Empower (formerly) Personal Capital vs. Wealthfront — Overview

With the many and varied options available to investors today, choosing a robo-advisor might seem easier than ever. Unfortunately, all these choices could lead to analysis paralysis —the inability to make a decision because there are just too many factors to consider! To help make your decision easier, we’re placing Empower (formerly Personal Capital) head-to-head with Wealthfront.

We like both of these investment services here at Robo-Advisor Pros because they offer some of the usual robo-advisor must-haves: comprehensive questionnaires to better understand their clients’ needs, account rebalancing, and a variety of investment strategies, to name a few. Both also offer cash management and pay higher than average interest on cash balances. There’s also investment customization options at each company.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

However, there are some crucial differences between Wealthfront and Empower (Personal Capital), making each suitable for a distinct client. Today’s deep dive will take you through those differences and help you decide which of these two investment management platforms are best for you.

What is Empower (Personal Capital)?

Empower is a large investment manager, who recently acquired Personal Capital. Founded in 2009, Personal Capital was designed to manage your investments and to help you understand both your current financial picture and to plan for the future. There are two services at Empower, free financial management tools and fee-based wealth management services that include CFP financial advisors.

Their well regarded free financial management software is available to anyone who links their accounts. You’ll receive depthful budgeting, retirement, investment and net worth reports, and analysis. Empower’s free financial tools are comparable to Mint or Quicken in some ways, though often more comprehensive.

The fee-based Wealth Management services are designed for investors with a minimum of $100,000. Wealth Management users receive services on par with those at a traditional financial advisory firm, albeit with somewhat lower fees. While the free services are an invaluable part of any investor’s individual portfolio management.

As a wealth management service, however, its closest competitor would be a robo-advisor in a larger institution such as Vanguard Personal Advisor Services.

To learn more, read our comprehensive Empower Review.

What is Wealthfront?

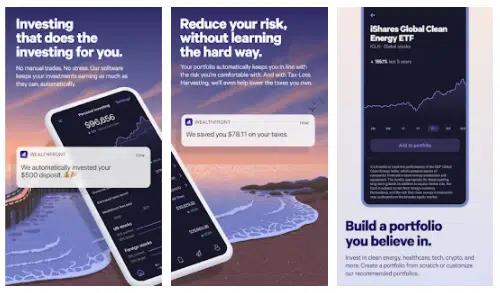

Wealthfront has been around since 2008, as one of the earliest robo-advisors. It is one of the more popular independent all-digital robo-advisors. This robo is known for its low account management fees and best digital financial advisor, Path, on the market. Techies and digital natives who are comfortable with an online platform have flocked to Wealthfront.

Wealthfront continues to innovate.

Clients gain benefits such as cryptocurrency funds, socially responsible investing, and the opportunity to customize your investments with hundreds of add on ETFs. Wealthfront also offers fee-free stock trading. You won’t find a human financial advisor here, though, which can be a deal breaker for some investors. Still, for those who prefer an automated investment service, Wealthfront offers a lot of benefits for a low account management fee. Those who need to talk with a customer support rep will be pleased to find that all the phone representatives are licensed stock brokers.

Wealthfront’s closest competitor is usually said to be Betterment, since they’re both independent and longstanding robo-advisors. Although, Wealthfront typically holds its own in comparisons against many other robo-advisors.

Empower vs. Wealthfront — Top Features

Personal Capital Free Investment Management Tools Tutorial

Empower Top Features

One of the top features at Empower is their free portfolio tracker. This free financial software links to your financial accounts located at investment, bank, and lending firms. You’ll receive reports and analysis including your net worth, investment asset allocation, portfolio growth, and more all in one easy-to-view dashboard. The retirement planner, fee analyzer and net worth calculator are among our favorite features. You don’t need to be an Empower client to use this free feature.

Empower offers paying clients a host of features, comparable with those from a traditional financial planner:

- Comprehensive portfolio diversification according to research-based smart weighting

- Human CFP financial advisors. Higher value accounts qualify for dedicated financial advisors, while accounts worth less than $200,000 have access to a team of financial advisors.

- Tax-loss harvesting and account rebalancing

- Investment advice on many different account types including 401k accounts

- Socially responsible investing options

- Individual stocks and private equity for larger portfolios

- Comprehensive wealth management services

- Cash management services

Wealthfront Top Features

Wealthfront provides several free offers. Their Path digital financial planner requires a sign up, after which you can go through the extensive financial planning questionnaire and receive digital financial guidance. You’ll receive answers to questions such as, “How early can I retire?” “How much will I need to send my child to college?” They also offer an extensive free Home Planning Guide. Anyone can open a fee-free stock trading account at Wealthfront as well.

Wealthfront offers many additional services to paid clients including:

- Multiple goal-based investment portfolios

- Low, 0.25% investment management fee

- Tax optimization through daily tax-loss harvesting

- Socially responsible investing options

- Hundreds of customization options with diverse ETFs, including cryptocurrency funds

- Cash management account

Empower and Wealthfront — Who Benefits?

Who Benefits — At a Glance

- Wealthier investors seeking a full service financial planner will benefit from Empower due to their high minimum investment requirement and comprehensive financial planning.

- Investors with lower initial investment capital or who prefer lower fees will benefit from Wealthfront.

- If you want human CFP advisors, you’ll benefit from Empower. If you don’t mind the absence of a financial advisor, or prefer to use an all digital financial planner then you’ll benefit from Wealthfront.

- Those who want a holistic overview of their investment portfolio — including all your financial accounts — will benefit from Empower’s free tools.

Who Should Use Empower?

Anyone can benefit from the free investment management tools at Empower. This includes the Empower investment checkup tool. This tool benefits investors whether or not they choose to pay for the Empower Personal Advisors and Wealth Management. Clients can see a full picture of their investments and expenses, track spending, investment progress and more. This free software compares favorably with Quicken.

Empower Wealth Management is appropriate for users with at least $100,000 to invest and is an appealing investment manager and financial planner for wealthier individuals. Investors seeking well trained CFP financial advisors, wealth planning, private equity and stocks in their managed portfolio might choose Empower. Although, their account management fees might be lower than those charged by traditional financial advisors, they’re still relatively high in the digital sphere: clients will pay 0.89% AUM until their account value hits $3M.

Who Should Use Wealthfront?

Wealthfront has a lower initial investment minimum of $500 and lower fees than Empower, which will benefit clients who are just getting started or those who don’t feel comfortable investing a large sum all at once. Their $500 minimum might put them out of reach of some beginning investors, though.

Investors comfortable with an all digital investment manager might find what they need at Wealthfront. The addition of crypto and additional ETFs ups the allure of Wealthfront. You won’t find a human advisor at Wealthfront, although their customer support team is highly trained and all carry at least a Series 7 investment advisor credential. Wealthfront is a great option for those who want to choose a few of their own investments and invest in a pre-made portfolio. Users who also want cash management and lending options might consider Wealthfront.

With the high yield cash account and fee-free stock trading, Wealthfront is approaching a full service financial firm.

Empower vs. Wealthfront — Fees and Minimums

One of the biggest differences between these two investment options is how much they charge for account management and how much money clients are expected to invest up front. This is because Empower and wealthfront are geared toward very different client bases.

Empower Fees and Minimums

There is no minimum initial investment or fee associated with Empower’s free financial tools. These can be accessed by anyone, regardless of whether they invest with Empower or not.

For clients who want paid investment management services, Empower Wealth Management requires an initial investment of $100,000. Fees begin at 0.89% AUM for the first million. From there, the pricing is tiered based on the value of your portfolio:

- 0.79% AUM for the first $3M

- 0.69% AUM for the next $2M

- 0.59% AUM for the next $5M

- 0.49% AUM for accounts valued over $10M.

There is no fee for Empower’s cash account or free tools.

Wealthfront Fees and Minimums

Wealthfront makes it easy: they have one account tier, which comes with a management fee of 0.25%. Clients need $500 to get started.

There are no fees for Wealthfront’s cash account or stock trading account.

If you click on the link below, new clients might receive a cash rebate.

There is no fee for Wealthfront’s cash account or the individual stock trading.

Empower vs. Wealthfront — Deep Dive

Empower vs. Wealthfront — Human Financial Planners

If you want personalized financial planning advice with a human touch, you’ll have to go with Empower. Wealthfront’s investment advice is automated. As part of Empower’s fees, you gain access to two dedicated financial advisors after your account reaches $200,000.

At Wealthfront, you’ll get help with the platform and answers to basic investment questions from the Series 7 credentialed Wealthfront customer service representatives.

Empower vs. Wealthfront — Tax-Loss Harvesting

Both Empower and Wealthfront use tax-loss harvesting and account rebalancing to keep your investable assets in line with your ideal asset allocation. The only difference is in how frequently this occurs. Wealthfront searches for tax-loss harvesting opportunities daily.

Tax-loss harvesting is a useful way to avoid paying hefty taxes on capital gains, and is not offered by all robo-advisors.

Empower vs. Wealthfront — Investment Strategy

Both Empower and Wealthfront use your risk tolerance, financial goals, and investment timeline to calculate your ideal investment portfolio. Both also use Modern Portfolio Theory to help ensure that your investments are diverse and well-suited to your unique financial situation.

Wealthfront will create an investment portfolio using their Path Financial Planner tool. This tool asks clients for their primary financial goal, their net worth, how they respond to losses, and more. Based on this information, Path determines the client’s risk tolerance and recommends asset class diversification.

Empower, has a unique sector weighting approach to investing, which isn’t found at other competitors. It equal weights investment sectors within your portfolio. In addition to determining a client’s risk tolerance and financial goals, Empower also looks at all of your investments. This approach to wealth management is effective because it determines your asset allocation and includes assets that you already holds elsewhere. This can lead to a more personalized investment portfolio.

Empower vs. Wealthfront — Investments

Initial Wealthfront and Empower portfolios invest in Exchange Traded Funds (ETFs) across diverse asset classes. Clients can also choose Socially Responsible Investing strategies from both firms.

Empower Investments

- US Stocks

- Foreign Stocks

- US Bonds

- International Bonds

- Alternatives (real estate, gold, energy)

- Cash

- Private equity, stocks, and bonds also available for wealthier clients

Wealthfront Investments

- US Stocks

- Foreign Stock (Developed and Emerging Market)

- Dividend Appreciation Stock

- US Bonds such as TIPs (Treasure Inflation Protected Bond), Government, Municipal, and Corporate Bonds

- Foreign Emerging Market Bonds

- Natural Resources (Energy)

- Real Estate

- Hundreds of additional ETFs and 2 cryptocurrency funds, for customization

- Self-directed stock investing account is available as well.

Empower vs. Wealthfront — Account Types

Empower offers taxable brokerage accounts such as individual and joint investment accounts, Traditional, Roth, rollover, and SEP IRAs, trusts, and cash accounts.

Wealthfront offers individual and joint taxable accounts, retirement accounts such as Traditional, Roth, rollover, and SEP IRAs, 529 college savings accounts, and cash accounts. Wealthfront is the only robo-advisor we cover that provides a 529 college savings account.

Empower vs. Wealthfront — Cash Accounts

Both Empower and Wealthfront offer cash accounts as part of their wealth management offerings.

Wealthfront Cash offers higher FDIC insurance through partner banks: they offer $2 million in coverage for individual accounts and $4 million for joint accounts. Like Empower, Wealthfront also offers this cash account with $0 fees.

Empower Cash offers up to $1.5 million in FDIC insurance on accounts. There are no fees associated with this cash account

The current Empower Personal Cash interest rate is 4.10% APY

Empower vs. Wealthfront — Free Tools

The free portfolio management tools at Empower are comprehensive and useful regardless of where you hold your investment account. This tool doubles as a retirement planner, budgeting tool, fee analyzer, and net worth calculator.

Wealthfront has some free tools, too. This robo-advisor offers a free home buying guide that includes guidelines for home buyers whether they are looking to buy in more than 5 years and those looking to buy this year.

Wealthfront’s free Path digital financial advisor is programmed to answer 10,000 financial questions and is a digital version of a human financial planner. The Path software includes a retirement planner and more.

If you’re looking for a robo-advisor with free account management, you’re in luck: quite a few do!

Empower vs. Wealthfront — Security

Both these robo-advisors take security very seriously. Your data is protected with encryption tools which make it difficult for hackers to reach your account. Additionally, clients will feel comforted by the fact that both Wealthfront and Empower have FDIC insurance through partner banks to protect cash accounts and SIPC insurance to protect investments.

SIPC insurance protects your from company failure or bankruptcy, not from losses that may occur due to fluctuations in the market.

Which is Best: Empower or Wealthfront? The Takeaway

We like both Empower and Wealthfront for different reasons. While each offers a range of services, the fact of the matter is that they target different types of clients.

Empower is very appealing to investors who have at least $100,000 to invest, but the benefits start rolling in as account values go over $1M. They offer many individualized services, due in large part to the dedicated advisors who manage clients’ accounts. Wealthier investors can even coordinate with tax and estate planning professionals.

Wealthfront, on the other hand, is within reach of more “everyday” investors. With only a $500 minimum investment amount to get started, and a manageable fee of 0.25% AUM, those who don’t mind the absence of dedicated human financial advisors will benefit from automated investment advice, tax-loss harvesting, and additional customization options.

In the big ways, however, Empower and Wealthfront are quite similar. They both seek to increase their clients’ net worth by diversifying investments through a range of asset classes — both offer more traditional stocks and bonds, as well as alternative investments like energy, gold, and real estate.

Finally, each robo-advisor offers some free services that might help make the decision easier. For example, clients can try out Empower’s holistic approach to investing by testing their free portfolio tracker. If your net worth is greater than $100,000, you can even chat with a financial advisor before signing up for Empower . Clients who are considering Wealthfront might look into their free digital investment and retirement planning questionnaire and online advice.

Ultimately, your current financial situation might make this decision for you. Unless you have $100,000 available for your investment management account, Wealthfront is a competitive robo-advisor.

Read

Frequently Asked Questions

Does Empower work with Wealthfront?

Is Empower trustworthy?

There is always risk in investing, but clients who choose Empower can rest easy knowing that the robo-advisor is working hard to keep clients’ investments safe.

Is Empower worth the money?

Is Wealthfront still worth it?

Related

- SigFig vs. Empower

- Wealthfront vs. Fidelity Go

- Betterment vs. TD Ameritrade

- Best Robo Advisor With High Yield Cash Accounts

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.

Wealthfront Disclosures:

Robo-Advisor Pros receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This creates an incentive that results in a material conflict of interest. Robo-Advisor Pros is not a Wealthfront Advisers client, and this is a paid endorsement. More information is available via our links to Wealthfront Advisers.

Cash Account is offered by Wealthfront Brokerage LLC (“Wealthfront Brokerage”), a member of FINRA / SIPC. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Wealthfront conveys funds to institutions accepting and maintaining deposits. Investment management and advisory services are provided by Wealthfront Advisers LLC (“Wealthfront Advisers”), an SEC registered investment adviser, and financial planning tools are provided by Wealthfront Software LLC (“Wealthfront”).

Wealthfront partnered with Green Dot Bank, Member FDIC, to bring you checking features.

Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Debit Card is optional and must be requested. Wealthfront Cash Account Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Wealthfront products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved.

Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Please see the Deposit Account Agreement for details.

Other eligibility requirements for mobile check deposit and to send a check may apply.

The cash balance in the Cash Account is swept to one or more banks (the “program banks”) where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC insurance is not provided until the funds arrive at the program banks. FDIC insurance coverage is limited to $250,000 per qualified customer account per banking institution. Wealthfront uses more than one program bank to ensure FDIC coverage of up to $2 million for your cash deposits. For more information on FDIC insurance coverage, please visit www.FDIC.gov. Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits at program banks are not covered by SIPC.

The Annual Percentage Yield (APY) for the Cash Account may change at any time, before or after the Cash Account is opened. The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks. Deposit balances are not allocated equally among the participating program banks.