Best Financial Planning Apps to Simplify Your Life and Build Wealth

Our society has moved so far beyond the traditional “banker’s hours” at this point. Without instant access to our finances, we would be at a complete loss. Wouldn’t it be nice to have a financial advisor app in your pocket? The good news is that these 10 financial planning apps are akin to your own financial advisor.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

With the wealth of information available—pun absolutely intended—here’s how can we choose the best financial advisor, planning and money apps to help us manage our finances, investments and budgets.

With financial planning apps, you’re set up to use money wisely by saving, managing and investing on your android or iOs mobile phone or tablet.

No worries: I’ve done a lot of the legwork for you. Here are 10 of the best financial advisor, investing and money apps to get your started on your journey, whether you are pursuing financial freedom, investmenting or basic money management.

[toc]

1. Personal Capital: Complete Money & Investing app

Management Fee: Free (Paid services available)

Available for Android and iOS.

Personal Capital offers the ability to see all of your finances in one place. The 22,000 reviews net an average 4.7 ranking. This is one of the best financial planning apps. Personal Capital reports trends in your spending, and does an asset allocation review to make sure you are getting the most out of your existing investments. This robust financial app offers a retirement planning tool and a window into your entire investment portfolio with recommendations to earn greater returns.

More than a net worth tracker app, Personal Capital offers these free reports:

- Net Worth and Account Balances

- Personal Capital Budgeting

- Cash Flow Analysis

- Income Report

- Spending Report

- Investment Returns

- Asset Allocation View

- Retirement Planner and Fee Analyzer

- Investment Check-up

Personal Capital compares favorably with the expensive Quicken money management program and other Quicken alternatives. All of these benefits come for free and with bank-level security to protect your information.

Click for access to Personal Capital Review

2. Acorns: Micro Investing app

Free download: Fees-minimum $1/month, or 0.25%/year of managed assets.

Available for Android and iOS.

This ingenious money app builds wealth as you go through your day. Acorns makes investing easy by helping you find money (read: the spare change left over from your daily purchases). This money—no matter how little—is invested in your portfolio. The idea behind this money app is that small steps make a huge difference in terms of your finances. This is a logical way to get started investing-and you won’t even miss the money.

Taking your money out is just as easy as putting it in; Acorns allows you to withdraw any time with no penalties. In order to provide this service, Acorns charges a small amount of money monthly for investors with less than $5,000. Once your portfolio reaches $5,000, you are switched to a flat rate of 0.25% yearly.

In 2016, Acorns stock investments came in 2nd in a robo-advisor comparison analysis.

Click for; Acorns Review

3. Robinhood: An Investing App for Everyone

Management Fee and Commissions: Free (Premium services extra)

Available for Android and iOS.

The name of this stock market investing app should immediately spark your interest. The premise of Robinhood is that everyone should be able to invest, so the app offers a simple dashboard that makes it easy for investing newbies to get their feet wet. Robinhood is a commission-free stock trading app. They charge for premium services like margin trading.

Robinhood offers customizability. Users can choose a different investment strategy depending on the stocks they purchase. The app teaches you to invest. Robinhood advocates a “learning by doing” approach, and is designed to help you succeed even if you are an absolute beginner.

Compare: Robinhood vs. Acorns vs. M1 Finance

4. M1 Finance: DIY and Managed Investing App

Management Fee: Free (M1 Plus charges an annual fee for additional services)

The M1 Finance financial planning app is like having a financial advisor in your pocket. For investing, the M1 Finance app offers access to pre-made investment portfolios or thousands of individual stocks and funds. The many pre-made portfolios include:

- Socially responsible

- Income

- Retirement

- General investing

Similar to a bank M1 Spend offers a high yield checking account and 1% cash back debit card.

The M1 Finance financial advisor app allows users to borrow at low interest rates, after investing $10,000.

Click for the M1 Finance Review.

5. Axos Invest: Automated Financial Advisor App

Management Fee: 0.24% AUM

Available for Android and iOS.

Axos Invest is a financial advisor in the palm of your hand. You let the robo-advisor know what your goals are, and the investing app sets out to help you automate your money to achieve these goals. You can start from scratch, or roll over existing retirement plans so everything is managed in one spot. Axos Invest is one of the earlier robo-advisors with a $1 minimum investment and 0.24% AUM fee. This app is perfect for the millennial looking to begin investing for the future, with the opportunity to choose specific investment tracks that fit with your values like:

- Blockchain Stocks

- Precious Metal Stocks

- Internet Innovators Stocks

- Digital Security Stocks

Click for Axos Invest Review

6. Bill Shark: Best Bill Cutting app

Fee: One time fee of 40% of money saved. No fee if they don’t save money on your bills!

Available for Android and iOS

Backed by famous businessman, Mark Cuban, Billshark promises to reduce your bills for up to 25%. If they don’t succeed, you don’t pay. So, there is literally no risk to trying the app out!

It’s simple to use. Downlad the app and upload your bills. The app negotiates your wireless, internet, home security, satellite TV and satellite radio providers.

BillShark is a huge time saver and the company claims that they can save you more money than you could save on your own.

This is the only app review we’ve seen on both iOS and Google Play with 100% 5 star reviews (at the time of publication).

Bonus: Robinhood vs. Acorns vs. M1 Finance

7. Mint: Budget, Bills & Finance app

Management fee: Free

Available for Android and iOS.

Mint is extremely user-friendly. Simply link your bank accounts, credit cards and loan accounts to Mint, and the app will track your budget. Mint even alerts you via push notifications if a bill is coming due or you overspend in a category. This makes Mint one of the easiest apps to use, and it is certainly popular. Many people use and recommend Mint highly. If you’re looking for a budgeting tool that maybe has a bit more advanced investment planning tools, maybe look at our comparison of Empower and Mint.

Click now for; Best Porfolio Management Software for Investors

8. Volkron Checkbook App: Money Organization

Fee: Free (Premium version available)

Available for Android

A list of the best financial advisor apps wouldn’t be compete without a simple income and expense tracking app. We were impressed with the 4.7 out of 2,827 rating on Google play. Users love this free money app.

- Payments

- Deposits

- Miscellaneous expenses

This app is great for a high school, college student, or anyone seeking a clean and intuitive money app.

9. Financial Calculators: Easy Access to Finance Solutions

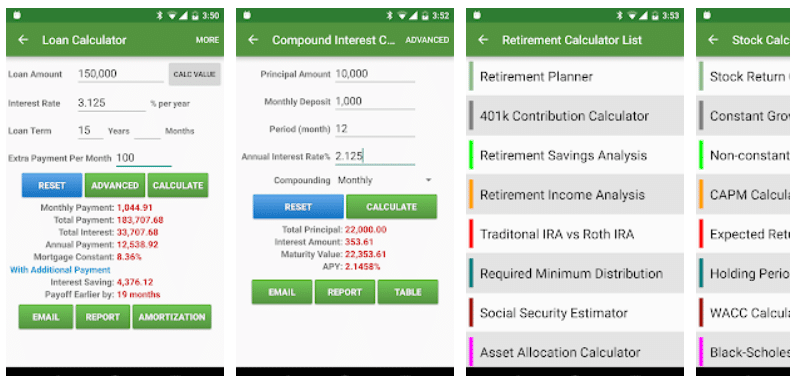

This is one of the best financial advisor apps for anyone who wants an extensive suite of financial calculators within a single app. Users love this app with an average 4.6 rating from over 19,000 users. The smart consumer seeking a comprehensive financial planning app, should check out Financial Calculators.

This financial planning app calculator includes over 50 functions, categorized within these areas:

Finance and Investment Calculators – Includes time value of money, currency converter, compound interest, rule of 72 and many more calculators.

Loan and Mortgage Calculators – Includes loan/mortgage calculator, loan comparison calculator, loan refinance calculator, rent vs buy calculator, fixed vs adjustable rate calculator and many more.

Retirement Calculators – Includes retirement planner, 401k contribution calculator, Traditional IRA vs Roth IRA calculator, Social Security Estimator, required minimum distribution calculator and more.

Stock Calculators – Includes stock return, CAPM, expected return, several options calculators and more.

Credit Card, Auto Loan and Lease and Miscellaneous Calculators – The remaining calculators cover any financial calculation you might desire.

Financial calculators is the perfect financial advice app for all of your financial planning questions.

Bonus: Stash vs Acorns vs Robinhood

10. Splitwise: Expense Sharing Tool

Fee: Free

Available for Android and iOS.

Splitwise takes the drudgery and headache out of splitting bills with roommates, significant others or fellow diners. The app keeps track of who owes you money, and who you owe—immensely useful for people who share apartments, or married couples with separate finances. The app even keeps a running tally of how much money you and another specific person have owed one another. Finally, Splitwise also reminds you when bills are due.

The app received an average 4.5 rating from over 100,000 reviews.

Here are some of the ways Splitwise helps with your smart financial management:

- Simplifies debts into easiest repayment plan

- Categorizes expenses

- Splits expenses equally, unequally by percentages, shares, or exact amoungs.

- Adds informal debts and IOUs

- Creates bills that recur monthly, weekly, yearly or biweekly

- Exports to CSV

- and more

The best financial planning apps simplify your life and help you maximize your finances.

Related

Personal Capital vs Quicken vs Mint

M1 Finance vs Personal Capital

Robinhood vs Betterment vs Acorns

Robo-Advisor Pros disclosure; I use Personal Capital, M1 Finance, and Axos Invest

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Empower compensates Stocktrades Ltd (“Company”) for new leads. Stocktrades Ltd is not an investment client of Empower.

Featured image by Rodion Kutsaev on Unsplash