What Is Smart Beta Investing?

Smart Beta investing is an investment approach that combines the typical passive index fund investing approach with a factor weighting, in order to outperform the index. Smart beta investing is based upon research that states that stocks which exhibit certain factors can outperform the overall index.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

To understand smart beta, you’ll need to grasp the statistical term Beta. The beta coefficient measures the volatility of an individual stock compared with the volatility of the overall market. Statistically, beta represents the slope of the line through a regression of data points, each point representing the individual stock return vs those of the market as a whole.

Beta measures a stock’s volatility with regard to the S&P 500 – a proxy for the total stock market. The S&P 500’s Beta is 1.0, and thus, a more volatile stock has a higher Beta than 1.0.

The smart beta or factor investing strategy dates back to the early 2000s and has become increasingly popular because of the potential for outperforming the market due to:

- Better portfolio risk management

- Smart diversification and asset allocation

- Enhanced risk-adjusted returns beyond cap-weighted indices.

Smart beta is an investment plan implemented with exchange-traded funds (ETFs). Smart beta funds can often yield higher returns than that of the market.

Example:

A stock that is 30% more volatile than the S&P has a beta of 1.3. Such a stock is riskier than the market index, but its value increases more than the index once the market rises. Hence, if the S&P 500 increases by 10%, the 1.3 stock increases by 13% during a particular period. On the other hand, a stock with a beta below 1.0 is less risky than the market index but also likely to have lower returns.

What is a Smart Beta Investing Strategy?

A smart beta investing strategy is a transparent, rules-based portfolio management method that uses passively and actively managed investing to outperform the market or reduce volatility. The goal of a Smart Beta portfolio is to obtain higher risk-adjusted returns, sometimes called alpha, than the overall market. The approach capitalizes on market inefficiencies that reward certain types of stocks.

The smart beta strategies look at performance factors of stocks and bonds and diversify portfolios based on factors such as:

- Good value – Inexpensive stocks relative to fundamentals such as price to earnings or price to sales ratios.

- Strong momentum – Stocks with strong recent performance have continued to increase in price.

- High quality – Financially healthy companies tend to offer better returns.

- Low volatility – Less volatile stocks might offer better risk adjusted returns or more stable values.

- High dividend – Stocks with high and increasing dividends demonstrate financial strength.

Smart beta investing or factor investing is based upon decades of investment research that has shown certain types of stocks have outperformed the overall market. Some of the outperforming factors include stocks with lower valuations, strong growth, and continuing momentum tend to outperform.

Smart Beta portfolios invest in index funds but use distinct weightings and factors to capitalize on market inefficiencies which might lead to higher risk-adjusted returns.

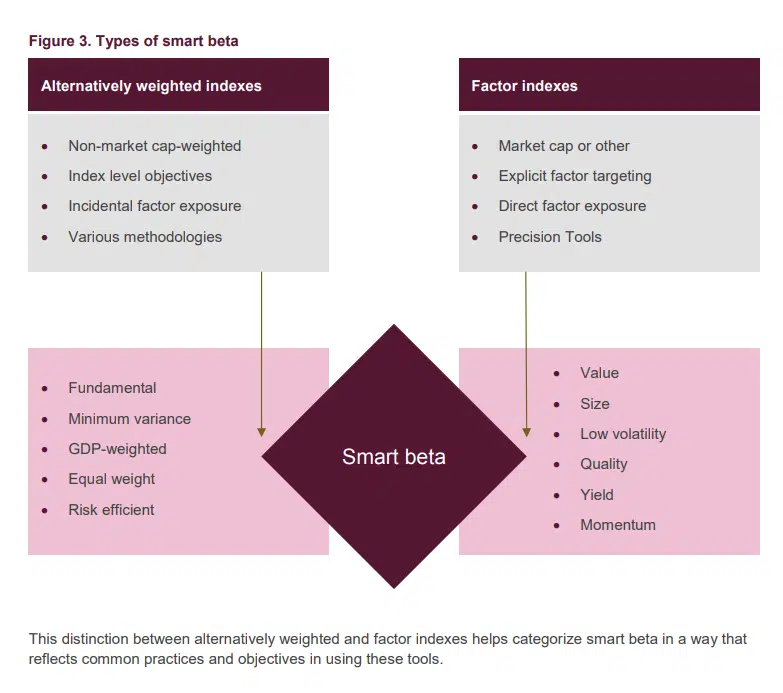

Source: https://content.ftserussell.com/sites/default/files/research/the-anatomy-of-smart-beta-final-1.pdf

Which Factors Drive the Smart Beta Investment Strategy?

Smart beta funds can include several factors or might focus on just one factor.

Smart beta strategies seek to follow indices passively and are frequently driven by the following factors:

Good Value: Smart beta formula determines value by looking for companies with a low price relative to its intrinsic value. This can provide investors exposure to companies that have high growth potential but have been overlooked by other investors.

High Quality: Here, smart beta strategies look for companies with the potential for growth, consistent returns, and stable earnings. Such companies usually have more substantial fundamental factors than others on the market.

Low Volatility: Stocks with low volatility don’t swing significantly in any direction. They can minimize losses during downdrafts, yet might also temper duringperformance expanding markets.

Strong Momentum: The smart beta strategies look for investments that show growth and price momentum. This group of momentum stocks typically outperformed the market during their faster growth periods. The goal here is to ensure clients purchase investments that are increasing in value.

What Are the Benefits of Smart Beta Portfolios?

The benefits of smart beta Portfolios include the following:

Higher returns: Goldman Sachs smart beta portfolios combine these factors— good value, high quality, low volatility and strong momentum— to create a diverse mix of investments. The combination maximizes the potential for higher returns than other passively managed index fund portfolio options on the market.

Broad choice: The Goldman Sachs smart beta portfolio consists of ETFs, including stocks from companies screened for the four Smart Beta factors.

Diversification: A Smart Beta Portfolio is highly customizable, with the option to invest in 1% increments anywhere from 1% to 100% stocks. That ends up being a whopping 100 different portfolio variations, making this investment option fully customizable based on your risk tolerance.

Low cost: Smart Beta ETFs are a low-cost alternative to actively managed mutual funds. Also, they give you access to more targeted strategies than investing in a purely passive strategy.

Predictability and transparency: Although there isn’t any assurance that an investment technique will achieve its goal, Smart Beta’s investment process consistency yields more predictable and explainable results progressively.

How Is a Smart Beta Portfolio Different from Other Portfolios?

In a typical market-cap weighted index fund portfolio all investments hail from a specific index, such as the S&P 500, in proportion to their size. The Smart Beta choice is more actively managed than the diversified index fund investment approach.

A smart beta portfolio might include only the stocks from a specific index or include companies that meet unique criteria:

For example:

- Growth stocks: Vanguard Growth ETF (VUG)

- Value stocks: Vanguard Value ETF (VTV)

- Low volatility stocks: iShares MSCI USA Min Vol Factor ETF (USMV)

- High dividend stocks: Schwab U.S. Dividend Equity ETF (SCHD)

- S&P 500 stocks in equal weight or 2% weight per stock; Invesco S&P 500 Equal Weight ETF (RSP)

Smart Beta Performance?

When comparing smart beta vs market vs actively managed funds, you’ll find that expense ratios for smart beta portfolios are lower than actively managed funds and higher than index funds. Smart beta portfolios are also based upon historical market anomolies and factors that have outperformed the overall market, in the past.

Deciding whether smart beta portfolios will outperform in the future, depends upon several factors. To outperform the market returns, smart beta portfolios need these conditions:

- The market anomalie must continue into the future. For example, value stocks must outperform the market or momentum stocks must deliver better returns than the market. The persistence of these trends is unknowable today.

- The added cost of a smart beta strategy, over a passive index fund investment approach must be offset by greater returns of the smart beta strategy.

- The strategy must be tested through a range of market conditions, in order to evaluate its succes.

There’s scant recent research to measure the comparison of returns of the market against those of smart beta strategies. Although, many smart investors and portfolio managers are using smart beta in their offers such as Blackrock, Goldman Sachs, Betterment and others.

What Are the Risks of Smart Beta Investing?

Some investment professionals question whether the Goldman Sachs Smart Beta or other Smart Beta portfolios over-promise in terms of performance. After all, it’s impossible to guarantee future performance for any investment.

Further, investors should be cautious with investment strategies that strive to outperform the market. Although the gains can be significant, all investment approaches risk periodic losses.

Reams of investment research, including several studies by index fund powerhouse Vanguard, show that in any given year, most investment funds fail to outperform the market performance. And those that outperform one year are unlikely to repeat that outperformance.

As such, this investing strategy isn’t for the conservative or short-term investor. Those with higher risk tolerance and time may still benefit from such a strategy.

How Do I Choose a Smart Beta ETF?

You choose a Smart Beta ETF by looking at three main checkpoints, including the following:

- The ETF’s exposure: Look at the ETF’s underlying benchmark index to measure the fund’s exposure.

- How well it delivers the exposure: Assess tracking differences to determine if the ETF delivers the intended exposure.

- How efficiently can you access the ETF: Look for higher volumes and tighter bid-ask spreads, which signifies accessibility and liquidity.

- Consider expense ratios: Lower priced funds frequently outperform those with higher expense ratios.

FAQ

Is smart beta really smart?

What is smart beta factor investing?

How do you create a smart beta portfolio?

Does smart beat investing work?

Smart Beta Investing – Wrap Up

There are many benefits of Smart Beta portfolios, including:

- Well-rounded investments that focus on growth potential, value, and low volatility.

- Diversified portfolios with passive and active management strategies.

- The flexibility of ETF investing.

Of course, no investment strategy is entirely risk-free. Some cons of the approach include the following:

- Its promises for growth are based on previous performance. The risk is similar to other investing strategy projections and means that growth is not guaranteed.

- Management fees of the Smart Beta ETFs are slightly higher than those of passively managed index funds.

You may wonder, “Should I invest in a smart beta portfolio?”

The strategy offers potential for investors comfortable with a riskier portfolio and a longer time horizon. Smart beta investing is also appropriate for those seeking to outperform market returns and uncomfortable with high-fee actively managed mutual funds. The smart beta strategy, like any other potentially high-return investment strategy, requires time to be effective. Investors should be prepared to accept some risk with their portfolio and have the patience to allow the portfolio to recover in the event of a decline in value.

Related

- Betterment Cash Reserve Review

- SoFi Active Investing Review

- Betterment Promotion

- Betterment vs Vanguard

- Best Robo-Advisors for Beginners

- FutureAdvisor | Blackrock Robo-Advisor Review

- Best Robo Advisors For Millennials

- Betterment vs. Ellevest – Which Robo-Advisor is Best for You?

- How To Choose A Robo Advisor

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable