TD Ameritrade Robo Advisors – Digital Advisor and Personalized Portfolio – are not accepting new customers. All interested robo-advisory clients are being referred to the Schwab Intelligent Portfolios and the Schwab Intelligent Portfolios Premium Robo-Advisors.

Top Robo-Advisors

TD Ameritrade Personalized Portfolios Strive for Perfection

On October 6, 2020, TD Ameritrade became a wholly owned subsidiary of The Charles Schwab Corporation.

Answering the call for greater human touch and more investment options than the typical digital wealth management robo-advisor, TD Ameritrade’s Personalized Portfolios seek perfection. Nearly on a par with an independent financial advisor, TD Ameritrade’s Personalized Portfolios targets wealthier clientele, with more than $250,000 to invest. They offer greater services and more personalized contact than a hybrid robo-advisor.

[toc]

The TD Ameritrade Personalized Portfolios joins hybrid robo-advisor TD Ameritrade Selective Portfolios as the second managed investment option at the company. The former, all-digital TD Ameritrade Essential Portfolios is now directing new clients to Schwab’s Intelligent Portfolios.

TD Ameritrade Personalized Portfolios

-

Fees

(3)

-

Investment Choices

(4.5)

-

Ease of Use

(4)

-

Tool & Resources

(5)

Summary

TD Ameritrade Personalized Portfolios is best for existing TD Ameritrade customers.

Pros

- Part of the TD Ameritrade family

- Great educational resources at TD Ameritrade

- Integrates all of your accounts

Cons

- High fees

- High minimums

- Financial advisors might not have CFP credential

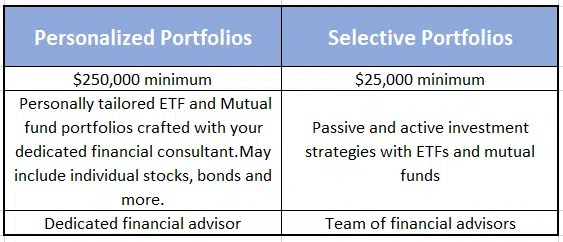

TD Ameritrade Personalized Portfolios vs TD Ameritrade Selective Portfolios

Read: Best Robo-advisors for Retirees

Personalized Portfolios provides goal planning, a professionally managed portfolio tailored to your individual finances, a dedicated financial consultant, tax loss harvesting and more. Your investment recommendations are made in conjunction with your dedicated financial consultant. With a $250,000 minimum, this option is competitive with Personal Capital and charges a 0.90% (or less, depending on portfolio) management fee. Although all the Personal Capital advisors are licensed Certified Financial Planners, one of the most highly regarded financial planner certifications. This isn’t the case at TD Ameritrade.

Bonus: TD Ameritrade Robo-Advisors Review – Selective Portolios

How TD Ameritrade Personalized Portfolios Works

The Personalized Portfolios are TD Ameritrade’s top level of customized financial management. Unlike typical robo-advisors, this service is driven by the Financial Consultant. In conjunction with your Financial Consultant, you’ll complete a financial profile which encompasses all of your existing investments, goals, risk tolerance and time horizon.

This data is forwarded to your Portfolio Consultant who creates a personally tailored investment mix that is aligned with your personal goals and overall financial picture.

The portfolio receives ongoing oversight including rebalancing and tax loss harvesting.

Your online dashboard provides ready access to your performance as well as the progress towards reaching your goals.

Like Personal Capital, you are able to link all of your outside financial accounts. This provides a comprehensive view of your entire finances including real time value of all of your financial assets.

The investment analyzer offers analysis by accounts and holdings. You can examine all of your investments and their asset allocation with a holistic view.

You can also check on your progress towards you goals.

Although, we believe that Personal Capital’s reports, insights and calculators are more comprehensive than those at TD Ameritrade.

Personalized Portfolios comprehensive dashboard features includes:

- Account aggregation

- Integrated goal-tracking

- Investment performance for both TD Ameritrade and non-TD Ameritrade accounts.

Investment Options

Personalized Portfolios are grouped by both Strategy and Risk Level. The five strategies are suitable for distinct types of investors:

- Core

- Tax Aware

- Socially Aware

- Specialty Risk

- Income and Growth

Within each of the five categories, you can choose from five risk levels, depending upon your comfort with investment loss. The riskier portfolios are for more aggressive investors, include greater amounts of stock investments and are more volatile. While conservative portfolios will likely loose less value during market declines and will own greater percentages of fixed investments and lesser amounts of stocks.

Risk levels:

- Conservative

- Moderate

- Moderate Growth

- Growth

- Aggressive

Your investment portfolio goes beyond ETFs and mutual funds and might include closed end funds, common stocks, preferred stocks, various types of bonds and other investments.

Get the free Robo-Advisor Comparison Chart

Investment Performance

TD Ameritrade lists performance of most portfolios here. Although performance data is interesting, we recommend using a holistic approach when choosing an investment manager, and consider investment choices, style, fees and your comfort with the advisor. Performance data is just one piece of the investment manager selection process.

Fees

The investment minimum for Personalized Portfolios is $250,000. Fees annual assets under management or AUM fees decline as account values increase.

Fee schedule for all portfolios:

0.90% AUM: $250,000 – $500,000

0.75% AUM: $500,000 – $1 million

0.60% AUM: $1+ million

The fee schedule is higher than nearly all of the hybrid robo-advisors that we cover and a tiny bit below that of a typical financial advisor.

Pros and Cons

Pros

- Part of the well-respected TD Ameritrade brand with one of the best self-directed trading platforms, thinkorswim.

- Personally crafted and customizable portfolios.

- Portfolios integrate all of your assets, not just those at TD Ameritrade.

- Tax-loss harvesting available.

- 24/7 phone contact and branch access.

- Excellent educational portal with videos, articles, courses and more.

Cons

- High minimums. You can get basically the same or more services for lower minimum investments at Betterment, Personal Capital, Vanguard and Charles Schwab.

- High fees. The managed account fees aren’t justified by the level of service.

- No assurance that you’re advisor will have a CFP, CFA or another top financial advisory credentials.

- Platform reports and analysis tools are sub-par. Personal Capital is the gold standard for financial reports and analysis, with a free financial management software for all investors.

- Given the acquisition by Schwab, there’s no certainty that this program will survive the integration of the two companies.

TD Ameritrade Personalized Portfolios Wrap up

Investors with more than $250,000 seeking investment management have a lot of options. From independent registered investment advisors to Wealth Management at all of the major brokerage firms and hybrid robo-advisors with financial advisors. TD Ameritrade’s Personalized Portfolios fee structure places it in the realm of independent financial advisors and wealth managers. While most hybrid robo-advisors have lower pricing, with equal or greater services.

Although TD Ameritrade is a well-respected, feature-rich investment platform, this particular offer doesn’t meet the standards of competitors. Schwab’s Intelligent Portfolios Premium offers a widely diversified robo-advisor and Certified Financial Planner access for a rock-bottom $30 per month subscription fee (plus a one time $300 set up fee). Betterment Premium charges 0.40% AUM for their hybrid robo-advisor that includes Certified Financial planners. The list continues with wealth management solutions available for lower fees at multiple companies.

Especially with the integration between TD ameritrade and Schwab, we’d recommend wealthy individuals compare their choices, before choosing an investment manager.

Learn more about TD Ameritrade Personalized Portfolios on their website.

Personal Capital vs Betterment

Related

- Merrill Edge Guided Investing Review

- Robo Advisor vs Financial Advisor – Which is Best?

- Betterment vs Personal Capital Comparison

Sources

- https://www.tdameritrade.com/content/dam/tda/retail/marketing/en/pdf/TDA4855.pdf

- https://www.tdameritrade.com/investment-guidance/investment-management-services/performance-pages/personalized-portfolios.html

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable