Finovate showcases the up and comers of the fintech and robo advisory field. Out of the excellent presenters at Finovate 2016, several stood out as being particularly useful for the consumer. Today we’re profiling several unique offerings in the robo-advisory sphere and a new stock social media platform for stock traders. If you missed our coverage yesterday, be sure to visit Finovate 2016 Breaking News for the Latest Fintech Platforms here.

Robo-Advisors for Franchises and P2P Lending

LendingRobot

As an investor and a financial writer, this new platform piqued my interest. Most of you are probably familiar with Lending Club and Prosper, two of the largest peer-to-peer social lending platforms. Simply, investors are able to act as a banker to consumers seeking small loans. Consumers benefit by gaining access to higher returns, and borrowers benefit with a large pool of available cash to fund their loans.

Here’s where LendingRobot comes in – they trade your peer-to-peer account with either Lending Club and/or Prosper, on your behalf:

“LendingRobot vigilantly scans for new loans, and will automatically invest your idle cash or sell your notes at your discretion. You’re always in the loop with our daily summary report.”

The benefits of this unique robo-advisor for peer-to-peer lending is that your cash will be invested and reinvested continuously on your behalf. If you’re interested in liquidating your position, they can help. Their sophisticated algorithms work to better the typical p2p lender returns.

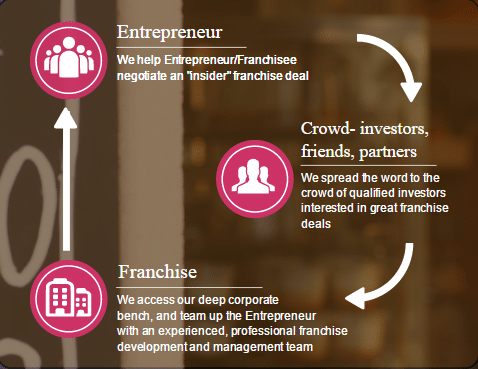

brandCrowder

Would you like to own a franchise? Secret revealed, I’ve considered investing in a franchise, it seems like a great way to own a business with a proven strategy. But, what about all the headaches and management that goes along with managing a growing concern? Not too much fun.

“brandCrowder is a mobile, web-based “equity” crowdfunding platform. The portal provides crowdfunding investments, and syndication services, bringing together franchisee/investors (funders) with franchisor/franchise investments (deals).”

With brandCrowder you can become a part-owner/investor of a franchise-without the day-to-day management headaches.

Social Platform for Stock Traders – SwipeStox

Are you a stock trader? You like the thrill of buying and selling, to beat the market. If you’d like a side of social interaction for your stock trades, you may enjoy SwipeStox, “the ultimate social trading app”.

“Swipe. Copy. Trade. The best trades at your fingertips. Anywhere and anytime.”

Think of SwipeStox as the Facebook for stock trading. But there’s more, you can follow specific traders, see what they buy and sell as well as their results. And, if you like, you can copy their trades.

What’s in it for you? Besides curiosity and community, you have a chance to make some money as well. If others copy your trades, then you get paid. The app is social, fun, and free.

For the entire list of Finovate Spring presenters, visit the site and get introduced to the latest fintech upstarts! Check out Part 1 of our Finovate Breaking News for more coverage.