Should I sign up for Empower (formerly named Personal Capital)?

You must sign up for Empower (formerly named Personal Capital) because of the free Empower (Personal Capital) Dashboard!

You may have seen Empower (Personal Capital), discussed online and on television. Now, learn why the Empower investment management software tools are helpllful for anyone who wants to maximize their wealth.

Is Empower (Personal Capital) free? Yes and no. The free Empower (Personal Capital) dashboard and software offers a suite of free money and investing tools. Empower (Personal Capital) Private Client Wealth Management is a paid investment and money manager.

Since the integration with Personal Capital, Empower clients have access to a range of investing and financial management services. This Empower (Personal Capital) Review is a deep dive into:

- The free Empower (Personal Capital) software and financial dashboard

- The Empower (Personal Capital) Private Client Wealth management service – includes unlimited financial advisor sessions

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Empower (formerly Personal Capital) Review

Name: Personal Capital

Description: Free personal finance software, tracking and tools. Plus, financial advisor driven robo-advisor to manage your money.

-

Fees

(3.75)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(5)

Summary

Best for:

- Anyone seeking investment management and tracking

- Those seeking comprehensive financial management services.

Pros

- Free retirement planning, budgeting, investment management.

- Investment management with financial advisor, individual stocks and socially-responsible investing.

- Top-ranked investment app.

Cons

- Users must field a call from a company representative.

Even if you don’t hire Empower to manage your investment portfolio, you should consider signing up for the Empower (Personal Capital) free financial software, tools, calculators and more.

You can track all of your investments and bank accounts without paying anything.

The Empower Personal Dashboard is a more complex version of Mint.com with a focus on investing. Comparable with Quicken and alternatives, the Empower investment management Dashboard is free. I use both Empower (Personal Capital) and Quicken.

Features at a Glance

| Overview | Digital investment management robo-advisor in concert with human financial advisors. |

| Minimum Investment Amount | Zero minimum for access to free investment management tools. $100,000 minimum for managed accounts. |

| Fee Structure | 0.89% for investments of $1M to $2.9M. Fees decline as assets increase. Low 0.49% for accounts over $10 M. |

| Top Features | Free investment and retirement management tools for all. For paid users: Certified Financial Planners, full financial plan, individual stocks, diverse asset classes, tax-loss harvesting and cash management. |

| Free Services | The most comprehensive suite of financial planning tools including cash management, investing and retirement planning tools. |

| Contact & Investing Advice | 24/7 email access. Phone, video and chat with financial advisors (for paid users). |

| Investment Funds | Individual stocks, ETFs, low fee bond and alternative asset ETFs. Individual bonds for accounts +$1M. |

| Accounts Available | Individual & joint investment accounts. Roth, traditional, SEP & rollover IRAs. Trusts. |

| Promotions | Free financial, retirement, and portfolio tracking tools. |

Empower (Personal Capital) Dashboard

Whether you are an experienced investor, like I am, or just starting out financially, Empower offers something for you. You can sign up quickly and link your accounts to access the free Empower (Personal Capital) software.

The Empower financial software will simplify your financial life.

We understand that you need to know more, so here is my personal review of the platform. We’ll start with the free Empower (Personal Capital) tools so you can discover if the dashboard is right for you..

This three part review covers:

- What is Empower (Personal Capital)?

- Empower (Personal Capital) Free Software and Investing tools

- Empower (Personal Capital) Private Client Wealth Management and Advisors

1. What Is Empower?

Empower is a financial management powerhouse. In addition to the Empower Dashboard of free investment, spending, retirement and financial planning tools the company is a full service investment broker with a variety of account types designed to serve all types of investors.

Empower.com offers free personal finance tools, software and tracking for saving, budgeting, retirement planning, net worth tracking and more.

Empower (Personal Capital) Wealth Management offers financial advisors and proprietary investment management including tax optimization, dynamic portfolio allocation and social responsible investing. Personal Capital pricing is less expensive than most financial advisors.

How Empower Works

Empower considers all of your financial accounts and provides information and direction about how to best allocate your money and investments to yield the greatest long term financial outcome.

Empower has 17+ million customers and administers $1.3 trillion across all of its subsidiaries.

For the Empower dashboard, connect your accounts and the free service gives you personalized financial information about; budgeting, spending, saving, investing, asset allocation and even tax loss harvesting.

You Must Sign Up for Empower If:

- You want a 3600 view of your complete financial picture; bills, income, debt, investments and more.

- You’re a DIY investor who likes control of your finances.

- You have many investments across various accounts.

- You want a free retirement calculator.

- You’re interested in planning for Junior’s college expenses.

- You want a continuously updated record of income versus spending and a comparison with the previous month.

- You might want to speak with an experienced financial advisor.

If you answered yes to at least one item, you must sign up for a free Empower Account.

You get comprehensive spending, saving, and investment performance information in a user-friendly interface.

The investment manager, Empower Advisors offers complete investment management with financial advisors. We’ll provide an Empower Wealth Management Review below.

2. Free Software and Investing Tools

Since the Personal Capital integration with Empower, all features remain the same. The only change is the new name.

Financial management starts with knowing your complete financial picture. Keep your net worth growing and the rest of your financial life will fall into place.

One of the most important financial goals is to grow your net worth over time and the Empower dashboard keeps your complete financial picture front and center.

I’ve set net worth and financial goals my entire life, and with decades in the investment markets, the financial growth is gratifying.

Kind of like dieting, if you don’t measure where you are when you start, you won’t know when you reach your goal. The same is true of tracking your net worth.

Empower Reports and Features

After the sign up for Empower (Personal Capital) you gain access to the following reports:

- Net Worth and Account Balances

- Personal Capital budgeting

- Cash Flow Analysis

- Income Report

- Spending Report

- Investment Returns

- Asset Allocation View

- Retirement Planner and Fee Analyzer

- Investment Check-up

Not only do you receive a picture of your current financial situation, but you get help managing your investments and figuring out what you’re doing well and what can be improved.

The reports allow you to perform a complete analysis of your finances and plan for the future.

The Personal Capital tools help you:

- Analyze your cash flow.

- Calculate your net worth.

- Check on and analyze your investments.

- Plan for retirement.

- Plan for college expenses.

- Analyze your account fees

- Prepare for a recession

Before we get into a drill down of the features in the free Personal Capital finance money management tools, here’s a quick overview of the sign up.

Spoiler alert – it’s very easy to sign up.

Empower Sign Up

You’ll receive tremendous financial data and information for a few minutes of set up time. Answer a few questions about your name, age and savings amount to create an account

Next link your investment, savings and debt accounts so the app can provide updated information and recommendations.

Data collection sign-up time; less than one minute per account.

Now, you’re ready to enjoy the broad range of saving, spending, budgeting, investing and analysis tools.

The Empower Personal Dashboard app, available for android and iOs bring your finances to your fingertips. Just download from the app store of your choice.

Cash Flow

Your financial plan starts with knowing how much money you have now, how much is coming in and the amount that you’re spending. The Cash Flow tool streamlines this segment of your life with a detailed dashboard.

Cash flow is your day-to-day, week-to-week money management compass. With cash flow data, you’ve got the tools to see where your money is going and whether you need to make changes or not.

Next, the income screen shows where your income is coming from, and how it’s changing over time.

Income

The income screen highlights where your money is coming from. The bar allows you to compare your monthly income with the average. You can also adjust the view to highlight a variety of time periods.

By analyzing your income, you can assess your incomes sources and use that data to consider how to improve your income profile.

If the image shows a positive month, with more income than spending, that’s good. If you’re having a month with more spending than income, you can’t hide from it.

Click on any section, and zoom in to see a detailed view. Click on income and see all of your income sources.

Expenses

On the expense screen you get your detailed spending analysis.

This ‘in your face’ cash flow picture gives you ready access to the viability of your lifestyle choices.

Go to spending and find out exactly where your money is going.

I remember the first time I noticed how much our family was spending on dining out, it was a real eye-opener. It caused us to sit down and figure out if the money we spent at the restaurants was worth the damper it was placing on our financial growth.

Interested in analyzing your spending more? The Empower Dashboard categorizes each purchase and you can drill down to view the date and merchant.

Budgeting

With a busy life, it’s tough to stay on top of bills due dates and when you made your last payment. Click on the Bills tab under Banking and Personal Capital shows you when bills are due, the minimum payment and total amount outstanding.

Investing

Being able to see all of your investment accounts is ideal. After inputting all of your information, you have a 360o view of your retirement, bank, and brokerage accounts. You can integrate that CD you have with a credit union with your prior 401(k) account, a Roth IRA, discount brokerage account and any other type of financial account that you have. This allows you to splice individual cash, stock, bond, mutual fund, ETF and any other financial holdings into a total picture.

You can view and analyze your investment portfolio:

- Holdings

- Balance

- Asset Allocation

- Performance

- Sector Allocation

- Investment Check Up offers recommendations to improve returns.

Investment Check Up

Compare your current portfolio allocation to the ideal target allocation designed to minimize risk and maximize returns to meet your financial goals,”

The investment check-up offers priceless tools. The overriding question that the investment check-up answers is “Could your portfolio give you greater returns for a reasonable risk level?”

The program answers this question by comparing your current asset allocation to the recommended target. Personal Capital offers suggestions to improve your returns, as well.

Target Asset Allocation

Personal Capital reviews your asset allocation and offers recommendations to improve returns in the Investment Check up.

Based on your risk preferences and expected retirement date Personal Capital creates an asset allocation for you. You get a personalized asset mix, with the greatest return for the least amount of risk. This portfolio leans towards the aggressive side.

Empower (Personal Capital) Retirement Planner

Are you wondering if you’re on track to meet your retirement goals? The Empower retirement planner gives you the answer. The retirement planner is one of the most coveted wealth management services in this investment tool.

In fact, we believe this is one of the best retirement calculators available online.

The calculator tells you:

- Best and worst case retirement scenarios.

- How much you can spend each month throughout retirement. If you’re out of whack and your spending is projected to surpass your income, you’ve got time and tools to adjust.

- How to adjust your projected spending and include special expenses like a large vacation or more.

- The Retirement Planner is flexible and allows you to switch inputs, such as annual projected spending, income events and even the opportunity to reduce spending as you age.

After uploading all of your investment and retirement accounts, you can estimate future income sources and spending goals. The accompanying graph then projects the probability of reaching your retirement goals.

You can change the inputs to find out how more or less spending will impact your future financial situation.

The Recession Simulator, which you can create in the “scenario view” tells how your portfolio might hold up if there is a recession at a date of your choosing.

The free retirement planner is included in the FREE personal finance software, and money management tools.

Retirement Fee Analyzer

This retirement fee analyzer calculator is also included in the free tools and reviews your fund fees. This shows how much of your money is going to pay the fund manager, not into your investments.

Even low fees can add up.

Since Empower uses individual stocks, there are no annual fees for individual stock ownership. You’ll only pay for the Personal Capital portfolio management fee.

Empower FREE Portfolio Review

If you sign up for the free Empower investment management tools, and your aggregate linked accounts are worth more than $100,000, you’re eligible for a free portfolio review, by a financial planner.

Click on the button below, sign up and get your investment portfolio reviewed by a Certified Financial Planner (no strings attached):

Just sign up with the link, connect your accounts and wait for a call from the Empower representative!

Using Empower

Asset Allocation

When comparing the current allocation with the suggested target, in my portfolio there’s more cash, than recommended as well as fewer international bonds than recommended. I’m also underweighted in US stocks.

The platform explains their recommendations, but you ultimately can choose to follow the suggestions or not.

There’s a slider that shows various scenarios for differing asset allocation mixes from more conservative to more aggressive. I liked this feature, as it gives the investor the opportunity to tweak their own asset allocation.

It’s important to understand that all investment return projections are based upon historical asset class returns. So, if specific investments, such as international stocks or US bonds don’t perform as they did in the past, the future returns will deviate from the projected gains.

We like this feature because you can decide whether your asset allocation is best or if you should consider revamping it. This is ideal for intermediate and advanced investors.

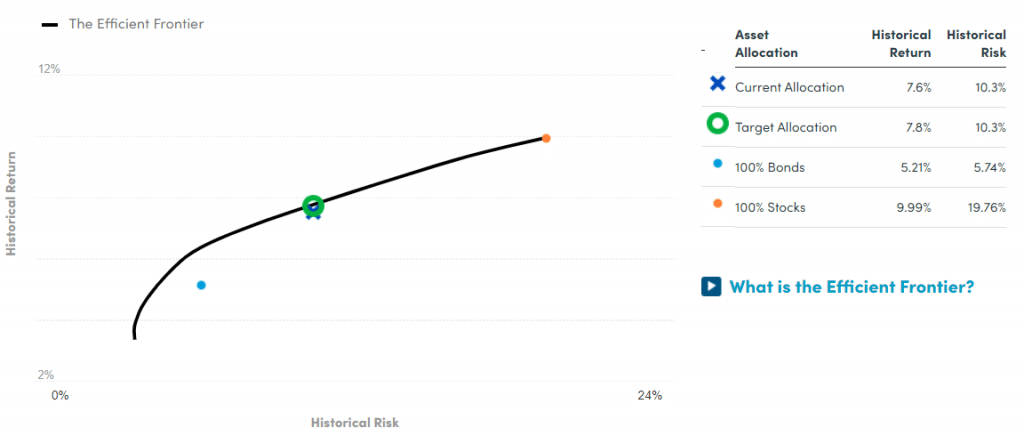

Risk v. Return

In the graph from the Empower investment tools section you can see the interaction between risk and return of the sample portfolio versus the targeted.

Empower uses Modern Portfolio Theory (and has its founder, Harry Markowitz, on their investment committee). The curve or efficient frontier represents the interaction between the portfolio’s risk and return with any portfolio which lies on the line representing the greatest return level for the amount of risk desired.

If you’re willing to take on greater risk for the possibility of higher returns, then your investments will include more stocks and will be further to the right, on the efficient frontier.

The FAQ at the end of the check-up is great if you have any lingering concerns about how Empower comes up with its results.

These are high level tools offered for free. There’s really no reason not to sign up for the free cash and investment management tools.

Pros and Cons of Free Empower (Personal Capital) Software

Empower Software Pros

- The data overview and integration is sound. It’s helpful to view net worth, income, expenses, and investments with the push of a button.

- The retirement analyzer is a superb tool, as is the retirement fee analyzer.

- The drill down into aspects of your portfolio is similar to the Morningstar x-ray tool and is a great way to uncover holes in your diversification strategy.

- The You IndexTM allows you to compare your investments against various benchmarks. For example, after a market drop the S&P fell -3.19%, while my portfolio only dropped -1.9%, due to its conservative allocation.

- Set up is very simple.

- Excellent, bank-level security.

- Empower dashboard, reports, retirement planning, investment check up and more are free.

Empower Software Cons

- All assumptions are based upon past data. There is no guarantee that the past performance of any asset classes will continue into the future.

- Their assumptions are a bit aggressive for my taste, even for the moderate portfolio. The investment check-up, using historical assumptions doesn’t jive with my personal preference of capital preservation over growth.

- The historical reports only go back two years. For more extensive reporting capabilities you might add Quicken or Ziggma to your investment management tool kit.

- The tradeoff for the free Personal Capial dashboard and tools is that you will need to field a call from an Empower representative.

3. Empower (Personal Capital) Advisors – Wealth Management Review

So far this Empower Review has covered the rich offerings of the Empower technology-assisted platform. From cash flow, investing, and retirement there are a wealth of free resources. Next, learn how the dedicated Empower Financial Advisors work for you.

Although I don’t use the Personal Capital financial advisors, I had a productive and informative meeting with a financial advisor where I received a complete analysis and personal portfolio review.

This drill down by the top investment committee of Empower does not obligate you to sign up for the paid service but gives you an idea of what to expect if you were to employ the firm to manage all or part of your investment portfolio.

This Empower Advisor Review delves into the Personal Capital cost, services and features. You’ll learn about all of the details of this robo financial advisor.

Wealth Management Features

- Personal Financial Plan driven by financial advisor.

- Smart Indexing — Incorporates Modern Portfolio Theory and equal sector/size weighting.

- Tax Optimization

- Dynamic Portfolio Allocation

- Rebalancing

- Cash Management

Bonus: Six Robo-Advisors with the Human Touch

Smart Indexing

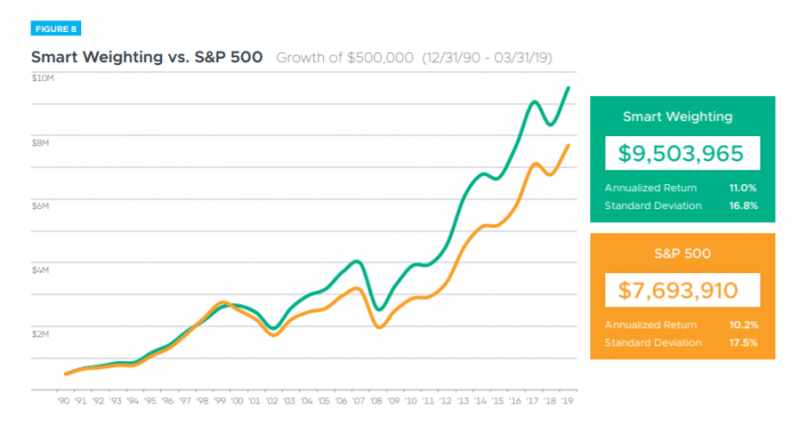

Empower’s dynamic asset allocation and smart weighting is unique among robo-advisors.

Empower creates an index with a sample of individual company stocks for portfolios larger than $200,000. Investors with under $200,000 have exchange traded funds in their accounts.

The goal is to achieve a relatively even exposure to size, style, and economic sector. The result of the strategy is to have equal weight in each major investment sector. This method contrasts with typical indexes that weight companies ownership by market capitalization or number of shares multiplied by share price.

Personal Capital’s expected benefits of smart weighting:

- Better diversification

- Increased return potential

- Avoidance of sector bubbles

- Elimination of fund costs

- Increased tax management opportunities

Since 1990, sector weighting has outperformed the market-capitalization weighted S&P 500 stock market index.

Empower Wealth Management Levels

Empower Private Client Wealth Management is available to high net worth clients with at least $100,000 of investment assets.

Investment Services

For clients with $100,000 to $200,000 of investable assets you receive:

- Financial planning tools

- Financial advisory team

- Financial and retirement planning

- Investment management and review

- Tax optimization

Wealth Management

For clients with $200,000 to $1,000,000 of investable assets you receive:

- Two dedicated financial advisors

- Specialists in real estate, stock options and more.

- Investment portfolio customization including access to individual stocks.

- Full financial and retirement plan

- Tax loss harvesting and tax location

- Guidance with all financial decisions including insurance, home financing, stock options and compensation.

Private Client

For clients with over $1,000,000 of investable assets you receive all of the above plus:

- Access to the investment committee.

- Customizable individual stocks, individual bonds (in certain circumstances) and ETFs.

- Estate, tax and legacy portfolio construction.

- Private equity and hedge fund review.

- Donor advised funds.

- Private equity and hedge fund investments.

- Private banking services.

Personal Capital Fees

How Much Does it Cost to Use the Paid Version of Personal Capital?

Personal Capital will manage your assets with a minimum investable balance of $100,000. The Personal Capital fee structure is as follows:

| Assets Managed by Empower | Fee per Assets Under Management (AUM) |

|---|---|

| $100,000 - $2,999,999 | 0.89% |

| For clients who invest $1,000,000 or more | |

| First $3,000,000 | 0.79% |

| Next $2,000,0000 | 0.69% |

| Next $5,000,000 | 0.59% |

| Over $10,000,000 | 0.49% |

The fees include advisory services as well as execution fees of securities transactions including any brokerage or third party management costs. Empower is a Registered Investment Advisory firm and operates under a fiduciary standard which upholds the company to put your interests above their own.

The fee structure is lower than that of most financial advisors

Empower (Personal Capital) Performance

We’re hesitant to showcase performance, because past performance is not indicative of future returns. Also, your returns will vary based upon when you begin investing and which portfolio you choose. That said, we appreciate that Empower’s (Personal Capital’s) performance for a range of portfolios and time periods is prominently listed on the Wealth Management, Performance page.

The data shows Empower returns surpassing their benchmarks in most years. Although interesting, we recommend using performance measures in conjunction with other features, when choosing a robo advisor.

Pros and Cons of Empower Wealth Management

Pros

- The sector weight allocation is a distinct from the majority of other robo advisors and studies claim that this approach will protect investors from excessive portfolio risk and improve returns.

- Their fees are competitive, when compared with other financial advisors. Actually, most financial advisors charge greater than 1.0% of AUM and often times up to 1.75%.

- The individual stocks (and bonds) within the portfolio provides greater opportunities for tax loss harvesting and can lower income taxes.

- My advisor listened well, confirmed my investing and retirement plans, prepared the Personalized Investment Strategy, all for no charge. He was helpful, not pushy or sales-oriented.

- All advisors are credential Certified Financial Planners.

- Empower offers tax, estate planning and sophisticated financial guidance.

- Their advisor board includes three of the top minds in investing today: Harry Markowitz, Sholomo Bnartzi and Luis Aguilar.

Cons

- You need $100,000 of investable assets to use the Empower advisors Wealth Management service. The platform is designed for the mass affluent client.

- The asset allocation recommendation for someone 10 years from retirement seemed aggressive with 26% allocated to bonds and cash and 74% in stock assets. Although, you’re free to adjust it.

- Only time will tell whether sector weighted investing will outperform market-weight asset allocation in the future. There are flaws with back-testing a theory, as it doesn’t guarantee that the results will play out accordingly in the future.

- There are other robo-advisors, with access to personal financial advisors with lower fees. Betterment Premium charges o.40% and includes financial advisor access. Vanguard Personal Advisors requires a $50,000 minimum investment, offers advisors and charges a 0.30% AUM fee. While Schwab Intelligent Portfolios Premium has a low, subscription based fee structure.

Empower Personal Cash

The current Empower Personal Cash interest rate is 4.10% APY

Here is a summary of the main features of the Empower Personal Cash account:

| Overview | A savings account |

| Savings rate (subject to change) | Personal Capital Cash interest rate varies with market rates |

| Account fees | $0 |

| FDIC insurance* | Yes – $2 million maximum |

| Minimum account balance | $0 |

| Mobile app | Yes |

| Deposits and transfers | Unlimited |

| Direct deposits | No, only ACH transfer |

| Bill pay | No |

| Branches | No |

| ATM access | No |

*Empower Personal Cash investments are bank deposit products provided by member banks and these banks provide $250,000 FDIC insurance, per bank.

FAQ

Is Empower (Personal Capital) safe?

Is Empower worth it?

Is Empower Really Free?

Empower Review Summary

There’s no doubt that the free Empower dashboard, cash flow, retirement planner, investment checkup and investment analyses are invaluable tools for the consumer. For the investor looking for a financial planner, the fees are reasonable and the services exceptional.

There are no future return guarantees for any investment approach and only time will tell if Empower’s dynamic asset allocation plan beats a more conventional market-weighted investment approach.

We recommend signing up for the free service, speaking with the investment advisor and deciding whether the paid service fits in with your personal investing needs.

Compare

| Empower | Betterment | |

|---|---|---|

| Overview | Empower offers stellar free investment management tools. and paid advisors and management. | A goals based automated investment advisor. Financial advisors available for extra fee. |

| Minimum Investment Amount | No minimum amount for free tools. $100,000 for Premium. | Digital - No minimum ($10 to invest) Premium - $100,000 |

| Fee Structure | Zero fees for free investment management tools. Premium-0.89%-0.49% AUM | Digital-$4 per month, accounts worth less than $20,000. 0.25% AUM accounts worth more than $20,000 or $250 monthly auto deposit. Premium-0.40% AUM |

| Top Features | Free money and investment management dashboard. Human advisors and customized financial plans. | Financial advisors for all- for added fees. Complete digital investment and cash management. Crypto portfolios. |

| Contact & Investing Advice | Phone M-F 6 am-6 pm PT Email-24/7 | Phone 9-6M-F EST. Email 7 days per week. |

| Investment Funds | Empower Advisor accounts invest in individual stocks (for large accounts) and stock, bond and alternative ETFs. | Low-cost, commission-free ETFs and cryptocurrency. |

| Accounts Available | Individual + joint investment accounts. Roth, traditional, SEP + rollover IRAs. Trusts. | Individual + joint taxable brokerage. Roth, traditional, rollover + SEP IRA. Trust. |

| Promotions and Website | Superb free money and investment management dashboard. | Free management fee promotion in effect (time limited) |

Related

- Empower vs Betterment

- Empower vs Mint vs Quicken

- M1 Finance vs Empower

- Empower Retirement Planner

- Best Portfolio Management Software for Investors

- Bill Harris – Personal Capital Marketing Genius

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.