How Bill Harris, Personal Capital’s Founder Upended the Robo-Advisor Financial Industry With Their Freemium Model

Personal Capital has been acquired by Empower, but all services remain the same.

The recipe is ingenious by Personal Capital founders.

Start with iconic founders, create a unique product, add on extra features and finish off with an amazing free giveaway. For investors seeking a sophisticated financial and investment management platform, for free, it’s tough to beat co-founder Bill Harris’ Personal Capital product, currently known as Empower. Wealthy investors looking to minimize advisory fees and create a sophisticated “smart beta” investment portfolio, will appreciate the reasonable fees and access to human financial advisors. Yet, Personal Capital offers really valuable finance software for free.

How the Personal Capital Founder Broke the Automated Investment Advisory Mold

Personal Capital co-founders Bill Harris and Rob Foregger of Personal Capital clearly state their goal; “build a better money management experience for consumers.” Foregger co-founded EverBank and Harris was CEO of both Intuit and Paypal.

These founders disrupted the financial advisory arena by blending technology with non-biased human financial advice. In a few short years, Personal Capital has garnered roughly 2.5 million registered users and $12.3 billion in direct assets under management in 2020.

With robust startup capital and a large employee base, Personal Capital is not your typical robo-advisor. The firm, uses a smart beta methodology in their investing, not the usual all-index ETFs of other digital investment platforms. Additionally, the company pairs users up with their own personal financial advisor. Their free retirement tool is available for anyone to use. It’s great for a check up to discover whether you’re on tract to meet your future financial aspirations.

Although not the cheapest robo-advisor, their fees are lower than those of most comparable human financial advisory firms.

This is all quite impressive-but their marketing model is brilliant.

What Do You Get with Personal Capital? The Freemium Model

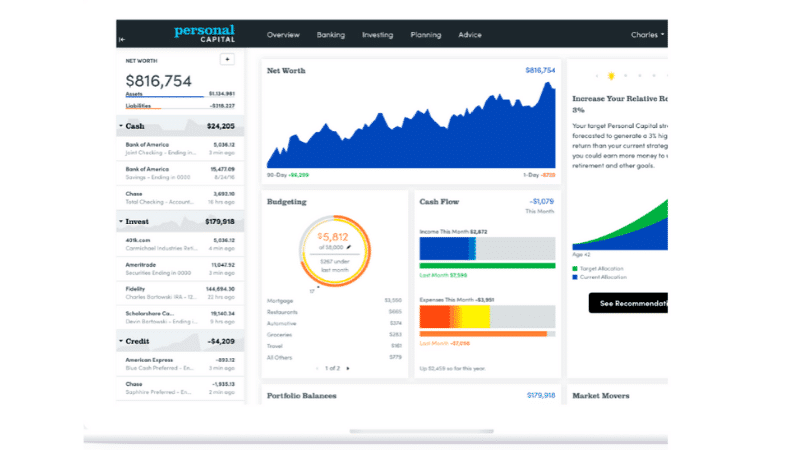

This is not a review of Personal Capital, but a look at how Foregger and Harris took the freemium model and went to the moon with it. They offer anyone who signs up and links their financial accounts an amazing financial toolkit, rivaling the paid Quicken tools and in some cases surpassing it. Registered users gain access to the impressive dashboard along with an array of money management tools.

Bonus; Personal Capital vs Quicken Review: Deep Dive into Top Money Management Software

After linking your accounts, in a painless and efficient manner, you get a 3600 personalized financial picture including; budgeting, spending, saving, investing, asset allocation and even a detailed retirement planner.

The free Personal Capital reports include:

- Account Balances

- Income Report

- Spending Report

- Investment Returns

- Asset Allocation View

- Projected Investment Fees

- Net Worth

At the risk of sounding like hawker for Personal Capital, I’ll finish with a brief description of one of their best free features-their Investing Tools. The platform brings an investment check that delves into your past and future projected portfolio performance.

Next, there’s the asset allocation analysis. Under the risk and return drill down, you get the following features:

- Retirement Planning Calculator

- Portfolio Fee Analyzer

- Retirement Fee Analyzer

But, there’s more.

Personal Capital Free Investment and Financial Management Tools Tutorial

The Rob Foregger and Bill Harris Personal Capital Marketing Genius

The company has taken the freemium model and gone all in. DIYers and others, with no intention of buying into the paid model, still get the Personal Capital dashboard, reports, analyses and wealth management tools-no strings attached.

Additionally, to broaden their reach, Personal Capital has a wide network of online publishers who promote their services (myself included) and pay the affiliates a generous commission, every time a user signs up for their services (based upon certain conditions).

Empower FREE Portfolio Review

If you sign up for the free Empower investment management tools, and your aggregate linked accounts are worth more than $100,000, you’re eligible for a free portfolio review, by a financial planner.

Click on the button below, sign up and get your investment portfolio reviewed by a Certified Financial Planner (no strings attached):

Just sign up with the link, connect your accounts and wait for a call from the Empower representative!

Why Pay for Personal Capital?

Thus far, it appears you get everything for free, but that’s not accurate. Many investors seek a human touch and hands on investment management. And that’s where Personal Capital makes its money. With a $100,000 minimum investment amount, the investor gets access to a complete financial planning package along with a Certified Financial Planner to guide their financial future.

Although, I didn’t hire Personal Capital to manage my money, as I oversee the investment management myself, the firm prepared a detailed analysis of my investment assets, in the hope that I will eventually use their paid platform.

The Personal Capital financial advisor recommended a tactical sector weighting asset allocation and provided a full portfolio review report for me.

The analysis was complementary although you might pay nearly $800 for a comparable review.

For the stock asset allocation, Personal Capital buys individual stocks. For the other asset classes, they use ETFs and ETNs.

Their paid services approach those of typical financial advisors-with a twist. Their proprietary investment strategy was back-tested against the S&P 500 and in most cases outperformed the index.

The other paid services include access to a CFP, portfolio management that takes all accounts into consideration, rebalancing and tax loss harvesting, private banking and lower fees for accounts of children and/or parents.

Personal Capital Founders Sell to Empower Media

Further underscoring the Personal Capital founders success is the recent sale of Personal Capital to Empower Retirement, a firm that aprovides retirement services to other companies.

The sale is priced at $825 million at closing with another $175 million expected in growth incentives. The sale further cements founders Bill Harris and Rob Foregger as both product creation, marketing, and sales super stars.

In fact, this sale is in the arena of the Facebook’s $1 billion acquisition of Instagram. Quite a feat!

Personal Capital Wrap Up

As a financial product, Personal Capital is not your typical robo-advisor. Their free dashboard and related financial and investment management tools are extremely valuable. Their paid service assists those who appreciate the automated platform and want a human touch. The firm nailed it on their business model and differentiated themselves from the ever expanding robo-advisory field.

For those that buy in to the paid model, the fees are lower than the typical financial advisor. Yet, on the higher end of the robo-advisory competitors. With a management fee of 0.89% for assets up to $1,000,000 and 0.79% for the first $3,000,000, you can get lower fees and access to advisors at Vanguard Personal Advisors robo. Vanguard’s robo-advisor platform charges just 0.30% for account management and includes access to financial advisors. Additionally, the Personal Capital sector-weighted investment management approach is distinct from a typical market-cap index fund investment tactic that most other robo’s employ. Which type of investment management yields better returns, remains to be seen. In general, you need a good decade (at least) of historical data to evaluate an investment approach and that’s tough to find in the automated advisory arena. Personally, I don’t buy in to the idea that back-tested analysis is enough.

For those DIYers, and others with their own financial advisor-Personal Capital paid services might not be for you. Yet, if you want a free overview of your financial picture-updated in real time-then why not sign up for the dashboard, no strings attached.

Personal Capital may offer one of the best freemium robo-advisor platforms. There’s a wealth of online Personal Capital reviews touting the free dashboard and favorably comparing it to Mint, Quicken and other services. The genius of the Rob Foregger and Bill Harris Personal Capital marketing model is only surpassed by their free financial management software. Sign up for the free software if you’re looking for a free, high level investment management tools.

Read our Expert Personal Capital Review for more detail: Personal Capital Review – Why You Must Sign Up for Personal Capital – Deep dive into the robust features of the free investment management dashboard and candid discussion of the paid service.

Related

- 10 Top Money and Investing Apps

- Personal Capital vs Betterment

- Personal Capital vs Mint vs Quicken

- M1 Finance vs Personal Capital

- Titan Invest Review – Hedge Fund Investing for All

- Retirement Planning for Women

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t personally believe is valuable.The original version of this article was published on TalkMarkets