Hi Facebook Visitors,

I’m Barbara Friedberg, a former investment portfolio manager, and university finance instructor. I’ve built wealth through investing and continue to invest in the financial markets today.

Here’s why M1 Finance is a great way to grow your investments – in my opinion. 🙂

Now, building wealth for tomorrow is more important than ever!

Hiring a financial planner can be expensive. Or, maybe you don’t have enough money to use one.

You can invest for free with M1 Finance – no management fees or commissions.

And you only need $100 to get started.

If you’re seeking a path to long-term financial success, but don’t want to pay high fees and commissions, then check out M1 Finance.

M1 Finance might be for you if:

- You are a DIY investor who wants the flexibility to choose your investments (from 1,000’s of ETFs and stocks)

- You want to buy and sell investments for FREE

- You would like the opportunity to select pre-made investment portfolios

- You’re interested in letting someone else rebalance your investments for you

- You want a company to help you invest for a secure financial future

Watch – How I invested in a super-simple stocks and bonds portfolio using M1 Finance.

In fact, now is a great time to add to your investment accounts or start investing.

M1 Finance Review

Name: M1 Finance

Description: Free investing app with portfolio management included.

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(5)

-

Tool & Resources

(4)

Summary

Best for:

- Investors who want to pick stocks and funds on their own.

- Investors who want free investment management.

- Investors who want pre-made investment portfolios.

Pros

- Free investment management and trading

- Low $100 minimum

- 6,000 investments

- 60+ pre-made investment pies/portfolios

- Low margin rates

- Fractional shares

- Auto-invest

- Checking integrated with investing

Cons

- No tax-loss harvesting

- No access to human financial advisors

- No risk quiz

- No options or Forex

- Limited trading windows

How M1 Can Help You Build Wealth – for FREE

With M1 Finance you can choose your own investments or select a pre-made portfolio (they call the pre-made portfolio a “pie”)

Expert Investment Portfolios

Want to pick and choose from already made investment portfolios?

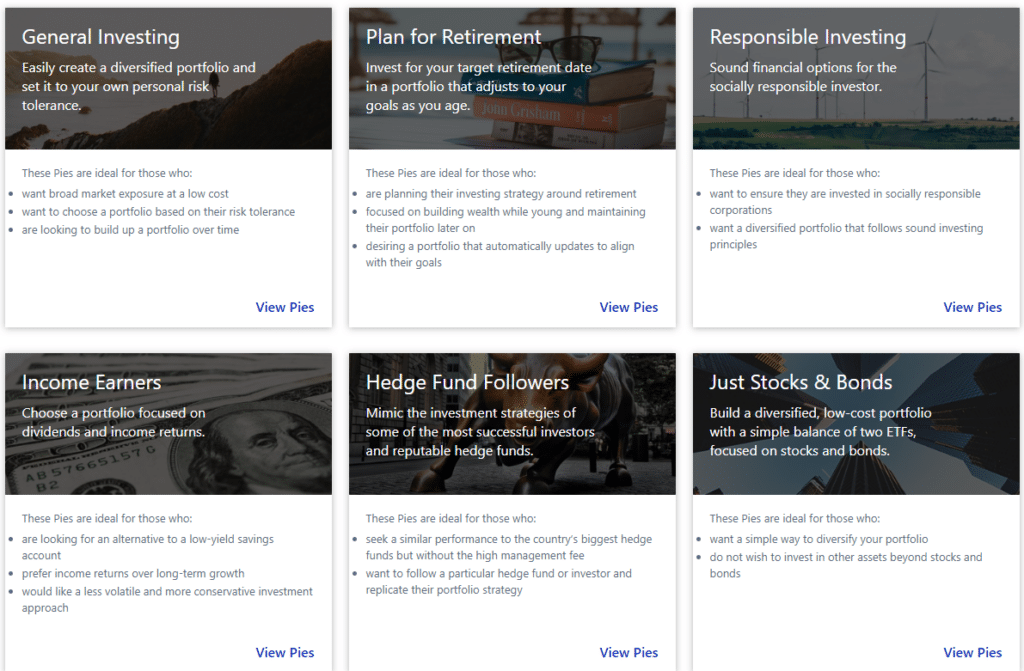

Here’s a list of pre-made “expert” portfolios (also called M1 expert pies):

- General Investing – perfect for well-balanced investments that match up with your risk level (like a typical robo-advisor).

- Plan For Retirement – Puts you on track for retirement

- Responsible Investing (Socially Conscious) – Invest in companies that matter to you

- Income Portfolios – Great for cash flow

- Hedge Fund Followers – Copy the investments of great investment managers

- Industries + Sectors – Target tech, AI, healthcare, and scores of other market sectors

- Just Stocks and Bonds – Great for stock and bond investors

For my investing, I selected the “just stocks and bonds” in a 60% stock and 40% bond allocation.

Over 6,000 Funds and Individual Stocks

M1 is great for do-it-yourselfers, who want to invest on their own!

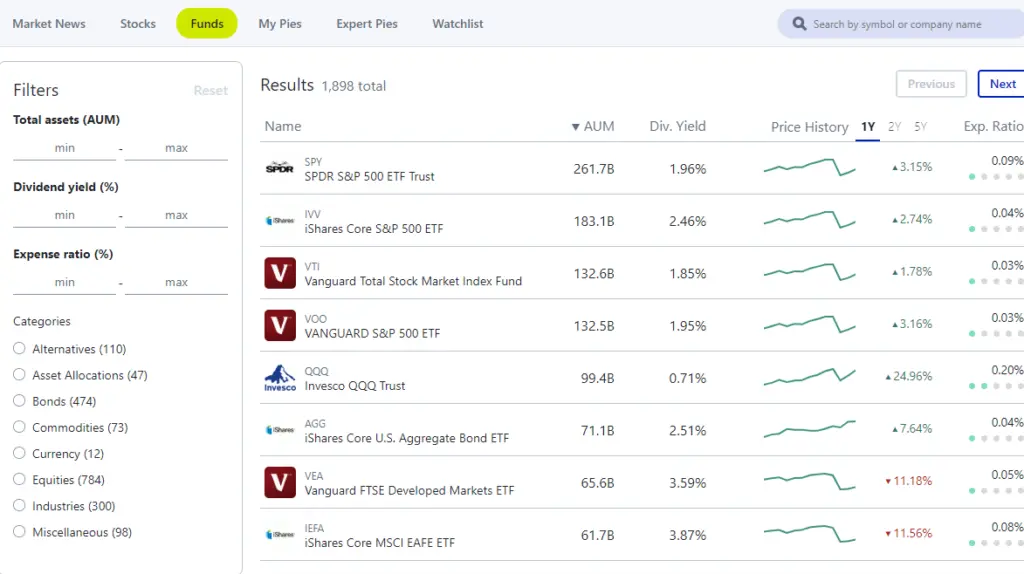

Funds:

There are 2,000 investment funds and a screener to help you choose:

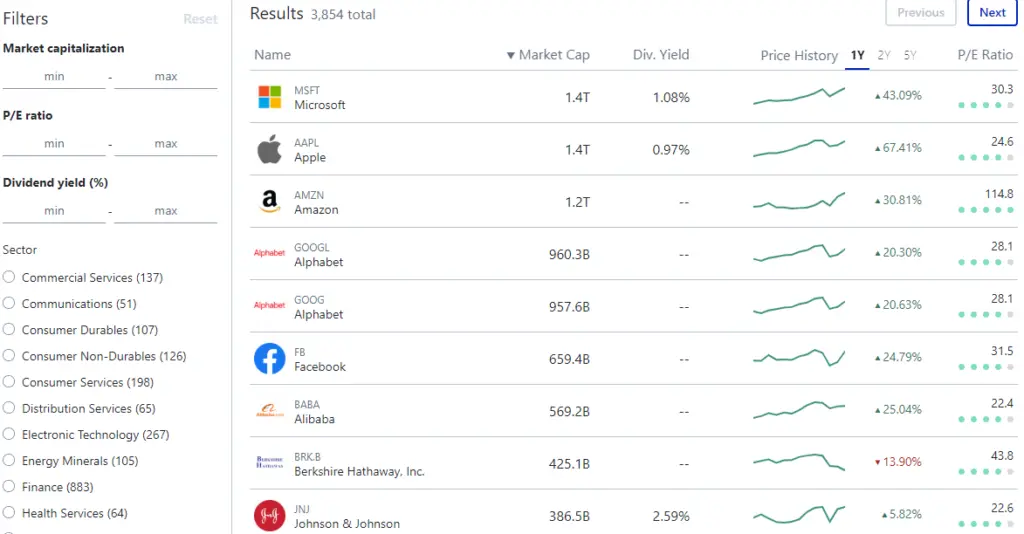

Stocks

For stock pickers, choose from nearly 4,000 stocks.

Use the handy stock screener to narrow down your choice.

Free Investment Management

After you select your investments, M1 makes sure that your allocation stays in line with your preferences. That’s investment management, that is done for you – for free.

Build a custom portfolio by picking the stocks and ETFs you want and setting target allocations for each security. M1 uses fractional shares and intelligent automation to invest your money according to your target allocations, so you can capture your money’s full potential.

M1 Finance website

Invest now to grow your wealth for your financial future.

I started investing as soon as I began working and have seen the power of long term investment growth.

If you want to grow your wealth for retirement or any medium or long-term goal, then M1 is a great place to start.

Whether you’re an experienced investor or just getting started, M1 offers help choosing the right investments – for you.

Read the complete M1 Finance Review

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.