SigFig vs. Betterment — Overview

With automated portfolio management becoming more popular, choosing between the many robo-advisors available today might be difficult. Yet choosing the right financial advisor — automated or otherwise — is one of the most important things you can do to improve your personal finance situation. SigFig and Betterment are two of the robo advisors with financial planners. In this review you’ll learn the features, pros and cons of each platform and decide which is best for you.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Top Features

Quick Overview

- SigFig is for you if you want to keep your current investments at Fidelity or Charles Schwab.

- Betterment is for you if you want to take advantage of the $0 account minimum and only $10 to begin investing.

- Cost conscious, small investors with $2,000 might prefer SigFig as they charge $0 account fees on your first $10,000.

- Those interested in cryptocurrency will want to go with Betterment.

- Both offer access to financial advisors. Although Betterment requires added fees for financial advisory access.

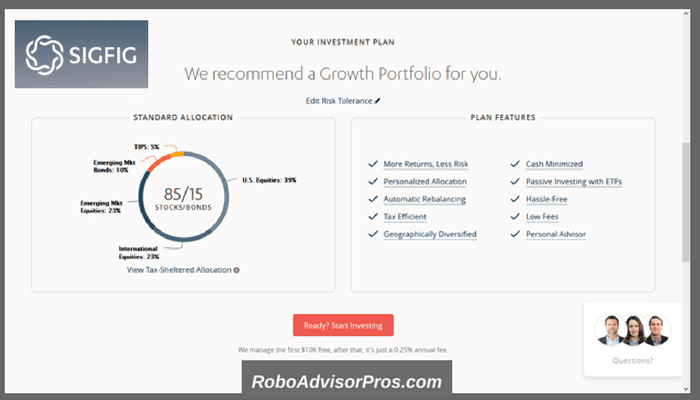

What is SigFig?

SigFig is a unique robo-advisor. Instead of offering its own platform for its managed portfolios, SigFig serves as a portfolio tracker and management system for accounts held elsewhere. Currently, they provide investment management for portfolios held at Charles Schwab and Fidelity. This is great for investors that don’t want to transfer their assets to an outside custodian.

Users complete a risk, financial goals and timeline questionnaire. Your responses will determine the composition and risk level of the portfolio, with more conservative investors owning more cash and fixed investments and younger more aggressive investors owning a greater allocation to stock ETFs. When percentage allocations deviate from your target, the platform automatically rebalances the assets to keep it in line with your preferences. After linking your investment account to SigFig, the investment management is performed by them, no need to transfer your investments.

Anyone can link their accounts and use SigFig’s free tracker to see how their investments are performing across different brokerages. This free service, which does not include any financial advice or portfolio management, is similar to the portfolio tracker offered by Empower.

SigFig is worth a look for clients of Schwab or Fidelity looking for a digital investment manager, with financial advisor access and investment portfolio tracking. Investors get the first $10,000 managed for free, a bonus for cost-conscious investors who have the required $2,000 minimum in their account. All paid clients have access to a financial consultant to discuss their financial goals.

SigFig Top Features

- Unlimited human financial advisor access

- No need to move investments between brokerages; Charles Schwab and Fidelity portfolios are supported

- Tax-loss harvesting

- Free portfolio tracking tools

- Free account management for accounts under $10,000

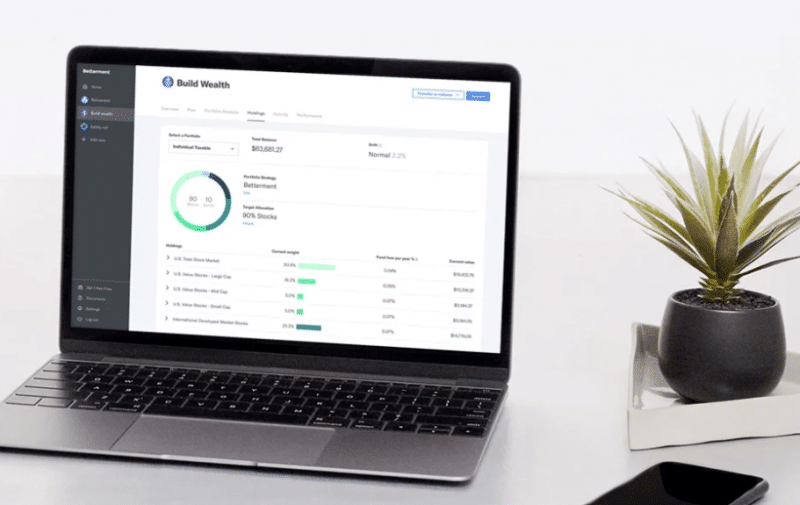

What is Betterment?

Betterment is the largest independent robo-advisor on the market and excellent for goal-based saving and investing. It is also one of the earliest robo-advisors. Like most digital investment advisors, users complete an initial risk, goals, and time period questionnaire. The answers will drive the portfolio selection. When assets deviate from the desired percentages, the platform automatically rebalances to keep you on track.

Not content to rest on its laurels, Betterment continues to innovate and improve. Most recently, Betterment acquired cryptocurrency firm Makara and now offers crypto portfolios for a distinct management fee.

Betterment is known for it’s goal planning features with the opportunity to invest and save for multiple goals. The dashboard also shows you if you’re on track to meet your goals and offers suggestions on how to improve when you’re off-track.

Betterment Digital is the all digital investment platform with no minimum and only $10 to begin investing. The low-cost financial advice packages provide guidance for specific planning questions. While Betterment Premium requires $100,000 and offers unlimited financial advisor access. All clients can accesssocially-responsible investing, smart beta portfolios and an innovative technology portfolio. For savers, the high yield cash reserve and checking accounts, offered through partner banks, are a sound addition.

Betterment Top Features

- Socially-Responsible Investments

- Smart Beta Portfolios

- Human financial advisors, for added fees

- Tax-loss harvesting

- Reasonable fees and no minimum investment ($10 to begin investing) for Betterment Digital

- High yield Cash Reserve and Checking Accounts, through partner banks

- Cryptocurrency

SigFig vs. Betterment — Who Benefits?

SigFig is a good option for investors who have their brokerage accounts at Fidelity, or Charles Schwab. Such clients can get investment advice for these accounts without moving their portfolios to a new firm.

Betterment is the way to go if you are a smaller investor, with less than $2,000.

If you have between $2,000-$10,000 to invest, SigFig is a great option. They do not charge account management fees on your first $10,000, after which you’ll pay 0.25% of asset value, the same as with Betterment Digital.

If you’re looking for cryptocurrency and cash management (through partner banks), Betterment is a good choice.

Those who want financial advisors will be happy with either service. Although Betterment financial advisors are offered at a higher price point than those at SigFig.

Those seeking ESG-sustainable portfolios, smart beta factor portfolios and cash management (through partner banks), will opt for Betterment, as SigFig lacks those features.

SigFig vs. Betterment — Fees and Minimums

SigFig Fees and Minimums

There are no account management fees or investment minimums for clients who want to use the free financial planning tools at SigFig.

For account management, SigFig’s minimum investment requirement is $2,000. You receive free management on your first $10,000; after that, you’ll pay 0.25% AUM.

Betterment Fees and Minimums

Betterment has two tiers: Betterment Digital and Betterment Premium.

The Digital plan does not have an investment minimum, and requires $10 to begin investing.

Betterment Premium has a minimum requirement of $100,000. The fee for this tier is 0.40% AUM and features unlimited sessions with a financial planner.

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

SigFig vs. Betterment — Deep Dive

What else sets these two options apart? There are a few things you need to know before deciding between Betterment and SigFig.

Betterment and SigFig — Human Financial Planners

Both robo advisory investment management services offer digital and hybrid advice, but the accessibility at each is distinct. You can work with human advisors with either of these options.

At Betterment Digital, consumers can pay from $299 to $399 for an Advice Package with a Certified Financial Planner (CFP). Topics include financial check up, retirement planning, marriage planning, college planning and more.

Betterment Premium clients, with $100,000 minimum, have unlimited CFP access, for an added fee.

All paying SigFig users can contact a financial consultant for basic platform and money questions.

SigFig vs. Betterment — Tax-Loss Harvesting

Both Betterment and SigFig offer tax-loss harvesting. This isn’t very surprising, however; many robo-advisors currently offer some version of tax-loss harvesting to their clients. Tax-loss harvesting is a strategy for taxable accounts that uses losses to offset gains, thereby reducing your total tax bill. Ultimately, this saves you money.

SigFig vs. Betterment — Investments

Betterment and SigFig both offer a standard array of exchange traded funds as part of their investment strategy.

SigFig Investments

Your investment portfolio consists of ETFs from asset classes such as U.S. and international stocks and bonds, U.S. treasury securities and real estate.

| Asset Class | Fidelity | TD Ameritrade | Charles Schwab |

|---|---|---|---|

| Treasury Inflation Protected Security | TIP | TIP | SCHP |

| US Bonds | AGG | AGG | SCHZ |

| Short-Term Treasuries | SHY | SHY | SCHO |

| Emerging Market Bonds | EMB | PCY | PCY |

| US Municipal Bonds | MUB | MUB | TFI |

| US Equity | ITOT | VTI | SCHB |

| Developed Market International Stock | IEFA | VEA | SCHF |

| Emerging Market International Stock | IEMG | VMO | SCHE |

| Real Estate | FREL | VNQ | SCHH |

SigFig lacks the customization available at the Betterment portfolios.

Betterment Investments

Betterment offers a wider range of investment strategies and assets. A core investment portfolio with Betterment will be made up of ETFs consisting of U.S. and international stock and bond ETFs including international emerging and developed market bonds. You’ll also find value leaning stock funds, shown to outperform during longer periods.

| Sector | Ticker |

|---|---|

| U.S. Total Stock Market | VTI, SCHB, ITOT |

| U. S. Large-Cap Value | IVTV. SCHV, IVE |

| U.S. Mid-Cap Value | VOE, IWS, IJJ |

| U. S. Small-Cap Value | VBR, IWN, IJS |

| International -Developed Market | VEA, SCHF, IEFA |

| International - Emerging Market | VWO, IEMG, SCHE |

| Sector | Ticker |

|---|---|

| U.S. High Quality Bnds | AGG, BND |

| U.S. Municipal Bonds | MUB, TFI |

| U.S. Inflation-Protected Bonds | VTIP |

| U.S. High-YIeld Corporate Bonds | HYLB, JNK, HYG |

| U.S. Short-Term Treasury Bonds | SHV |

| US Short-Term Investment-Grade Bonds | NEAR |

| International Developed Market Bonds | BNDX |

| International Emerging Market Bonds | EMB, VWOB, PCY |

Users seeking strategy and factor investing will appreciate the socially responsible – ESG investing, innovative technology, smart beta and crypto (for added fee) options.

SigFig vs. Betterment — Socially Responsible Investing

Out of the two, only Betterment offers SRI options (socially responsible or environment, social and governance)

The Betterment ESG portfolio strategy can replace the Core portfolio and increases investments in companies that fulfill ESG criteria. There are three SRI options including Broad Impact, Climate and Social Impact.

SigFig vs. Betterment — Account Types

The platforms are comparable with regard to account types.

Betterment offers a wide variety of taxable accounts as well as retirement accounts (Traditional, Roth, SEP and rollover IRAs). You can also open a trust with Betterment.

SigFig accounts are comparable, offering both taxable accounts and IRA accounts (Traditional, Roth, SEP and rollover). SigFig can also manage your trust account.

Neither platform offers custodial or 529 college savings accounts. Wealthfront is the only robo-advisor with 529 accounts, that we are aware of.

Betterment vs. SigFig — Other Services

In addition to portfolio management for existing brokerage accounts at Fidelity and Charles Schwab, SigFig also offers a portfolio tracker. SigFig lacks any sort of cash management option, although investors can open cash accounts at Schwab or Fidelity.

Betterment, on the other hand, has other services available including:

- Cash reserve – A fee-free high yield savings FDIC account, through partner banks.

- Checking account – A fee-free checking account with Visa debit card and $250,000 FDIC insurance, offered through partner banks.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

SigFig vs. Betterment — Which is Best? The Takeaway

When we look at the basic features, these two robo-advisors are fairly similar. Both offer access to a human financial advisor, although Betterment Digital customers need to pay a small fee for additional financial advise, and SigFig has consultants built into the fee. Each platform charges a reasonable management fee of 0.25% AUM. While these are low fees compared to traditional financial advisors, they’re certainly not the cheapest robo-advisors available.

Another commonality between Betterment and SigFig is that they use your risk tolerance, financial goals, and investment timeline to create a personalized, diversified portfolio. Like all robo advisors, when your investments veer from their target asset allocations, the portfolios are rebalanced back to their original percentages. Each platform also offers tax-loss harvesting.

Still, there are some major differences between the two robo-advisors.

You’ll need a bit more capital for investment management by SigFig. A $2,000 minimum will get you started, and your first $10,000 will be managed for free.

Consider SoFi for no minimum, fee-free investment management.

Additionally, if you already invest with Charles Schwab, Fidelity, or TD Ameritrade, then SigFig might be the best choice. You won’t need to move your assets to another brokerage, which saves you time and hassle.

If you’re looking for an investment account that also has access to other types of bank accounts, you’ll need to go with Betterment. The same goes for clients who want cryptocurrency or SRI options.

Betterment is also more accessible for smaller, beginner investors, with no minimum required.

Ultimately, your choice depends upon your specific preferences and financial needs.

Read

More Comparison Articles

- SigFig vs. Empower

- Betterment vs. Acorns

- Wealthfront vs. Fidelity Go

- Empower vs Wealthfront

- SoFi Invest vs Wealthfront

- Empower vs Quicken

- M1 Finance vs Schwab

- M1 Finance vs Robinhood

- SigFig vs Wealthfront

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.