Validea Legends Expert Review

By staff columnist, Kevin Mercadante

The vast majority of robo-advisors seek only to match the performance of the underlying markets. They invest in index-based exchange traded funds (ETFs) in pre-determined mixes of stocks, bonds and other asset classes. You’ll keep pace with the markets, but you won’t outperform them. They’re completely passive in nature, which is actually part of the attraction.

But Validea Legends takes the opposite approach. They interpret the investment strategies of well-known stock market investors they refer to as gurus. Validea then utilizes proprietary technology to incorporate the investment style and decision-making of these Wall Street legends. The systematic investment process that eliminates emotion and bias. The entire focus is on outperforming the market over the long-term.

The inspiration and investing algorithms comes from the investment styles of well known investors like Warren Buffett, Benjamin Graham and Peter Lynch.

Validea was founded in 2003 by John Reese. He began conducting his own research 20 years ago into quantitative investment strategies, with a goal to find strategies that consistently outperform the market over the long-term. Using these quantitative strategies of investment legends, he then applied his own background in computer science and artificial intelligence to create investment models for Validea.

[toc]

Validea Legends Robo-Advisor Features at a Glance

| Overview | Active stock selection using strategies of Wall Street legends, with asset allocations modeled after leading institutions and endowments. |

| Minimum Investment Amount | $25,000 |

| Fee Structure | 0.25% of AUM for Validea Legends Advisor 0.50% for Validea Legends Income |

| Top Features | Active account management that attempts to outperform the general stock market, and not just match it; relies on the investment selection of the top investment gurus on Wall Street. Downside risk protection. Access to financial consultants. |

| Free Services | None |

| Contact & Investing Advice | Available by phone and email |

| Investments | Low cost ETFs & stocks, Each portfolio owns shares of the Berkshire Hathaway A. Also owns gold, commodities, real estate investment trusts (REITs) and private equity. |

| Accounts Available | Individual and joint taxable accounts; traditional, Roth, rollover and SEP IRAs; trusts and other account types |

| Promotions | None at present. |

What Differentiates Validea Legends from Competitors

Validea goes beyond the typical allocations of stocks and bonds, and also includes real estate investment trusts, private equity, gold, timber and other commodities.

They also incorporate a downside protection technique seeking to reduce the percentage in stocks in bear markets, while maintaining a disciplined re-entry into stocks after the bear market ends.

Validea does this using what it calls an equity rotation allocation. It reduces exposure in the higher risk asset classes of a portfolio when their technical criteria indicate further losses may be coming. And when valuations reach very high levels they will also employ a small position in tail risk strategies to limit downside risk.

Similar to another actively managed robo-advisor, United Income, Validea offers all investors access to financial consultants.

Validea isn’t afraid of holding cash when it deems appropriate.

Who Benefits from the Validea Legends Robo-Advisor?

Validea Legends is a unique robo-advisor designed specifically for those who are looking to outperform the market. This is done through a combination of active investment management, combined with risk minimization through equity rotation.

This type of robo-advisor is best suited to a person who is looking for the collective advice of several Wall Street investment guru’s, but is also looking for a higher level of diversification, as well as downside risk minimization.

Validea Legends Robo-Advisor Drill Down

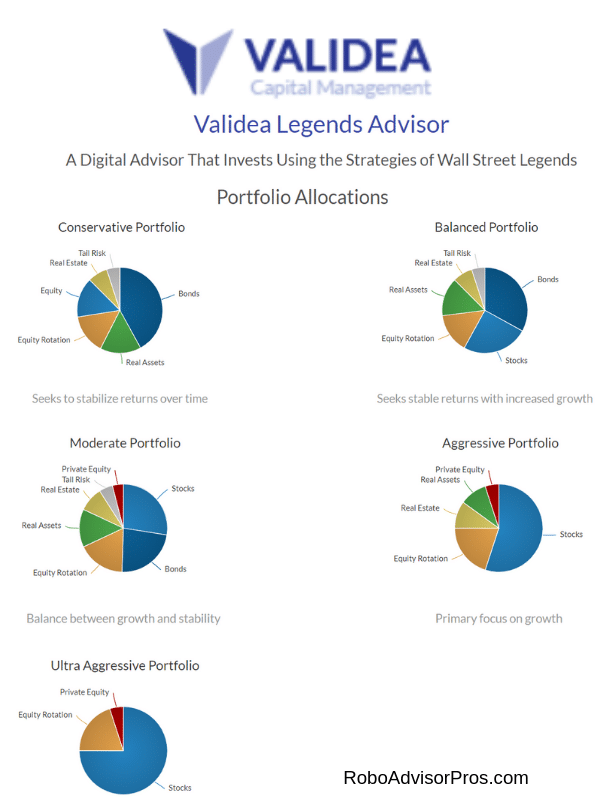

Similar to other robo-advisors, Validea starts by having you complete a questionnaire to determine your risk tolerance. The portfolio allocation will be based on one of five models as determined by your risk tolerance. That allocation will be reviewed periodically, and changed or adjusted as necessary.

Validea provides two different robo-advisors, Validea Legends Advisor and Validea Legends Income.

Validea Legends Advisor

This portfolio invests in stocks using the investment models of 10 different legendary investors. But it also invests in Berkshire Hathaway, which has returned over 20% per year since its inception. Your portfolio is rebalanced on a monthly basis.

Learn; 7 Main Differences Between Robo-Advisors

The five different portfolio allocations are:

- Conservative Portfolio

- Balanced Portfolio

- Moderate Portfolio

- Aggressive Portfolio

- Ultra Aggressive Portfolio

Source; https://www.valideacapital.com/robo-advisor

Exactly which asset allocations will be held in each portfolio, and how much is allocated, depends on the purpose of the portfolio. For example, the Ultra Aggressive Portfolio will be invested entirely in stocks, equity rotation, and private equity, but no bonds or real estate. Clearly, the conservative portfolio owns a greater proportion with less risky bond/fixed income investments.

Validea Legends Advisor Investment fees.Though the basic management fee is 0.25%, the net fee will be higher based on the type of portfolio For example, total fees on the Conservative Portfolio are 0.53%. But on the high end, total fees for the Aggressive Portfolio are 0.80%. These higher fees include the investment fees within the ETF’s used to construct each portfolio.

Investment Funds Used

Validea Market Legends ETF (VALX) – This is a proprietary fund run by John Reese himself. It’s an actively managed ETF that invests in equity securities based on Validea’s interpretation of published investment strategies of Wall Street legends.

The fund is comprised of 100 stocks using 10 distinct “guru-based models”. It uses a variety of investment styles, including value, growth, momentum, and income. The portfolio is rebalanced monthly.

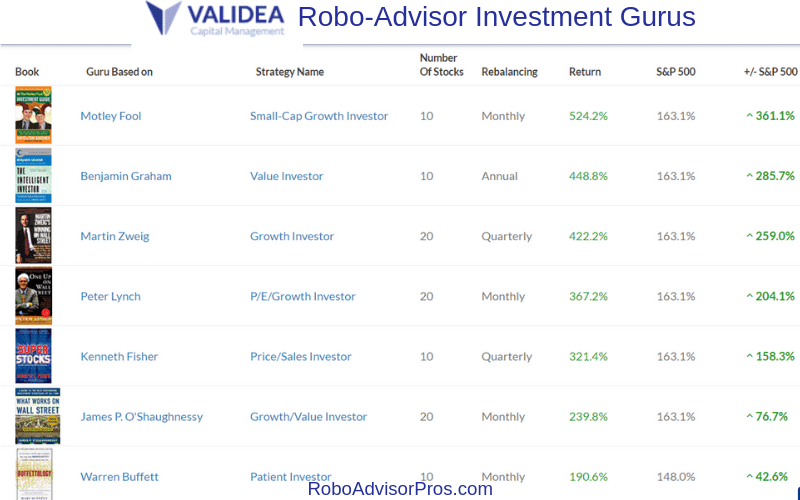

The investing guru’s the ETF is based on the following investment legends (this is a partial list):

Source; https://www.validea.com/gurus

Notice how the returns of each legends strategy is compared with that of the S&P 500. The time period considered wasn’t listed on the website. We’re frequently skeptical of return data, as it will change along with the time period measured. Thus, we don’t advise making investment decisions based upon portfolio returns.

Validea Legends Income

This robo uses the same reliance on investment gurus in choosing stocks, but the emphasis is on both capital appreciation and income. The focus of this robo is yield. Validea Legends meets the income requirement by focusing on income generating investments. Investments selected seek to generate above average yield, including high yield stocks, investment grade corporate and government bonds, high yield bonds, foreign bonds, bank loans and real estate.

Similar to Validea Legends Advisor, Legends Income also builds a customized portfolio for each investor based on their personal risk profile.

Bonus; 2020 List of Top 30 Robo-Advisors

As well, Validea Legends Income also makes use of Validea’s proprietary equity rotation feature to reduce exposure to the higher risk asset classes when technical criteria indicate further losses may be coming. Those asset classes will be replaced with bonds when a sell signal is generated so that the portfolio maintains its income goals.

Validea Legends Income uses three basic portfolio allocations:

- Conservative Income

- Moderate Income

- Aggressive Income.

Though they have different risk levels, all three emphasize income in their asset allocations.

Validea Legends Income Investment fees. The basic management fee for this robo is 0.50%, but total fees are 0.61% when underlying ETF fees and all trading commissions are included.

Validea Legends Robo-Advisor Sign-up Process

The application process takes place completely online, and in a series of screens that ask the following:

- Your email address.

- Current age.

- Your annual pre-tax household income.

- Total value of your cash and liquid assets.

- What is the total amount you plan to invest with us?

- What is your primary goal of your investment with us – long-term growth, generating income, or preserving capital?

- Will you be investing taxable or nontaxable money with us?

- How long can you invest before you will need to withdraw all or most of your money? (from 1 to 10+ years).

- What is most important to you – Maximizing gains, minimizing losses, a blend of both?

- If your investment with us was to decline 10% over the next month, what would you do? (Sell all my investments, sell some of my investments, do nothing, or buy more.)

- What is the maximum loss you would sustain on your $100,000 investment before you would sell or reduce your risk exposure?

Once you complete that questionnaire, you’ll be given a portfolio based on your responses.

Your asset allocation and investment choices will be created, in accord with your responses to your risk tolerance, age and screening questions. The screening questions are comprehensive enough to provide confidence that your risk level is on a par with your investments.

And, if you have any questions, speak with one of the Validea Legends financial consultants.

Should you decide to open an account, you’ll be taken to the custodial website, Folio Investments, Inc (see Account Custodian and Clearing Agent below).

Account funding withdrawals. Funding can be done by electronic funds transfer, wire, check, or transfer of an existing brokerage account. Withdrawals can be completed using the same methods.

Find out; The Future of Robo-Advisors

Account custodian and clearing agent. Your account is held with FOLIOfn Investments.

Validea Legends Robo-Advisor Pros and Cons

Validea Legends Robo-Advisor Pros

- Validea uses the investment recommendations of the most successful investors on Wall Street.

- Your investments are held beyond stocks and bonds, and also include gold and other commodities, REITs, private equity investments, and cash.

- Equity holdings are reduced in bear markets, and increased as the bear market ends.

- Unlimited access to investment consultants free of charge.

Validea Legends Robo-Advisor Cons

- Validea Legends Advisor base fee structure of 0.25% is in line with other robo-advisors, like Betterment and Wealthfront, which also charge just 0.25%. But due to the active management of Validea investments, the net fee is higher (as high as 0.80%). However, since Validea employs active investment management, it’s not a clear comparison. It may be more appropriate to match Validea’s total fees with those charged by traditional investment managers, which are typically between 1% and 3% of assets under management. Or you could compare their fees with other actively managed robo-advisors.

Validea Legends Robo-Advisor Review Wrap Up

Validea Legends is a unique type of robo-advisor, and probably can’t be judged but the same parameters as typical passively managed robo-advisors. They do charge higher fees overall, but what you’re getting in exchange is a very high level of portfolio management, that incorporates some of the most aggressive investment strategies on Wall Street, in combination with risk minimization techniques.

Validea is a platform designed for investors looking to outperform the general markets, both during rising and declining markets. The structure may best be compared with that of traditional active investment managers, but with lower fees.

If you’d like to get more information, or if you’d like to open up an account, visit the Valiea Legends website.

Kevin Mercadante is professional personal finance blogger, and the owner of his own personal finance blog, OutOfYourRut.com. He has backgrounds in both accounting and the mortgage industry. He lives in New Hampshire and can be followed on Twitter at @OutOfYourRut.