Robo advisors constitute a newer type of investment platform where most of the investment decisions are automated via algorithms created by the robo advisor company. The short answer to “How much money can you make with a robo advisor?” is, it depends. You’ll have a complete picture of your money making potential by investing with a robo advisor, after reviewing this article.

What is the Role of a Robo-Advisor?

Compared to traditional financial advisors, robo advisors typically offer better return/cost ratios due to their lower fees and the algorithms that remove the emotions that often lead to poor investment decisions (e.g., panic selling). The average retail investor looking to make money without much hassle often finds robo advisors to be an attractive alternative to traditional platforms due to the low minimum capital requirements and the simple investment strategies commonly offered. Read on to find out just how much money you can make with a robo advisor, in various scenarios and whether robo investing is right for you. You’ll also learn the answers to some of the most common robo-advisor questions.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Before gaining access to a robo advisor, you will typically need to undergo a questionnaire regarding your personal finance goals, risk tolerance, and experience. Your answers to the questionnaire will determine where on the spectrum of very conservative to very aggressive your portfolio will reside. Typically, aggressive portfolios are the domain of younger investors with greater allocations to stock investments. Aggressive investors are willing to accept more volatility in their investments with the expectation of greater investment returns. While older, more conservative investors might lean to an asset mix with greater allocations to bonds and fixed cash-like assets. Conservative investors are typically closer to retirement or more intolerant of stock market declines.

Over the long run, aggressive investors have an opportunity for greater returns than more conservative investors. This is due to the historically higher returns of stocks versus bonds. But as 2022 demonstrates, more aggressive investors are also at risk of greater drawdowns during declining investment markets.

The ultimate role of robo advisors is to craft an investment portfolio in line with your risk tolerance, goals, and timeline. After creating the diversified investment portfolio, the robo advisor will keep the portfolio in line with your preferred asset allocation through periodic rebalancing.

What do Robo Advisors Invest In?

Robo advisors investment strategies differ based on the individual company. However, you can typically expect most robo advisors to invest in passively managed stock and bond funds and sometimes in real estate or REIT ETFs (exchange-traded funds). In this way, many robo advisors work to emulate investing in the total stock market, as an index fund is essentially a basket of stocks and/or bonds that represent a major portion of the investment market.

The reason robo-advisors typically choose to invest in low-fee index funds is due to cost savings and long term investment success. Passively managed index funds copy unmanaged stock and bond market indexes. Among the most popular stock market index is the S&P 500 and you’ll find an ETF matching this index in most robo-advisors. Reams of studies and research has proven that index fund performance typically beats actively managed funds 60% to 70% of the time.

How much money you can make with a robo advisor typically corresponds with your asset allocation. For example, a robo-advisor would recommend to a conservative investor a portfolio with roughly 60% to 70% fixed assets (e.g., bonds) and 30% to 40% equity (e.g., stock funds). Similarly, an aggressive portfolio would be allocated something like an 80% stock, 20% fixed asset portfolio. More aggressive portfolios usually leads to greater long term returns. We’ll explore this topic in depth below.

Can Robo Advisors Make you Money?

Robo advisors work like advisory or brokerage services: You can choose to put your capital into an investment vehicle such as an ETF, and your returns will correlate with those of the underlying stocks and funds. Some hybrid robo advisors offer financial advisor access, while others are all-digital investment services. If you prefer access to professional financial advice, a robo advisor like SoFi Automated Investing or Vanguard Personal Advisors Services might be for you.

Even the best robo advisor cannot guarantee returns.

Top Robo-Advisors

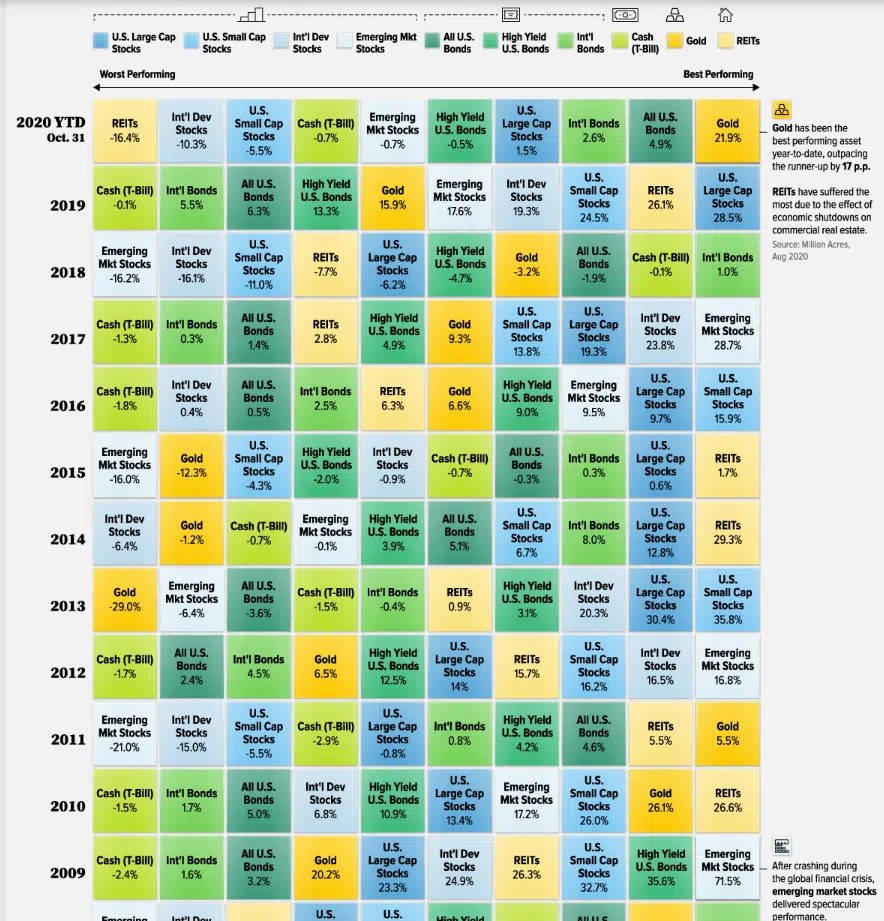

That said, knowing how various asset classes have performed over time can give you a general idea of how much you could expect to make with robo advisors investing in those asset classes. On average, the S&P 500 has risen nearly 10% per year, over the past 100 years, while the 10 year U.S. government treasury bond index has risen almost 5% per year. However, these returns are not guaranteed and you’ll notice in the chart below, that distinct asset classes outperform each year, underscoring the importance of holding a diversified portfolio.

Ranking Asset Classes by Returns: 2009 – 2020

If I invest $5,000 in a Robo Advisor, What Can I Expect?

One of the most common questions about robo advisors is “How much return can you expect from a robo advisor?” The answer really depends upon your asset allocation. For example, say you invest with a 70% stock, 30% fixed asset portfolio. Now assume over the coming year, the stock portion returns 15%, and the fixed portion returns 3%. Your total return would be 15%*70% + 3%*30% or 11.4%, which would turn your $5000 into $5570. A more conservative investor, with a 70% fixed asset, 30% stock portfolio would see a return of 15%*30% + 3%*70% or 6.6%, which would turn your $5000 into $5330. While the conservative investor earned less, she would be more protected in the case of a market crash, and tend to lose less during the market drop..

Of course, every year will be different, and financial markets tend to be volatile, especially over the short term. The average investor will not be able to accurately predict how much he will make over a single year but can get a pretty good idea of the average return over a long period of time simply by the law of large numbers. The main reason to be conservative is to reduce the potential loss from any given year.

Here’s how much you can expect to make with a robo-advisor:

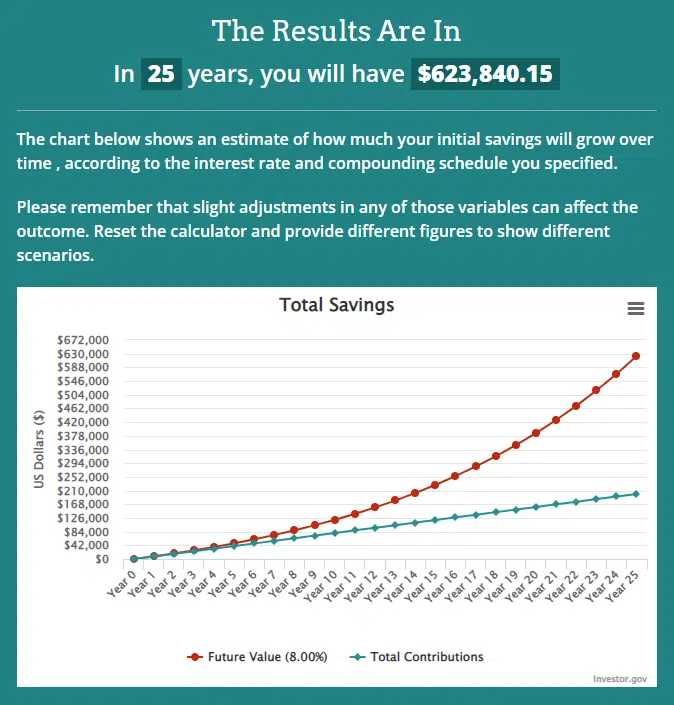

Let’s assume that you invest $5,000 per year, for 25 years, in a robo-advisor in a combined stock and bond asset allocation and earn an average of 8% annually. At the end of year 25, your $125,000 total investment would be worth roughly $389,665.

Now, consider the chart above which shows the likely return if you upped the amount invested each year to $8,000 (invested monthly and compounded quarterly) and kept all the other assumptions constant. Your $200,000 total investment would be worth about $623,840 after compounding for 25 years.

Investing over long periods of time is a powerful way to build wealth. And, investing with robo-advisors make it easy and cost effective to grow your wealth.

How Much do Robo Advisors Cost?

In general, nearly all robo advisory management fees are lower than those of traditional financial advisors. Robo advisory management fees range from zero to 0.89% of assets managed, for Personal Capital, the digital investment manager most like a traditional financial advisor.

For fee conscious investors there are many robos with rock bottom management fees. We offer a good list of free and low fee robo-advisors like M1 Finance and SoFi Automated Investing. In fact, you can watch our comparison video of the two on YouTube.

In addition to the investment management fee, which is typically based upon assets under management or AUM, nearly every ETF charges a very small expense ratio, that is paid directly to the fund management company. This fee ranges from 0.04% to approximately 0.10%.

Although both Sofi and Fidelity offer several no-fee funds included within their robo-advisors.

Can You Lose Money with a Robo-Advisor?

Sometimes you buy in right before a crash. Consider this: If you had bought a NASDAQ mutual fund in 2000, before the crash, you’d need 14 years to recoup your losses. This is why your investment strategy is essential in proper financial planning. For example, you can use dollar cost averaging (DCA), which is when you invest at regular intervals instead of putting all your available capital into an investment at once, to reduce both the chance and the impact of buying in right before a crash.

Ensuring your investment portfolio is diversified also goes a long way to protecting your wealth. It’s never a bad idea to check the past performance of an asset class before investing. Check out the image above, “Ranking Asset Classes by Returns” to view how various asset classes have performed during distinct years.

What’s the Difference Between Robo Advisors vs Self Directed Investing?

Many investors notice that robo advisors’ worth is in their portfolio design. They then ask themselves, “Why can’t I just choose the same funds robo advisors offer and get the same investment performance?” Doing so is certainly possible and results in lowering fees (you still have to pay the expense ratio of the specific ETF).

The main caveat is that you are now responsible for your own financial planning. If you see a large loss, you will probably feel worse when the loss came from your own financial decisions instead of the robo advisor’s, and you might be tempted to sell. This is primarily an emotional difference – indeed, some investors prefer to have others manage their money so that they don’t make mistakes, that will cost them money in the long run. If you can handle being responsible for the future performance of your capital, you can certainly bypass robo advisors and choose investments on your own.

But another reason some investors prefer robo investing over investing with a financial advisor is that with robo-advisor investing, the platform chooses the assets, performs tax loss harvesting, and rebalancing. In other words, the automated software removes some of the management that would otherwise be necessary were you to manage your own portfolio. Because robo advisors typically have low fees, an investor might feel the quality-of-life improvements she gets with a robo advisor are worth the annual fee.

Robo-Advisors with Human Financial Planner Access

Can You Make a lot of Money With Robo Advisors?

Compound interest is the eighth wonder of the world. He who understands it earns it… he who doesn’t… pays it.

-Albert Einstein

A better question is “Can you make a lot of money investing?”

Most investors are focused on the long-term and enjoy the benefits of compounded returns. The earlier you understand the power of compounding returns, the sooner you’ll be able to reach your investing goals. Compounding is the phenomenon of dividends, interest and capital growth being reinvested and thereby becoming part of your principle investment. Essentially, compounding lets your interest earn interest on itself.

If you start investing when you are young, even small additions to your portfolio during your working life can lead to a robust nest egg at retirement. In the short term, aggressive investors might make a lot of money, if they are lucky. But, they also might lose a lot of money. Statistically, you are unlikely to beat the market, as even the vast majority of mutual fund managers fail to do this very task they are employed to do. Moreover, with a market crash occurring an average of once per seven years, going all-in with an aggressive strategy typically requires a longer time horizon to realize large gains.

In the end, the most logical answer to the question of whether you can make a lot of money via the robo advising is, yes, over the long term, if you invest regularly. If you are an aggressive investor, you might make a lot of money in the short term with robo investing, or you might also lose a lot of money.

As investing in financial markets involves risk, and investment values go up and down, it’s best to deploy money into ETFs and mutual funds that you can leave invested for at least five to seven years.

How Much Should I Invest in a Robo-advisor?

Just as a human financial advisor would counsel you to consider your financial goals before determining the amount you need to invest in a robo advisor. Both a human and robo advisor would take your retirement goal and extrapolate from it your optimal amount of yearly/monthly investments. Many robo-advisors have wonderful calculators to help you figure out how much you need to invest to reach a certain goal, such as retirement. One of our favorites is Personal Capital. In fact, Personal Capital has a suite of free investment management and planning tools, including a superb retirement planner.

Overall, you should consider your comfort with investing and whether you prefer a DIY approach with a traditional brokerage firm or the guidance of an investment manager. With low management fees and a low account minimum, robo advisor investment accounts are accessible to practically every investor, though. It’s not necessarily a bad idea to just start investing with robo advisors and then pivot to other routes of wealth management after becoming familiar enough with robo advising.

How Much Money Can you Make With a Robo Advisor? Wrap Up

Robo advising is a low cost way to grow your wealth in the investment markets.

The robo advising business doesn’t have any big secrets; you can easily replicate the portfolios of robo advisors on your own. The main benefits of robo advisors are the time, effort, research, and stress savings you get from hiring a robo advisor firm to invest for you. Moreover, robo advisors benefit investors by precluding common mistakes that tend to lead to large losses (e.g., behavioral and emotional mistakes; forgetfulness; improper diversification). Even with the numerous free online workshops and interactive tools for DIY investors, many people still engage in poor wealth management. Robo advisors minimize these potential problems.

So perhaps the better question is whether robo advisors can save you from losing money, to which the answer is “yes” for many investors. The best way to think of robo advisors is as a portfolio management service. The money you pay in the low fees charged by robo advisors can be justified if robo advisors are presenting you from engaging in common investment portfolio mistakes and saving you time.

Finally, long term investors are likely to make money when investing with a robo-advisor. How much you make depends upon investment market performance, your asset allocation and how long you allow your money to grow and compound.

Related

- Best Robo Advisors

- 5 Best Robo Advisors For Beginners

- 6 Best Robo Advisors For High Net Worth Investors

- M1 Finance Spend Review – High Yield Checking and Saving Account

- Robo Advisors With Downside Risk Protection

- 8 Differences Between Robo Advisors

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.