Motif Investing Has Closed it’s Doors

The robo advisory landscape is competitive and Motif has suspended it’s business and will be transferring all accounts to Folio Investing as of May 20, 2020. Motif was founded roughly a decade ago and focused on thematic investing.

For all existing Motif investors, we recommend that you consider switching to M1 Finance. Or answer 4 quick questions from our Robo-Advisor Selection Wizard to help you choose the best investment manager for you.

Motif Platform Recap

Motif Investing is a low-cost way to create your own portfolio and get actionable investment ideas.

As we wrote in “Robo-Advisor vs. DIY – Motif Is For All Investors” you can become your own mutual fund manager for a low fee.

Motif portfolios are collections of 30 stocks, which investors can buy pre-made or design themselves. DIY investors choose from scores of Motif’s representing market sectors, such as tech or healthcare, to investment approaches such as momentum or values based strategies.

[toc]

For investors who want a pre-designed Motif, there are many options in addition to their socially responsible investment offerings. Investors can buy a target date Motif or high dividend stock or bond Motif. There are even portfolios centered around political themes. Essentialy, investors can choose from hundreds of pre-designed Motifs.

Not one to stagnate, Motif created its own version of a robo-advisor platform. Here’s an introduction to the Motif Robo-Advisor, with or without impact investing.

Motif Impact Investing Portfolios – Robo-Advisor + Sustainable Investing

Motif Impact Investing Portfolios

“Motif Impact identifies best-in-class companies that meet an investor’s personal as well as financial criteria.” ~Motif.com

Research shows that investors want to align their investing with their hearts. Motif, like M1 Finance, solves the impact investing problem for investors with three Impact Portfolio options.

First, Motif’s Impact Portfolios start with five asset class Motifs made up of individual securities and American Depository Receipts (ADRs) listed on U.S. exchanges:

- U.S. Stocks

- Developed Markets Stocks

- Emerging Markets Stocks

- Real Estate Stocks

- Commodities Stocks

Each of the initial asset-based Motifs are designed to approximate their related underlying indexes. Now, if you’re unconcerned about investing in accord with your values, then you can choose the default asset class portfolios.

Also, the initial portfolios include two bond Motifs:

- U.S. Bonds

- International Bonds

Create Your Sustainable Motif Impact Portfolio

For investors striving to invest with their hearts, don’t worry, it’s easy to craft your Motif Impact Portfolio based upon your values. Motif analyzed and categorized each stock based upon its Environmental, Social and Corporate Governance (ESG) impact. So, investors have several choices when creating their Motif Impact Investment Portfolios.

The sign-up process for Motif’s Impact Investing Robo-Advisor Portfolios is simple:

- Choose an investing goal: retirement, college, home purchase, greater wealth, or “something else.”

- Choose a time horizon for your investments, including your target financial goal: “In ___ years, I hope to save $___.”

- Choose your risk tolerance for the investment: low, medium, or high.

- Choose your impact preferences on the next screen. If you prefer, you can invest in the default investment classes without the nod to impact investing.

The Motif Impact Categories

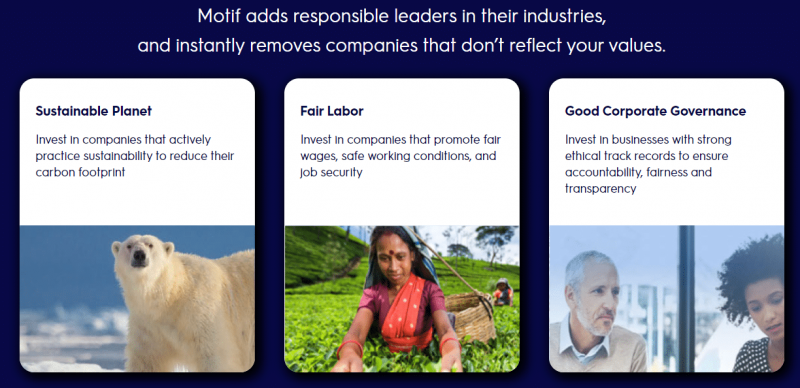

Each default asset class also has a companion ESG portfolio, that includes the companies scoring the highest in a particular ESG category:

- Sustainable Planet-This category focuses on a company’s carbon emissions and product carbon footprint. The Sustainable Planet versions of the basic asset class portfolios includes companies with the lowest carbon footprints.

- Fair Labor-This category rates companies on how well they treat their employees based upon labor management, health, safety and supply chain labor standards. Companies in this Motif are ranked to treat their employees and affiliated workers well.

- Good Corporate Governance Behavior-Companies are judged based on business ethics, fraud, corruption and financial systems. The companies with high corporate behavior scores remain in this Motif.

Scenario: Julie is worried about climate change and wants her investments to reflect companies that practice high environmental standards.

Here’s how the Impact portfolio might work for Julie, as she incorporates the Sustainable Planet Motif:

First Julie selects her investment goal and time horizon. The stock portion of her portfolio would consist of recommended percentages of U.S., developed markets international, emerging markets international, real estate and commodities stocks. Instead of choosing the default asset classes for her personal investment portfolio, Julie chooses the Sustainable Planet version of the default Motifs.

Bonus: What is the Ultimate Goal of a Robo-Advisor?

The Sustainable Planet Version of an asset class includes only companies with good scores in the carbon emissions/sustainability categories. This gives Julie broad diversification while bowing to her principles. The robo-advisor does this in real time, showing investors a screen that adds and removes companies based on the impact category right before your eyes.

Investors concerned about human rights would choose the Good Corporate Behavior Impact Portfolios. Those seeking firms with the fairest labor practices would invest in the Fair Labor Impact choice.

The Motif Investment Impact Portfolios own individual stocks, not ETFs like other platforms. This allows more customization.

Additionally, the trading algorithm is set up to minimize taxable trades.

Motif Review – Impact Investing Robo-Advisor Features

Similar to most other robo-advisors, all Motif Impact Portfolios are updated quarterly back to the investors preferred asset allocation. Investors set their own “drift threshold,” which defaults to 5%; when the portfolio drifts away from this percentage, then it is rebalanced back to your preferred asset mix.

The initial asset allocation percentages vary in the amounts apportioned to stocks versus bonds. More conservative investors hold smaller percentages of stock investments and greater percentages of bond type investments. Conversely, the more aggressive investors own greater amounts of stock asset classes with a fewer percent of their overall portfolio in bond investments.

The Motif robo-advisor algorithm rebalances your investments quarterly or when the asset percentages deviate more than 5% from your preferred mix.

Rebalancing means that stocks and bonds are bought and sold so that percentages invested in each category reflect the investors initial asset allocation.

Motif’s Customizable Investing Fees – Free Next Day Trading

Like many robo-advisors, Motif Impact Portfolios come with an account management fee of 0.25% AUM. This fee includes fund management and rebalancing. The Betterment robo-advisor also includes impact investing for a low-management fee.

Following are other types of fees on the Motif investing platform.

Motif Trading – Individual Stock and ETF Trading Fees

Motif is appealing because the company has transparent pricing. As of April 2019, Motif offers free Next Market Open trading on single stocks and ETFs, or real-time trading for $4.95. That means if you’re willing to wait until tomorrow for the trade you make to be placed, you pay no commissions.

Auto-invest Recurring Trading is available for $4.95 per trade, with a $250 minimum investment amount. Investors set the frequency for trades, with options ranging from biweekly trades to quarterly ones.

Motif Trading Fees

Investors can also make larger changes to their Motifs, including buying, selling, rebalancing, or otherwise customizing their Motifs for $9.95 for Next Market Open trading, or $19.95 for Real-time trading.

And if you’re investing in the Professional Motif Portfolios, next day market trades are free, and real time trades are $9.95.

Motif Blue

For $19.95 per month, owners of Motif investment accounts have access to more trading opportunities and other features:

- 3 commission-free real-time trades

- 5 commission-free next market open trades

- Commission-free trades with Impact Investing Portfolio

- Early notification on IPOs

- All stock quotes are real-time on all pages, not just trade pages

Motif Impact Investing Automated Portfolios Review – Pros and Cons

Pros

The impact portfolios are a transparent way to participate in socially conscious or impact investing.

You directly own the stocks within your Motif impact investment portfolio. This cuts your costs, as ETFs typically charge small fund management fees, while individual stocks do not.

Tax aware investing, keeps taxes under control.

Motif’s fee structure is transparent as well. Flat fees mean investors know what to expect.

Cons

If an investor has more than one interest in sustainable investing, it’s unclear how she might put that into play. It appears that she can only choose one of the impact portfolio choices.

In sum, there’s a lot to like about the Motif Impact portfolios including auto rebalancing, the opportunity to own individual stocks, as well as low and transparent fees. If you’re looking for a robo-advisor that respects your values, then Motif Impact Portfolios might be for you.

Related: