What is the E*TRADE Robo-advisor?

E*TRADE Core Portfolios from Morgan Stanley is the E*TRADE robo-advisor investment management program. E*TRADE automatic investing provides professional investment management with a competitive fee structure and strong customer service.

E*TRADE Core Portfolios combines various asset classes, or types of investments, to create a low-fee diversified mix of exchange traded funds (ETFs). Following the proven Modern Portfolio Theory (MPT), E*Trade Core Portfolios combines U.S. stock, international stock and bond funds to minimize risk and increase returns.

According to the company, “Sometime in the latter half of the second quarter of 2023, ETCM [E*TRADE Capital Management] will close Core Portfolios to any client that does not hold an existing account at E*TRADE. ” Also, mid-2023, new Core Portfolios clients will need to open a Morgan Stanley Smith Barney Brokerage account prior to opening the Core Portfolios account.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Based on your answers to their Investor Profile Questionnaire, E*TRADE Core Portfolios creates a managed portfolio which incorporates your objectives, risk tolerance and time horizon to determine an appropriate mix of investments for you.

-

Fees

(4)

-

Investment Choices

(4)

-

Ease of Use

(4.25)

-

Tool & Resources

(4.75)

E*TRADE Core Portfolios Review

E*TRADE Automatic investing through Core Portfolios provides well managed, diversified investment portfolio to Morgan Stanley Smith Barney and E*Trade customers.

Pros

- accessible customer service

- Smart beta and socially responsible funds

- Access to low-cost self-directed investing and banking

Cons

- No tax-loss harvesting

- Higher comparative management fee

Features at a Glance

Who is the E*TRADE Robo-advisor Best for?

E*TRADE Core Portfolios is best for the person who wants a basic digital investment manager that is part of a large financial firm. The E*TRADE automatic investing handles all facets of your investing, in accord with your goals and risk level.

Current E*TRADE customers seeking low fee investment management might consider E*TRADE Core Portfolios.

E*TRADE is also great for active traders, DIY investors, and those seeking a portion of their investments digitally and efficiently managed. The vast products and services offered by the E*TRADE brokerage firm, make this an ideal platform for anyone seeking an investment management robo advisor and:

- Actively managed accounts

- DIY investing

- Portfolio recommendations

- Banking

- Diverse account types

- Mutual funds, Stocks, ETF, bond trading and more

The E*Trade Core Portfolios is a strong competitor with the Schwab, Fidelity Go, Vanguard Personal Advisors and investment firms’ digital investing platforms.

Features Drill Down

Fees and Minimums

The minimum investment for E*TRADE Core Portfolios is $500. This is a competitive minimum investment amount and lower than some of the big firm competitors.

Portfolio fees include an overall management fee and trading commissions.

In addition to the annual advisory fee of 0.30%, which is prorated and paid quarterly, you will also pay fund related expenses, such as ETF fund management fees. However, these secondary fees are typical and are paid to the fund company, not to E*TRADE. In fact, any time you buy an exchange traded fund (ETF) or mutual fund, you’ll pay a small management fee.

Sign-up Process

The first step in opening an E*TRADE Adaptive Portfolios account is to complete the Investor Profile Questionnaire. In it, you will be asked a series of questions that will inform your Investor Profile.

The investor profile questions cluster around these areas:

- When you’ll need the money, how long it should last, and your goal.

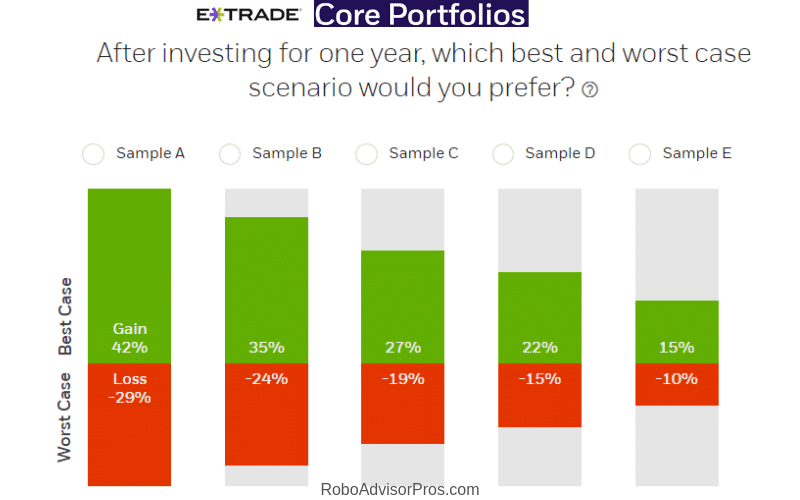

- Your preferred sample portfolio, based upon hypothetical one-year results. The five examples show distinct return and loss expectations. They range from aggressive to conservative.

- Several risk questions aid your comfort with potential losses.

After investing for one year, which best and worst case scenario would you prefer? As the image shows, the greatest potential returns also include a larger potential for losses. The most aggressive portfolio suggests a best case scenario of a 42% gain and a comfort with a -29% loss.

Once you complete the questionnaire, your Investor Profile portfolio recommendation is created.

My answers yielded a balanced, 60% stock, 40% bond portfolio-right in line with my current target asset allocation!

How E*TRADE Core Portfolios Works

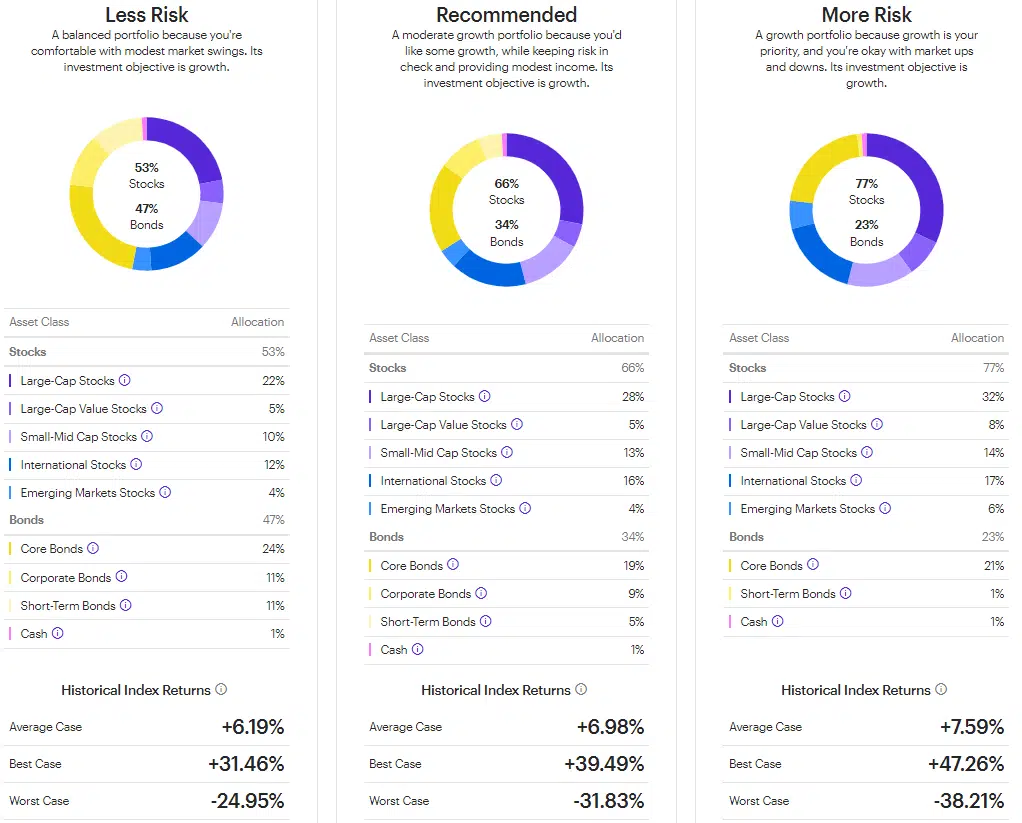

The chart below shows a recommended portfolio, alongside a lower and higher risk option. We like that you can take the financial and risk questionnaire and view sample portfolios before signing up and funding an account. Additionally, if you have any questions, you can call he Core Portfolio support team.

The asset mix includes categories of stocks and bonds, such as large-cap stocks, small-mid cap stocks, international stocks, core and corporate bonds, and cash. The specific funds aren’t revealed until the account is opened.

We like the investment questionnaire and believe it’s informative and comprehensive. The comparison feature of more and less risky portfolios is helpful.

After completing the questionnaire, you can open your Core Portfolios account and fund it. You always have the option to change your Investor Profile, which is your aset mix, by changing your answers to the questionnaire.

Investment Mix

Your portfolio is based on your stated investment objectives, your time horizon and your risk tolerance. E*TRADE uses a detailed Investor Profile Questionnaire to make this determination. In fact, the investor questionnaire asks more depthful questions than most competitors (with the exception of Wealthfront’s PATH questionnaire, that attempts to replace a human advisor.)

E*TRADE Core Portfolios offers three categories:

- Core – This is the basic passive index fund investing strategy, with diversified asset classes and an asset allocation in line with your goals, time line and risk tolerance..

- Socially Responsible – This investment style considers a company’s social, environmental and corporate governance impact in addition to returns.

- Smart Beta – This investment style seeks to outperform typical index fund investing by constructing passively managed investment funds based on criteria expected to perform well. Sample criteria includes value stocks, equal weight index funds, or dividend focused index funds.

The investment options are quite varied and include:

- Large cap stocks

- Small- and mid-cap stocks

- Emerging market stocks

- International market stocks

- Core, corporate and short term bonds

For taxable accounts, the E*TRADE Core Portfolios offers tax-sensitive ETFs to minimize taxes. Although, there is no tax-loss harvesting.

The portfolios provide regular automatic rebalancing. They also rebalance when the asset percentage deviates too much from the target.

E*TRADE Core Portfolios Returns

As with any platform, your returns vary, based upon the performance of the underlying ETFs. And, past returns do not imply similar future returns.

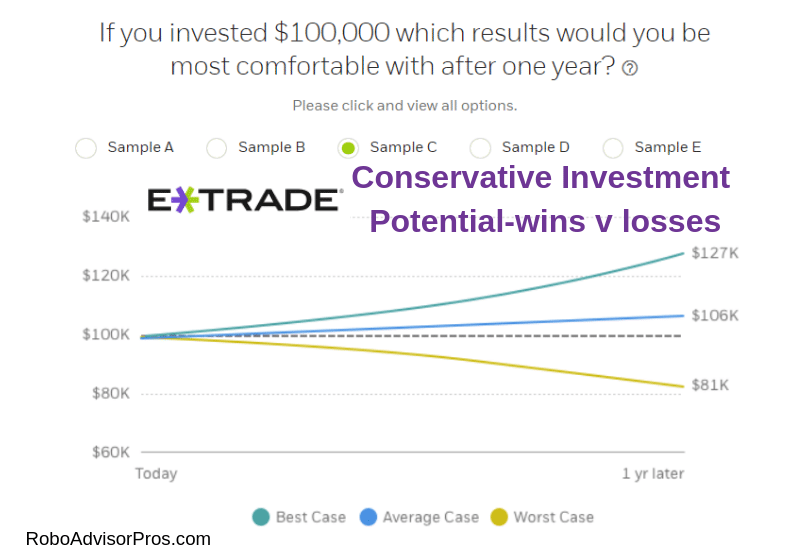

That said, we particularly like that the preliminary questionnaire includes best and worst outcome for five sample portfolios. This information provides an idea of potential returns.

For instance, the middle choice (between most conservative and most aggressive options) suggests that the best-case return for a $100,000 investment would be a $127,000 portfolio value at the end of the year. On the other hand, the worst case outcome would be an $81,000 value at the end of the year, with a $19,000 loss. The expected one-year return is pegged at a reasonable 6% for a $106,000 investment portfolio value.

Account Types

The Core Portfolios offer a reasonable variety of accounts:

- Taxable brokeage accounts include – individual, joint, and custodial.

- Retirement accounts include – Rollover, Traditional, Roth, and SEP IRAs

The Core Portfolio accounts are adequate, although if you’re seeking trust accounts and other types of business accounts you’ll need to visit other services like Betterment or M1 Finance.

Top Robo-Advisors

Are E*TRADE Core Portfolios Safe?

All accounts are covered by SIPC, for up to $500,000 in cash and securities, including up to $250,000 in cash. SIPC coverage protects against broker failure, not against losses due to market factors. Additional coverage is available through London insurers.

Is E*TRAde insured? Understand that only bank savings accounts offer FDIC insurance.

Mobile App

Investors have mobile access through both Android and iOS devices, making it easy to track investments whenever you want. Although, the E*TRADE core portfolios are included in the general app and don’t have a separate mobile platform. E*TRADE also gives monthly commentary on market trends that help you see what movement might affect your investments.

Customer Service

The designated E*TRADE Core robo advisory support team is available Monday through Friday 8:00 am to 8:30 pm ET. The support team are all registered as broker dealer regulated representatives. They are well trained in the platform as well as licensed financial professionals. This is not the same as a designed financial advisor.

Pros and Cons

Advantages

E*TRADE Core Portfolios has more in common with it’s competitors than not. Yet, there are several advantages that set this platform apart.

- The ability to engage in self-directed investing, with the option to move some or all of your portfolio over to the E*TRADE robo-advisor Core Portfolios. This is similar to Schwab, Fidelity and other investment broker created robo-advisors.

- The opportunity to invest in smart beta and socially responsible funds is a plus.

- You have the ability to change your Investor Profile, strategy, and asset allocations at any time.

Disadvantages

- A drawback of E*TRADE Core Portfolios is that tax-loss harvesting is not offered. This is not a “deal breaker” for many investors, but it has become a common offering by many similar services, and its absence could be seen as negative.

- The platform doesn’t offer financial advisors.

- The annual management fee of 0.30% is slightly above standalone shops like Betterment and Wealthfront, each of which charges a 0.25% annual fee. And Schwab Intelligent Portfolios and SoFi Automated Investing (with financial advisors) offer their basic robo-advisory services for free.

- You must open a brokerage account before opening the Core Portfolios account, beginning mid-2023.

E*TRADE Core Portfolios Review – Wrap Up

The E*TRADE robo-advisor is a solid platform. The membership in the Merrill Lynch Smith Barney family affords investors many other investment options.

You can use E*TRADE for self-directed investing – and it’s one of the better platforms available – and hold some of your money in the managed portfolios.

Bonus; 6 Impact Investing Robo-Advisors and Apps – Do Good and Build Wealth

The opportunity to invest with socially responsible strategies offers investors the chance to align their money and their values. While the actively managed smart beta factor based investment strategy is appropriate for those who strive to outperform the market.

Other services that offer an element of active and passive management include M1 Finance and Zacks Advantage.

E*TRADE Core Portfolios is a solid solution for the investor who wants the benefit of low-cost portfolio management, with investing style variety and good customer service options.

For more information visit the website.

Comparison – Empower and Wealthfront

Related

- Wells Fargo Intuitive Investor Review

- Zacks Advantage Review

- Morgan Stanley Access Investing Review

- Chase You Invest Review

- Rebalance360 IRA Review

- Webull Robo Advisor Review

Sources

- https://www.morganstanley.com/press-releases/morgan-stanley-closes-acquisition-of-e-trade

- https://us.etrade.com/knowledge/library/getting-started/is-a-robo-right-for-you

- https://us.etrade.com/frequently-asked-questions/core-portfolios

- https://content.etrade.com/etrade/estation/pdf/Wrap_Fee_Programs.pdf

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable