Based in San Francisco, FutureAdvisor was founded in 2010 by Microsoft refugees, Bo Lu and Jon Xu. They started the platform in response to friends who were having difficulty knowing where to invest their money. The service is comprised of chartered financial analysts, data scientists, designers, engineers, marketers and service specialists. FutureAdvisor is a subsidary of BlackRock, the world’s largest investment management firm, with more than $6.28 trillion in assets under management (AUM).

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

FutureAdvisor Review

-

Fees

(3.5)

-

Investment Choices

(5)

-

Ease of Use

(2.5)

-

Tool & Resources

(3)

Summary

Best for:

- Investors with accounts at TD Ameritrade and Fidelity

- Those seeking account management and financial advice

Pros

- Tax loss harvesting included with FutureAdvisor Premium.

- Free portfolio analysis of all your investments.

- Financial advisors included.

Cons

- Management fees are higher than other robo-advisors.

- High investment minimum.

- Clunky website navigation.

What is FutureAdvisor?

FutureAdvisor, the Blackrock robo-advisor is actually two services:

- FutureAdvisor Premium is a robo advisory firm that manages your existing investment accounts held at Fidelity or TD Ameritrade (soon to be integrated into Charles Schwab). With FutureAdvisor, you don’t need to transfer your assets to their platform! The service automatically monitors, re-balances and tax manages your current investments. Low-cost index funds are added where necessary to strengthen your portfolio.

- FutureAdvisor offers a free investment portfolio review, regardless of where your investments are located. This service analyzes your investments and provides recommendations.

As part of their services, Blackrock’s FutureAdvisor can do the necessary paperwork to consolidate investors’ accounts at TD Ameritrade or Fidelity Investments. This includes making tax-conscious decisions about how your existing investments are transferred over.

For would-be clients without investment accounts, FutureAdvisor can assist in opening taxable, Traditional IRA, and Roth IRA accounts.

Features at a Glance

| Overview | Automated online investment management robo-advisor platform |

| Minimum Investment Amount | $5,000 |

| Fee Structure | 0.50% of AUM, charged quarterly as 0.125% |

| Top Features | The service uses funds that you already own through TD Ameritrade or Fidelity Investments, or helps you to transfer and open accounts at these institutions. FutureAdvisor then adds additional ETFs when necessary to achieve the desired asset allocation; you can maintain certain investment positions in your portfolio alongside the recommended allocations. |

| Free Services | FutureAdvisor can analyze your existing investments before you commit to using the service. |

| Contact & Investing Advice | Contact form available via website 24/7. Financial advisors available. |

| Investment Funds | Diversified index funds from 14 different asset classes |

| Accounts Available | Individual and joint taxable accounts; traditional, Roth, and rollover IRAs |

| Promotions | N/A |

What Differentiates FutureAdvisor Blackrock Robo-Advisor From Competitors?

Along with SigFig, FutureAdvisor is one of the few robo-advisors that doesn’t require you to transfer your assets into their platform. They manage your assets in your existing Fidelity and TD Ameritrade Investments accounts. FutureAdvisor can help you transfer your money to these companies, or will assist in opening new accounts at either institution.

FutureAdvisor provides access to financial advisors and service specialists.

These financial pros can help with investing questions about what is going on with your portfolio. Don’t understand why to invest in foreign stock funds? The financial advisor will help.

One of the more interesting features of FutureAdvisor is that the platform allows you to hold a small amount of personally selected securities in your account. However, the vast majority of your asset allocations will be ETF’s selected and managed by the service.

FutureAdvisor cautions that the financial advisors are not suitable for comprehensive financial planning nor tax or legal planning.

FutureAdvisor’s investment mix is diverse.

Nobel prize winner Eugene Fama and colleague Kenneth French found that over the long term small capitalization and value value stocks outperform the returns of the overall stock market. (Although, in recent years this hasn’t been the case.) To capture this potential out-performance FutureAdvisor includes US and international value and small cap stocks in their investment mix.

FutureAdvisor also includes international emerging debt or bonds and global real estate funds another nod at broad diversification leading to potentially higher returns.

These factor investments set FutureAdvisor’s investments apart from the pack.

401(k) plan management is available for rollovers.

FutureAdvisor can manage some 401(k) plans, but only if you no longer work at the employer and if the plan is rolled over to an account at Fidelity or TD Ameritrade Investments. FutureAdvisor does not manage 401(k) plans that are being actively contributed to.

Robo-Advisors with Human Financial Planner Access

Who is FutureAdvisor Best for?

If you have a brokerage account with either Fidelity Investments or TD Ameritrade, and you’d like to add investment management to the account without having to switch over to another service, you might consider FutureAdvisor.

FutureAdvisor is suitable for investors seeking fund management without having to sell all of their current investments. Although be aware that when hiring FutureAdvisor to manage your investments in a taxable account, there might be tax consequences as they replace existing holdings with recommended ETFs.

The platform leverages its algorithms and financial advisors to manage your account. Although, SigFig is a similar robo-advisor with a lower management fee and access to financial advisors as well.

FutureAdvisor Review Features – Robo-Advisor Drill Down

How Does FutureAdvisor Work?

FutureAdvisor manages investment accounts held with Fidelity or TD Ameritrade. If you already invest through those platforms, FutureAdvisor can be added as your investment advisor. If not, you will need to move your investment accounts over to either broker.

If your accounts must be transferred from another investment broker, FutureAdvisor works to minimize capital gains in the transfer process. In tax-sheltered accounts, like IRA’s, transferred account balances under $10,000 are liquidated, and those with assets above $10,000 are transferred as is. FutureAdvisor typically transfers taxable accounts as-is, regardless of account balance.

FutureAdvisor management includes investment selection, trading and rebalancing.

Sign up for the FREE Robo-Advisor Comparison Chart

Investment Strategy and Portfolio

The service uses a combination of the FutureAdvisor human investment team, and their software Recommendations Engine. The asset allocation strategy incorporates Modern Portfolio Theory (MPT), which strives to deliver the greatest returns for the users preferred risk level.

Once FutureAdvisor begins to manage your account, you can expect to have automatic account rebalancing—another typical robo-advisor feature. However, FutureAdvisor’s algorithms are designed to weigh the potential benefits of rebalancing against the costs, including capital gains taxes and transaction fees.

One of their basic investment methodologies is to reduce risk as you approach retirement. This will be a gradual process of reducing equities in favor of bonds.

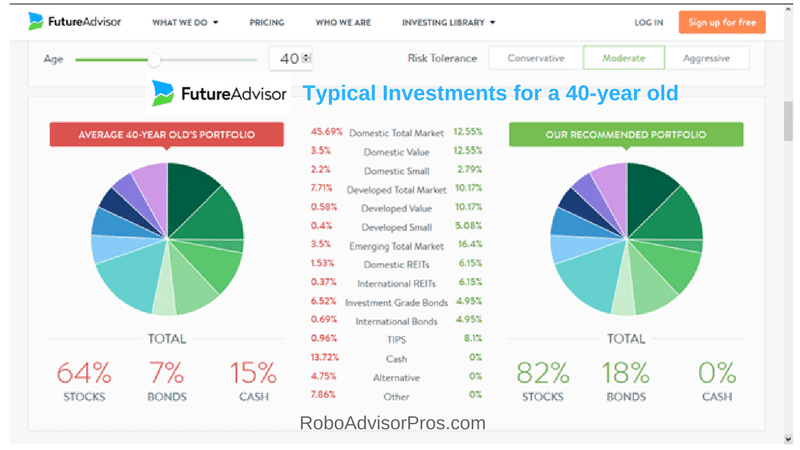

Investment allocations. FutureAdvisor uses 14 asset classes in portfolio construction. Each asset class is populated with one or more low fee exchange traded funds from Schwab, iShares, SPDR and Vanguard. We like the vast diversification within the investment funds.

Funds and asset classes are subject to change.

A portfolio constructed for a 40-year-old who has a moderate risk tolerance would look something like the model below. The presentation compares the FutureAdvisor portfolio (on the right) with the average for a typical 40-year-old.

Minimization of “cash drag”. Note that in the portfolio above, there is no cash allocation. The cash exclusion eliminates the cash drag of uninvested funds. This is in contrast with Schwab Intelligent Advisors which believes in an investment portfolio cash allocation.

Rebalancing. Rebalancing takes place when investments drift from their preferred asset allocation, typically 4 to 6 times per year, on average. In the process, they use a portfolio rebalance algorithm that doesn’t realize over $200 or 5% of the position value, whichever is greater, in short-term capital gains taxes. This is done to minimize the high tax burden of short-term capital gains.

Tax-loss Harvesting

FutureAdvisor employs tax-loss harvesting. They also use tax efficient asset placement. Bonds are favored in tax-deferred accounts, since they generate regular income. Equities are preferred in taxable accounts, to take advantage of lower capital gains tax rates.

FutureAdvisor Fees and Minimums

FutureAdvisor pricing has only one account level and charges a set fee for all accounts, determined by the amount of assets under management (AUM).

The FutureAdvisor cost is 0.50% AUM for all accounts they manage. Clients will be charged 0.125% AUM quarterly. Pricing may include trading fees.

Investors must have $5,000 minimum in assets to work with FutureAdvisor.

Bonus: Retirement Planning for Women

Account Types

The platform will manage the following accounts:

- Individual and joint taxable brokerage accounts

- Traditional, Roth, or Rollover IRAs

There is no FutureAdvisor 401(k) but the firm will help clients transfer 401(k) plans from former employers to new retirement accounts at either TD Ameritrade or Fidelity Investments.

Free Services

During the sign-up process, FutureAdvisor will analyze your existing portfolios for free. This is marketed as simply an educational feature; FutureAdvisor will not make any changes to these portfolios on your behalf. You may implement, on your own, any proposed changes recommended by the free FutureAdvisor Portfolio review.

FutureAdvisor App – Mobile Access

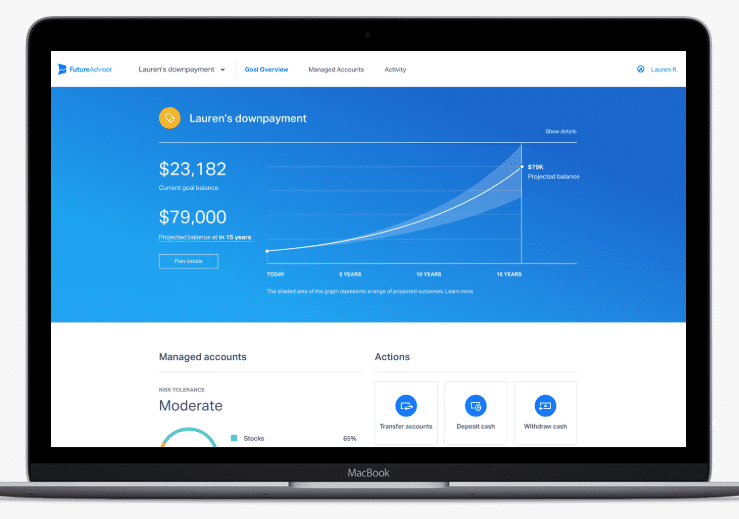

FutureAdvisor itself does not have a mobile app at this time, though they do give investors access to a comprehensive online dashboard through their website.

Investors who are curious about the performance of their portfolios can instead look to theFidelity or TD Ameritrade mobile applications.

Click here for access to free financial toolkit – money and investment dashboard

Sign-up Process

In order to enroll in FutureAdvisor you must be a legal US resident and US citizen, aged 18 or older, with at least $5,000 in investable assets. You need a valid Social Security number or tax identification number.

Once you register for the service – which requires your email address and the creation of a password—you will enter your name, date of birth, household income level, marital status, financial goal, timeline for the goal, and your initial investment amount. After this point, you will receive your portfolio allocations.

You then have the option to analyze an existing portfolio, involves linking a bank or retirement account to the FutureAdvisor service. This portion of the sign-up process is optional and free. Although, during three tiles, the platform timed out before my TD Ameritrade account could be linked. You may also choose to proceed to the FutureAdvisor account management plan.

If you want to hire FutureAdvisor to manage you investments, link your account to a bank account to enable direct transfers and recurring deposits. Once again, unless your accounts are already held with either Fidelity Investments or TD Ameritrade, your accounts will be moved over to either of those two brokerage firms.

Is FutureAdvisor Safe?

Since your FutureAdvisor account is held at either Fidelity or TD Ameritrade, you are subject to their safety protocols. As major financial investment firms you can be certain that your account is insured by the SPIC (Secuties Investor Protection Corporation). Additionally, the websites employ the highest level bank-level security protocols and two-factor authentication.

FutureAdvisor Blackrock Robo-Advisor Pros and Cons

Advantages

- You can use the account for free, to get your recommended portfolio allocations. The service continues to be available for up to three months thereafter. Although, Personal Capital also offers free portfolio analysis (and a free money and investment dashboard).

- Future advisor offers live advice and service specialists.

- FutureAdvisor does allow you to hold a small amount of personally selected securities in your portfolio. However the vast majority will be ETF’s managed by the platform.

- The inclusion of global real estate and value funds adds to the portfolio diversification and is not common among most competitors.

- You don’t need to transfer your money to an external third party, if you are invested at TD Ameritrade or Fidelity.

Disadvantages

- Customer service is subpar with lack of quick responses to email. There is no phone customer service for the general public.

- The FutureAdvisor cost of 0.50% AUM is high among digital investing platforms in general, although much more affordable than traditional financial planners.

- Betterment and Wealthfront charge just 0.25%, with lower investment minimums. At Betterment, you could sign up for the digital package and pay a small fee for financial planning advice through their a la carte sessions.

- The platform doesn’t offer an app, although you can see your account at the Td Ameritrade and Fidelity apps.

- The website is limited in it’s information and the FAQ section is sparse. Additionally, the FAQ doesn’t discuss the credentials of the advisors.

Compare – Betterment and SoFi Invest

FutureAdvisor Robo-Advisor Review Wrap Up

Live financial advice and the ability to leave assets in their Fidelity or TD Ameritrade accounts are major advantages of the FutureAdvisor Premium service. Access to value, growth, small cap funds and global bond funds is also unique. Although you could include value and global real estate funds when investing in M1 Finance, and their management fee is zero.

The unresponsive customer service leads us to other platforms, like SoFi, where you get financial advisor access and better customer service, along with zero management fees.

The fee structure on this platform is high enough to warrant considering lower costs alternatives. Although it’s a positive for many investors, particularly those with greater assets, to leave their funds with the existing brokerage firm.

Fee conscious investors might consider SoFi Invest. The platform offers free Automated Investing with free financial advisors and career consultants included.

If you’d like additional information, or if you’d like to sign up for the service, visit the FutureAdvisor website.

Related

Ellevest Review – Not for Women Only!

Cheap Robo-Advisors with Low Fees

Robo-Advisors with Financial Advisors

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources:

- FutureAdvisor FAQ: https://www.blackrock.com/futureadvisor/faq

- FutureAdvisor legal docutnments: https://www.blackrock.com/futureadvisor/legal-documents

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.