Schwab Robo-Advisor Review – Intelligent Portfolios Offers Higher Yields on Cash Allocations

We like the Schwab Intelligent Portfolios. Find out why in this comprehensive expert review.

Digital robo-advisors are popping up everywhere, from independent shops such as Wealthfront, Betterment, and Personal Capital to those embedded in large investment brokers like Vanguard and Fidelity.

Schwab belongs to the comprehensive robo-advisor category that is part of a larger financial firm. Schwab Intelligent Portfolios is one of the most popular robo-advisors with approximately $65 billion assets under management and 262,000 client accounts. In fact, my business SIMPLE IRA is invested with Schwab Intelligent Portfolios.

The original Schwab Intelligent Portfolio robo-advisor is a professionally managed investment portfolio made up of exchange-traded funds (ETFs) without a management fee and the subscription-based Schwab Intelligent Portfolios Premium provides unlimited access to live financial advisors and digital investment management.

Schwab acquired TD Ameritrade, and all of their robo-advisory clients will be transferred to Schwab within the coming year.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Schwab Intelligent Portfolios Review

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for: Schwab customers Fee-conscious investors Beginner to advanced investors

Pros

- Low pricing from zero to $360/year management fees

- Access to branch offices and 24/7 customer service

- Unlimited CFP advisor access for Premium clients

Cons

- High-ish investment minimums from $5,000-$25,000

- Tax loss harvesting only available for $25,000 or larger accounts

- Requires cash allocation (may or may not be a con)

Schwab SEC Settlement

“Schwab has resolved a matter with the SEC regarding certain historic disclosures and advertising related to Schwab Intelligent Portfolios between 2015-2018, and we are pleased to put this behind us. The SEC order acknowledges that Schwab addressed these matters years ago.” Schwab has agreed to pay $186.5 million to the SEC to resolve the complaint that the public was not advised that the required cash allocation in Schwab Intelligent Portfolios could be a drag on returns during certain market conditions.

https://www.aboutschwab.com/schwab-statement-on-settlement-with-SEC-related-to-schwab-intelligent-portfolios

Schwab didn’t acknowledge wrongdoing, but did remediate the complaint by providing more transparency surrounding the cash allocation. On a positive note, the Intelligent portfolios cash allocation will continue to be invested in Schwab Bank, but the cash yield will equal that of the Schwab Government Money Fund (SWGXX). This provides users with higher yields on the cash allocation than previously offered.

Here’s our latest Schwab Intelligent Portfolios Review from a former portfolio manager and user.

In fact, I like the Schwab Robo-Advisor so much that I invested my business Simple IRA in the Intelligent Portfolios! As a former portfolio manager and university finance professor you can be assured that the Schwab Intelligent Advisory Review is accurate and non-biased.

What is Schwab Intelligent Portfolios?

Schwab Intelligent Portfolios offers beginning to advanced investors automated investment management and in depth full-service financial planning.

Schwab offers 2 robo-advisory plans:

- Schwab Intelligent Portfolios-Free digital investment manager

- Schwab Intelligent Portfolios Premium-Subscription-based digital investment manager with unlimited access to Certified Financial Planners

Schwab rocked the robo-advisory industry with two differentiating features for their basic intelligent portfolios:

- Fee-free investment management

- Cash asset category – All accounts are required to have a certain percent of cash in the portfolio.

Schwab has since been joined by the Ally Invest robo-advisor who allocates 30% cash to many portfolios.

Schwab made history again with a subscription pricing model for the Schwab Intelligent Portfolios Premium. Although, Ellevest recently introduced subscription pricing as well.

As competition ramps up, a newer entrant into the robo-advisor field, SoFi Invest also offers fee-free investment management and access to live advisors.

Charles Schwab Intelligent Portfolios – Features at a Glance

Who Are Schwab Intelligent Portfolios Best for?

Both robo-advisory plans are excellent for existing Schwab customers.

Investors seeking in-person contact will benefit. Schwab customers have easy branch access and 24/7 live phone support.

The Schwab Intelligent Portfolios Premium service is perfect for the investor with financial questions and a more complicated situation. You get unlimited CFP access and a free financial plan with the Premium plan.

The basic Intelligent portfolio is good if you have the $5,000 minimum.

The premium intelligent portfolio is good if you have the $25,000 minimum.

Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium – Drill Down

Overview

Schwab Intelligent Portfolios

Goal-driven automated investment manager.

After responding to a few questions about your risk tolerance, age, timeline and goals, Schwab recommends a diversified investment portfolio comprised of low-cost investments in line with your age, goals and risk tolerance.

If you don’t like the recommendation, you can change it!

The conservative investment mix will include greater percentages of cash and fixed assets, while aggressive investors will own more stock funds.

Your portfolio is monitored daily and rebalanced when needed, back to your pre-selected asset mix percentages.

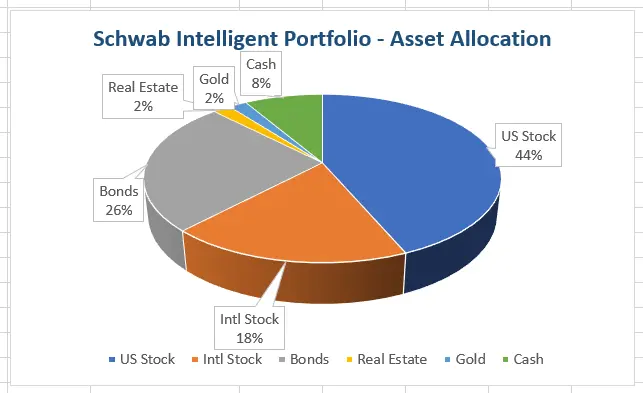

In the investment section below, you’ll see charts of my SIMPLE IRA account which is invested in a moderate asset allocation.

Schwab Intelligent Portfolios Premium

“A comprehensive financial plan is like having a roadmap to help with your financial goals. It takes into account all aspects of your financial life—income, expenses, investments, college savings, retirement planning, and more.” ~Schwab website

The premium plan includes an automated investment manager plus unlimited access to Certified Financial Planners.

Here’s what you get with the Schwab robo-advisor premium subscription:

- Diversified portfolio of low cost investments, apportioned to account for your age, goals and risk tolerance.

- Daily portfolio monitoring and automatic rebalancing when needed.

- Tax-loss harvesting

- 24/7 support from professionals

- Unlimited individual guidance from a Certified Financial Planner professional

- A complete financial plan

- Interactive online planning tools

From the questionnaire responses, you get a detailed digital plan and portfolio that can be discussed with the financial advisor. You can view your plan to uncover your progress and amend it online at will.

You can discuss your goals and questions with the advisor, including when to take Social Security, whether to rent or buy a home and more. Further, you can add assets to your digital dashboard that are not under Schwab management, for a more holistic view of your financial picture.

The Schwab Intelligent Portfolios Premium has 30 dedicated certified financial planners (CFP®) across the country who counsel clients by phone or video chat. Each salaried employee claims an average of 10 years of experience and uses the same planning software. This creates consistency across the platform.

Beginner Robo-Advisors

Fees and Investment Minimums

Investment management fees come from two distinct sources:

- The ETF expense ratio is the fee charged by evey ETF. This money goes directly to the fund manager. The fund management expense ratios range from .06% to .65% of AUM. While the average total portfolio expense ratio is roughly .13% of AUM.

- Portfolio management fees charged by the Schwab Intelligent Portfolios Premium, to manage your account. The basic, all-digital Schwab Intelligent Portfolios does not charge an investment management fee.

Schwab Intelligent Portfolios

- Minimum – $5,000

- Management Fee – $0.00

The basic Schwab robo-advisor does not charge account management fees. The only charges you will pay are those management expense fees levied by the fund companies.

This is the robo-advisor I use for my Simple IRA.

The investment minimum is $5,000 which is about in the middle of most robos, although, M1 Finance also offers fee-free investment management has a $100 investment minimum. M1 also offers the opportunity to customize your investments, in addition to their pre-made portfolios.

Schwab Intelligent Portfolios Premium

- Minimum – $25,000

- Management Fee – $300 one-time set up fee and $30 per month

The Schwab Intelligent Portfolios Premium fees are levied with a subscription model. The fee, as a percent of assets under management, is lower the larger your portfolio.

Your investment management fee as a percent of your portfolio size vaires based upon the size of your portfolio.

Schwab Intelligent Portfolios Premium Management Fees (as a percent of AUM)

| Account Balance | $360 per Year Fee as a Percent of Total Assets (charged $30/month) |

|---|---|

| $25,000 | 1.44% |

| $50,000 | 0.72% |

| $100,000 | 0.36% |

| $300,000 | 0.12% |

| $500,000 | 0.07% |

This management fee chart doesn’t include the one-time $300 set up fee.

Once your assets reach $100,000 the Schwab robo-advisor subscription charge is very economical, when compared with both typical financial advisors and other robo-advisors.

The $25,000 account minimum for the premium service is a relatively low minimum for an investment manager with live advisors.

Visit the Robo-Advisor Selection Wizard, take a quick quiz, and find out which robo-advisor is the right one for you.

Available Accounts

The account types for both Schwab Intelligent Portfolios and Schwab Intelligent Portfolio Premium include:

- Brokerage: Individual, Joint Tenant with Rights of Survivorship, Tenants in Common, Community Property, Custodial

- Revocable Living Trust: Single Trustee, Two Trustees

- Retirement: Roth IRA, Traditional IRA, Rollover IRA, Simple IRA

This is another feature we like about the Schwab robo-advisor, the wide selection of available accounts. This makes the robo suitable for a very wide range of consumers.

Investment Funds

Both Schwab robo-advisor platforms invest your money in exchange-traded funds from a pool of 53 choices, representing 20 asset classes.

Of that group, approximately 60% of the ETFs are Schwab’s while other funds are managed by Vanguard, iShares and PowerShares, according to a recent press release.

The funds represent a wide range of asset classes including global real estate, gold, and precious metals in addition to the various stock and bond funds.

| Category | Primary ETF | Secondary ETF |

|---|---|---|

| STOCKS | ||

| US Large Company | SCHX–Schwab U.S. Large-Cap | VOO–Vanguard S&P 500 |

| US Large Company–Fundamental | FNDX–Schwab Fundamental U.S. Large Company | PRF–PowerShares FTSE RAFI US 1000 |

| US Small Company | SCHA–Schwab U.S. Small-Cap | VB–Vanguard Small-Cap |

| US Small Company–Fundamental | FNDA–Schwab Fundamental U.S. Small Company | PRFZ–PowerShares FTSE RAFI US 1500 Small-Mid |

| International Developed Large Company | SCHF–Schwab International Equity | VEA–Vanguard FTSE Developed Markets |

| International Developed Large Company -Fundamental | FNDF–Schwab Fundamental International Large Company | PXF–PowerShares FTSE RAFI Developed Markets ex-U.S |

| International Developed–Small Company | SCHC–Schwab International Small-Cap Equity | VSS–Vanguard FTSE All-World ex-US Small Cap |

| International Developed Small Company–Fundamental | FNDC–Schwab Fundamental International Small Company | PXF–PowerShares FTSE RAFI Developed Markets ex-U.S |

| International Emerging Markets | SCHE–Schwab Emerging Markets Equity | IEMG–iShares Core MSCI Emerging Markets |

| International Emerging Markets–Fundamental | FNDE–Schwab Fundamental Emerging Markets Large Company | PXH–PowerShares FTSE RAFI Emerging Markets |

| US Exchange-Traded REITS | SCHH–Schwab U. S. REIT | VNQ–Vanguard REIT |

| International Exchange-Traded REITS | VNQI–Vanguard Global ex-U.S. Real Estate | IFGL–iShares International Developed Real Estate |

| US High Dividend | SCHD–Schwab US Dividend Equity | VYM–Vanguard High Dividend Yield |

| International High Dividend | HDEF-xTrackersMSCI EAFE High Dividend Yield Equity ETF | VYMI-Vanguard International High Dividend Yield |

| Master Limited Partnerships | MLPA–Global X MLP | ZMLP–Direxion Zacks MLP High Income |

| FIXED INCOME | ||

| US Treasuries | SCHR–Schwab Intermediate-Term U.S. Treasury | IEI-iShares 3-7 Year Treasury Bond |

| US Investment Grade Corporate Bonds | SPIB-SPDR Portfolio Intermediate Term Corporate Bond | VCIT–Vanguard Intermediate-Term Corporate Bond |

| US Securitized Bonds | VMBS–Vanguard Mortgage-Backed Securities | MBB-iShares MBS |

| US Inflation Protected Bonds | SCHP–Schwab U.S. TIPS | IPE-SPDR Bloomberg Barclays TIPS |

| US Corporate High Yield Bonds | HYLB-X trackers USD High Yield Corporate Bond | USHY-iShares Broad USD High Yield Corp Bond |

| International Developed Country Bonds | IAGG-iShares Core International Aggregate Bond | BNDX-Vanguard Total International Bond |

| International Emerging Markets Bonds | EBND-SPDR Bloomberg Barclays Emerging Markets Local Bond | EMLC-VanEck Vectors JP Morgan EM Local Currency Bond |

| Preferred Securities | PFFD-Global X US Preferred | PSK-SPDR Wells Fargo Preferred Stock |

| Bank Loans | BKLN–PowerShares Senior Loan | N/A |

| Investment Grade Municipal Bonds | VTEB–Vanguard Tax-Exempt Bond | TFI–SPDR Nuveen Barclays Municipal Bond |

| Investment Grade California Municipal Bonds | VTEB-Vanguard Tax-Exempt Bond | TFI-SPDR Nuveen Bloomberg Barclays Muni Bond |

| COMMODITIES | ||

| Gold and Other Precious Metals | IAU–iShares Gold Trust | GLTR–ETFS Physical Precious Metal Basket Shares |

Each individual investor’s portfolio might contain up to 20 asset classes, as represented by an individual ETF.

As mentioned above, investment funds charge small management fees.

This is apart from the percent that you pay to the Shwab Intelligent Advisor Premium robo for your overall portfolio management.

The 53 individual fund fee’s range from 0.03% to 0.65% of assets. Schwab explains that the weighted average that customers pay is 0.07% for conservative holdings, moderate and aggressive portfolios are 0.16% and 0.21% respectively.

Tax loss harvesting for Intelligent Advisory portfolios requires a minimum $50,000 account balance.

The Cash Asset Class

Every investment portfolio has from 6% to 29% in the cash asset class, depending upon your asset allocation. More conservative investors would hold greater amounts of cash than more aggressive portfolios. Michael Cianfrocca of Schwab explained that very few clients will hold the maximum amount of cash.

Schwab explains three benefits of the cash position:

- Provides stability

- Offers downside protection and cushions negative returns when stock and bond funds go south

- Adds additional diversification

Additionally, the cash will earn interest at a rate of the Schwab Government Money Fund (SWGXX).

During times of extreme market volatility, you’ll appreciate having a bit of extra cash to temper the stock market’s ups and downs.

Although there some investors prefer a lower cash allocation due the potential for a cash drag during rising investment markets. This would yield lower overall returns during rising investment markets, should interest rates remain low.

We don’t share their concerns. Although, if you’re looking for a low fee robo-advisor, there are many sound choices including M1 Finance and SoFi.

Schwab Intelligent Portfolios Customization

Schwab’s customization features are a handy option for investors that want more control over their robo-advisory investments.

Investors can have Schwab replace up to three ETFs with another of the firm’s choosing.

You can also set up as many as 10 distinct Schwab robo-advisory accounts, as long as there’s a minimum of $5,000 invested in each account. Although, personally, I’m not sure why you’d want that many accounts, unless you’re comparing distinct asset allocation strategies, it might make sense.

Sample Moderate Investment Portfolio

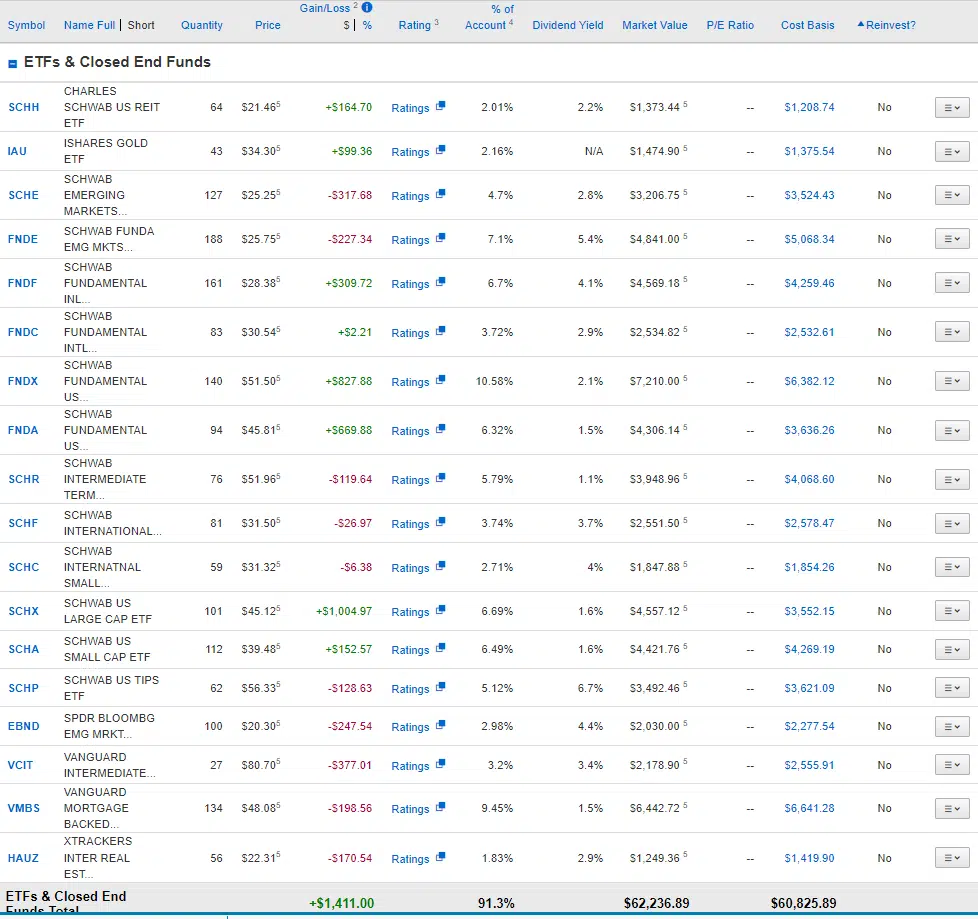

My Simple IRA is invested in a diversified moderate portfolio.

My portfolio is invested in 19 funds from the stock, bond, real estate, and gold asset classes.

The overall asset allocation is:

- 62% stock

- 25% bonds

- 2% gold

- 2% real estate

- 8% cash

Following are the low-fee ETFs that are included in my Schwab Intelligent Portfolio account. I’ve included a chart with the percentages allocated to each fund as well the total returns the portfolio has earned. It was opened with a contribution in 2019, with annual contributions in 2020 and 2021. The cash allocation 8.7% and has a value of $5,927 as of July 4, 2022.

Schwab Intelligent Portfolio Performance

It’s just common sense that you’re investing to make money. It would seem to follow that choosing a robo-advisor with the highest returns makes sense. But, there’s more to investment returns than one year returns.

Determining the performance of a robo-advisor encompasses many factors, such as the underlying funds and when they were bought or sold.

With passive index fund investing, like the Schwab robo uses, your returns will be similar to those of the related asset classes. Schwab and most robo-advisors, with the exception of a few actively managed robo-advisors and those that focus on downside protection, design their portfolios to match the returns of investment markets. The reason is because countless studies show that only a small percent of actively managed investment strategies outperform a passive index fund investing approach.

For example, if your robo-advisor owns 50% FNDX (Schwab Fundamental US Large Company Index) and 50% SPIB (SPDR Portfolio Intermediate Term Corporate Bond ETF) then you would expect that your returns would be similar to a 50%-50% mix of US large company and Intermediate Term Corporate bond returns.

Within the Intelligent Portfolios dashboard, its easy to view your performance along with progress towards your stated goals.

Choosing a robo-advisor based on performance is tricky business, because investment sectors go in and out of favor. One portfolio mix might provide excellent returns one year, while lower returns the next. It’s important to compare your investment returns not with the S&P 500, but with the comparable indexes, that are represented in your portfolio.

One of the reasons that I like the Schwab robo-advisor is due to their sensible asset allocation. A wide range of assets can potentially smooth out investment returns. While, a cash allocation is a welcome buffer when stock and bond funds take a turn for the worse.

Tax Loss Harvesting

Taxable accounts valued at more than $50,000 are eligible for the tax-loss harvesting service.

This means, “If a taxable security has lost value since you purchased it, Schwab will sell it at a loss, and use the loss to offset your capital gains, and up to $3,000 of ordinary income a year, for federal income tax purposes”, according to Schwab’s FAQ.

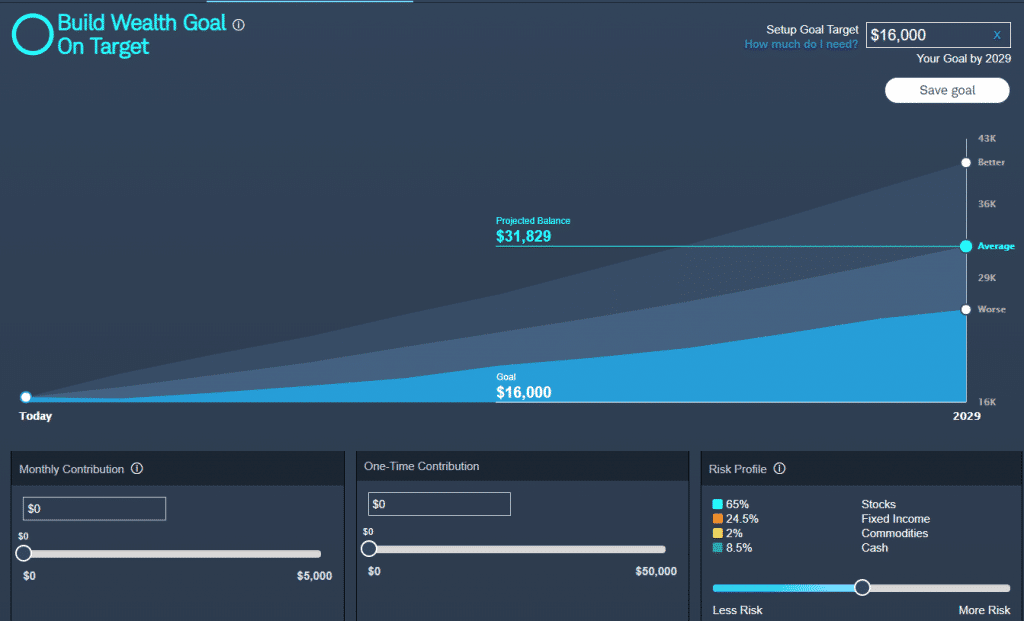

Schwab’s Intelligent Portfolios Goal Tracker

Schwab has a handy goal tracker which gives you an idea of how long it will take to meet certain pre-determined goals. The image above shows of the simple “Wealth Building” goal of a newly opened retirement account.

You set up the goal and then add monthly or one-time contributions and the dashboard gives you an estimate, given your current investment portfolio, of how long before you’ll reach your goal.

Like many competitors, Schwab uses Monte Carlo simulations to calculate the probability of meeting your goal. If you’re not quite on track, Schwab will make suggestions to help you improve the likelihood of reaching your target.

The tool can also monitor withdrawal rates, for investors in the later stages of life.

What is Schwab Intelligent Income?

This service for Schwab robo-advisory customers is ideal for retirees seeking a systematic method for cash withdrawal from their investment portfolio.

The Charles Schwab Intelligent Income projects how much you can afford to withdraw from your investments every month.

Here’s what Schwab Intelligent Income offers:

- Monthly cash flow with attention to tax savings. It’s like a predictable paycheck.

- The online dashboard monitors your progress and allows you to start, stop or adjust withdrawals at any time. You can even experiment with various withdrawal scenarios.

The Schwab Intelligent Income portfolio is integrated with your Schwab Intelligent Advisory account.

“The Charles Schwab Intelligent Income portfolio uses low-cost ETFs to build a portfolio that is based on your risk profile. Your portfolio is diversified, with up to 20 asset classes across stocks, bonds, commodities, and cash; is rebalanced automatically.” ~

Schwab Intelligent Investing Website

The portfolio is structured so that the annual cash needed for withdrawals remains in stable cash or fixed income assets.

The Schwab Intelligent Income calculator allows you to try out various cash withdrawal scenarios to determine which one make sense for you.

Is Schwab Intelligent Income worth it?

We think so. The Schwab Intelligent Portfolio for income automatically synchronizes withdrawals from all your Schwab Intelligent investing accounts including taxable, tax-deferred and tax-exempt accounts. The platform’s computer algorithm is set up to maximize tax-savings and minimize portfolio drawdown.

How Does Schwab Intelligent Investing Make Money?

Schwab’s Intelligent Portfolio Premium subscription fee predominantly goes to fund the team of salaried Certified Financial Planners®.

Both robo-advisors also make money from two additional sources:

- Schwab earns revenue from a small management fee for the Schwab ETFs and revenue on some 3rd party ETFs.

- The cash portion of your account is held in the Schwab bank, thus they profit from the access to your money, such as for lending and more.

How Do the Schwab Intelligent Advisory CFPs® Differ From the Branch-Based Financial Consultants?

All 30 Planning Consultants in the Schwab Intelligent Portfolios Premium are CFPs®.

Schwab has 325 or more branches across the country with 1,100 financial consultants. Of the branch based advisors, 800 are CFPs®.

Although branch-based Schwab financial consultants can answer basic questions about Intelligent Portfolios, such as how it works, the questionnaire etc. they don’t “advise” on the portfolios because the Intelligent Portfolios are centrally managed by a distinct team.

So, don’t drive over to a branch and expect to get full on financial planning from a financial representative.

Pros and Cons of the Schwab Robo-Advisors

Pros

You can’t beat the fees. Zero management fees for the Intelligent Portfolios is tough to beat, despite a small cash allocation. The monthly subscription management expense ratio fee for the human-assisted Intelligent Portfolios Premium is reasonable for larger portfolios, greater than $100,000.

The investment minimums are affordable for many investors, with $5,000 for the Intelligent and $25,000 for the Advisory.

Diversification options are great with a selection of 53 funds across a wide range of asset classes.

Schwab judiciously selects ETFs with low average fund management fees. Schwab’s white paper explains how the funds are chosen and outlines the management fees for each fund.

The Schwab Intelligent Income withdrawal option is unique among robo-advisors and is an excellent feature for retirees and allows them an income stream.

The Schwab brand ensures that the firm will be in business for the long term.

Unlimited financial advisor access for Premium clients is a big draw.

Branch access is great for those seeking a human to chat with.

Cons

Some investors consider the cash allocation a negative, especially in the current low-interest rate environment as that money is earning very little return. Many robo-advisors lack a cash allocation. Personally, I like a cash allocation for the reasons that Schwab describes and don’t find it bothersome that they’ll garner a small benefit from holding the money in their bank.

With branches scattered across the country, it’s unusual that most Intelligent Advisory clients don’t have access to in-person financial advisors. Although their CFP network is separate from their branch advisors.

If your Schwab Intelligent Portfolios Premium account is smaller, the $30 per month subscription fee equates to a higher percentage of assets under management. For instance, with an account of $25,000, the $30 per month is equivalent to a hefty 1.44% AUM fee.

If tax-loss harvesting is important to you and you lack, $50,000, then this isn’t the best robo-advisor for you.

Schwab Intelligent Portfolios – Takeaway

We recommend investing in either platform of Intelligent Portfolios.

Schwab rightly holds a solid place in the low fee, high-quality investment arena.

We like the diversity of funds and asset classes.

If you don’t need to speak with an advisor, then it’s tough to beat the zero management fee for Schwab Intelligent Portfolios. And for quick questions, there’s the 24/7 phone consultation and multiple branches.

For unlimited contact with financial advisors, the Intelligent Portfolios Premium is a low-fee alternative to a typical financial advisor.

Direct access to Schwab Intelligent Portfolios website.

Compare Schwab Intelligent Portfolios With Betterment and Wealthfront

Other Zero Management Fee Robo Advisors:

- M1 Finance

- Ally Invest Managed Portfolios (requires 30% cash allocation)

- SoFi Invest

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable.

Disclosure: I have an account with Schwab Intelligent Advisors

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.