The Main Differences Between Robo-Advisors Span Fees, Investment Style, and Services

Not all investment options are created equal. Any smart investor will tell you that it’s a good idea to learn the differences between robo-advisors before choosing one to manage your money. With financial automation expanding and digital advisors growing, learn before committing to one platform.

Without looking at all the features available, or lacking with any one robo-advisor, new investors run the risk of selecting a robo that is incompatible with their goals or means.

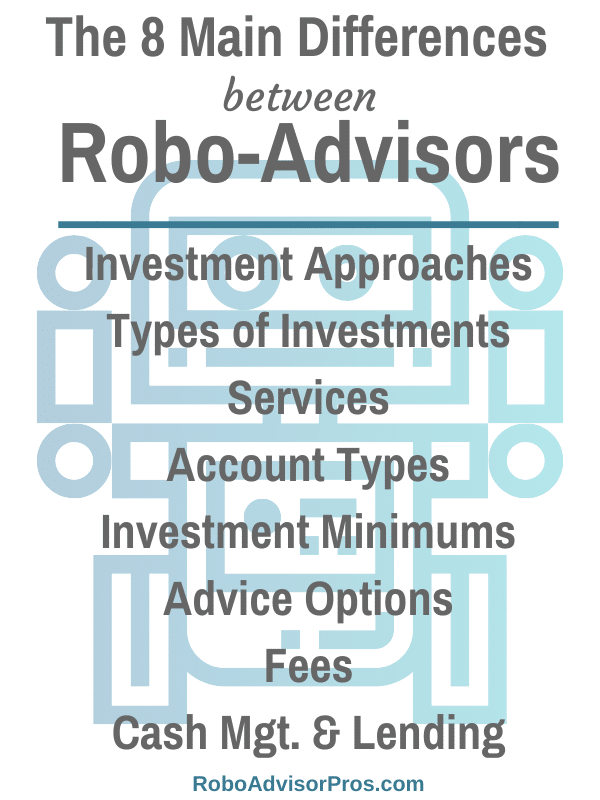

In fact, there are 8 main features of robo-advisors that are quite different depending on which robo you choose to use.

Bonus: M1 Finance vs Betterment – Which Robo-Advisor is Best for me?

These 8 distinctions between robo-advisors will help you choose the features that matter most to your unique financial situation.

[toc]

*This article contains affiliate links to help pay for this website. That said, our reviews are held to the highest standards of honesty.

1. Investment Approach: Passive vs. Active

The investment approach of a digital advisor is an important consideration, because it impacts the way your money is managed.

Most automated advisors offer passive investment options.

Passive investing means that the platform uses low-fee investment funds to match several investment indexes like the S&P 500, international stock indexes, and a bond index or more. The reason for this strategy is because most active fund managers fail to beat the performance of the indexes, over the long term.

With a passive index fund investment portfolio, you invest in a portfolio of low-fee funds, in proportion to your risk level (or how much volatility you can accept). Within this portfolio is a breakdown of different types of investments—depending on the platform, this could be anything from exchange traded funds (ETFs) or stocks.

In many cases, the computerized algorithm invests in these categories on your behalf automatically without any human intervention.

Another differentiating factor, is that some robo-advisors use active management. These robo-advisors invest actively, through the help of human financial planners in attempt to beat typical index fund returns. Active investing means that the strategy might change based upon the economy and/or investment market conditions.

Robo-advisors such as Personal Capital, Elm Partners, Merrill Edge, T Rowe Price, and Titan Invest all offer active investing. Active investing uses humans to help the computer algorithms make more nuanced investing plans for investors. This leads to a complementary team that provides a specific strategy for your individual needs.

Regardless of the approach, most platforms offer a diversified investment portfolio to help balance out the ups and downs of the financial markets.

2. Types of Investments

The types of investments varies from one platform to another. The most common type of investment available is the Exchange-Traded Fund, or ETF. And while most companies offer ETFs, many have additional investment options as well.

ETFs vary in the stocks and bonds that they invest in. For example, some offer a few diversified stock and bond investments. Whereas M1 Finance allows access to thousands of various funds. Other platforms fall somewhere in the middle.

Wealthfront recently added over 200 ETFs plus several crypto funds that users can add to existing portfolios. Wealthfront clients can even create their own portfolios and then the platform will manage the portfolio for them.

Some digital investment platforms include real estate, commodities and alternative types of investments. There’s really a strategy for any type of investor.

Occasionally, individual stocks are available. Personal Capital offers the opportunity to invest in individual stocks using direct indexing. Betterment and Wealthfront also offer direct indexing which can be less expensive and more flexible than owning ETFs.

FREE – Robo Advisor Comparison Guide

Wealthfront and Personal Capital offer direct indexing. Like the name suggests, instead of buying index-matching mutual or exchange traded funds, direct indexing buys all or a representative sample of the funds owned within an index. This approach can reduce fees and trading costs.

In fact, both M1 Finance and Robinhood allow investors to trade stocks. (Although Robinhood is similar to a brokerage.)

Likewise, investors can make a difference with their money through socially resonsible investing. Investors interested in “doing good” with their dollars have a growing pool of digital platforms from which to choose including Betterment and Axos Invest.

3. Features and Services

The types of services offered can make up one of the most important distinctions among robo-advisors because it is essential to choose services that will help you meet your goals.

Robo-advisors generally all offer rebalancing. This is good news for investors: rebalancing helps keep your portfolio diverse and compensates when investment percentages aren’t lining up just right. Robo-advisors are fantastic at rebalancing portfolios, as their algorithms handle the process saving humans for oversight and planning.

Some robo-advisors offer tax-loss harvesting services. Betterment is only one of the robo-advisors which helps investors minimize taxes. This ultimately leads to more money in your pocket! FutureAdvisor, Personal Capital, Schwab (for larger portfolios), and Wealthfront also offer tax-loss harvesting.

Ellevest is unique in that it offers both financial advisors and career coaches to its clients. Ellevest also has tax-advantaged strategies.

Retirement planning is a feature many would-be investors are looking for. Personal Capital is a wealth management system and robo-advisor that has the option for goals-based investing and specializes in retirement planning. This system works great, whether you’re planning for retirement or a vacation.

4. Account Types

Many robo-advisors offer IRA accounts; this is almost standard fair across the board. While some robo-advisors might stick to only traditional or Roth IRAs, many are beginning to add simple and SEP IRAs as well.

Still other robo-advisors dabble in trusts, UTMA accounts, and business accounts.

Wealthfront is the only robo-advisor at present with a 529 plan.

Another robo-advisor reaching a diverse audience is Betterment, with 401(k) plans for businesses.

Click here and sign up for Comprehensive Robo-advisor Comparison Chart

The one commonality is that all robo-advisors offer taxable brokerage accounts.

5. Investment Minimums

If you don’t have a lot of cash to invest upfront, we have great news: there’s a robo-advisor that’s within your reach! Many robo-advisors offer low or no minimum investment amounts.

Some of the most affordable robo-advisors include:

- SoFi: no minimum investment

- Betterment: no minimum investment!

- M1 Finance: $100

- Wealthfront: $500

- Axos Invest: $500

Sign up for FREE Investment Management at M1 Finance.

Other robo-advisors have much higher investment minimums, including:

- TD Ameritrade Essential Portfolios: $5,000

- FutureAdvisor: $10,000

- Schwab Intelligent Portfolios: $5,000

6. Advice and Customer Service

You’ll find digital, phone, text (Betterment), and human advice options.

The typical phone contact hours range from Monday through Friday business hours to 24/7 phone access for FidelityGo.

Most robos offer email and some have chat.

Betterment is really making waves by rolling out a new system that allows users to pay for the amount of human intervention they want in their investments. Ellevest also offers the discounted fees for financial advisory consultations.

While stand out SoFi Invest offers fee-free investing, financial advisors, career coaches along with crypto and active investing.

Not all robo-advisors have access to human financial planners, though. A few rely solely on digital financial advice—M1 Finance and Wealthfront are two of these firms.

Regardless, all robo-advisors thus far have offered the option to contact a human, whether by phone, email, or chat, if you need assistance with the platform itself.

7. Fees

Pricing and costs range from fee to roughly 0.89% AUM. Even at the high end, automated management is typically lower than the 1.0% to 1.5% charged by financial advisors.

Many investors are excited to hear that there are extremely low-fee or free robo-advisors available. Others might be happy to know that even for the more “expensive” firms, the savings garnered by not having to pay higher financial planners fees, make robo-advisors well worth it.

Sample fee structures include:

- M1 Finance: zero account management fees.

- SoFi Automated Investing: zero account management fees.

- Schwab Intelligent Portfolios: zero account management fees.

- Axos Invest (formerly WiseBanyan): 0.24% AUM

- Betterment: 0.25% AUM for the Digital Plan; 0.40% for Premium.

- SigFig: 0.20% AUM after the first $10,000; 0.50% for the Diversified Income Portfolio.

- Ellevest: Subscription based pricing.

- TD Ameritrade: 0.30% AUM.

- Vanguard: 0.30% AUM.

- FidelityGo: 0.35% AUM.

- Future Advisor: 0.50% AUM, plus additional commissions.

Bonus: Robo Advisor Fees from Lowest to Highest

8. Cash Management and Lending

New on the robo-advisor front are several services typically offered by banks. These include borrowing and cash management.

M1 Finance offers both. Investors can borrow a portion of their account value with M1 Borrow at low interest rates. The new M1 Spend offers a high yield cash account and other cash management services.

Betterment also rolled out a full cash management suite including a savings account, high yield checking, debit card and more.

Visit fee-free Betterment Cash Reserve and Checking Account Review.

While Wealthfront offers a high yield cash account and a portfolio line of credit for users who don’t want to liquidate investments to pay for a wedding or other expense.

FAQ

What is the difference between a robo-advisor and a financial advisor?

Robo-advisors depend upon computer programs to managed investment accounts and typically cost less than financial advisors. Although financial advisors may be available through some robo advisors. And some financial advisors use robo-advisor technology to manage client portfolios.

Robo-advisors typically charge lower fees than financial advisors.

What’s the difference between a target date fund and a robo-advisor?

Do robo advisors beat the market?

What does a robo-advisor do?

Wrap Up

These investing tools come in so many different packages that users need to pay attention to all of the features. While some may be on the higher end of the fee scale, like FutureAdvisor, these robo-advisors may also offer services or investment options that the lower cost robo-advisors do not.

In general almost every robo-advisor is more affordably priced than typical financial advisors.

Finally, there is a robo-advisor for every investor from beginner to advanced with features and services to suit a range of consumers.

Related

Robo-Advisor vs Financial Advisor

Robo-Advisor with Downside Risk Protection

Robo Advisor vs Target Date Fund

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.