With recent leaps in artificial intelligence technology, many financial advisors worry whether their position will be replaced by machines. The future of robo-advisors looks strong, and human advisors are uneasy.

Human financial advisors are particularly worried because of the explosion of new AI platforms. These AI systems are a competitive challenge. Human advisors are scrambling to adapt to a changing environment.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

In the investment world, artificial intelligence plays a key role. Currently, there are over 200 platforms known as “Robo-advisors” that create and manage investment portfolios for their users. Certainly, all of them won’t survive. We’ve already seen the demise of Qplum, Hedgeable, Motif, Blooom and Swell.

What Does a Robo-Advisor Do?

Most robo-advisors create an investment portfolio based on the choices you select from a simple survey. Although the surveys vary, they are designed to assess your goals and risk tolerance or comfort.

In general, the platforms offer a diversified menu of investments. Your final portfolio is set up to comply with your stated goals and risk level.

After completing a brief questionnaire your asset allocation is created. This is the mix of stock, bond, and occasionally funds from other asset classes. The platform then will provide ongoing portfolio management and rebalance your funds, when they deviate from your desired asset allocation.

You choose the dollar amount you wish to invest. Essentially, the computer algorithm based portfolio management controls your investment without requiring a human-touch. Most of the time, the system works much like a human investment advisor. And that’s the competitive problem for traditional wealth managers.

As more investment products are added, like lending and cash management, human advisors and the advisory business may suffer. Investors may balk at paying upwards of one-percent to a financial advisor when the digital or hybrid equivalent charges significantly less.

Robo-advisors generally charge significantly lower fees than human financial advisors.

On the other hand, though investing with a robo-advisor is simple, there are some downsides you should understand.

Hybrid Robo Advisors – the Wave of the Future

As artificial intelligence and computer algorithms progress, many still crave the guidance of human contact and advice. Robo advisory information has evolved as many platforms now provide computerized investment management along with human guidance. These combination digital investment managers are frequently labeled hybrid robo advisors.

Try the robo advisor selection wizard and screen for robo advisors with human financial advisors:

Some of the most popular robo advisors with financial advisors include a range of services, from full scale financial planning at Empower to Schwab’s subscription based Personal Advisor.

A standout in the hybrid robo investing model is SoFi Invest. This platform does not charge management fees or trading commissions. The company offers automated investing and active investing all under one roof. And, to top it off, included for all users is access to financial advisors and career coaches.

Robo advisors with access to financial advisors:

Robo-Advisors with Human Financial Planner Access

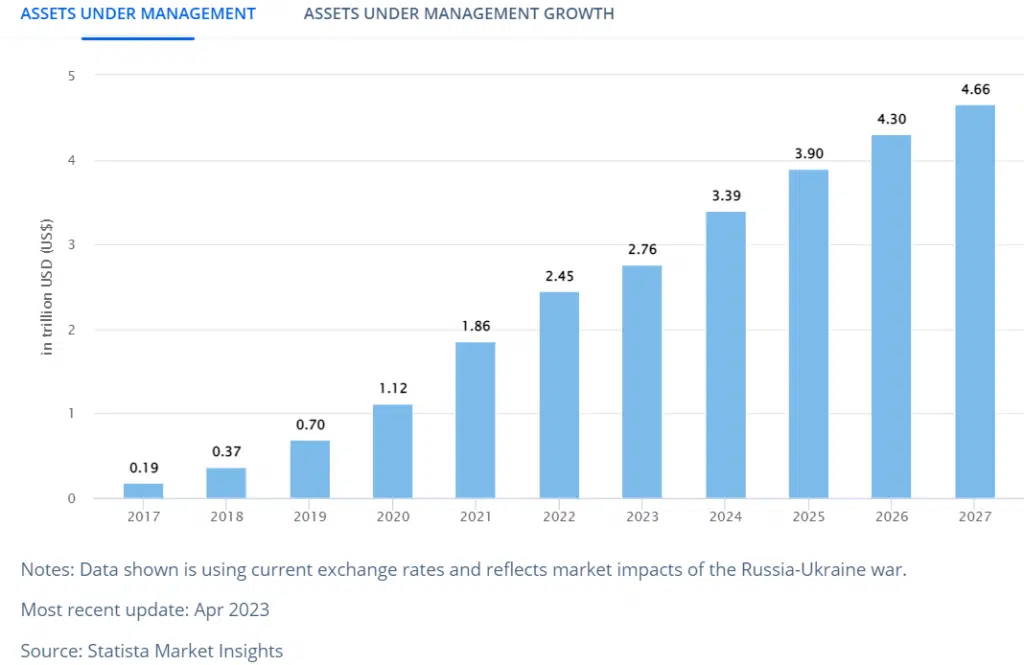

Robo Advice Future Projections

Statistica tallys current worldwide robo advisory client assets under management at $2.76 trillion. The U.S. claims the most AUM with $1.172 billion in 2023. The robo users is predicted to hit 234.3 million by 2027.

Worldwide, the average robo advisory assets under management per user is $8,005. While in the U.S. this amount grows to

Global Robo Advisor AUM Growth – Projected to 2027

Source: https://www.statista.com/outlook/dmo/fintech/digital-investment/robo-advisors/worldwide#assets-under-management

Globally, the US tops the list of robo advisors by AUM.

5 Biggest Robo’s Assets Under Management

- United States

- Germany

- Russia

- United Kindgom

- Japan

Types of Robo Advisors

The vast variety of digital platforms contribute to a sound future for this wealth management sector.

Beginning in 2008, during the financial crisis, the earliest platforms focused on basic digital investment management. Only Wealthfront and a few other platforms launched as a way for investors to save and invest for their futures with small amounts of money and proven investment strategies.

Today, the earliest entrants and newer platforms have branched out into a wealth of services.

Empower, formerly Personal Capital, targets baby boomers and retirees.

While Schwab offers two platforms, one all digital and the other with financial advisors and a low subscription fee.

The Ellevest platform is created for women and offers access to human financial advisors and career coaches for discounted fees.

SoFi, which began as as a lender, has branched out to provide robo-advisory services, a self-directed investment platform, member events and fee-free financial advisor meetings.

There are even several robo advice platforms with active investing strategies.

From those services with zero investment management to those with low minimums, there’s something for every type of investor.

And, if you’ve got an account at one of the big financial firms, you can frequently access low-fee digital wealth management too.

Robo-Advisor Investing Cautions

Much like any online-based industry, the robo-advisory field also has the potential for scams and inappropriate tools. It is best to conduct thorough research before you create an account with any online investment platform.

Besides the risk, most services cannot provide the same level of customization as human investors. To determine the investment goals and needs of a client, the digital platform requires the client to complete a simple survey.

On the other hand, human advisors will likely sit down with you for a couple of hours, asking numerous questions, to create a highly targeted investment portfolio for you. Robo-advisors can only slightly tailor portfolios to match your unique needs and goals.

As a matter of fact, the level of customization available with robo-advisors might be low and their “Recommended” strategies are recommended to many other clients. This may lead to an investment portfolio not tailored specifically to your distinct situation.

For more affluent investors, seeking broad wealth management services, there are only a few platforms that are suitable-like Empower, Schwab, Ellevest, and Vanguard.

A recent Brookings.edu article, mentioned that there is still a group of investors who don’t trust algorithmic advice. That same article discussed the lack of a holistic planning approach on some of the platforms.

Additionally, some of the robot advisors lack easily accessible phone customer service. This is a serious drawback for investors who need to chat with someone either about their investments or about the platform.

Despite their drawbacks, most robo-advisor’s portfolios are based upon well-regarded investment theory, and their fees are quite affordable. Despite slowing, growth, according to recent Statistical data, the field shows no signs of going away.

Should You Avoid Robo-Advisors?

This begs the question; should more people invest using robo-advisors? Or is it best to avoid them because their future could be uncertain?

Investing with a robo-advisor is easy and anyone can do it.

Yet, just because the future of robo-advisors is uncertain, doesn’t mean you should shun this wealthtech industry. These fintech investment managers offer low fees and sound investment guidance for many types of investors. So, in short, don’t avoid robo-advisors.

Even if the service that you choose fails, they all offer SIPC insurance and protection so you won’t lose your money.

And if you’re leery of investing with an all-digital investment manager, choose one with access to financial managers. Or pay a fee-only financial advisor for periodic investment advice.

Will Robo Advisory Platforms Replace Traditional Investment Firms?

Due to the success of robo-investment, many traditional financial advisors are worried they’ll be replaced. Yet, when reading the tea leaves, the robo advisory growth looks promising, but shows no signs of replacing traditional financial planners.

Many people prefer walk-in meetings with their favorite investment advisory firms. And robo-advisors, though growing rapidly, remain a small piece of the investment pie. In fact, many robo-advisors are hiring white label robo advisors to manage their client investment portfolios, freeing time for the financial planner to help clients with their money and related life-planning concerns.

Further, the trend towards automated and human financial advice continues to grow.

Can Small Robo-Investment Firms Succeed?

New robo-advisory firms are sprouting up rapidly and many don’t see the light of day.

Currently, about 200 firms dominate the robo-investment market. The legacy firms with a good reputation and proven track record may benefit from an independent future or the potential to be bought by bigger players.

One of the earliest robo-advisors, Betterment, was a break-through independent platform in the investment world. The service offers investment advice for additional fees and continues as a popular leader in the robo-advisor sphere.

It is a challenge for start-up robo-advisors, to compete with legacy robo advisors like Wealthfront, or with the robo-advisors attached to big brands like Fidelity Go and Schwab Intelligent Advisors. Unless the new firm can provide additional features and a better return on investment combined with lower fees, they’ll have difficulty surviving the competitive envoronment.

For example, Titan Invest, a newer platform with a hedge-fund approach is gaining ground against the legacy players.

Although those without advisory services may be operating at a disadvantage.

The challenges are great for new entrants. The acquisition costs for new money are high. And the preponderance of small investors make profitability a challenge. Upgrading their platforms and algorithms is also costly for the small robo advisors. Newer and minor independent robo-investment firms may struggle to receive a cut of the digital investment market, unless they are backed by powerful investors and a large sum of funds.

Nevertheless, hybrid-robo firms (investment firms that combine robo-investments with a human-touch) are predicted to grow much faster than their “pure” robo-counterparts. And the Schwab, Fidelity, E*Trade, BlackRock and other big firms are tough to beat as they develop or acquire their own robo-advisory shops.

FAQ

Which robo-advisor has the best returns?

Are robo-advisors worth it?

Can robo-advisors make you money?

What is the Future of Robo-Advisors and Human Financial Advisors?

If you’re concerned whether robo-firms will take over the investment services industry, there is little need to worry. On the contrary, ending up in the trash heap is also unlikely for this industry. Although, a recent ThinkAdvisor article, “Will Robo-Advisors Be Terminated?” by Ginger Szala, suggested that these once impressive disruptive technologies were facing strong headwinds.

John Ndege, CEO of Pocket Risk, a provider of risk tolerance questionnaires believes that the “tipping point” for robo-advisors will be gradual. He expects larger firms to build or buy robo-technology and growth to slow. Eventually, the venture capital may dry up and valuations may stall.

The next market crash is likely to have an impact on the future of robo-advisors. While the current slowing economy and elevated inflation is hurting many investors.

For those, sticking with the robo’s attached to big brokerage companies or those firms with proven track records is probably the best solution.

Ultimately, the future of robo-advisors is like the future in general-unknowable.

Keep your eye on the trends and when choosing a robo-advisor, perform your due diligence first. Small independent robo-advisors might have a tougher road ahead than the bigger players. Human advisors will need to adapt, to compete.

Related

- Best Robo Advisors

- The Ultimate Goal of a Robo-Advisor

- Should I Use a Robo Advisor?

- Webull Robo Advisor Review

- 5 Robo-Advisors With Downside Risk Protection

Sources

- https://www.brookings.edu/research/robo-advice-an-effective-tool-to-reduce-inequalities/

- https://www.statista.com/outlook/dmo/fintech/digital-investment/robo-advisors/

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Disclosure: I have accounts with M1 Finance and Schwab Intelligent Portfolios.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.