Are you pressed for time and seeking investment portfolio management to help lighten your load?

M1 Finance and Betterment are two investing options under the robo-advisor umbrella. Yet, each platform has as many differences as similarities. Look under the hood of M1 Finance vs Betterment fintech robo-advisors to find out which one is right for you.

Both Betterment and M1 Finance are among our favorite robo-advisors, and fortunately are distinct enough to make choosing between them seamless. Both offer low account fees or none and a variety of account types.

First, check out the side-by-side comparison of M1 Finance vs Betterment.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Compare Betterment vs M1 Finance

Next, get a synopsis of M1 Finance and Betterment’s platforms. Finally, the M1 Finance vs Betterment wrap up helps you decide which robo-advisor is best for you.

Who is M1 Best For?

- Self directed investors who want to opportunity to invest in more than 6,000 stocks and ETFs

- Investors who prefer to choose a pre-made investment portfolio.

- Any investor who wants their portfolio rebalanced back to their original asset allocation.

- Investors who prefer fee-free account management.

- Investors who want to opportunity to borrow up to 40% of their portfolios value.

Who is Betterment Best For?

- Investors seeking a low fee (0.25% management fee) investment manager who will sensibly create a portfolio in line with your risk tolerance and goals.

- Investors who want access to financial advisors, for low fees. Digital investors can purchase low-cost financial planning packages. Premium members get unlimited financial planner access, for an additional fee.

- Investors who want access to smart beta, socially responsible and income portfolios.

What is M1 Finance?

M1 Finance is not your typical robo-advisor which asks a few questions and then offers up a pre-made investment portfolio of ETFs in line with your risk profile. M1 Finance is akin to a combination DIY plus robo-advisor investing package.

Simply, that means that M1 is ideal for the investor who wants a variety or pre-made customized portfolios, stock and ETF trading and portfolio rebalancing.

M1 Finance Top Features

- Thousands of investments including stocks and ETFs.

- Ability to choose from pre-made investment pies.

- Opportunity to buy and sell securities on your own.

- M1 Spend – cash management with checking, debit card and high yield cash account.

- M1 Borrow – ability to borrow, once your investments reach a certain level.

Investing

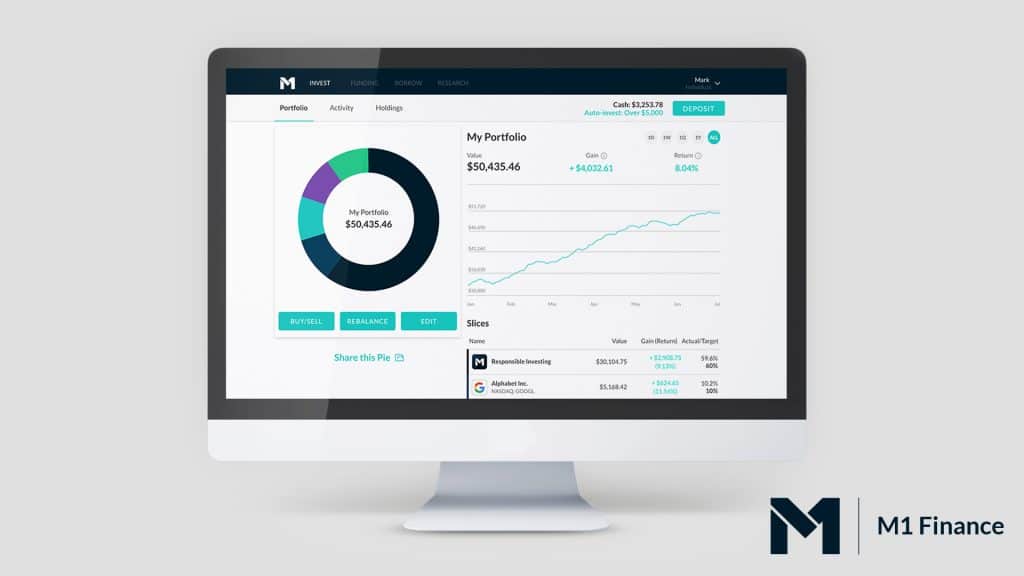

What makes M1 Finance stand out in the robo-advising arena is its unique take on portfolio creation. You can set up your own investment portfolio or choose from a ready made group of investments or “pie.”

- Investors create pie charts to visually design their investment portfolios. Each slice of pie is represented by an individual stock, ETF or pre-made/customized pie (portfolio).

- Investors can create more than one investment pie or portfolio. In total, you can own up to 500 individual assets that include EFTs, stocks, or even other pies.

- An investment pie slice represents a percentage of your portfolio.

- The visual nature of this platform makes it easy to see how your investing style is reflected in the investment options you have chosen.

For investors not sure where to start, M1 Finance also offers pre-made investment pies to choose from.

The scores of pre-made pies include selections similar to a typical robo-advisor and other more unique choices:

- General Investing – Choose a portfolio from conservative to aggressive

- Target-Date – Pick your expected retirement or “end” date and portfolio will automatically adjust to become more conservative, as the target date approaches.

- Fixed Income – For conservative investors seeking cash flow with relatively stable investment portfolio value.

- Industries – Good for investors who want to target specific industries like tech, healthcare or many others.

- Hedge Fund Replication – Follow the strategies of top hedge-fund managers. This is quite unique among robo-advisors!

- Index Tracking – PIck a portfolio to track your favorite index from S&P 500 to Nasdaq and more.

Socially Responsible Investing with M1 Finance

The burgeoning millennial group is living life on their own terms. And that means they want to invest in what they believe in. In fact, the US Bank Wealth and Worth report found that 76 percent of millennial’s consider their investment choices as a way to state their social, political and environmental values.

M1 Finance offers Socially Responsible Investment Portfolios in partnership with Nuveen and offers investments screened according to ESG (environmental, social, and governance) factors.

To integrate socially responsible investing into your M1 Finance Portfolio just select from the pre-screened ESG funds and add them in.

M1 Finance Automated Rebalancing Features

You set your own asset allocation (or choose from a pre-made portfolio), and M1 Finance does the rest. The M1 Finance rebalancing uses cash inflows and outflows to automatically rebalance back to your preferred asset percentages. Or you can push an icon to initiate rebalancing.

Simply, you create the portfolio of assets and M1 finance manages and rebalances it.

M1 Borrow

You’re eligible to borrow up to 40% of the value, and pay it back on your terms.

The process is fast and does’t require a credit check. The low interest rate is great if you want to refinance existing high interest rate credit card debt or pay for your wedding or other expense. You can pay for an expense while letting your investments grow.

This is great if you need a short term loan and don’t want to sell your investments.

M1 Spend

M1 Spend is an FDIC-insured checking account and debit card that is integrated with the M1 platform. It combines digital banking with bill pay and spending with the M1 Visa debit card.

You can even direct deposit your paycheck into your M1 Spend account!

The M1 Spend checking account pays above market interest rates on your accounts cash balance. While the M1 Finance debit card awards 1% cash back on all spending.

M1 High Yield Interest Rate – 5.0% APY*

We love that M1 has expanded to include not only investing but also banking and lending services. Of the stand alone robo-advisors, M1 is one of our favorites.

M1 Plus

M1 Plus is a higher level service for investors that want:

- A super charged checking account. The m1 Plus account offers a high yield checking account and a debit card with cash back. Finally, M1 plus customers get 4 ATM withdrawal fees reimbursed per month.

- Lower borrowing costs

- Two daily trading windows, instead of one

The M1 Plus service offers more services for a low annual fee.

The fee for M1 Plus is a reasonable $95 per year, with a 3 month fee waiver for new clients.

How Much Does M1 Finance Cost and What is the Minimum Investment Amount?

To get started, the investment minimum is an affordable $100.

Your entire investment is managed for free by M1 Finance. This is a tremendous advantage for a robo-advisor or DIY investment platform with rebalancing and includes zero commission buying and selling.

M1 Plus costs $95 per year and offers additional features (described below).

You can reach the support team Monday through Friday from 9:00 AM to 5:00 PM CT.

M1 Finance Account Types

The firm offers sufficient account types for most investors. We especially appreciate that there are trust accounts available.

- Individual and joint taxable brokerage accounts

- IRA’s – Traditional, Roth, SEP, rollover from 401(k) or other retirement plan

- Trust

- Cash

What is Betterment?

Betterment is a legacy robo-advisor that keeps getting better. With financial advisors available for all users (for an additional fee) , $10 to begin investing, and low fees, there’s a lot to like about Betterment.

Betterment creates a goal-based portfolio of index ETFs based upon your responses to a questionnaire. Depending on your particular goal, time horizon and risk profile your money will be funneled into a group of stock and bond ETFs selected from a base list of 13 ETFs.

The available funds include U.S. and international stock funds and a variety of U.S. and international bond funds. Crypto currency funds also available for the more aggressive investors. The fund choices are diverse and well thought out.

This is one place where Betterment differs from M1 Finance. Betterment creates the investment portoflio for you, using pre-selected exhcange traded funds (ETFs). While, with M1, you can choose a “pre-made” portfolio or you can select your own individuals stocks or funds and create your own portfolio.

See a list of Betterment Stock and Bond Funds

Betterment Top Features

- Goal based investing

- Rebalancing

- Socially Responsible (SRI), smart beta and income stream portfolios

- Tax-loss harvesting

- Access to human financial advisors and financial planning packages, for added fees

- Global view of all assets, those within and outside your Betterment account.

- Betterment cash reserve, through partner banks – high yield cash account, checking and debit card.

Betterment Investing

Betterment’s diversified investments include funds that span the US and global stock markets. Their bond ETFs are among the most diverse that we’ve seen.

Additionally, these niche investments are ideal for investors seeking to outperform the market.

Thus, although Betterment offers fewer funds than M1, they have sufficient investment choices for most indivicuals.

Betterment offers Socially Responsible Investing, Smart Beta and Income Stream Portfolios

- Socially Responsible Investors – The SRI portfolios allow you to invest with your values and choose to put your money in socially responsible firms.

- Goldman Sachs Smart Beta Portfolios – This approach is good for investors who want to attempt to beat the market and are willing to take on a bit higher risk.

- BlackRock Target Income Portfolios – These bond portfolios are designed for conservative investors seeking cash flow.

These three investment options can be selected in addition to or instead of your traditional Betterment goal-based portfolio.

How Much Does Betterment Cost?

Betterment requires no minimum investment, and $10 to bein investing.

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Betterment premium includes:

- All benefits of Betterment Digital

- Human financial advice on all investments, within and outside of Betterment accounts. That includes managing 401(k)s, real estate, stocks and more.

- Unlimited access to CFP® credentialed financial advisors for all life planning decisions that impact your money; retirement, having a child, getting married and more.

Betterment Financial Advice

Unique to Betterment, the customers can buy a la carte financial planning packages for investment guidance during important life changes.

The specialized advice packages are designed for specific investors. The Getting Started package is great for newbies who want a quick assessment of their account. The Financial Checkup package is designed for a thorough financial assets review. The College Planning package is for parents who want help navigating the college planning (and payment) process. And the two remaining packages, marriage planning and retirement planning are as their names suggest.

The one-time fees for these add-ons are reasonably priced

.

Betterment Account Types

- Individual and joint taxable brokerage accounts

- IRA’s – Traditional, Roth, SEP, inherited, rollover from 401(k) or other retirement plan

- Trust

- Cash Reserve- a high-yield cash account, offered through partner banks

- Checking account offered through partner banks

Betterment Cash Reserve

Similar to M1 Spend, the Betterment Cash Reserve (all cash management services provided through partner banks) offers:

- Superb interest rates – Betterment Cash Reserve rates compare favorably with the highest returns available online.

- All ATM fees reimbursed – worldwide.

- FDIC insured, just like a typical bank.

- A Visa debit card is available.

- Unlimited Betterment withdrawals are unlike comparable high yield bank accounts which typically limit withdrawals to six per month.

- No fees or minimum balance requirements.

- The opportunity for investing and cash management services within one platform.

FAQ

Is M1 Finance Legit?

Is Betterment a Good Investment?

Betterment is a good investment company.

Is M1 Finance Better than Acorns?

M1 Finance vs Betterment – Which is the Best Robo-Advisor for You?

The decision is simple. M1 Finance and Betterment are each designed for a distinct type of investor. And, we like both M1 Finance and Betterment robo-advisors – a lot.

The Betterment and M1 Finance similarities are:

- Access to ETFs and cryptocurrency

- Rebalancing

- Cash management, through partner banks

Yet, with these two robo-advisors, the differences outweigh the similarities.

Choose Betterment for:

- A full service, hands off digital investment advisor with tax-loss harvesting features and access to human financial advisors, for added fees. You complete a questionnaire, transfer your funds into the platform, and Betterment does the rest. Betterment’s a la carte financial planning services and the ability for all users to text with a financial planner gives you ready investing guidance.

- A robo-advisor with services for beginners though advanced investors, Betterment fits the bill.

- Financial advisor access, for added fees, and tax-loss harvesting.

- Wealthier investors, who need unlimited access to Certified Financial Planners through the Betterment Premium platform (for an additional fee)

Choose M1 Finance for:

- A wide array of funds, stocks and bonds, and the ability to create your own investment portfolios. With roughly 6,000+ investments to choose from and pre-made portfolios, M1 Finance is ideal for the intermediate to sophisticated investor. With M1 Finance, you can control your portfolio creation (or not). After that, M1 Finance does the investment management and rebalancing.

- If you’re looking for free investment management, then M1 Finance is a bargain.

- If you desire 60+ customized pre-made portfolios or pies.

- The opportunity to borrow.

- If you want to trade and invest on your own, but are not a day-trader.

In the end, it’s about how much hands on control you’re seeking with your investing, what services you’re seeking and whether you’re willing to pay a fee for investment management. DIYers tend to prefer M1 Finance while DIFY (do it for you) investors will be in experienced hands with Betterment.

Read the complete M1 Finance Review

Read the complete Betterment Review

Related

- Personal Capital vs. Betterment

- Robinhood vs. Acorns vs. M1 Finance

- Betterment vs. Vanguard vs. Wealthsimple

- M1 Finance vs Robinhood

- Is Acorns Worth It?

Disclosure: I have an account with M1 Finance.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.