T Rowe Price Robo Advisor For Retirement Accounts

Currently, many robo-advisors try to reach an overly generalized audience. They tout their low fees and digital account management strategies, but do not necessarily target a niche audience. While there’s nothing wrong with investing with a robo geared toward the everyday investor, it’s exciting when we see a robo-advisor with a specific niche. T. Rowe Price’s ActivePlus Portfolios offers a specialized robo-advisor for investors seeking to beat the market.

T. Rowe Price ActivePlus Portfolios Review

-

Fees

(3)

-

Investment Choices

(4.5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for:

- Investors seeking actively managed robo-advisor

- T. Rowe Price clients

Pros

- Opportunity to outperform the market

- Live phone customer service

Cons

- Higher fees than some competitors

- High minimum required

T. Rowe Price has been in the investment business for more than 80 years. Their main focus is on “strategic investing,” which draws on research by investment professionals who strive for efficient risk management. The company’s portfolio managers have nearly two decades of experience with T. Rowe Price on average, which speaks to the company’s success.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

This T. Rowe Price ActivePlus Portfolios review will cover everything you need to know before you make an investment decision. You will learn how to get started, what investment funds are available to ActivePlus clients, and how to determine whether you’ll benefit from investing with this company.

Features at a Glance

What are T. Rowe Price ActivePlus Portfolios?

T. Rowe Price ActivePlus Portfolios is designed for investors saving for retirement. Currently, their only account offerings are Roth, Traditional, or Rollover IRAs. Far from being a downside, however, this hyper-focus on retirement accounts means that T. Rowe Price has a lot of know-how to share with their clients.

Every client is assigned a model portfolio with a mutual fund asset allocation tailored to that client’s risk tolerance. There are a total of 10 model portfolios available under this model.

Clients do not pick their model portfolio on their own, however. After a brief questionnaire, the T. Rowe Price ActivePlus Portfolios program will make a model portfolio recommendation based on the client’s risk tolerance and investment time horizon.

All model portfolios invest in 8-15 T. Rowe Price mutual funds. No outside mutual funds are included.

If you’re seeking a lower minimum retirement robo advisor, consider Retirable:

Who are T. Rowe Price ActivePlus Portfolios Best For?

- Clients who are focused on retirement and want a robo-advisor who specializes in IRAs.

- Investors with a minimum of $50,000.

- Existing T.Rowe Price clients.

- Investors who prefer an actively-managed investment portfolio with the opportunity to outperform passive index fund investments.

- Clients who prefer investing in mutual funds.

ActivePlus Portfolios would not benefit clients who wish to have access to human financial advisors or a DIY investing approach.

T. Rowe Price ActivePlus Portfolios – Drill Down

Fees

The ActivePlus Portfolio fees are unique in that there is no AUM annual investment fee. The only fees that clients pay are the mutual fund management fees for investments owned within the portfolio. This is similar to the fee structure of Schwab Intelligent Portfolios digital offer, except that Schwab’s underlying funds are low-fee passively managed index funds.

Clients can expect to pay fees between 0.49% and 0.7% for one of their model portfolios. The fees are dependent upon the percentages of funds owned within the client portfolio.

While this is more affordable than the 1.00+% AUM fees a typical financial advisor charges, it’s not exactly low-cost for a robo-advisor — especially when you consider that SoFi offers fee-free funds and zero management fees.

That being said, this may be a moment where you get what you pay for. T. Rowe Price advisory services has been around since the 1930s. They have years of experience helping clients reach their financial goals.

Minimum Investment

T. Rowe Price advisory services are not for beginning investors — unless they’ve received a substantial windfall, that is! Clients need to deposit a minimum of $50,000 to open an account. Although, those contributing the maximum to a retirement account for several years could easily have an account worth $50,000 or more.

Tax-Loss Harvesting

Since the T. Rowe Price ActivePlus Portfolios are only available for retirement accounts, tax-loss harvesting is not appropriate. Retirement accounts are already protected from taxes while investing within the account. And Roth IRA owners can withdraw funds from their account tax-free as well.

Robo-Advisors with Human Financial Planner Access

Access to Human Financial Advice

These are actively managed portfolios, so clients can expect some human oversight in addition to traditional robo-advisor benefits. Clients have access to live client services professionals by phone to discuss their account. These specialists have the basic investment brokerage licenses but are not trained as Certified Financial Planners or Registered Investment Advisors. For personalized investment advice in combination with digital advice, you’re better off with a hybrid robo-advisor.

Licensed Customer Support can assist with :

- Navigating the platform.

- Discuss portfolio strategy and goals.

- Basic investment related questions.

The T Rowe Price robo-advisor doesn’t offer full-service financial planning.

An annual check in with a Client Specialist is recommended. This conversation reviews your asset allocation, goals, and risk tolerance level to ensure that your portfolio is aligned with your preferences. Additionally, you can retake the investment questionnaire at any time, to adjust your portfolio.

Customer service is available on weekdays from 8am to 8pm.

User Experience — Sign-Up Process

The sign-up process for ActivePlus Portfolios is a breeze. Clients don’t need to provide any personal details to take the initial goals and risk questionnaire, and receive a recommended portfolio. This is great for individuals who just want to investigate various robo-advisor options before committing.

All investors are asked to provide their age, their initial investment amount ($50,000 minimum), and whether they are opening a Rollover, Roth, or Traditional IRA. Next, users are asked whether they plan to spend this money themselves during retirement or if the money will remain invested for their heirs.

- If you plan to spend it yourself, you are asked when you need to spend the money (estimated retirement age) and how long you need the money to last for (expected lifetime). This questions help determine your time horizon so the robo-advisor can determine the right model portfolio to meet your needs.

- If you plan to save for your heirs, you are asked whether you value growth potential or lower-risk investments. While this option does not ask about a time horizon, it does help determine which model portfolio will provide the right sort of investments for your heirs.

The final two questions are used to determine risk tolerance. Clients are asked what they have done in the past when investments have lost value, and whether they would adjust their asset allocations if your portfolio decreased in value 15-20% over six months.

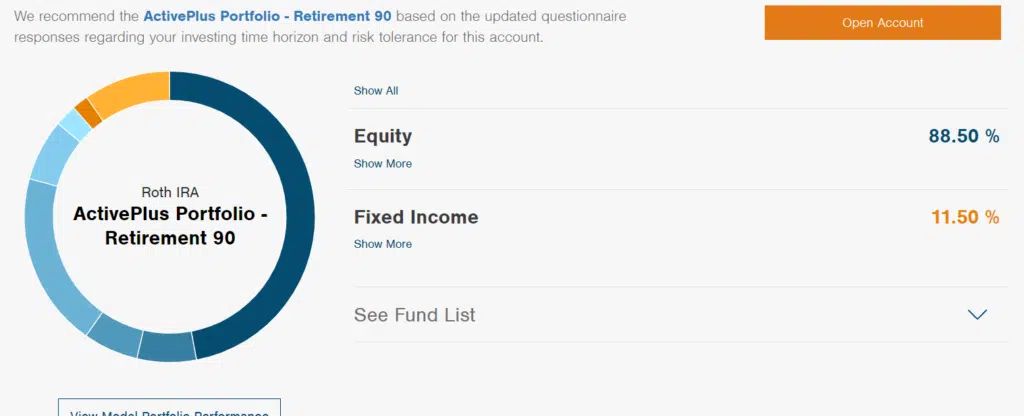

After this brief questionnaire, clients can see their suggested portfolio asset allocation. All model portfolios are made up of T. Rowe Price mutual funds; however, the asset allocation varies based on how much risk you can tolerate and how much growth you need to achieve.

At that point, clients can retake the questionnaire to see different portfolio allocations or proceed to the next step: providing personal information and funding their account.

Security

T. Rowe Price Advisory Services, Inc., uses a variety of security measures to keep your accounts safe. These security measures include: multi-factor authentication; encryption; extended validation certificates, requirements for usernames and passwords, and security questions. They also send transaction confirmation notifications via mail, email, or text message.

Mobile App

There is a T. Rowe Price app available for Android and iOS. Users can view and manage their brokerage accounts from the app, including viewing asset allocation, portfolio and mutual fund performance, and more.

The apps have mixed reviews. The Apple iOS app received a substantially better aggregate ranking and reviews than the android app. Android users shouldn’t expect much from the mobile app.

Investing Strategy

All ActivePlus Portfolios are made up of mutual funds. There are ten model portfolios included in their recommendations, and each has a different breakdown of funds. The asset allocations vary based on the client’s risk tolerance.

We responded to the questionnaire with these assumptions:

- Age-40

- Will start to draw in 32 years

- Would like the money to last for 15 years

The questionnaire yielded the following aggressive ActivePlus Portfolio – Retirement 90. The 90 correlates with nearly 90% investing in riskier stocks and approximately 10% invested in bond type investments.

Three of the portfolios are designed to reduce short-term fluctuations in price while still maintaining growth potential:

- Model 10 (10% equity funds, 90% fixed income funds)

- Model 20 (20% equity funds, 80% fixed income funds)

- Model 30 (30% equity funds, 70% fixed income funds)

Three model portfolios are designed to balance moderate short-term fluctuations in price with moderate potential for growth:

- Model 40 (40% equity funds, 60% fixed income funds)

- Model 50 (50%/50% split in funds allocation)

- Model 60 (60% equity funds, 40% fixed income funds)

Finally, the remaining four portfolios seek growth potential despite possible high fluctuations in short-term prices:

- Model 70 (70% equity funds, 30% fixed income funds)

- Model 80 (80% equity funds, 20% fixed income funds)

- Model 90 (90% equity funds, 10% fixed income funds)

- Model 100 (completely dedicated to equities)

The sign-up questionnaire will help you determine your risk tolerance and recommend a portfolio for you. Before committing to the T Rowe Price ActivePlus Portfolios you can review portfolio benchmarks and performance trends for each of the model portfolios.

Investments

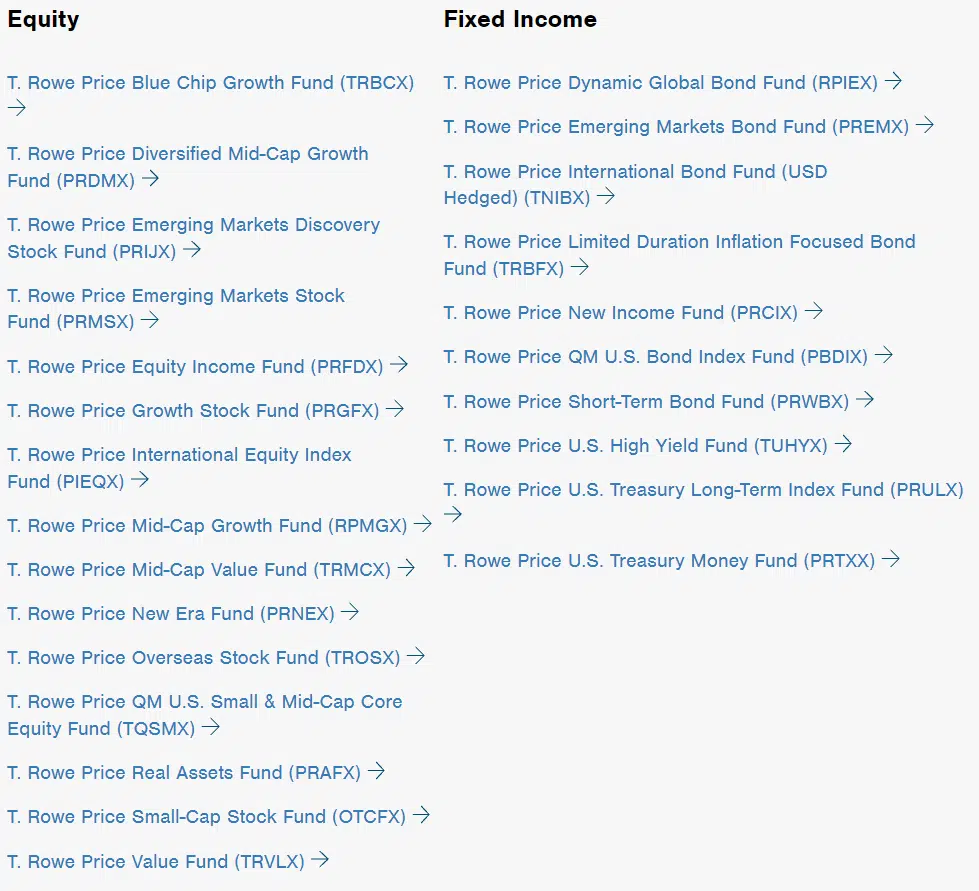

Only mutual funds from T. Rowe Price are used in these portfolios. Clients can exclude some mutual funds from their account (up to 3), but there is little wiggle room for customizability in these portfolios.

Clients who want to include mutual funds from other companies will need to look elsewhere.

There are many funds available at T. Rowe Price investment services, including U.S. equity stocks, emerging markets stocks and bonds, cash, and more.

For example, the Model 40 portfolio fund list includes investments like the Emerging Markets Discovery Stock Fund, Mid-Cap Growth Fund, Emerging Markets Stock Fund, International Equity Index Fund, Global Bond Fund, Treasury Money Fund, and more.

T. Rowe Price ActivePlus Investment Funds

T. Rowe Price ActivePlus Portfolios Performance

We appreciate the platforms transparency with access to returns for each of the T Rowe Price Model Portfolios. We also like that users can view sample portfolios without providing any personal information.

We don’t recommend choosing an investment advisor based upon historical performance, as that information can change quickly along with the winds of the market. That said, the T. Rowe Price robo-advisor provides the following performance data for each of their portfolios:

- One-month

- Year-to-date

- One year

- Three year

- Since inception

Each return data point is compared with a benchmark return, to show how the portfolio has performed vs. the appropriate unmanaged index. The benchmarks are comprised of unmanaged index returns in the same asset allocation as the company’s portfolio. With the exception of the all-stock Model 100 portfolio, all of the ActivePlus Portfolios’ annualized returns for the prior three-year period beat their benchmarks by a less than one percent. For updated performance data, you can visit the website.

T. Rowe Price Robo-Advisor Pros and Cons

Pros

- Knowledgeable company which specializes in retirement accounts

- Research-backed portfolio breakdowns

- Balance between robo-advisor benefits and human oversight

Cons

- High minimum investment

- Fees are high for a robo-advisor

- Portfolios are not very customizable. Risk tolerance is taken into account when determining asset allocation, although clients cannot further customize their funds beyond the model portfolios

- No CFP financial advisors

FAQ

Does T. Rowe Price have managed accounts?

Is T. Rowe Price a good mutual fund company?

Can I invest with T. Rowe Price?

T. Rowe Price Robo-Advisor Wrap Up

If you’re looking for an advisor that specializes in retirement accounts and uses its own in-house mutual funds, the ActivePlus Portfolios option might be right for you.

Using your time horizon and risk tolerance, ActivePlus recommends a model portfolio. This model portfolio will be made up of mutual funds from a variety of U.S. stocks and bonds, emerging markets funds, cash, and more.

This robo-advisor is best for wealthy investors who have at least $50,000 ready to invest immediately. Their fees also lean on the higher side for a robo-advisor. Still, these higher fees can be explained by the company’s historical performance. Their balance of human advisor research and robo-advisor algorithms have designed model portfolios that perform well over time.

That being said, it’s important to remember that ActivePlus Portfolios is still, above all, a robo-advisor. Clients can expect some human interaction, but not much. This makes this robo-advisor iffy for individuals who are hoping for more human connection and access to financial advisors.

The use of a set model portfolio also makes ActivePlus Portfolios incompatible for clients who are hoping to fully customize their investments. There is little wiggle room for clients to pick and choose their own mutual funds.

Still, historical performance makes it clear that T. Rowe Price has created an intuitive, effective robo-advisor that marries the knowledge of financial professionals with all the benefits of robo-advisor algorithms. For those who are comfortable with the higher fees and large initial investment, T. Rowe Price might be the right retirement investment platform for you.

Related

- Best Robo-Advisors

- Empower (formerly Personal Capital) Review

- Best Robo Advisors For Wealthy Investors

- Why Robo-Advisors are Better than DIY Investing with Mutual Funds

- Best Robo-Advisor Performance

- Zacks Advantage Robo-Advisor Review

- Webull Smart Advisor Review

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources

- https://www.troweprice.com/personal-investing/advice/activeplus-portfolios/index.html

- https://www.troweprice.com/personal-investing/advice/activeplus-portfolios/fees.html

- https://www.troweprice.com/personal-investing/advice/activeplus-portfolios/faqs.html

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Empower compensates Stocktrades Ltd for new leads. Stocktrades Ltd is not an investment client of Empower.