Morgan Stanley Robo Advisor – Is it Right for You?

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

While stand-alone robo-advisors like Betterment and Wealthfront continue to perform well, add new features, and grow in assets and clients, some investors still prefer a robo-advisor back by an established financial institution. This is where the Morgan Stanley robo-advisor comes into play.

If you’re an investor who wants a no-frills robo-advisor, this review will show you how Morgan Stanley Access Investing manages your money in a simple, straightforward way.

[toc]

If you’re concerned that your investments might not align with your values, this review will take you through the portfolio themes and impact investing options available through Morgan Stanley Access Investing.

If you’re looking for a robo-advisor backed by an established firm or if you want to move to full-service investing someday, this Morgan Stanley Access Investing review will tell you exactly how Access Investing can help you do that.

Morgan Stanley Robo Advisor Review

-

Fees

(3)

-

Investment Choices

(5)

-

Ease of Use

(4)

-

Tool & Resources

(3)

Summary

Best for:

- Current Morgan Stanley customers

- Clients with relatively uncomplicated financial needs.

Pros

- Specialized investing themes and impact investing portfolios.

- Active and passive investment styles.

- Easy gateway to full service financial company.

Cons

- Relatively high fees and invetment minimum, in contrast with competition.

- No financial advisors.

What is Morgan Stanley Access Investing?

Founded in December 2017, the Morgan Stanley robo-advisor Access Investing is a completely digital investment tool that balances active and passive investment strategies. This robo is backed by Morgan Stanley Smith Barney LLC, a well-established investment and brokerage company.

The Access Investing arm of Morgan Stanley is a virtual advisor, which means it relies on clients’ self-reported financial goals and robo-advisor algorithms to calculate recommended investment portfolios.

While the robo-advisor is managed by Morgan Stanley, it does not use human financial advisors to help clients plan their investments. Despite this perceived limitation, Morgan Stanley customer reviews indicate that users are overall pleased with the company’s offerings.

The Morgan Stanley virtual advisor balances active and passive investment strategies in an effort to beat the market and provide clients with a well-rounded investment strategy. They couple this strategy with themed investment portfolios, so you always know your investments are working with industries and initiatives you value.

In this Morgan Stanley Access Investing review, you will learn:

- How Morgan Stanley Access Investing works

- Who benefits from Morgan Stanley Access Investing

- Whether the Morgan Stanley robo-advisor is right for you

Features at a Glance

| Overview | Access Investing is a digital-only investment service backed by investing powerhouse Morgan Stanley. Clients identify and invest in goals, including major purchases, building wealth, and retirement. |

| Minimum Investment Amount | $5,000 |

| Fee Structure | 0.35% AUM. Mutual funds and other investments may include additional fees. |

| Top Features | Three distinct portfolio options (Impact, Market-Tracking, and Performance-Seeking); fully-managed portfolios; themed portfolios. |

| Free Services | N/A. |

| Contact & Investing Advice | Account and technical support available via phone. Access Investing clients do not have access to investing advice |

| Investment Funds | ETFs and Mutual Funds. |

| Accounts Available | Personal taxable accounts, Traditional IRAs, Roth IRAs. |

| Promotions | N/A |

Who is Morgan Stanley Robo-Advisor Best for?

The basic investor: The Morgan Stanley virtual advisor offers the basic robo-advisor features, making it great for individuals who have simple, uncomplicated financial situations. This robo covers all the basics you might want, such as tax-loss harvesting and portfolio rebalancing, without any of the frills.

The digital-friendly investor: Morgan Stanley Access Investing does not offer access to human financial planners. All Morgan Stanley robo-advisor clients will need to be comfortable making their own investment decisions with the help of the virtual advisor alone.

Impact investors: Do you want your money to make a difference? Morgan Stanley Access Investing allows investors to create portfolios that support companies that integrate environmental, social, and governance factors. These companies benefit gender diversity initiatives, clean energy, and more.

Investors who may want full-service financial advice in the future: The Morgan Stanley virtual advisor may be good for now, but what if you want to work with a human financial planner in the future? Fortunately, Morgan Stanley already predicted that need. Considered an “entry tool” to full-service advising, the Morgan Stanley robo-advisor can help you establish your investing portfolio and transition to full-service investing when and if you want more investing tools or support.

Investors with a high minimum investment: The minimum investment amount is $5,000, making Morgan Stanley Access Investing out of reach for many beginning investors.

Morgan Stanley Access Investing Drill Down

Fees

Morgan Stanley customers will pay 0.35% AUM for their Access Investing accounts. There may be additional fees as well, depending on the investments clients choose and whether or not trading fees are involved.

The Morgan Stanley mangement fee for Access Investing is similar to Fidelity Go and higher than the free Ally Invest and M1 Finance.

Minimum Investment

A $5,000 minimum investment is required to get started with Access Investing. If that seems too steep, there are many other robo-advisors on the market with lower minimum investment requirements.

Tax-Loss Harvesting

Tax-loss harvesting is available to Access Investing available to clients. Tax-loss harvesting is the process of selling off investments at a loss to offset taxes on capital gains. This is a pretty common feature with robo-advisors, though not all offer it.

Portfolio Rebalancing

Morgan Stanley monitors accounts and offers frequent portfolio rebalancing. They also alert clients via email when they rebalance accounts, so clients stay in the loop.

Morgan Stanley Customer Reviews and Service

Customers will be happy with the Morgan Stanley website, which is optimized to be read on a desktop or a mobile phone. However, they do not advertise their mobile apps on the website; this makes it difficult for customers to know where to find these apps.

Another limiting factor is that Morgan Stanley does not list customer service hours on their website, nor do they have a chat feature—something which comes near-standard for many robo-advisors nowadays.

User Experience—Sign-Up Process

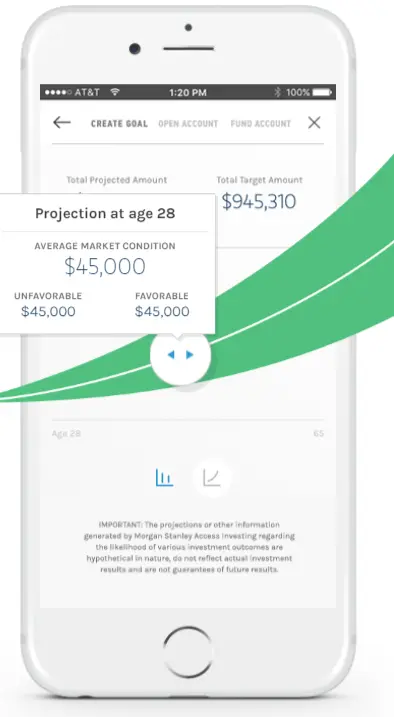

The Access Investing sign-up process is straightforward and easy to use. One of the best parts about this process is that you don’t even need to enter your personal information until after you’ve seen your recommended portfolio and its projected growth. This also makes it easy to change your answers before committing to Access Investing.

Access to Human Financial Advice

Morgan Stanley Access Investing is a robo-advisor in the truest sense: clients will not have access to human financial advice with this service. Unlike a robo-advisor like Schwab Intelligent Portfolios, which allows clients to upgrade to premium services for an additional fee, the Morgan Stanley robo-advisor requires clients to jump to full-service membership if they want access to human financial planners.

Robo-Advisor Security

Morgan Stanley Access Investing is a member of the Securities Investor Protection Corporation or SIPC. They protect your account from default for up to $500,000.

The robo-advisor also offers 256-bit SSL encryption on their website and a two-factor authentication on their mobile apps, which meets industry standards for safety and security.

Investing Strategy

One of the neat features of Morgan Stanley Access Investing is its investment strategy. They offer clients ways to invest in initiatives or industries they value; clients can also choose research-driven investment strategies that seek maximized returns or minimized fees.

Active, Passive, or Active-Passive Investments?

Actively managed investments rely on human financial planners or portfolio managers to supplement robo-advisor algorithms with research to outperform the market – or at least to try to.

Passive investments, on the other hand, run almost on their own. This is the strategy used by most robo-advisors because it is the cheapest; these savings are then passed directly to the client by way of reduced account management fees.

The majority of robo-advisors use a passive intestment style and seek market-matching returns. This is actually a well respected investment strategy as passive investing strategies have a strong record of solid long term returns.

Morgan Stanley Access Investing is built on the principle that an active-passive approach is the best investment strategy. As such, this robo-advisor is designed to give you a blend of mutual funds and ETFs that use both strategies.

Portfolio Types

There are three distinct portfolios types available to Morgan Stanley customers:

- Impact Portfolio. This portfolio is best for clients who value companies that align with environment, social, and governance factors. These portfolios are designed to create value in the long term while avoiding risk.

- Market-Tracking Portfolio. This portfolio is best for those who want diversified portfolio made up of only ETFs. The goal of this portfolio is to have a blended, diverse market index that contains funds from various asset classes and global markets.

- Performance-Seeking Portfolio. This portfolio is best for investors who want to try to beat the market. This portfolio combines ETFs and mutual funds in an attempt to outperform the current market.

This is one of our favorite features of this robo-advisor, the opportunity to invest in more than one investment style.

Investing Themes

A portion of clients’ portfolios can be directed toward a theme that aligns with their goals or values. Morgan Stanley has many options available, including:

- Climate Action, which is good for investors who value companies dedicated to solving climate change or those that avoid harming the environment

- Defense and Cybersecurity, which is good for investors who want to support companies or sectors that protect against security threats.

- Emerging Consumer, which targets investments in economies where an increase in middle class spending is expected to grow.

- Gender Diversity, which is ideal for investors who value companies with diverse management and initiatives that have programs or policies to support women.

- Genomics and Bio-Medicine, which supports scientific research on treatments for diseases.

- Global Frontier, which is good for investors who want to target growth opportunities in less-developed economies.

- Inflation Conscious, which is ideal for clients who want to ensure their investments grow at or better than the pace of inflation.

- Robotics, Data, and AI, which is good for investors who value development in the fields of artificial intelligence, robotics, or data analysis.

Morgan Stanley Access Investing Pros and Cons

Pros

- All-digital investment advice means that your investments are accessible 24/7.

- Impact and themed investment portfolios give you added customization.

- Supported by the investment know-how of Morgan Stanley.

- Ongoing portfolio monitoring keeps clients in the loop about portfolio performance and anticipated changes to their investments.

Cons

- No access to human financial planners may be a downside to Morgan Stanley Access Investing. Clients will need to upgrade to full service in order to get investment advice.

- Limited account types: individual taxable accounts, Traditional IRAs, and Roth IRAs are currently the only options.

- Minimal details available on their website. FAQs are brief and provide only bare-bones answers in most cases.

- Unclear customer services availability. The Morgan Stanley Access Investing website lists a phone number, but no operating hours.

FAQ

How much money do you need to invest with Morgan Stanley?

Is Morgan Stanley a good place to invest?

Morgan Stanley is also a robo-advisor with socially-responsible investing options. Clients who want to invest in business that focus on clean energy and gender equality would benefit from investing with Morgan Stanley Access Investing.

On the other hand, investors who want a more diverse account offering would benefit from looking elsewhere – Morgan Stanley Access Investing only had three basic account types: individual taxable accounts, traditional IRAs, and Roth IRAs.

How do I invest in Morgan Stanley?

After you have answered all the questions, Morgan Stanley will recommend a portfolio allocation and show you an estimated rate of return. At that point, you will be prompted to enter your personal details to create an account.

Does Morgan Stanley have mutual funds?

Wrap Up

So, is Morgan Stanley Access Investing right for you?

This is a no-frills robo-advisor, that offers tax-loss harvesting, regular portfolio monitoring and rebalancing, and the opportunity to invest in themes and socially-responsible investment opportunities. Their blended active-passive approach to investing stands out in terms of diversity and adaptability.

The $5,000 minimum investment and 0.35% AUM account management fee put Morgan Stanley Access Investing on the more expensive end of robo-advisors. Without access to human financial planners, investors who want a simple robo-advisor might opt for something like M1 Finance, which offers greater customization options for no account management fees and a $100 minimum investment.

Overall, we think that Schwab, with zero management fees, Betterment, Wealthfront or other robo-advisors offer more features and lower fees and lower investment minimums.

Comparison

| Betterment | Access Investing | |

| Overview | A goals based automated investment advisor. Offers a variety of human financial planning options and high yield cash account. | An all digital investment manager with active and passive investment strategies. |

| Fees and Investment Minimums | Digital-Zero minimum. 0.25% AUM up to $2 million. 0.15% for accounts over $2 million. Premium-$100,000 minimum. 0.40% AUM up to $2 million-Includes unlimited access to CFP. 0.30% for accounts over $2 million. A la carte financial planning sessions from $199 to $299. | $5,000 minimum. 0.35% AUM management fee. |

| Best for: | All levels of investors. Small investors seeking zero minimum. Investors seeking financial advisor. All investors get access to varying levels of financial advisors. Investors seeking cash management. | Investors comfortable with all digital investing. Those seeking specialized themed portfolios. Existing Morgan Stanley customers. |

| Website | Betterment website. | Access Investing website. |

Related

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable