M1 Finance vs SoFi – Expert Review of Robo and DIY Features

Both SoFi and M1 Finance are dominating the robo advisory automated and self-directed investing worlds. Each platform is easy to navigate and offers free investment management. For DIY investors, you can access stocks, ETFs, crypto and more. You’ll find investing, banking, and borrowing all under one roof at M1 and SoFi. But, only one offers fee-free Certified Financial Planner access.

To find out the similarities, differences and which one is best for you, read this comprehensive review – and watch the comparison video.

cry[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

M1 Finance vs. SoFi — Top Features

Quick Summary

- M1 Finance and SoFi both offer free basic investment management.

- While both are on the low end in terms of initial investment requirements, SoFi wins out with only $5 required to begin investing, versus $100 at M1.

- M1 Finance offers over 6,000 stocks and exchange traded funds (ETFs), in addition to 60+ pre-made portfolios across investment styles and risk tolerance levels.

- SoFi provides access to free financial consultants.

What is M1 Finance?

M1 Finance is a highly customizable robo-advisor, known for its “pie”-based investment model. Clients can choose to invest in one of M1 Finance’s 60 pre-made portfolio options AKA “pies”, or customize their portfolio completely by assembling their own “pie” slices. Investors can screen for and invest in more than 6,000 individual stocks and ETFs.

While they’re best known as a robo-advisor, M1 Finance isn’t stopping there. They offer other features, such as M1 Borrow (margin loans) and M1 Spend (high-yield APY checking account and a rewards credit card).

If you’re looking for premium features, M1 Finance has those, too. M1 Plus, which costs $125 per year, offers lower fees for M1 Borrow clients, an additional trading window for M1 Invest clients, and more.

| Features | M1 | M1 Plus |

| Cost | Free | $125/year 3 month free trial |

| Trading Windows |

One/day | Two/day |

| Cash Management |

Checking account Debit card Credit card fee – $95 per year |

High yield checking Send checks Cash-back debit card Credit card – fee waived |

| ATM Reimbursement |

1 per month | 4 per month |

| Borrow | 40% of account value (>$2000) |

Lower borrowing rates 40% of account value (>$2000) |

M1 Finance Top Features

- $0 account management fees, or $125 per year for M1 Plus

- Ability to keep your investment, lending, checking, and credit card accounts under one roof

- Sustainable, socially-responsible investment options

- Vast diversification available

- Cryptocurrency

What is SoFi?

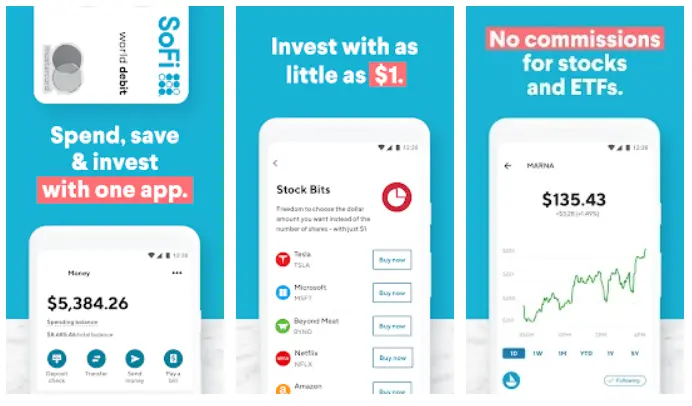

SoFi, the company, is well-known as a lending platform. Popular for student loan refinancing, SoFi is now a financial products and investment power housel The company offers financial products and services to help create a one-stop-shop for clients’ financial needs including the SoFi Automated Investing robo-advisor and active investing options.

SoFi Invest includes the Automated Investing Robo-advisor. The SoFi robo-advisor – Automated Investing – invests your money in diversified exchange traded funds, or ETFs and manages it for you. Automated investing doesn’t charge management fees and offers complimentary one-half hour financial advisory meetings.

SoFi Invest Top Features

- SoFi Automated Investing robo-advisor

- Crypto, stock, and ETF investment options

- Access to CFP financial advisor appointments

- $0 account management fees

- $10 initial investment requirement

- Many financial products, so you can stay with one company regardless of your needs

M1 Finance vs. SoFi — Who Benefits?

If you want access to live financial advisors, you’ll love SoFi. SoFi Invest is also the only robo-advisor option we know of that offers fee-free guidance to make sure your overall financial strategy is aligned with your personal goals.

Clients who want socially-responsible investing will gravitate toward M1 Finance. Beyond simply choosing to invest in companies that are doing good in the world, M1 Finance also highlights companies that are run by historically marginalized communities.

Either robo advisor will work if you don’t want to shell out hundreds of dollars a month in management fees and want well-constructed pre-made portfolios. Both SoFi Invest and M1 Finance are free robo-advisors!

Self-directed DIY investors will enjoy either M1 Finance or SoFi Active Investing, each with zero commissions and access to ETFs and stocks. Although only M1 will rebalance and manage your self-directed stock and ETF portfolios, along with your custom robo-advisory pies/portfolios.

Seeking cryptocurrency trading? SoFi and M1 Finance both offer digital coin investing.

Quick Overview: Who Benefits from SoFi Invest vs. M1 Finance

Both SoFi and M1 Finance offer unique features for a variety of investors:

- Sustainable investors – M1 Finance offers SRI investments

- Customized pre-made investment portfolio seekers – M1 Finance offers 60+ customized thematic portfolios like retirement, income, hedge fund, innovation and more

- Certified Financial Planners – SoFi Invest has human financial advisors available by appointment

- Fee-free investment management – Both robos offer $0 account management fees

- Loans – SoFi offers a large stable of lending products, while M1 emables investors to borrow a percent of their investment value.

M1 Finance vs. SoFi — Fees and Minimums

One of the reasons we like both of these robo-advisors is their accessibility. Though advanced investors can benefit from either platform, SoFi and M1 Finance are mindful that not all investors are able to invest thousands of dollars upfront.

As you’ll see, they are also some of the most reasonably priced robos on the market.

M1 Finance Fees and Minimums

You can get started investing with M1 Finance’s taxable brokerage investment account for only $100, or one of their retirement accounts for $500.

M1 Finance does not charge account management or trading fees for its basic account. M1 Plus — the premium account type with extra features — costs $125 each year, with free promotion available to offset the annual fee.

SoFi Fees and Minimums

You need only $1 to open an account with SoFi Invest, though you’ll need to reach $5 in order to begin investing.

Like M1 Finance, SoFi Invest does not charge clients management or transaction fees.

M1 Finance vs. SoFi — Deep Dive

Both of these robo-advisors may be affordable and appealing for first-time investors. But what really sets them apart? This deep dive will analyze the similarities and differences between SoFi Invest and M1 Finance so you can make the best decision for your unique investment goals.

M1 Finance vs. SoFi — Human Financial Planners

This is a key differences between M1 Finance and SoFi: only SoFi Invest clients will have video or phone chat access to Certified Financial Planners (by appointment). The website states they’ll help you make sure your asset allocation is aligned with your goals. But, SoFi doesn’t offer in depth personalized financial advice.

This shouldn’t come as much of a surprise, as M1 Finance is very much a self-directed DIY platform.

What is surprising, however, is that SoFi Invest offers financial advisor conversations for free! Many other robo-advisors offer human financial advisors as part of their packaging, but we don’t know of any that do so without any account management fees.

M1 Finance vs. SoFi — Investments

Clients will find fairly diverse investment options at either robo-advisor. Both have a unique take on their investment options, however, which leads to great customizability for clients.

M1 Finance Investments

M1 Finance offers over 6,000 stock and ETF options, some of which include real estate and cannabis ETFs. Clients can create their own “pies” made up of their own combination of stocks and bonds, or they can invest in community and expert pies.

The expert pies span a range of investment categories in varying combinations of stock and bond ETFs. For example:

- Hedge fund replica

- Retirement

- Income

- Socially responsible

- General investing

According to their website, “M1 Community Pies focus on groups of publicly traded companies led by Black, female, or LGBTQ+ executives.” They also offer pies focused on Latin- and Asian American Pacific Islander (AAPI)-led companies, and promise to add more in the future. These community pies, as well as their Sustainable Businesses pie, help clients invest in causes and communities that matter to them.

Additionally, M1 Finance allows clients to purchase fractional shares, which helps small investors achieve portfolio diversification.

SoFi Investments

SoFi itself offers six SoFi-specific ETFs as options for investors:

- WKLY, which pays weekly dividends and follows global stocks

- TGIF, a fixed-income, actively managed ETF that pays on Fridays

- GIGE, which follows high-growth tech company IPOs

- SYF, which provides clients a share of the 500 largest, publicly traded companies in the US

- SFYX, which invests in 500 mid-cap companies in the US

- SFYF, which invests in the top 50 stocks available on the platform

The SoFi investment company as a whole offers quite a few ways for clients to invest. Options include:

- Active Investing. Take a hands-on approach to your investment portfolio by making your own trades. SoFi calls this an opportunity to “learn the market as you do-it-yourself.”

- Automated Investing. This is the robo-advisor arm of SoFi. The platform will create an investment portfolio for you based on your financial needs, risk tolerance, and more. Accounts are automatically rebalanced as needed.

- Cryptocurrency. You need only $10 to get started trading Bitcoin, Dogecoin, Ethereum, and more. Cryptocurrency trades can take place 24/7, all through the SoFi app.

- IPO Investing. This is an option available to Active Investing members only. IPOs, or Initial Public Offerings, are opportunities to jump on a brand new stock. It comes with a potentially higher risk, but can also pay off.

- Fractional shares, or “stock bits” options. No need to save up hundreds of dollars just to purchase a share in a large company! Fractional shares let you purchase stocks for much less, so you can benefit quickly.

M1 Finance vs. SoFi — Trading Windows

SoFi offers open trading windows. This is a good option for clients wo want to trade frequently. Day trading is allowed for those active investors with account balances greater than $25,000.

M1 Finance offers only one trading window, or two per day if you’re an M1 Plus client. M1 Finance is not suitable for frequent traders.

M1 Finance vs. SoFi — Tax-Loss Harvesting

Neither SoFi nor M1 robo-advisors offer tax-loss harvesting.

If this is an important feature to you, there are many other robo-advisors that include tax-loss harvesting.

M1 Finance vs. SoFi — Socially-Responsible Investments

M1 Finance offers SRI options, which is appealing to those who want to select investments that make a difference in the world. Investors can choose one of several SRI Expert pies.

SoFi does not offer SRI sustainable investment portfolios at this time.

M1 Finance vs. SoFi — Account Types

M1 Finance customers can open an individual or joint brokerage account, Traditional, Roth, and SEP IRAs, trusts, and custodial accounts.

SoFi is a little more limited, and offers individual and joint taxable accounts, and Traditional, Roth, and SEP IRAs.

M1 Finance vs. SoFi — Additional Services

Both companies aim to be one-stop-shops for the clients, though in this case the SoFi features outweigh M1 Finance’s offerings.

M1 Finance Additional Products:

- Borrow: Margin loans, available at competitive rates.

- Spend Checking Accounts: M1 basic clients don’t get any bells and whistles, but M1 Plus clients will receive interest on their cash balances, 1% debit card cash back and 4 ATM fee reimbursements per month, and more. All checking accounts are FDIC insured.

- Spend Owner’s Reward Card: A credit card with up to 10% cash back. The $95/year fee is waived for M1 Plus members. As an additional bonus, your cashback rewards can be reinvested in your portfolio.

M1 High Yield Interest Rate – 5.0% APY*

SoFi Additional Products:

- Loans: Student loans, student loan refinancing, personal loans (e.g. home improvement and wedding loans), mortgages, small business and auto loan refinancing.

- Credit card: Up to 3% cash back.

- Checking and savings accounts: Interest bearing accounts. You can also earn up to 15% cash back with the attached debit card.

- Insurance: Auto, life, homeowners, and renters insurance.

- Estate Planning.

- Additional financial “insights,” such as credit score monitoring, property tracking, investment portfolio summaries, and budgeting and spending assistance, to support your personal finance journey.

M1 Finance vs. SoFi — Customer Service

SoFi’s customer service hours vary based on department, but in general they can be reached via phone Monday-Friday 5am-7pm PT, and Saturdays and Sundays from 5am-5pm PT.

M1 Finance offers “Instant Help” via chat feature. Individuals can also submit help requests via form, and a success team member will respond within one business day. Phone customer service is available 9:00 to 4:00 ET on days when the stock market is open.

Which is Best: M1 Finance or SoFi? The Takeaway

Both of these robo-advisors are competitive because they offer diversified investments and a combination of DIY and automated investing portfolio options. We also appreciate how each company offers additional financial products; this is convenient for clients who want to keep their cash accounts under the same company as their retirement accounts!

Even better, there’s free portfolio management and a low minimum deposit requirement for each robo.

Still, many clients may prefer SoFi Invest because it has many more features.

SoFi Pros:

- Free access to CFPs

- Cryptocurrency and IPO options

- More diverse personal finance products in addition to investment portfolios

- Open trading window

- $0 account management fees and $5 account minimums to begin investing

SoFi Cons:

- Limited account types; no trusts or custodial accounts

- No tax-loss harvesting

- No Socially-Responsible Investing options

- Financial advisors aren’t suitable for personalized long term financial planning. Fee-based Empower or Betterment Premium offer more individualized financial advice, albeit at a higher price.

Don’t count M1 Finance out just yet, however. Though they are a smaller company, the firm continues to innovate and add new features.

M1 Finance Pros:

- DIY and highly tailored investment portfolios, or “pies,” including SRI sustainable portfolios.

- High yield cash account, margin borrowing, debit and credit cards.

- $100 initial investment is low compared to many robo-advisors.

- $0 account management fees.

M1 Finance Cons:

- No tax-loss harvesting.

- No access to human financial planners,

- Limited trading windows, even with M1 Plus membership.

The two major deciding factors that many will need to choose from are: Do you need access to CFPs? Do you want to invest specifically in certain community-led companies, and if so, does SoFi offer enough customization to meet your needs?

In brief, if free access human investment advice is essential to you then you’ll lean towards SoFi.

If you’re more concerned about what sort of companies your investments are supporting, you’ll need to choose M1 Finance.

Related

- Betterment vs. Schwab Intelligent Portfolios

- M1 Finance vs. Schwab

- SoFi Invest vs. Wealthfront

- Betterment vs SoFi Invest

- 6 Best Lowest Fee Robo-Advisors

- M1 finance vs Betterment

- M1 Finance Promos

*Spend interest rate for M1 Plus customers.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable