This Marcus Invest review covers the Goldman Sachs’ robo-advisor arm, which is designed to give average folks – not just the uber wealthy – access to Goldman Sachs’ financial wisdom.

Marcus Invest appeared on the market in early 2021. The robo-advisor is part of Goldman Sachs, which has an operating track record since 1869.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Marcus Invest Review

-

Fees

(4)

-

Investment Choices

(5)

-

Ease of Use

(4)

-

Tool & Resources

(4)

Summary

Marcus Invest robo-advisor is best for:

- Goldman Sachs clients

- Investors seeking broad diversification

- A trusted brand

Pros

- Nearly 15 diversified asset classes

- Tax-minimization strategy

- Core, ESG, and Smart Beta strategies

Cons

- No financial advisors

- Limited track record

- Lower fee alternatives available

About Goldman Sachs

Goldman Sachs is a global financial company that serves individuals, major corporations, and everyone in between. Their products span investment banking, securities, wealth management and consumer banking. The company was previously known as a banker and financial manager to the affluent.

Marcus Invest invites the average investor into the Goldman family.

In this Marcus Invest review, you’ll learn why this new robo-advisor is already a strong contender on the market, who benefits from their services, pros, cons, and much more.

What is Marcus Invest?

Marcus Invest is an automated robo-advisor available through the Goldman Sachs Marcus portal. This robo was designed to meet the needs of mainstream investors who might not have enough money to invest in the Goldman Sachs products. It is quite a coup for the average investor to receive advice from the premier Goldman brand.

As an automated robo-advisor, clients with a Marcus Invest account can expect all the bells and whistles that come standard with other robo-advisors, including:

- Automatically generated portfolio recommendations based on your risk tolerance and timeline.

- Three portfolio options: Core, Impact and Smart Beta

- Diverse stock and bond ETF offerings – the platform really shines with a standout selection of diversified asset classes including value stock funds and international real estate.

- Automatic portfolio rebalancing on a periodic basis. This feature keeps your investments in line with the asset allocation you specify, with certain percenages in stock, bond, and alternative funds.

- Tax minimization features.

Other Marcus products, rolled out for the average consumer include banking with high yield cash solutions, lending, and educational articles and resources.

Features at a Glance

Who is the Marcus Invest Robo-Advisor Best For?

With so many robo-advisors from which to choose, you need to assess which robo is the best choice for you. To help you make the best decision, consider what you need from an automated platform like types of accounts, diversification, access to human advice or not, pricing, and more.

Marcus is best for:

- Those seeking a simple product backed by a financial giant. Goldman Sachs has over 150 years of experience in the financial industry; this is a huge boon to customers who want to pay low fees with to quality financial services.

- New and beginner investors. You can get started with just $5. This minimum amount is less than the robo-advisor options at Vanguard.

- The investor looking for diversified investment options. Marcus Invest offers a widely diverse set of stock and bond ETFs. We like the nod to value-based funds. Although, you won’t find cryptocurrency investments here.

- Investors who don’t mind the absence of a human financial planner. Alternately, stand-alone robo Betterment offers clients access to human financial planners for reasonable fees. And beginners get financial advisors and free investment management at SoFi Invest Automated Investing.

- The investor who cares about the economic and social impact of their investing. Marcus Invest offers a socially-conscious portfolio to limit funding harmful industries and companies.

- Someone interested in trying to beat the market with smart beta choices.

Marcus Invest Drill Down

Fees

Marcus Invest charges an account management fee of 0.25%, which is equivalent to $2.50 per year on accounts valued at $1,000. This is higher than other digital platforms like Schwab, SoFi Invest and M1 Finance, who offer free investment management.

As is common with most funds, the underlying ETFs typically have low fund management fees. However, they do offer a money-saving feature: if clients pay any fees to purchase Goldman Sachs ETFs, those fees are applied toward the monthly account management fee for your Marcus Invest portfolio.

The Marcus Invest average ETF expense ratios are quite reasonable for each strategy:

- 0.05-0.16% for Goldman Sachs Core

- 0.11-0.19% for Goldman Sachs Impact

- 0.15-0.17% for Goldman Sachs Smart Beta

Lowest Fee Robo-Advisors

Minimum Investment

There is no minimum investment amount required. Although you’ll need $5 to start investing. There are many low- or no-minimum robo-advisors on the market like Betterment, Wealthfront, and M1 Finance.

The zero minimum requirement puts Marcus investment accounts within reach of small and new investors.

Tax-Loss Harvesting

The Marcus roboadvisor offers a tax minimization strategy that includes, tax-free municipal bonds in taxable accounts, and selling strategically to minimize payments to Uncle Sam. They refer to their strategy as a “tax-lot relief methodology.” Whenever your portfolio is rebalanced or you make changes to your allocation, Marcus strategically sells off assets in order of lowest tax burden. This helps lower your overall tax bill.

Although not a strict tax-loss harvesting approach, the attention to tax efficiency will benefit clients with taxable investment accounts.

Top Robo-Advisors

Customer Reviews and Service

Marcus Invest offers typical customer service hours via telephone: Monday-Friday, 9:00-6:30 ET. Users can obtain help through the FAQ and email contact as well. Customers across both the iOS and Android apps seem happy with the family of Marcus offerings and the apps themselves. Users of this Goldman Sachs robo advisor can access their portfolios through the Marcus android or iOS apps. Factors that positively affect their rating include their account minimums, rebalancing, and expense ratios; on the other hand, the lack of human advisors is an issue for some would-be clients.

User Experience – Sign-Up Process

Account Sign-Up

When you sign up for an account, you are asked the following questions:

- Whether you’re able to save any money after paying monthly expenses.

- Whether you have enough savings to cover livinexpenses for three months.

- How long you plan to keep your money invested in your account.

- The percent amount of loss (in the portfolios value) you can afford in any given year.

- How you would adjust your portfolio’s risk level if a global market downturn occurred.

The last two questions get at your comfort with risk or declines in account value.

Finally, your’re asked to choose one of the three investment strategies:

- Goldman Sachs Core, which tracks market benchmarks rather than striving to beat the market.

- Goldman Sachs Impact, which is a socially conscious robo-advisor for those who want to avoid doing social or environmental harm with their investments.

- Goldman Sachs Smart Beta, a strategy that offers the potential of higher gains over time.

Retirement account clients have access to the Core and Impact portfolios only.

After choosing a strategy, clients receive a portfolio with recommended stock and bond fund allocations.

Next, enter your personal information and fund your account!

Access to Human Financial Advice

Unfortunately, Marcus Invest does not offer human financial planners as part of their offerings. This is likely in an effort to keep account management fees low, though we see many other robo-advisors, like Ellevest, managing to offer human financial advice while still keeping fees low.

Security

Marcus Invest takes security so seriously that they have an entire Security Center page available for clients! This page includes advice for protecting yourself online, but also covers company-specific security measures. These measures include SSL encryption, multi-factor authentication, and firewalls.

Additional security measures include FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation) memberships. There are always risks that come with investing; however, FINRA ensures that you clients receive the appropriate disclosures and information required to make informed investment decisions.

While your investments could lose their value entirely, SIPC ensures that if Goldman Sachs goes bankrupt, your assets are protected.

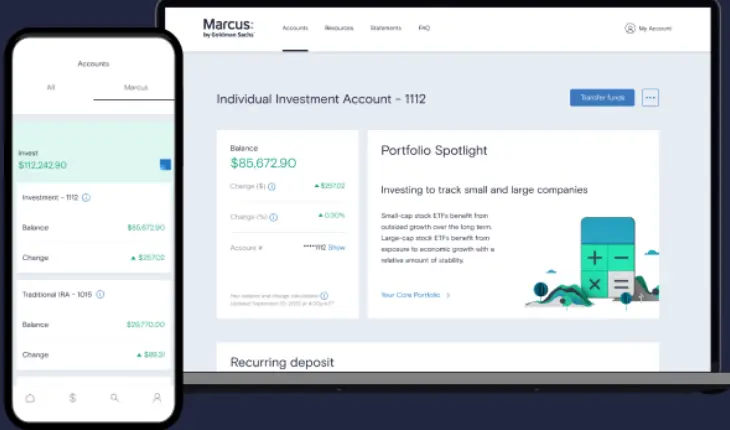

Mobile App

Goldman Sachs offers a Marcus app for all of their Marcus products, including Marcus Invest, savings accounts, and loans. This app is available on iOS and Android. The invest services on the app include:

- Sign up.

- Portfolio construction.

- Educational features.

- Account dashboard access.

The app also offers Marcus Insights which includes smart tools for money management. We like that you can link external accounts to visualize and track finances in one place. Although you won’t find the in depth investment tracking, analysis and management like offered at Personal Capital.

Investing Strategy

Marcus Invest offers three different investment strategies for individual and joint investment accounts, and two for retirement accounts. Retirement accounts like IRAs lack access to the Smart Beta option. These are well researched portfolios created by the company’s experienced Investment Strategy Group professionals.

The company adheres to the belief that a thoughtful portfolio is one that is globally diversified, fits the client’s risk tolerance, and will navigate ups and downs in the market. We like the 13 diversified asset classes which include access to value stocks, high yield bonds, and international real estate, less frequently found on competitor platforms.

Goldman Sachs Core

The Core portfolio is diversified and uses primarily market-cap index tracking ETFs. This portfolio is great for those who want to track market benchmarks, but aren’t concerned with trying to beat the market. This is the standard strategy most digiral platforms emply. Although Marcus is distinct with it’s stable of uniquely diversified funds. The Goldman Sachs roboo-advisor sees this as “an efficient strategy with risk mitigation factors in place.”

Goldman Sachs Impact

The Impact portfolio is appropriate for those who want to make environmentally and/or socially beneficial investments. These ETFs, which are, of course, highly diversified, strive to meet Environment, Social, and Governance (ESG) criteria. That means that some sectors, such as fossil fuels, will be excluded from your portfolio whenever possible. However, the company doesn’t guarantee that all investments in this portfolio will be ESG ETFs; they might choose non-ESG ETFs if those would be better for your portfolio.

Goldman Sachs Smart Beta

The Smart Beta portfolio strives to “modestly outperform the market” by weighing ETF valuation and quality, among other factors. Using a rules-based approach to selecting companies, Smart Beta portfolios are more strategy-based than the other investment strategies; however, this investment strategy remains part of the overall automated robo-advisor structure, so you won’t have active management strategies here.

Smart beta are strategies that are based upon factor research that has shown outperformance or “alpha” of certain investment styles over general stock market returns. These factors might include small capitalilzation and value stocks.

Asset Classes

We like the access to 13 distinct asset classes. The asset class selections are based upon sound investing data and research.

US Stocks including small and large cap value, international Stocks including developed and emerging markets, and investment grade, high yield, and municipal bonds, and US and International Real Estate Securities.

Here’s a list of all asset classes represented in Marcus Invest portfolios:

- US investment grade short term bonds

- US investment grade municipal bonds

- US investment grade bonds

- US high yield bonds

- US large capitalization stocks

- international developed market stocks

- US small capitalization stocks

- Emerging market stocks

- US large capitalization value stocks

- US small capitalization value stocks

- US real estate

- International real estate

The website does a great job of offering a brief explanation for each asset class and how it benefits the users goals.

FAQ

Is Marcus Invest Worth it?

Is Marcus Invest Safe?

Is Marcus by Goldman Sachs FDIC Insured?

Pros and Cons

Pros

- Backed by Goldman Sachs, which has many years of experience in investing.

- Multiple investment strategies that help clients find an approach that fits their values and preferences.

- Diverse asset classes.

- Transparent fee structure.

- Easy and intuitive sign-up process.

- Monday through Sunday customer service.

Cons

- No human financial advisors.

- No tax loss harvesting.

- The product has a limited track record.

Marcus Invest Review Wrap Up

Overall, this digital investment manager offers many promising features. This robo-advisor, is affordable and accessible to the everyday investor and comes through on its promises. It offers all the components we’ve come to love about robo-advisors, like automatic rebalancing and portfolio monitoring. The sign-up process is easy and shows you exactly how your investments are allocated before you even enter any personal information. Finally, they do this all for a fairly affordable account management fee.

The investors who might best appreciate Marcus Invest are those who want access to prestigious Goldman Sachs investment management, have at least $1,000, and are seeking both market matching, and access to socially responsible and smart beta portfolios.

Consider other alternatives if you prefer human financial planner access or fit in the high net worth category.

lot of bells and whistles. Personal Capital’s $100,000 minimum investment and higher account management fees may seem off putting, but their host of services, from Certified Financial Planners to personalized financial plans and cash management might be more appealing for wealthier investors. While Vanguard Personal Advisors only charges 0.30% asset management fee and offers a combined human and robo advisory platform. This option requires a $50,000 minimum.

If you don’t want to pay for a fairly basic automated investment portfolio. M1 Finance is a free alternative. M1 is not backed by a powerhouse like Goldman Sachs, but it does offer ETF-based portfolios that are easily customized. Like Marcus Invest, M1 Finance also offers additional financial products so you can keep everything under one roof.

There are a lot of good features included in the platform.

With three distinct investment strategies and moderate account management fees, Marcus Invest offers something for most investors. If you prefer an automated, ETF-based robo-advisor we wouldn’t hesitate investing with Marcus.

Related

- SigFig vs Betterment

- Wells Fargo Intuitive Investor Review

- Zacks Advantage Review

- E-Trade Core Portfolios Review

- FutureAdvisor Review – Blackrock Robo-Advisor

- Vanguard Robo Advisor Review

- Wells Fargo Intuitive Investor Review

- Zacks Advantage Review

- E-Trade Core Portfolios Review

- FutureAdvisor Review – Blackrock Robo-Advisor

- Vanguard Robo Advisor Review

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Sources

- https://www.marcus.com/us/en/invest

- https://www.marcus.com/us/en/disclosure/invest-disclosures

- https://www.marcus.com/content/dam/marcus/us/en/pdfs/november-form-adv-part-2.pdf

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable