TIAA Robo-Advisor is Not Accepting New Clients

“The TIAA Personal Portfolio Program is a fee-based discretionary advisory service offered online through an interactive website,

TIAA Personal Portfolio – Form ADV

mobile application or other electronic platform that is used to operate the Program (the “Site”). As of May 15, 2020, the Program is no longer accepting new Program accounts. Program accounts will be managed as outlined in this Disclosure Brochure and in accordance with the agreement you entered into

upon enrollment (the “Advisory Agreement”).”

It seems like many quality robo-advisors are shifting direction and closing their doors. If you want a quality retirement planner, with low investment minimums, access to financial advisors that is designed for retirees, consider Retirable.

For help picking a robo-advisor, take the quiz:

Beginner Robo-Advisors

The addition of a robo-advisor platform with a strong emphasis on retirement savings is a natural evolution for a major financial company like Teachers Annuity Association of America, otherwise known as TIAA. The company’s name is practically synonymous with retirement plans, and they offer all types.

TIAA Personal Portfolio Robo Advisor can be used for taxable investing as well as retirement. But their goal-based investment planning makes this robo-advisor particularly user-friendly. They offer three different portfolio options, including a socially responsible investment choice. Since TIAA has been engaged in this type of investing all the way back to 1990, you can bet the socially responsible investment option will be one of the best among robo-advisors.

[toc]

To make the package even better, opening an account with TIAA Personal Portfolio gives you access to the many other financial services offered by the TIAA family.

TIAA Robo-Advisor Review

-

Fees

(3)

-

Investment Choices

(5)

-

Ease of Use

(1.5)

-

Tool & Resources

(5)

Summary

Best for:

- TIAA customers

- Investors seeking active management

Pros

- Part of TIAA family

- Many available funds

- Socially responsible funds

Cons

- High fees

- No tax-loss harvesting

- Website difficult to navigate

Features at a Glance

| Overview | Automated investment management robo-advisor platform. |

| Minimum Investment Amount | $5,000 |

| Fee Structure | 0.30% of AUM |

| Top Features | Robo-advisor with passive and active management portfolios. Can opt out of a fund if you don’t want to invest in it. Access to wide ranging financial services at TIAA. |

| Contact & Investing Advice | Available by phone Monday - Friday from 8:00 am to 7:00 pm EST. There are more than 70 experienced consultants available to help with account-related and financial questions. |

| Investment Funds | Diversified mutual funds and exchange traded funds, offered primarily by Nuveen Investments, Inc., iShares, and other TIAA affiliated funds. |

| Accounts Available | Individual and joint taxable accounts; traditional and Roth IRAs |

What Differentiates TIAA Personal Portfolio Robo-Advisor From Competitors

In addition to having your money professionally managed at a low annual fee that’s well below that of traditional money managers, TIAA Professional Portfolio offers a portfolio option that invests in socially responsible companies. This is a growing trend throughout the investment industry, but TIAA has been offering impact investing funds longer than most of its competitors.

Personal Portfolio also benefits from being part of the TIAA family. TIAA is one of the largest financial institutions in the country. The firm currently manages $1 trillion.

TIAA offers a full range of financial products, including the following:

- Banking – includes high interest checking and savings accounts, money markets, CDs, and home financing.

- Investing – in addition to Professional Portfolio, they also offer retirement plans and annuities, brokerage and trading, 529 education savings, and various managed investment accounts.

- Insurance – term and whole life insurance and annuities

As one of the world’s largest financial institutions, TIAA is virtually a one-stop shop for all your financial needs.

Who Benefits from the TIAA Personal Portfolio Robo-Advisor?

If you’re looking to invest your money, but have no experience or desire to do so yourself, TIAA Personal Portfolio is an excellent low-cost platform, with a 0.30% fee. You can have a $20,000 portfolio managed for just $60 per year. That will include portfolio selection, rebalancing, and portfolio adjustments as necessary. All you’ll need to do is fund your account.

It’s also an excellent platform if you’re interested in socially responsible investing – and a growing number of investors are. TIAA Personal Portfolio has a portfolio option dedicated to just that.

Short on cash? 5 Free Robo-Advisors

If you’re looking for one institution to handle all of your financial needs, the TIAA robo-advisor might be for you. For example, you can do your banking and purchase life insurance – and even get home financing – through the same company you invest your money with.

Other one-stop-shop robo-advisors include Schwab, Vanguard, and Fidelity Go robo-advisors.

TIAA Personal Portfolio Robo-Advisor Drill Down

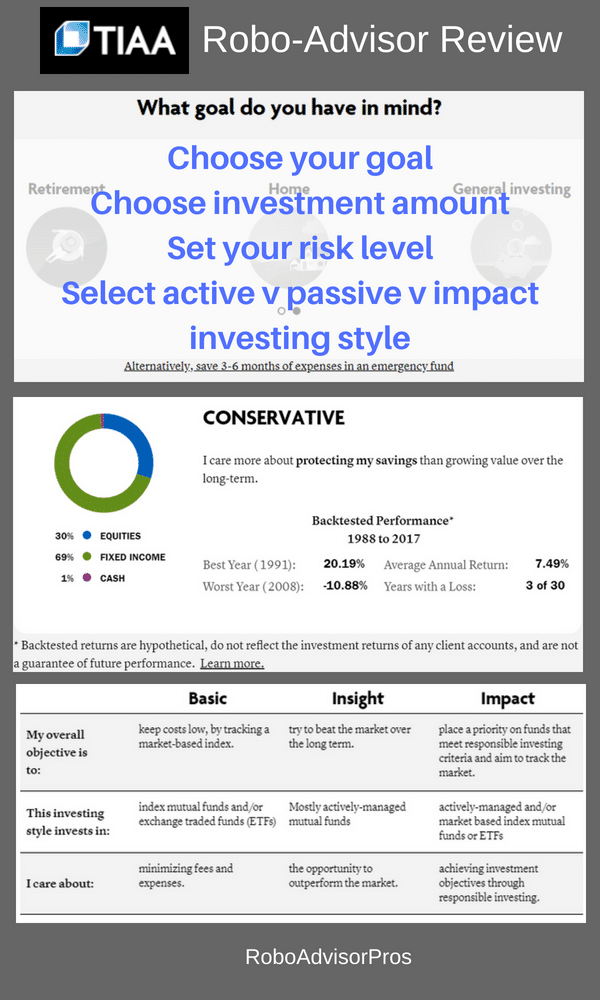

TIAA Personal Portfolio offers three types of portfolios: Basic, Insight and Impact. Each involves a distinct investment style, based on the investor’s goals and risk tolerance.

1. TIAA Personal Portfolio Basic

This portfolio option involves passive investing, which is typical of the majority of robo-advisors, like Betterment and Wealthsimple. The fund works to track the market, rather than attempting to outperform it through active investment management.

This portfolio is considered the cost-saving option because it is composed of index funds, which have lower turnover ratios and lower expenses than their actively traded mutual fund cousins. Index fund investing typically outperforms actively managed portfolios.

2. TIAA Personal Portfolio Insight

This option is the opposite of Basic. It uses active investment management, which means as investment managers select funds in an attempt to outperform the general market over the long term. Because they’re actively managed funds, they contain higher fund expenses than index funds.

3. TIAA Personal Portfolio Impact

This is TIAA’s actively managed socially responsible portfolio. The Impact portfolio targets two goals: investing in funds that meet socially responsible investment criteria and tracking the market. This is consistent with TIAA’s long history – going back to 1990 – of offering socially responsible funds.

This option can also be actively managed and attempts to select investments based on environmental, social and governance related criteria. It excludes investing in companies that investors might consider objectionable. But more specifically, it seeks to invest in companies that provide long-term value creation, while delivering economic, social and environmental sustainability. It has a dual objective of “doing good, and performing well”.

Fees and Investment Minimums

All TIAA Personal Portfolio options require a $5,000 minimum investment amount and charge a .30% of assets under management fee. The advisory 0.30% fee is levied as a percent of your total AUM, and is charged quarterly in arrears.

There are no trading fees charged for buying and selling asset positions.

As is the case with most investment funds, there are also management expense fees charged by the issuing companies. These fees go directly to the investment firms who create the individual funds. TIAA and most robo-advisors typically offer low-fee ETFs (exchange traded funds).

Here’s where TIAA differs from competitors, they invest in their proprietary TIAA and Nuveen funds. Many of their mutual funds and actively managed funds levy higher fees. This will cause your total costs to be higher than many other platforms which stick to low-fee ETFs.

Although, within the IRA accounts, TIAA offers fee offsets, which lower your overall costs.

The TIAA $5,000 minimum investment amount is comparable to Schwab, although the Schwab Intelligent Portfolio robo-advisor doesn’t charge a management fee.

Investments

In general, the fund choices are broad and include typical stock and bond funds along with growth and value stock ETFs. The TIAA offerings include a variety of bond funds, real estate and socially conscious funds. Some of the funds are passively managed index funds while others are actively managed and try to outperform the indexes, as mentioned in the Insight portfolio section.

TIAA Personal Portfolio uses primarily “affiliated funds” in the construction of individual portfolios. Affiliated funds typically represent 90% or more of a portfolio and are comprised of the TIAA family of mutual funds, and funds managed by Nuveen Investments, Inc.

TIAA Personal Portfolio investments include both mutual funds and ETF’s. Although, the index ETFs also include iShares funds. Your portfolio can be constructed with all or any subset of these funds.

Bonus: Actively Managed Robo-Advisors Strive to Beat the Market

TIAA has a very long list of mutual fund offerings.

You can view a list of mutual funds provided by Nuveen to see what funds may be included in your portfolio.

The specific fund management fees are typically greater for actively managed funds than for vanilla index funds.

More TIAA Personal Portfolio Features

Automatic Rebalancing. Your Personal Portfolio is monitored daily. Your portfolio will be rebalanced as a result of changes in market conditions, or deposits and withdrawals to and from your account. Rebalancing will ensure that the allocation stays within the target model portfolio. Rebalancing tempers typical investment value ups and downs.

Clearing agency. TIAA Personal Portfolio uses Pershing, LLC as the program custodian. Independent clearing agencies add another layer of security to your investments. Pershing is one of the largest such agencies in the world.

Account protection. Uninvested cash, held in an interest-bearing TIAA Bank Sweep account, is FDIC insured for up to $250,000 per depositor. There is also protection provided by the Securities Investor Protection Corporation (SIPC) against broker failure for up to $500,000 in cash and securities, including up to $250,000 in cash. However, be aware that the SIPC does not protect against losses due to fluctuations in the market value of your investment positions.

Read; 6 Robo-Advisors With Financial Advisors

Financial Consultants. You are welcome to contact TIAA and speak with any of the 70 financial consultants to discuss your investments or make changes, at any time. You can discuss your account, basic financial questions, and goals with the consultants. Unlike some other platforms, TIAA does not offer a “dedicated” financial advisor, which means you may speak with a new advisor during planning calls.

Quarterly Check Ins. TIAA will contact you quarterly to inquire about your financial situation and goals. If they have changed, a new asset allocation may be recommended. We like that they remind you to revisit your initial goals.

TIAA Website. The website is difficult to navigate, and it is nearly impossible to get information about the TIAA robo-advisor from the website. Messages direct you to phone an advisor, which may be a way to further engage you with the firm. Personally, we prefer a more transparent website, with easily accessible information.

Participation revocation. TIAA can revoke your account if the balance falls below $5,000 due to your withdrawals, or if it’s determined that the program is no longer appropriate for you.

To open up an account for a TIAA Personal Portfolio you must:

- Be a resident of the United States

- Be at least 18 years old

- Have a valid Social Security number

As is usually the case with robo-advisors, your portfolio or mix of investments is based on three factors: your financial goals, your time horizon, and your risk tolerance.

As with all financial platform the TIAA login involves choosing a user ID and password.

Investors are connected with a financial consultant to guide the process.

The three-step sign up process includes:

- Set Goal

- Build Portfolio

- Open Account

Set Goal. The goal can be retirement, home, general investing, celebration, travel, or start a business. There’s also the option to save up for an emergency fund. You choose one, then move to the next screen. There, you’re asked to set a goal dollar amount, a time frame, your initial investment, and your monthly contribution.

Goal setting is a common feature of many robo-advisors, including Betterment, which has a lower fee of .25% of AUM versus TIAA’s .30%.

Check out: Betterment Robo-advisor Review

Build Portfolio. This is where your portfolio allocations are determined.

First, you choose from five different risk levels:

- Conservative

- Moderately conservative

- Moderate

- Moderately aggressive

- Aggressive

If you’re not sure which category you fall under, take a brief questionnaire to help you choose your risk level. Conservative portfolios hold greater amounts of bond funds and lesser amounts of riskier stock investments. Conversely, as you move up in risk comfort, your investments reflect increasing stock fund allocations and decreasing bonds.

Next, you’re asked if you would prefer your portfolio be comprised of index funds and ETF’s, or actively managed mutual funds. This matches up with the three types of portfolios listed above:

- Passive index fund portfolio is called the Basic

- The actively managed portfolio that strives to beat the index is called the Insight

- The socially responsible portfolio is called the Impact

A projected future value is presented, indicating the likelihood of your achieving that investment goal, based on your time horizon, initial investment, and monthly program contributions.

You can change your portfolio at any time.

Compare: M1 Finance vs Betterment – Which is the Best Robo-Advisor for Me

Open Account. Here you’ll be asked to provide the routing number for your source bank account, your address, income and net worth, date of birth, and employment information.

Once your account is up and running, it must be funded with a minimum of $5,000. This can be done either by mailing a check to TIAA Brokerage Services along with a deposit slip, or by linking your bank account to your Personal Portfolio.

Please note that third-party checks are not accepted, nor are cashier’s checks for less than $10,000.

Account Withdrawals. You can make withdrawals by selecting the “Transfer Money” option. If securities need to be sold to complete the withdrawal, the funds will take between five and seven business days to arrive at the destination account. You can also request a withdrawal check mailed to your home.

There is an important restriction on withdrawals. A withdrawal cannot cause your account balance to go below $4,500. If it does, it might trigger the participation revocation discussed earlier.

TIAA Personal Portfolio Robo-Advisor Pros and Cons

Advantages

- TIAA Personal Portfolio is a solid robo-advisor for socially responsible or impact investing.

- The availability of additional financial services from TIAA offers a one stop shop for financial matters. Although, this is not unique to TIAA and is also available at Schwab, Fidelity, Charles Schwab, Ally and more.

- Access to 70 live financial consultants during week-days make customer service a breeze.

Disadvantages

- No tax-loss harvesting is available.

- The fee structure of 0.30% is a bit high among comparable robo-advisors. Betterment and Wealthfront charge just 0.25%, with Wealthfront managing the first $5,000 for free. Among competing large broker robo-advisors, Charles Schwab Intelligent Portfolios has no management fee at all.

- The mutual and exchange traded funds’ charge higher expense ratio fees than those of most competitors. When these charges are added to the 0.30% robo-advisory fee, this fund is more expensive than most comparable platforms.

- The TIAA robo-advisor mobile app is actually a general app for TIAA. There isn’t an app specifically designed for the robo-advisor.

- The website is difficult to naviagate, and lacks a dedicated TIAA Personal Portfolio Robo-Advisor page.

TIAA Personal Portfolio Robo-Advisor Review Wrap Up

If you’re primarily interested in socially responsible investing, TIAA Personal Portfolio is a viable robo-advisor. They’ve been doing impact investing for longer than just about anyone.

And if you’re interested in adding banking services, life insurance, annuities, retirement planning or home financing through the same company, TIAA can do it all. In all, the TIAA robo-advisor is a bit more expensive than competitors, due to higher underlying fund management fees and the 0.30% TIAA Personal Portfolio management charge.

All in all, there are lower fee robo-advisors with more affordable investment funds and greater transparency.

For more information, or if you’d like to open up an account, visit the website.

Related

Robo Investment Advice Pros and Cons

- Titan Invest Review

- United Income Review

- Wells Fargo Intuitive Investor Review

- Twine App Review

- JP Morgan Robo Advisor Review

For more information about robo-advisors grab your free Robo-Advisor Comparison Chart:

Article Sources

Robo-Advisor Pros uses only primary sources for their articles. This includes original data from websites, experts, white papers, and personal interviews. We do not include secondary information, unless specifically cited.

- https://www.tiaa.org/public/pdf/TIAA_Personal_Portfolio_Advisory_Agreement.pdf

- https://www.tiaa.org/public/pdf/what-should-your-portfolio-look-like.pdf

- https://www.tiaa.org/public/invest/financial-products/investment-management

- https://www.tiaa.org/public/about-tiaa/news-press/press-releases/pressrelease681.html