“M1 believes people should always have their money working for them in a way that aligns with their objectives and values.”

Brian Barnes, CEO M1 Finance

Regardless of what you call it; socially responsible investing, ESG investing, impact, sustainable or socially conscious investing, the genre is exploding. To answer the need for values-based investing, ESG robo-advisors are becoming more widely available.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Investors are clamoring to do good with their investment dollars.

M1 Finance Makes it Easy to Invest in Socially Responible Companies

M1 Finance is unique among robo-advisors. Not quite a fully automated investment advisor, M1 integrates DIY investing with automated portfolio management, for free. You pick the investments; funds, individual stocks or pre-made M1 portfolios. Invest in your chosen asset percentages and M1 Finance does the rest. The platform invests all new monies according to your pre-decided asset allocation. M1 rebalances to keep your investment amounts in line with the percentages that you chose.

Read the complete Expert M1 Finance Review

If you like the idea of crafting an investment portfolio in line with your values, and leaving the management up to a pro, then the M1 Finance – Nuveen partnership with simplified responsible investing might be for you.

The companies included in the Nuveen funds – offered by M1 Finance are selected according to a variety of ESG factors:

- Environmental – Impact on climate change, natural resource use, waste management and emission management.

- Social – Corporate/employee/supplier relationships, product safety and sourcing practices.

- Government – Company’s corporate governance practices and business ethics.

The socially conscious funds typically exclude the vice and controversial industries; alcohol, tobacco, military weapons, firearms, nuclear power and gambling and others, according to the Nuveen website.

Ready to invest? Go directly to the website.

M1 Finance Socially Responsible Expert Pies (Portfolios)

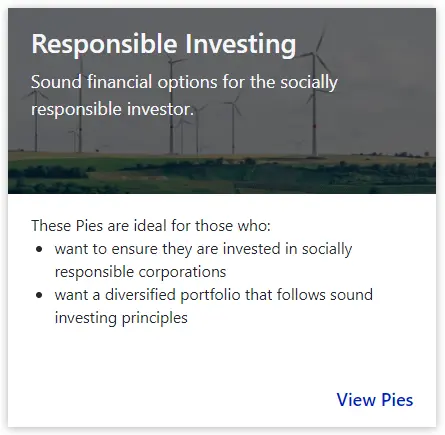

For those who prefer a set-it-and-forget-it investment, M1 Finance makes investing in ESG easy.

- Sign up for an account at M1 Finance

- Go to the Research menu item

- Click on the Expert Pies

- Choose Responsible Investing

Next, you’ll have a choice of two socially responsible expert pies (Click View Pies):

- N (Nuveen) Responsible Investing

- N (Nuveen) International Responsible Investing

Each portfolio includes five distinct US ESG funds (listed below).

The International choice adds in a developed market and emerging markets ESG fund.

Socially Responsible Investing Funds

The funds are culled from widely accepted stock investment styles, with the socially responsible investing overlay.

The US-based and international ESG expert pie includes these five funds:

- Nuveen ESG Large-Cap Growth (BATS: NULG)

- Nuveen ESG Large-Cap Value (BATS: NULV)

- Nuveen ESG Mid-Cap Growth (BATS: NUMG)

- Nuveen ESG Mid-Cap Value (BATS: NUMV)

- Nuveen ESG Small-Cap (BATS: NUSC)

The International Responsible Investing Pie adds the following two funds to those listed above:

- Nuveen ESG Emerging Markets ETF (NUEM)

- Nuveen ESG International Developed Market ETF (NUDM)

Here’s a quick video about how I invest with M1 Finance for dividends and growth:

Create Your Own Socially Responsible Portfolio

If you’d prefer to choose your own stocks and funds, it’s easy to do with M1. They offer approximately 6,000 individual stocks and investment funds from which to choose.

You’ll need to do your own research first, to decide which stocks and/or funds meet with the SRI guidelines that you’re seeking.

If you want to invest in climate change you might invest in an alternative energy ETF or companies that make solar panels.

If you’re interested in women’s rights, look for companies with women on the board and family-friendly policies.

Once you choose your investments, it’s easy to add them to your M1 Finance Investment pie, in the percentages that you prefer.

You can even combine an expert ESG pie with additional stocks and funds.

Other Expert Pies

If you are interested in other types of expert pies, there are a lot from which to choose.

If you want pre-made investing options, in addition to the Socially Responsible portfolios, M1 offers these categories of “professionally curated templates”:

- General Investing: Investing based on your risk tolerance.

- Plan for Retirement: Invest for your target retirement date in a portfolio that adjusts to your goals as you age.

- Responsible Investing: Sound financial options for the socially responsible investor.

- Income Earners: Pies focused on dividends and income returns.

- Hedge Fund Followers: Pies that mimic the investment strategies of some of the most successful investors and reputable hedge funds.

- Industries & Sectors: Aerospace to biotech and beyond, invest directly in the industries you believe are future winners.

- Stocks & Bonds: Low-cost pies with a simple balance of two ETFs, focused on stocks and bonds.

- Other Strategies: Additional investment strategies.

Pros and Cons of Socially Conscious Investing with M1 Finance

Pros

- It’s fast an easy to sign up, and select an M1 Finance ESG expert pie. You can design your own portfolio and select the pre-made socially conscious portfolios.

- You also have the opportunity to add in other types of investments such as bond funds, real estate funds or even a target date or hedge fund allocation.

- Do-it-yourself investors can easily choose their own SRI focused stocks and funds as well.

- We like that M1 Finance is perfectly customizable to align with your goals and values.

Cons

When creating your own SRI portfolio make sure that you’re investing in true socially responsible firms.

Some companies claim to be socially responsible, yet don’t actually meet the accepted standards for SRI investing.

“More companies have adopted the practice of “greenwashing,” which involves making themselves appear socially responsible (via certain marketing, donations, etc.) while still engaging in socially or environmentally harmful practices.”

M1 Finance website

Companies can change policies, and loose their SRI practices.

All companies, socially responsible or other should also be viewed according to profitablility and growth metrics to make sure that the SRI company is sound fundamentally.

M1 Finance SRI Wrap Up

If you’re like most investors with a life and a lack of time, then you might enjoy the benefits of Socially Conscious investing with M1 Finance.

You can select a few SRI funds on your own and then add other funds and stocks to your M1 pie. We like the free rebalancing that the platform offers. It’s just one less thing you have to do on your own.

Whether you choose an SRI expert pie or choose impact investing funds and stocks on your own, M1 makes it easy to buy, sell, and manage your investments.

- Additionally, you have the opportunity for banking-type services and borrowing at M1 Finance, making it an easy financial management hub.

Ultimately, M1 Finance takes care of all of the portfolio maintenance for you. And that makes life easier!

Read the complete M1 Finance Review

Watch M1 Finance videos on the Barbara Friedberg YouTube Channel.

Related

Best Robo-Advisors for Socially Responsible Investing

Guide to Sustainable Investing and Sustainfolio Review

Answer 4 quick questions and the Robo-Advisor Selection Wizard will present the best robo-advisor for you.