Update: The Swell Invest robo-advisor closed it’s doors in July 2019. But, if you’re looking for socially responsible investing, there are many excellent alternatives. Here are a few of our favorite socially responsible investment robo advisors:

| M1 Finance | Betterment | Ellevest |

|---|---|---|

| M1 Finance Review | Betterment Review | Ellevest Review |

| Open Account | Open Account | Open Account |

| Management Fee 0.00% | Management Fee 0.25% | Management Fee 0.25% |

| Account Minimum $100 | Account Minimum $0.00 | Account Minimum $0.00 |

For more socially responsible robo-advisors read this article:

For more guidance choosing a robo-advisor, try our quick, 4 question Robo-advisor selection tool.

Choose a robo-advisor in under one minute: ROBO-ADVISOR SELECTION WIZARD

Following is the original Swell Investing Review:

Sometimes it can seem like building wealth is incompatible with ethical standards; all throughout media we are sold the message that the wealthy got where they are by taking advantage of people (Mr. Scrooge, anyone?). These unfair stereotypes may prevent some people from investing in stocks for fear of compromising their values.

The Swell App makes socially conscious investing easy!

Luckily, you don’t need to choose between building wealth or making ethical choices. Socially Responsible Investing (SRI) options abound for investors who are interested, so the only real choice you need to make will be between robo-advisors or buying individual socially responsible funds!

The Swell Investing App is one investing option for people who are interested in SRI options. With Swell, investors can choose to make a difference in their communities or the world at large.

[toc]

Swell Investing App: What is Swell?

Swell is an investing platform that targets investment options that are socially responsible. Invest in companies that provide or support clean water, healthy living, and clean air.

The platform functions as an investing advisor and investments are held in Folio Investments, Inc. brokerage accounts. Portfolio managers handle Swell investments and help ensure the investment approach each portfolio takes is appropriate to the goals of the individual investor.

Swell Investing

The SwellInvesting website offers pre-designed portfolios, including options for different breakdowns and allocations which investors can use to customize their portfolio. These portfolios are made up of ETFs (exhange traded funds) and individual or foreign stocks.

After signing up, users of the Swelll iOS app can pic from three predetermined “mixes” of Swell’s portfolios, or create their own Swell “mix”. The predetermined Swell mixes include:

• The Tech Optimist – appropriate for those who want to double down on the power of green technology.

• The Environmentalist – devoted to environmental initiatives and conservation

• The generalist – a broader option that gives you exposure to all sectors and impact areas.

Or, you can choose from the following areas and craft your own mix.

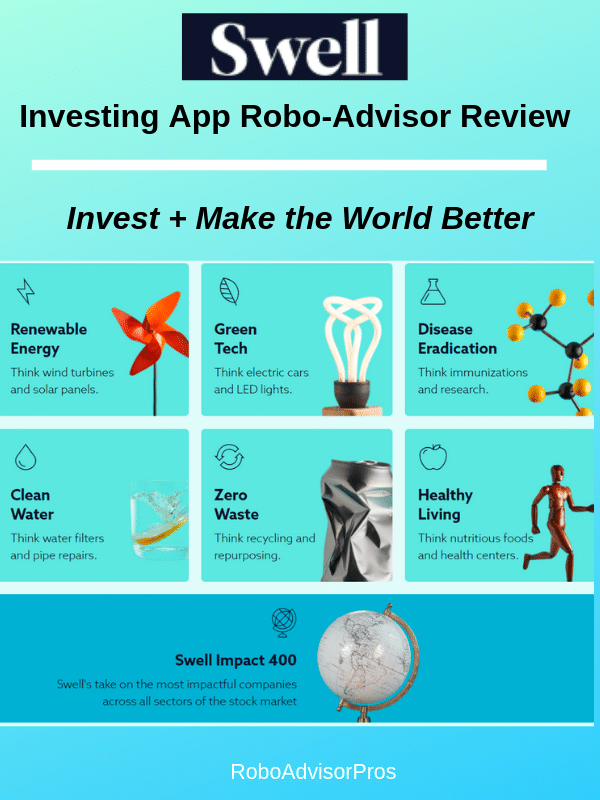

Right now there are six Swell Impact Investing portfolio options for investors to choose from—each supports a specific field or social concern:

• Green Tech

• Clean Water

• Zero Waste

• Renewable Energy

• Disease Eradication

• Healthy Living

After choosing a portfolio, investors have some limited options for customizing the stocks they hold. This allows investors to remove companies from their portfolio that don’t support their values.

One very neat feature of the Swell Investing App: investors actually own shares in the companies they support, so they have more of a voice in company decisions. This is great for people who are serious about SRI.

Swell Investing chooses companies in alignment with at least 1 of the 17 United Nations Sustainable Development Goals. The UNSDGs help governments and others tackle climate change, end poverty and fight inequalities.

The Swell Impact 400 portfolio is like a basket that holds many companies across multiple sectors and impact themes. Each company scores high on one or more Environmental, Social or Governance (ESG) factor.

Swell Review Features

Swell impact investing. While the number of robo-advisors offering SRI are rising, they are still not the norm. Investors might find that Swell is worth the higher management fees because of their attention to ethical investment options.

Invest $50 – Low initial investment. Swell is a new robo-advisor with an affordable investment portfolio for people looking to get started without much up-front capital. Investors can get started for only $50,

Automatic deposits. Since there are no trading fees involved, investors can set up small, frequent deposits so that investments grow over time. Combine these smaller deposits with Swell’s already small initial investment minimum and you can see how easy it is to start building up a strong portfolio!

An additional benefit to automatic deposits: the option to invest smaller amounts also prevent clients from worrying about saving up large amounts of money to be invested at a later date—invest what you have now for the greatest impact.

Tax optimization. Swell automatically rebalances your portfolio on occasion and after making a sale. At that time, your taxable portfolio is also examined for capital gains. Swell is designed so that shares that are showing a loss will be sold first in order to minimize the amount of taxes you pay on your gains.

What Does the Swell Investing App Cost?

One benefit to Swell is that it offers an affordable entrance point: investors only need $50 to get started. With such a low minimum balance, Swell is attractive to new investors and those who are interested in trying out investing with a small up-front investment.

On the other hand, Swell’s 0.75% AUM fee is on the higher end of some robo-advisors.

While the Swell management fee is higher than some other robo-advisors, it is all-inclusive. Investors do not pay trading fees. Additionally, Swell keeps .25% of all assets in cash form so that they do not need to sell stocks in order to cover the fee—a benefit some investors might really appreciate.

Swell Investing Promo Code

For visitors here at Robo-Advisor Pros, you get a $50 bonus when you sign up for Swell by using promotion code: ROBOADVISORPROS

That makes reading this Swell Investing Review worth your while!

Even though investing is scary, your future self will thank you for beginning your investment journey. Click now for a $50 bonus to Start Planning For Your Future!(Use promotion code: ROBOADVISORPROS)

That makes reading this Swell Investing Review worth your while!

How is Swell Customer Service?

Swell customer service is straight forward. The Swell customer service options are:

- Use the contact form on the Swell webite.

- Email directly to support (at) SwellInvesting.com.

- Use email to schedule a phone call.

How to Sign up for Swell Investing App?

The signup for the Swell Investing App is easy.

- Download the app

- Pick your Swell “mix”

- Answer a few questions

- Link a bank account and start investing!

What are the Benefits of the Swell Investing App?

Great for investors who want socially responsible investing companies. Investors in the Swell 400 socially responsible investing fund can spread a small amount of money across many impact investments. Investors who use the Swell app can be confident that while they’re growing their own wealth, they are also helping others. It’s a win win!

Low initial investment. Since investors can get started for only $50 (and get $50 with the Swell investing promotion code-(Use promotion code ROBOADVISORPROS), Swell is great for people looking to get started without much up-front capital.

Swell invest management fee is all-inclusive. There are no trading commissions, or fund management fees. This makes the fee schedule transparent.

What are the Limitations of the Swell Investing App?

Account diversity. Right now, Swell offers both individual taxable brokerage accounts and Traditional, Roth, and SEP IRAs. While you can roll over your 401(k) to Swell, you might prefer a robo-advisor with more investment options for the rollover account.

Swell fees. The 0.75% AUM fees Swell charges put them on the higher end of robo-advisors, so investors will want to carefully weigh the benefits Swell provides with the cost. Are the features comparable to other SRI-focused robo-advisors?

Limited investment options. Swell is not a comprehensive investment platform. It’s focus on conscious investing in the stocks of public companies, lacks bond or fixed income investments, an important part of a complete investment portfolio.

Should I Invest in Swell? The Takeaway

There are pros and cons to every robo-advisor, and investors who plan to consider Swell are wise to look at the many factors before making a decision.

Swell investing app is great if you want to start investing now with $50 and are committed to investing with your values.

If you want to choose the socially responsible investing area (like clean water) then Swell investing can work for you. And the Swell Impact 400 fund is ideal for a one-stop impact investment portfolio.

Bonus: 7 Best Robo-Advisors for Millennials

However, Swell might not be for you if you’re seeking a free investment manager. In that case, M1 Finance or Schwab might be better for you. if you must have a financial advisor to speak with, then consider Betterment.

If you decide to invest with Swell, it’s important to have other cash and fixed income investments as well. Owning only stock investments will subject your portfolio to too much volatility.

Overall, Swell offers a wide variety of socially-conscious investment options and might be a good investment platform for individuals who hope to make a difference in their societies. While they come with a slightly higher investment management fee, the robo-advisor is customizable to an extent and offers the basics that many investors need.

Updated June 6, 2020

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.