research before handing over their social security numbers.

Once the suggested asset allocation has been calculated, however, Schwab offers clients the chance to customize the sample portfolio slightly by increasing or lowering the risk tolerance. There’s very little wiggle room, however, which makes M1 Finance the more adaptable platform in this case.

Account Types

Schwab offers more account types than M1 Finance. Still, M1 has enough account types to reach most investors.

M1 offers:

- Taxable investment accounts (individual and joint accounts)

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

Schwab offers:

- Taxable investment accounts (individual and joint accounts)

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Simple IRA

- Trusts

M1 Finance vs. Schwab — Additional Financial Products

There are benefits to keeping all of your financial products under one roof. Schwab is the larger financial institution, so it should come as no surprise that they offer more financial products than M1. From savings and checking accounts to home loans, Schwab clients can find almost anything they need.

M1 is a bit simpler, but that doesn’t mean they’re less effective. M1 Borrow allows clients to borrow up to 30% of the value of their portfolio with low margin rates. M1 Spend for basic M1 users offers clients a debit card; M1 Plus members will also earn high yields and 1% cash back, plus the ability to send checks electronically.

M1 High Yield Interest Rate – 5.0% APY*

Mobile App and Interface

Both brokerage firms offer a mobile app. Though both are comprehensive and fairly easy to use, clients have voted M1 Finance’s mobile app the most intuitive of the two.

Additionally, both robos have useful web-based interfaces. Again, the M1 Finance mobile app offers a simpler, more streamlined option, but that is likely because it has fewer offerings and products than Schwab.

Pros and Cons

M1 Finance Pros

- Free account management

- Passively managed accounts

- DIY or ultra-customizable risk-based portfolios

- Socially Responsible Investing

- Multiple types of accounts

- Varied investment options

- Borrowing and cash management

- Crypto investing

M1 Finance Cons

- Not suitable for day traders with only one trading window (two for M1 Plus members)

- No tax-loss harvesting, though tax-optimization is available

- No access to human financial planners

Schwab Pros

- Large financial institution; gives access to family of products for all sorts of financial needs

- Free account management for Schwab Intelligent Polios basic service

- Access to CFPs with Premium Portfolios

- Varied investment options

- Branch access

Schwab Cons

- High minimum investment amount for managed robo-advisory portfolios

- Limited ability to customize managed portfolios

- Investors need a separate brokerage account for DIY investing, margin, and lending options

FAQs

Is M1 Finance better than Charles Schwab?

Is M1 Finance a good brokerage?

Is M1 Finance better than Robinhood?

Read our M1 vs Robinhood head-to-head comparison post.

M1 Finance vs. Schwab — Which is Best? The Takeaway

The benefit to both these platforms is that they are free at the basic level. Even the premium package at Schwab charges reasonable fees — much lower than those charged by other robo-advisors such as Empower. However, Schwab is more prohibitive when their minimums are considered: Schwab Intelligent Investor clients will need to invest $5,000 right away, compared to M1’s $100 minimum.

Both robos offer varied account options, meeting the needs of most investors. They also boast sufficient investment options for a diversified portfolio.

When we put these two robo-advisor head-to-head, Schwab wins in the majority of our deep dive categories. In some ways, this is to be expected. As a larger financial institution, Schwab has the staff and financial ability to offer a more complex investment platform, including benefits such as human CFPs and actively managed portfolios for those investors who can afford them.

However, M1 certainly holds its own. Like Schwab, they offer an intuitive interface and the ability for clients to access their portfolios 24/7 from their phones. What they lack in human support they make up for in fully customizable portfolios.

Since these two options are pretty well matched, choosing between them comes down to whether you need a full service discount broker at your disposal or whether you’re happy with the more streamlined M1 app and offerings. Ultimately, if you’re just starting out, with less than $5,000, then M1 is your choice. In all other categories, either robo-advisor would benefit most investors.

Read the M1 Finance Review

Read the Schwab Intelligent Portfolios Review

More Comparison Articles

- Betterment vs. Wealthfront vs. M1 Finance

- Schwab Intelligent Portfolios vs. Betterment

- Wealthfront vs. Vanguard

- Wealthfront vs Schwab

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Disclosure: Barbara A. Friedberg, MBA, has an account with M1 Finance and and Schwab.