Wells Fargo Robo Advisor – Is it Right for You?

Discover whether Wells Fargo Intuitive Investor is the best robo-advisor. Consider your investing experience, your desire for financial advisor access, preferred engagement with your investments and access to capital.

This Intuitive Investor review reveals that the Wells Fargo robo-advisor is suitable for beginner investors who prefer entirely automated, hands-off investing and can raise the $500 minimum. It is also appropriate for people who already have accounts with Wells Fargo.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Name: Wells Fargo Intuitive Investors Review

Description: Wells Fargo robo-advisor is a hybrid robo-advisor with access to live and automated investment advice.

-

Fees

(4.5)

-

Investment Choices

(4.5)

-

Ease of Use

(2.75)

-

Tool & Resources

(4)

Summary

Best for:

- Wells Fargo customers

- Beginning investors

Pros

- Live financial advisors

- Access to Wells Fargo branches and products

- ESG and global investing strategies

Cons

- Website lacks transparency

- Must input Social Security number to view sample portfolios

Features at a Glance

What is Wells Fargo Intuitive Investor?

Wells Fargo Intuitive Investor is an online advisory platform providing automated investment services, access to financial consultants and is best for its existing Wells Fargo customers. The platform is also suitable for those who might be interested in some of its most refined services, like smart beta portfolios and tax-loss harvesting.

Wells Fargo and Company operate the Intuitive Investor program as part of Wells Fargo Advisors, registered broker-dealers, and non-bank affiliates. Wells Fargo Intuitive Investor is a robo-advisor that simplifies and automates investing for the hands-off investor.

It allows you to invest in one of nine pre-set diversified portfolios designed by experts. After completing a simple questionnaire about your investing goals, risk tolerance, and time scale, the technology suggests the portfolio best suited to your needs.

Intuitive Investor uses computer algorithms to monitor, balance, and maintain your portfolio over time. You may also elect to talk to a financial advisor if you wish to become more involved or have questions about your investments.

The hybrid robo-advisor combo with live advisors and digital investment management is excellent for those who prefer to have someone to chat with when financial questions arise.

Who is Wells Fargo Intuitive Investor Best for?

Wells Fargo Intuitive Investor is best for the following categories of investors:

- Beginner investors: You do not need to know much about investing or understand the intricacies of managing an investment account over the long run. That makes Wells Fargo Intuitive Investor well suited to beginner investors.

- Hands-off investors: The Intuitive Investor program positions itself to suit the hands-off investor whose preference is to feed funds into their investment account and outsource the rest.

- Unsophisticated investors: Wells Fargo boasts that its Intuitive Investor program is ‘simplified investing with a personal touch.’ The portfolios are highly diversified across countries and economic sectors and hold investments in different types of ETFs.

- Investors possessing a moderate minimum investment: You must feed your account a minimum of $500 within 180 days of opening it.

- Existing Wells Fargo customers or those seeking a breadth of financial services and branch locations.

Wells Fargo Intuitive Investor Drill Down

Fees

Wells Fargo Intuitive Investor comes with the following fees:

- Annual advisory fee at 0.35% of your account value (discounted to 0.30% when linked to a Well Fargo bank portfolio). It is charged quarterly and covers investment account management and a range of advisory services, including unlimited guidance calls to financial advisors.

- Portfolio’s estimated expenses cover the costs of buying and selling ETFs. You can check the estimated expense ratios for the nine investment portfolios offered by the Intuitive Investor program; these ratios vary between 0.07% of assets for a conservative income portfolio and 0.15% for an aggressive growth portfolio.

- Account transfer and termination fees include an IRA termination fee ($95), an outgoing account transfer fee ($95), an outgoing domestic wire transfer fee ($30), and an international wire transfer fee ($40).

Minimum Investment

The minimum investment required to open an Intuitive Investor account is $500.

In contrast, Schwab Intelligent portfolios, requires a $5,000 minimum. But, in contrast with Wells Fargo, Schwab offers fee-free digital investment management.

While SoFi Invest offers financial advisors, zero management fees and a one dollar investment minimum.

Tax-loss Harvesting

Intuitive Investor account offers optional tax-loss harvesting monitoring for opportunities to lower your tax liability. The (optional) tax-loss harvesting service is included in the annual advisory fee.

Tax loss harvesting only applies to taxable investment accounts.

Portfolio Automation – Rebalancing

Investing with the Intuitive Investor program is highly automated, and sophisticated algorithms monitor your account allocations daily and ensure that these are on track- rebalancing them when necessary. Algorithms track the individual funds in your portfolio, looking for misalignment between your portfolio and your stated goals.

You can also automate your investment portfolio contributions by setting up a recurrent transfer.

Top Robo-Advisors

Desktop and Mobile Experience

Intuitive Investor is part of the Well Fargo Advisor site. It’s easy to find Wells Fargo Intuitive Investor with a quick search. Finding the program from within the Wells Fargo financial advisor site home page is trickier because the Intuitive Investor is one among many offerings.

The website is mobile-ready and is easy to read, navigate, and use on mobile phones and tablets.

There is no dedicated Wells Fargo Intuitive investor app. Thus, you’ll need to wade through the app to to track your robo investing investments.

The website is wholly mobile-ready and is easy to read, navigate, and use on mobile phones and tablets.

There is no dedicated Wells Fargo Intuitive investor app, thus you’ll need to wade through the platform to track your investments.

Wells Fargo Customer Service

Wells Fargo Intuitive Investor customer service is available during weekdays 8:00 am to 8 pm ET. Although, you might need to wait up to four or five minutes for your call to be answered.

Wells Fargo Intuitive Investor offers a comprehensive FAQ section but no live chat.

User Experience – Sign-up

In order to uncover your recommended portfolio, you’ll need to complete basic demographic information which includes your Social Security number. This is a drawback for those that want to view a proposed investment portfolios before investing.

Next, complete a simple questionnaire to assess your aims, risk tolerance, and time horizons. After that, the system recommends one of the nine pre-set portfolios. You will choose between globally diversified and ESG portfolios. There are a range of portfolios for various risk tolerance levels, described below.

Robo-advisor Security

Security at Intuitive Investor is up to industry standards, using 256-bit SSL encryption and two-factor authentication for desktop and mobile functions. Wells Fargo also guarantees fund replacement if the site or account is hacked. The Wells Fargo Advisors Financial Network provides access to Securities Investor Protection Corporation (SIPC) and excess insurance.

This insurance does not guard against the normal changes in investment values.

Investing Strategy

Your recommended portfolio includes up to 11 exchange-traded funds (ETFs), carefully selected to meet your recommended asset allocation and intended portfolio objective.

In addition to traditional low-cost ETFs that seek to track market-weighted indexes, Wells Fargo Intuitive Investor also offers ETFs designed to track the performance of alternatively weighted indexes, such as equally weighted, fundamentally weighted, and volatility-weighted indexes, to achieve higher returns and better long-term diversification.

Some of these funds are called Smart Beta, also available at Betterment and Personal Capital.

Intuitive Investor Asset Classes

Equities

- US Large Cap

- US Mid Cap

- US Small Cap

- Developed International

- Emerging Markets

Fixed Income – Bonds

- US Investment Grade

- Emerging Market Debt

- Domestic High Yield

- Developed International Debt

Real Assets

- Global Real Estate (REITs)

Once you have selected your portfolio, investments are entirely passive – the only thing you must do is continue contributing to your Intuitive Investor account. The portfolio will be regularly rebalanced to maintain your preferred asset allocation.

You can automate your contributions as well.

Of course, you can always change your asset allocation, as your situation evolves.

Investment Portfolio Strategy and Styles

Wells Fargo Intuitive Investor offers core Globally Diversified and Sustainably focused (ESG) portfolios. The difference between the two strategies is that the ESG portfolios integrate Environmental, Social and Good Governance metrics when choosing the ETFs to include in the portfolio construction.

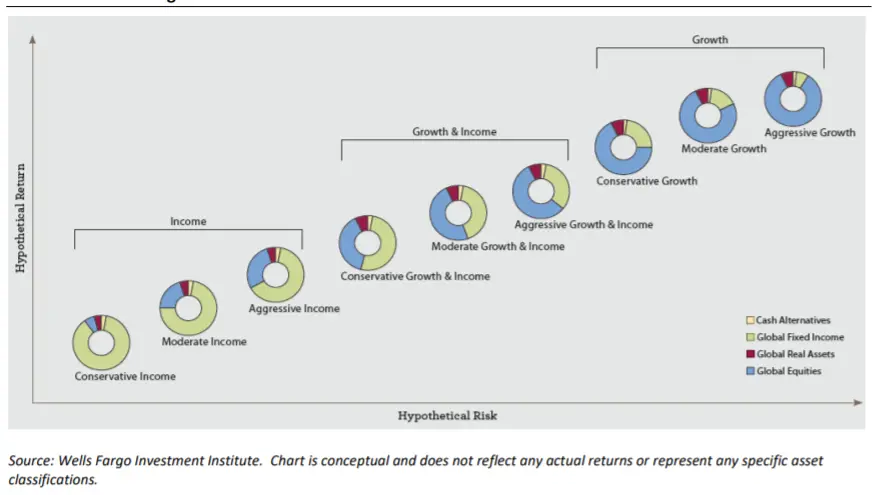

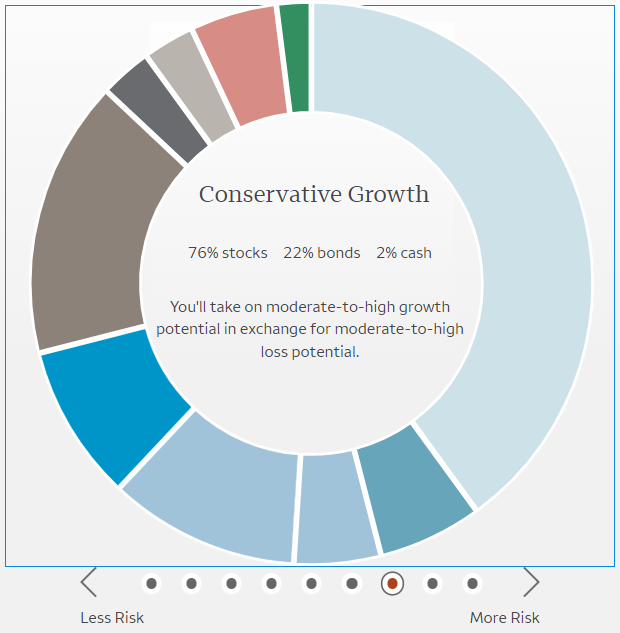

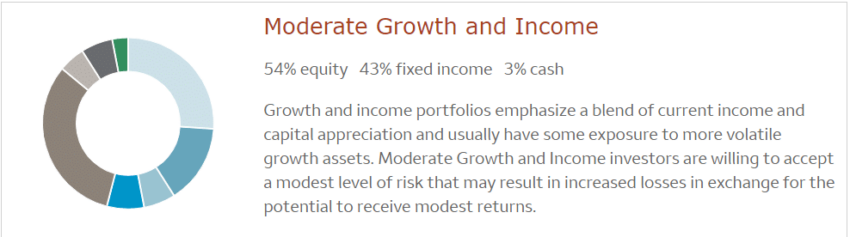

Apart from deciding between ESG or globally diversified, the recommended portfolio will have a recommended risk level. The risk levels include varying degrees stock vs bond ETFS.

Sample types of portfolios – based upon your risk tolerance and financial goals:

- Income (more bonds than stocks)

- Growth and Income (balanced bonds and shares)

- Growth (more stocks than bonds).

Each type further comprises three portfolios. For instance, you can select from three ‘Income’ portfolios, e.g., conservative, moderate, and aggressive.

The image above is an example of an asset allocation or mix for the moderate investor who selects the “Growth and Income” style investment portfolio.

The following is the asset allocation for each investment strategy for the three types of investors – conservative, moderate, and aggressive.

Sample Asset Allocation for Income, Income and Growth, and Growth Portfolios

Wells Fargo Robo Asset Allocation

We would prefer it if Wells Fargo listed the actual investment funds on the website.

Wells Fargo Intuitive Investor Pros and Cons

There is much to recommend the Intuitive Investor program, and there are also features on which we are not keen.

Pros

- Fully automated investment portfolios.

- Excellent offering of strategies and ETFs.

- Tax loss harvesting available for taxable accounts.

- Wide range of accounts.

- Reasonable fee for automated robo investing with financial advisor access.

- Easy access to financial advisors.

- Access to branches and other services at Wells Fargo.

Cons

- Sign up process is clumsy.

- Required to input Social Security number and personal information in order to review investment portfolios.

- The Intuitive Investor website lacks transparency into the investment philosophy and ETFs.

FAQ

Is Wells Fargo a good place to invest?

What is Intuitive Investing?

Are Wells Fargo Advisors good?

How do Wells Fargo Advisors help clients?

Wrap Up

The Wells Fargo robo advisor is a solid addition to the firm’s arsenal of banking, investing and lending products. Like most automated investment advisors, Wells Fargo Intuitive Investor lives up to its promise to simplify investing while preserving the personal and human touch. With a lowered investment minimum of $500, the robot investor is accessible to all but the smallest investors. Those just getting started might consider SoFi Invest or M1 Finance, with a $100 minimum.

We’re somewhat concerned about the website’s lack of transparency. The tendency to cross sell products, while annoying, is not uncommon among competing platforms.

My verdict on the Intuitive Investor is that it automates investing and makes it easy and offers financial advisory services along with tax loss harvesting for a reasonable 0.35% fee. The platform might be best suited for existing Wells Fargo customers who can benefit from the synergies among services.

Direct access: Wells Fargo Intuitive Investors website.

Wells Fargo Intuitive Investor vs SoFi Invest

Ultimately, deciding whether to invest with Wells Fargo Intuitive Investor or not, depends on the opportunities it offers and how these opportunities compare with those provided by other providers.

Here is an ‘at a glance’ comparison between the Intuitive Investor program and SoFi Invest.

The management fee of Intuitive Investor is higher than the fee-free SoFi Invest. Although, Wells Fargo offers branch access and 24/7 customer service.

Additionally, the minimum amount is a significant difference between these two robo-advisor platforms. Hence, the choice may depend on your ability to invest $5,000 and how important branch access is to you.

Related

- US Bank Automated Investor Review

- Ally Invest Cash-Enhanced Managed Portfolios Review

- Personal Capital Review

- Betterment Socially Responsible Investing Review

- Chase You Invest Review

- Marcus Invest Review

- T.Rowe Price Robo Advisor Review

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable