M1 Finance Review

M1 Finance has emerged as one of the best robo investing platforms by combining fractional shares, stock, ETF and investing with access to scores of pre-made investment portfolios. Beginner and Intermediate investors will appreciate free portfolio management, low interest rate borrowing and a cash account. While, day traders need to look elsewhere.

This M1 finance review will cover the pros, cons, features and who this platform is best for. If you want affordable automated investing, fractional shares and a robust selection of specialty portfolios then check out M1 Finance.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

M1 Finance Review

Name: M1 Finance

Description: Free investing app with portfolio management included.

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for:

- Investors who want to pick stocks and funds on their own.

- Investors who want free investment management.

- Investors who want pre-made investment portfolios.

Pros

- Free investment management and trading

- Low $100 minimum

- 6,000 investments

- 60+ pre-made investment pies/portfolios

- Low margin rates

- Fractional shares

- Auto-invest

- Checking integrated with investing

Cons

- No tax-loss harvesting

- No access to human financial advisors

- No risk quiz

- No options or Forex

- Limited trading windows

Features

What is M1 Finance?

One of the most comprehensive robo-advisor platforms to hit the market, M1 Finance offers a unique twist to the fintech robo investing landscape – a combination investment trading platform and a robo advisor service. At M1 users get stock, ETF and cryptocurrency investing plus pre-made well-designed investment pies or portfolios that include income, hedge fund, robo investing, retirement. cannabis and more.

M1 Finance is a commission-free and self-directed brokerage app that offers all sorts of customization options — including spending, borrowing, and investing — all in one place.

The FDIC insured checking account is akin to a typical bank offer with an ATM debit card, direct deposit and integration with your investment account. Seasoned investors will appreciate the margin lending feature with low borrowing rates.

As mentioned, there are no stock or ETF trading fees, and free rebalancing of your investments. Rebalancing means buying or selling securities to return the portfolio to your pre-determined asset allocation mix. Unlike other robo advisors, you’ll need a degree of insight to determine which pre-made pies and which asset allocation is best for you. In contrast with other platforms like Betterment or Wealthfront, there is no risk, financial goals questionnaire to help define your preferred investment combination.

M1 Finance Features Summary:

- M1 Invest – Stock, ETF and cryptocurrency investing, and customized pre-made investment pies

- M1 Spend – Checking account, Visa debit card and Owners cash-back rewards credit card

- M1 Borrow – A portfolio line of credit with ultra low margin interest rates

- M1 Plus – Premium features include second trading window, cash back debit card, interest bearing checking account and lower borrowing rates.

M1 Finance portfolios are easy to visualize as each investment is shown as a slice of pie. The whole M1 Finance pie represents your entire investment portfolio. You can create your own portfolio, called M1 Finance Pies, selected from roughly 6,000 stocks and ETFs, cryptocurrency, and 60+ customized pre-made pies.

Who Benefits from the M1 Finance Robo-Advisor?

- The DIY investor who wants to outsource the rebalancing his or her portfolio.

- The new investor seeking a pre-made investment portfolio in line with her risk tolerance.

- The investor who wants to copy the hedge fund investors, without researching their strategies.

- The retiree seeking access to target date investment portfolios and the opportunity to invest on their own.

- The income investor who wants a pre-made portfolio.

- The cost conscious investor who wants their personal portfolio managed and rebalanced for free.

- Passive investors who want portfolios like ESG, growth, retirement or value strategies.

- Investors who want to try cryptocurrency investing.

M1 is not a good choice active and day traders or those seeking options and an advanced trading platform. Sophisticated traders might lean towards robo-advisors who are part of larger investment broker like Vanguard or Fidelity.

M1 Account Types

M1 Finance offers a wide range of accounts, suitable for most investors. The availability of trust accounts invite greater access for wealthier investors.

- Taxable individual and joint brokerage

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trusts

- Custodial (requires M1 Plus)

M1 IRAs (traditional and rollover) and M1 Roth IRAs are excellent accounts to supplement your workplace 401(k) and build extra cash for retirement!

M1 Investing

M1 is in a class of its own when it comes to investing. You have the best of both a robo-advisor with managed portfolios and the opportunity to buy and sell individual stocks, funds and cryptocurrency. The secret sauce is that M1 Finance rebalances your portfolio back to your preferred asset allocation, for free.

M1 Pies

M1 Pies are the label M1 Finance gives to a group of investments. Actually, M1 uses the word pie in place of portfolio when describing your the percent of each asset that you own. Pie is the name that M1 Finance gives to it’s investment portfolios, because when grouped together in their particular asset allocations, or percentages, the portfolio looks like a pie.

You can customize your M1 pies by selecting individual stocks, ETFs and digital coins in the percentages that you prefer. You can add in expert pies as well. You might own 10% each in eight stocks and 20% in a global income expert pie.

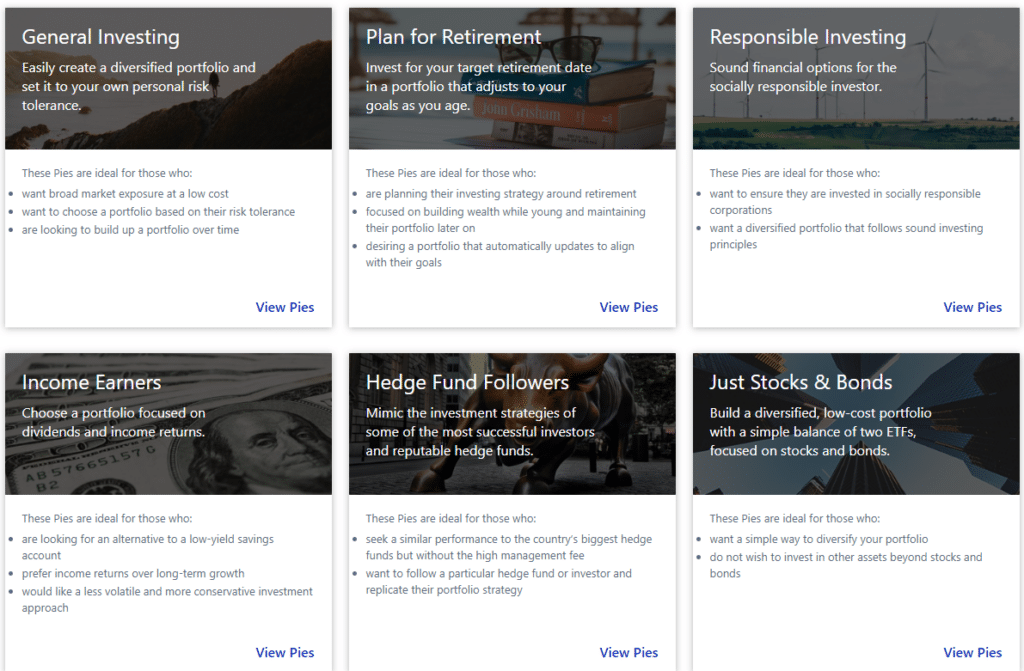

We’ll start by delving into the pre-made expert pies. The M1 expert pies are created to mirror many investment strategies. Expert pies give you an opportunity to invest in a pre-made portfolio of funds and or stocks that fit within a specific strategy.

M1 Finance Expert Pies

M1 Finance Investment Strategies – Expert Pies

- General Investing – Perfect for well-balanced investments that match up with your risk level (like a typical robo-advisor).

- Plan For Retirement – Similar to a target date fund.

- Responsible Investing – Socially Conscious Investing.

- Income Portfolios – Great for cash flow.

- Hedge Fund Followers – Copy investing strategies of well-known investors, like Warren Buffett.

- Just Stocks and Bonds – 9 Pre-made investment portfolios of just 2 funds, a global stock and a bond ETF from most conservative to very aggressive.

- Other Strategies – Includes pot stocks, ARK ETF, growth and value pies.

I opened a simple two stock portfolio with 60 percent invested in the Vanguard Total World Stock ETF (VT) and 40% invested in the Vanguard Total Bond ETF (BND). Then I added a Global Dividend Pie.

Barbara A. Friedberg

Robo-advisor vs M1 Finance General Investing Pie

For those seeking a passively managed portfolio, the General Investing M1 expert Pies include 10 stock and bond funds covering diverse corners of the US and global stock and bond markets. These portfolios are similar to a typical robo-advisor portfolio like you might find at Wealthfront, Betterment or Ally. The main difference between this M1 pie and one you might find at a typical robo advisor is that you need to decide on the asset asset allocation that best fits your risk tolerance. Most robo-advisors give you a quiz to help determine which portfolio fits with your goals, time frame and risk level.

M1 Finance General Investing pie choices:

- Ultra Conservative

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

- Ultra Aggressive

The Ultra Conservative portfolio is allocated with these funds in the following percentages (90% bonds vs 10% stocks):

- Short Term Treasury Bonds – SHY – 82%

- Municipal Bonds – MUB – 2%

- Small cap US Stocks – VB – 6%

- Large cap US Stocks – VOO – 2%

- Developed Market Stocks – VEA – 6%

- Emerging Market Stocks – VWO – 2%

On the other end of the spectrum, the Ultra Aggressive portfolio is allocated as follows (99% stock vs 1% bond):

- Large cap US stocks – VOO – 29%

- Mid cap US stocks – VO – 9%

- Small cap US stocks – VB 13%

- Developed Market Stocks – VEA – 34%

- Emerging market Stocks – VWO – 7%

- International Bonds – BNDX – 1%

- Real Estate REIT – VWO – 7%

The other general investing portfolios fall in between in their allocation percentages to stocks vs bonds. You can view all of the pre-made portfolios without funding an account, although you will need to go through the sign up process. Each of these “General Investing” robo-advisor replica portfolios contain between six and ten individual funds.

The remaining seven categories of pre-made expert pies are created in line with their designated strategy.

For example, the income portfolio includes dividend stock, as well as domestic and international bond funds.

The miscellaneous “Other Strategies” pre-made portfolios includes an array of diverse strategies including:

- ARK ETF equal weight

- Cannabis

- Domestic growth

- Domestic value

- International growth

- International value

Most investors will find a pre-made strategy to fit their investment approach.

M1 Finance Stock, ETF and Cryptocurrency Investing

If you want to create your own combination of investments (or investment pies) you can choose from 4,325 stocks and/or 1999 exchange traded funds. M1 Finance also offers a stock screener to help you construct your own investment portfolio.

Those interested in digital currency can add up to 10 cryptocurrency digital coins to their M1 pie. M1 also offers six Greyscale crypto ETFs.

There are more than enough stocks and ETFs for most investors. If you’re not sure which stocks or funds to choose, the basic stock screener allows you to search by:

- Market capitalization

- P/E ratio

- Dividend yield (%)

- Sector

You can screen ETFs by:

- Total assets

- Dividend yield

- Expense ratio

- Category

The screeners are great for beginners through advanced investors seeking to choose the best stock or ETF that aligns with their strategy. The screeners are great for uncovering undervalued stocks, high yield stocks and ETFs, low fee ETFs and both stocks and ETFs from specific sectors and categories.

I’m also doing an experiment to compare performance of my 50% allocation to Just stocks and bonds and 50% allocation to a global dividend stock pie. find out how the returns on this simple portfolio compares with other investment strategies.

This is the original Expert Pie that I invested in (Just Stocks and Bonds). I’ve since added a global income stock portfolio. You can learn more in this YouTube Video.

Fractional Shares

If you only have a few dollars to begin investing, you can get started with fractional shares. This means, you could buy an expert pie of shares of stocks or ETFs for a specific dollar amount and not worry about the price of the shares.

If a stock costs $1,000 and you want to invest $100, you can buy 1/10th of a share. This is a great feature for beginner investors.

Portfolio Management – Rebalancing

Rebalancing is another area where M1 Finance is like automated investment platforms. Rebalancing means returning the proportion of your specific investments back to their preferred percentage. When you create your initial M1 pie, you choose the percent invested in each asset, like the 50% stock ETF and 50% bond ETF we previously mentioned.

Over time, stock prices might increase more than bond prices, causing your pie to become 60% in the stock ETF and 40% in the bond ETF. With any incoming or outgoing funds, M1 will automatically invest in the asset that brings your portfolio back to your preferred percentages. So, new money coming in will go into the bond fund to move the pie back to the 50% – 50% mix.

You can also select a button to rebalance at any time.

All trades occur during the M1 Finance trading windows:

- 9:00 AM est when markets open, until all orders are filled

- 2:00 PM est is a second trading window available to M1 Plus customers

Dividends are reinvested automatically once they total $10.

The benefit of rebalancing is that you’ll always have money going in to the most undervalued asset, versus more money going into the higher priced stock, fund or expert pie. Rebalancing works to minimize your portfolio’s volatility and makes it less susceptible to huge swings in value.

Auto-invest

The M1 auto-invest feature gives you control over reinvesting cash in your portfolio. First, set a level, above which all additional funds will be reinvested.

With a minimum cash balance of $0 – Once the value reaches $25, shares will be purchased to return the cash balance to $0.

Dividend Reinvestment – Cash dividends remain in your account until they reach your minimum cash balance amount. At that point, dividends will be reinvested in the assets that have fallen below their asset allocation targets.

If you’d prefer to leave $500 cash in your account, set the minimum cash balance to $500. Then, cash exceeding $500 will be invested.

You can turn auto-invest off to build up cash within the account to use for investing.

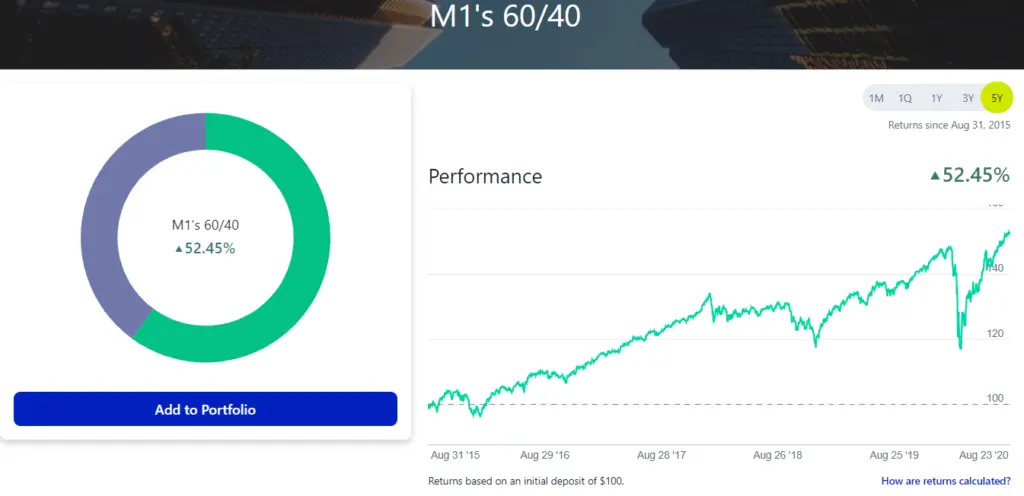

M1 Finance Performance

M1 provides 1 month, 1 year, 3 year and 5 year performance data for each of the expert pies.

It would be difficult to list the performance of the M1 investing pies that you create since there is the possibility of thousands of investment combinations. But your M1 dashboard will give you performance data.

In general, the performance of any M1 Pie, either pre-made expert pie, or one you craft on your own, will depend on the investments that are owned within the pie and their returns.

Minimum Deposit

Unlike many other robo-advisors, M1 only requires $100 to get started! And you can open an account for free.

IRA accounts require a $500 minimum to invest.

M1 Finance Fees

M1 Finance is free for the basic platform, which includes:

- Commission free stock, bond, ETF trading

- Investing in all M1 Finance pies and pre-made portfolios

- Investment rebalancing

- M1 Spend-with cash account, debit and credit cards

- M1 Borrow

M1 Crypto charges a 1% transaction fee for all purchases and sales.

All ETFs levy minimal management fees that go directly to the fund provider. Like most investment brokers today there are no commissions or trading fees to buy and sell stocks, ETFs or expert pies. Of course, if you borrow from M1 there will be low margin interest rates.

As you’d expect, M1 Finance does charge for services such as overnight mail delivery, paper statements, retirement account termination and a few more.

M1 Plus charges $125 per year and offers additional features, and promotions.

M1 Plus

M1 Plus is a higher level service for investors that want:

- A super charged checking account. The m1 Plus account offers a high yield checking cash management account and a debit card with 1% cash back. Finally, M1 plus customers get 4 fee-free ATM fee reimbursements per month

- Lower borrowing costs

- Two daily trading windows, instead of one

The M1 Plus service offers more services for a low annual fee.

The fee for M1 Plus is a reasonable $125 per year, with a one year free promotions. Sign up for M1 and give it a try:

| Features | M1 | M1 Plus |

| Cost | Free | $125/year 3 month free trial |

| Trading Windows |

One/day | Two/day |

| Cash Management |

Checking account Debit card Credit card fee – $95 per year |

High yield checking Send checks Cash-back debit card Credit card – fee waived |

| ATM Reimbursement |

1 per month | 4 per month |

| Borrow | 40% of account value (>$2000) |

Lower borrowing rates 40% of account value (>$2000) |

Is M1 Finance Safe and Insured?

Your money is insured by SIPC (Securities Investor Protection Corporation) against loss of cash and securities from a brokers failure. It does not protect against normal investment price declines.

M1 Spend and M1 Plus accounts are further insured through Lincoln Savings Bank.

Apex Clearing Corporation is M1’s clearing firm and custodial bank. Apex is a well-known firm and provides similar functions for many of the world’s largest institutional and retail brokers.

M1 data is transferred and stored, protected with military-grade 4096-bit encryption. Your data isn’t stored on any device and all information is encrypted in transit between your computer and M as well as on the M1 servers. M1 protects account access with two-factor authentication.

Free Stock App

Invest for free in your favorite stocks and ETFs with the M1 Finance app. Most of the desktop features are available on the M1 Finance app.

There are No trading fees or commissions. Once you have $2,000 invested the M1 app enables a low-cost portfolio line of credit. While the M1 Visa Debit Card link sends excess cash automatically into your investments. The M1 Finance app is available in iOs or Android.

Tax Efficiency

M1 doesn’t offer tax-loss harvesting.

M1 tax efficient investing uses a strategy when selling securities to help reduce the amount owed on taxes automatically. It’s not tax-loss harvesting, but it does take into account potential tax consequences when selling an investment by choosing the shares with the lowest tax basis.

Free Representative Consult

You can schedule a free consultation with an M1 Finance representative for guidance navigating the platform.

So, if you have any questions about the platform, you can speak directly with an M1 representative to guide you.

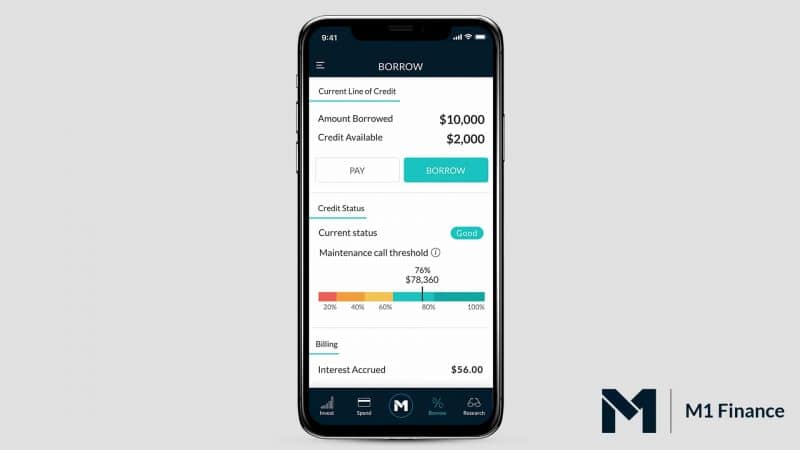

M1 Borrow

If your account is valued at $2,000 or more, you’re eligible to borrow up to 40% of the account value, and pay it back on your terms.

M1 Plus customers are eligible for lower interest rates than basic members. Although in general, M1’s margin interest rates are affordable.

The process is fast and doesn’t require a credit check. You can use the money for anything. The low interest rate is great if you want to refinance existing high interest rate credit card debt or pay for your wedding.

M1 Spend

M1 Spend is the cash management account similar to an online checking account. It is FDIC-insured insured up to $250,000. M1 Spend combines digital banking, bill pay and spending with the M1 Visa debit card and credit card. No minimum deposit is required.

You can even direct deposit your paycheck into your M1 Spend account! M1 Basic customers get one ATM fee reimbursement per month vs 4 fee reimbursements monthly for Plus customers.

M1 Plus customers receive added features from M1 Spend:

- Interest on your checking account balance

- 1% cash back on eligible debit card purchases

- 0% international ATM fees

- Able to send checks

- Early access to direct deposit paycheck funds

We like that M1 has expanded to include not only investing but also banking and lending services. Of the stand alone robo-advisors, M1 is one of our favorites for intermediate investors.

M1 High Yield Interest Rate – 5.0% APY*

* Only M1 Plus customers receive interest on checking account balances.

M1 Finance Sign-up Process

It’s easy to sign up and get started with M1 Finance.

- Input your email address, create a password, answer a few questions and create an account.

- Next you build a sample portfolio.

- Choose the account type by selecting from the account list.

- Link your bank account.

At that point, before funding the account you can explore the platform’s features. You can look at the pre-made portfolios and explore the thousands of investment options for your DIY portfolio.

Finally, transfer money in to fund your portfolio. The process is seamless, although it does take a few days to get the account up and running.

FAQ

Is M1 Finance Free?

For investors seeking more features, M1 Plus is available for $125 per year.

How does M1 Finance make money?

Loans and M1 Plus also make money for M1.

Can you day trade on M1 Finance?

To keep costs low, M1 is only trading once per day during week-days NYSE trading hours or twice with M1 Plus.

Does M1 offer any promos?

Is M1 Finance good?

M1 Finance Pros and Cons

M1 Finance Pros

M1 Finance account management services are free.

The $100 minimum investment amount makes it easy for the new investor to dip her toe into the markets.

The visual structure of the M1 Finance pies makes it easy to understand what you’re invested in.

Adding money to your account is clear cut. The platform invests new money according to your asset allocation preferences.

The automated portfolio rebalancing makes investment management easy.

The opportunity to choose your own investments and receive portfolio rebalancing for free is a huge draw.

M1 Borrow is a nice option when you need extra cash with a low interest rate.

M1 Spend can even replace your checking account.

M1 Finance Cons

In contrast with other automated or robo-advisors, M1 Finance doesn’t offer a risk quiz. This could be a disadvantage to a newer investor. Thus, if you’re not confident of your personal risk tolerance, you might seek an online risk tolerance quiz for guidance.

Regarding the Hedge Fund Replication choices, M1 invests in the publicly listed securities of the specific fund. Yet, you don’t know the price that the hedge fund manager paid for their holdings. And part of smart investing is buying at the right price. This option is best for more advanced or aggressive investors.

M1 doesn’t offer tax-loss harvesting, although they do offer “tax minimization” which allows you to sell investments in the most tax efficient way.

M1 Finance Review – Wrap Up

You choose how involved you want to be with your portfolio management. From pre-made pies to DIY investment portfolio creation, you decide which investment road to take.

M1 Finance is great for on-the-go portfolio management with apps for iOs and android devices.

M1 Finance is user-friendly, so once your initial portfolio is set up it is easy to manage. Just like a bank account, investors only need to worry about depositing or withdrawing money and the new M1 Spend will handle the direct deposit of your paycheck.

The platform itself takes care of the trading and the money is automatically allotted to your pre-determined specifications.

Even with a fully customizable portfolio, some people worry about the human touch some robo-advisors lack. M1 Finance has a customer support team available during business hours, so if their extensive FAQs can’t answer your questions, a real human can.

M1 Finance offers a promising alternative to other investing options. If you’re stuck between a DIY approach and a fully automated robo-advisor, then M1 is a nice in-between solution. In particular, this platform adds depth and customization to the robo-advising market. Investors, who want hands-on and easily accessible investing options, will find that M1 Finance has a lot to offer.

If you’re sophisticated enough to know what you want in your investments, but don’t want to constantly rebalance and maintain your investment portfolio, M1 Finance is a good alternative.

We’re all busy today and you need to pick and choose how you’ll spend your time. If you like to pick your investments, and seek investing inspiration as well, then consider M1. With the low $100 entry fee, and free account management anyone can dip their toes into the investing world.

Related

- Robinhood vs. Acorns vs. M1 Finance – How to Choose the Best Investment App

- Betterment vs. Wealthfront vs. M1 Finance – Robo-Advisor Comparison

- M1 Finance vs. Personal Capital – M1 Finance Robo-Advisor Comparison Analysis

- M1 Finance vs. Robinhood – Which Free Trading App is Best?

- M1 Finance vs. Vanguard Personal Advisor Services – Should I Pay for a Robo-Advisor?

- Is M1 Finance Safe?

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Disclosure: I have a funded account with M1 Finance.

*Using margin involves risks: you can lose more than you deposit, you are subject to a margin call, and interest rates may change. To learn more about the risks associated with margin loans, please see our Margin Disclosure (https://s3.amazonaws.com/m1-production-agreements/documents/Margin_Disclosure.pdf). M1 Borrow available on margin accounts with a balance of at least $2,000. Does not apply to retirement accounts.