Blooom News – Blooom is closing it’s doors to retail investors

Blooom has closed it’s retail investment arm. The company software was sold to Morgan Stanley. Your money will remain in it’s existing account. There will be no changes to your assets, only that they will not be managed by Blooom anymore. Consider Retirable for a low cost retirement investment manager with cash flow options and financial planners.

Learn how your retirement plan can earn more money in this Blooom 401k Review (IRAs too).

Want to make your retirement account work harder and potentially earn more money for you? Then, delve into this Blooom Review and find out how this investment robo-advisor might be the way to lower fees and increase retirement account investment returns.

Blooom Inc. was founded by Chris Costello and Randy AufDerHeide, who wanted to lower fees and improve performance for your retirement accounts. Initially, Blooom 401k manager was designed just for your workplace retirement account. As the company grew and evolved the firm added 403(b), TSP, and IRA accounts to their 401k management.

Knowing what’s in your 401(k) and investing it correctly is hard. So is understanding the retirement account fees that you’re paying. That’s where bloom shines. It only takes 5 minutes for Blooom to evaluate your retirement account – for FREE. If you decide to hire the Blooom investment manager, the fees are reasonable.

Blooom Inc. even offers access to financial advisors, for your finance related questions. And your money question doesn’t need to relate to your 401(k)!

Consider Blooom your retirement account investment manager to yield the best available nvestment choices for you – invested in low fee funds.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Blooom Review

-

Fees

(4.75)

-

Investment Choices

(4.9)

-

Ease of Use

(5)

-

Tool & Resources

(4.8)

Summary

Best for:

- New to intermediate investors.

- Anyone who wants to optimize their retirement account.

Pros

- Financial advisor access

- Affordable Fees

- Free retirement portfolio review

Cons

- Asset allocation tool doesn’t account for external accounts

Blooom is different! Blooom does only one type of investment management – manages your retirement 401(k), 403(b), TSP, and IRA accounts.

You keep your account where it is*, with the employer, and receive retirement account management for a reasonable annual price,

Blooom asset management optimizes your account to potentially minimize fees and maintain the best diversification for you.

Get the features, pros and cons in this Blooom robo-advisor review. With fair and transparent fees and sound investment management, there’s a lot to like about Blooom’s retirement account manager.

Features at a Glance

Blooom Review – Is This Robo-Advisor Right for You?

If you have a retirement account, you can benefit from the FREE retirement account analysis. Unless you enjoy digging in, reviewing your asset allocation, comparing the fees for your available fund choices and periodically rebalancing your 401(k), you will likely benefit from Blooom.

Blooom is ideal for the novice or intermediate investor who wants the best returns and the lowest fee investments in his or her retirement account.

Blooom is good if your retirement accounts are your primary investment accounts. The investment manager does a good job of diversification. If you have many other investment accounts, the Blooom model might not work as well for you. In that case you might want a robo-advisor that considers all of your accounts like Wealthfront or Betterment.

The low management fees makes Blooom difficult pass up. And if you want to make any changes or adjustments to your account on your own, you’re always free to do so.

What Differentiates Blooom Investment Robo-Advisor from its Competitors?

Blooom manages only your retirement accounts.

In fact, Blooom has no direct competitors with the exception of Betterment’s 401k plan for employers.

Blooom provides professional investment management to anyone with a workplace retirement account or IRA account*. The firm is laser focused on helping you build your retirement nest egg possible by optimizing investments available to you within your retirement account.

Blooom gives you a FREE retirement account analysis.

I had my retirement account analyzed in minutes, for free and you can too. Just click below.

I enjoyed the speedy 401(k) investor questionnaire and the results of my 401(k) account analysis.

Fees – How Much Does Blooom Cost?

Blooom offers three levels, each with specific features and services.

| Features | Personalized Portfolio | Advisor Access | Financial Consulting | |

| Yearly Fee | $120 | $245 | $395 | |

| Plan Research | X | X | x | |

| Personalized Fund Recommendations | X | X | X | |

| Investment Management | X | X | X | |

| Unlimited Retirement Accounts | X | X | X | |

| You’re in Control- you place trades in account | X | X | X | |

| Trade Assist- Blooom places trades for you | X | X | ||

| Advisor Access– through chat or email | X | X | ||

| Withdrawal Alerts | X | X | ||

| Annual Advisor Consultation – 30 min. phone or video | X |

Blooom Features Explained

Plan Research

- Researches funds in your plan.

Personalized Fund Recommendations

- Funds match your risk tolerance

- Creates a diversified portfolio

- Minimizes fees

Investment Management

- Notifications and portfolio rebalancing – keep investments on track with your preferred risk level.

Withdrawal Alerts

- Receive a text message if a withdrawal from your account takes place.

Advisor Access

- Ask a financial advisor your investment and money related questions through chat or email.

Withdrawal Alerts

- Get notified when withdrawals are made.

Annual Advisor Consult

- Individual Financial Advisor 30-minute video or phone consultation.

How Does Blooom Work?

- Sign up in minutes by answering a few questions and creating your Blooom profile.

- Link your retirement account through the secure platform.

- Blooom analyzes your current investments and fees for FREE.

- Using your answers to the questionnaire and best practices investment management, Blooom crafts the right investment mix for you, based on your age, retirement date, risk tolerance, and funds available in your retirement account.

- Finally, after signing up, Blooom manages your account to keep fees low and the diversification appropriate for you.

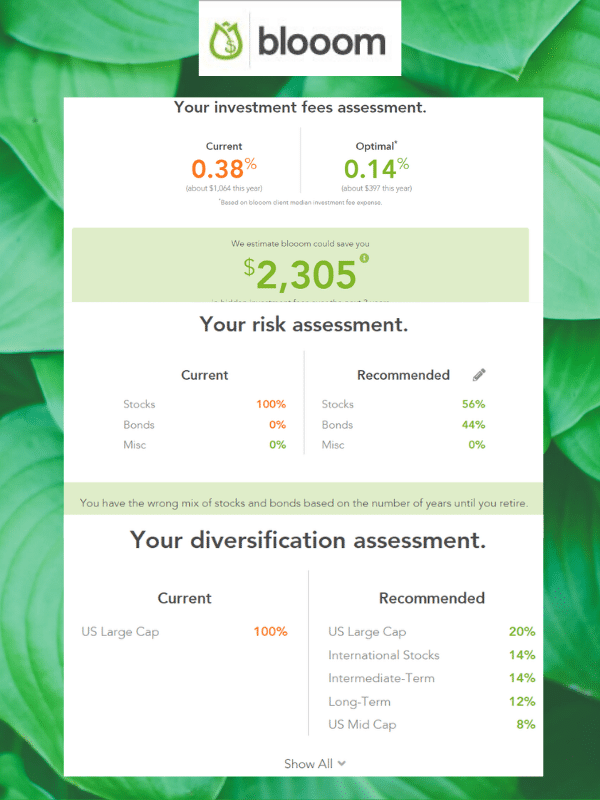

My retirement account analysis is shown in the image above. You’ll also understand your approximate portfolio value at retirement, with three distinct scenarios.

If you have other non-retirement accounts that Blooom doesn’t access, your asset allocation recommendations won’t include those investments.

Blooom recommended a more diversified portfolio form me, but I have 100% stocks in my retirement account by design. That’s because I have other accounts with more diversified assets that contribute to my 62% stock vs 38% fixed asset allocation.

It’s worth a few minutes to try the FREE retirement portofolio analysis at blooom.

Is Blooom Safe?

Blooom is a fiduciary investment advisor. This means that the company and its employees are required by law to act in your best interest, not theirs.

Their website is protected by top level security including:

- 256-Bit Encryption to ensure that your data remains private.

- Bank-level security.

- Secure servers.

- Third party verification. (They sent my cell phone a code, before I could login.)

Blooom Robo-Advisor Review – Drill Down

Retirement account investment manager Blooom manages your funds for the appropriate diversification and low fees within your plan. Blooom strives for diversification based upon the number of years until your retirement and your personal risk preference.

The Blooom diversification model considers the following asset classes:

Stock Asset Classes:

- US large cap

- US mid cap

- US small cap

- International developed market

- International emerging market

- Real estate

- Commodities

- Other stock asset classes

Fixed/Bond Asset Classes:

- Corporate

- Treasury

- International Developed Market

- Emerging Market

- Treasury Inflation Protected

- High yield

- Money market

- Stable value

- Other

Before committing to the Blooom service, click below to try a free retirement account analysis.

Blooom Retirement Account Management

Blooom regularly monitors and rebalances your account. Bloom uses technology and humans to maintain your investment account. So, the automated algorithm does the heavy lifting while licensed financial advisors occasionally check to ensure your account is balanced appropriately.

The Blooom account optimization is available at the Standard and Unlimited levels.

Free Blooom Robo-Advisor Sign-up Process

1. Create a Blooom account with your email and a password.

2. Answer a few questions regarding:

- Your name, birth date, and expected retirement date.

- Your existing financial accounts.

- Your investing knowledge and understanding.

- Your comfort with risk. The questions delve into how comfortable you’ll be with the ups and downs (or volatility) of your account value.

Next, you’re presented with a suggested asset allocation or mix between stocks (more risky) and bonds (less risky).

3. Link your 401(k), 403(b), TSP or IRA accounts.

After completing the sign up steps and reviewing the feedback on your asset allocation, fees, diversification, sign up and “become a member”.

4. Add your payment details to the secure site.

You can change your asset allocation whenever you desire.

Account Minimum

There is no account minimum.

Account Types

Workplace Retirement Account Management

Blooom manages various types of workplace retirement and IRA accounts.

Blooom manages the following workplace retirement accounts:

- 401k

- 403b

- 401a

- 457

- TSP

IRA Account Management

Blooom manages various types of IRA accounts that hare held at Fidelity or Vanguard. If you have an account at another financial institution, you can transfer it to Fidelity or Vanguard for investment management.

Blooom manages these types of IRA accounts:

- Traditional IRA

- Roth IRA

- SEP IRA

- Nondeductible IRA

- Spousal IRA

- Simple IRA

- Self-directed IRA

Blooom manages IRA accounts at Fidelity, Vanguard and Schwab. If your IRA is another firm, you can transfer it to Blooom to receive account management. SigFig and Blackrock’s Future Advisor both manage your investment accounts, including IRAs while they remain at their existing brokerage firm.

Financial Advisor Access

Blooom Offers Financial Advice for Your Money Questions

Are you considering buying a dog, or a house or paying off debt? Ask your Blooom financial advisor how that decision will impact your finances. Your financial advisor can respond to a number of your finance-related questions.

Both the Advisor Access and Financial Advisors accounts offer human financial advisor access.

The Advisor Access Plan allows email and chat communication with a financial advisor.

The Financial Consulting Plan also offers chat and email communications and an annual one-half hour phone or video chat with a financial advisor. You can discuss any financially-related topic, not just items related to your Blooom account.

Blooom Robo-Advisor Review Pros and Cons

Pros

- Free retirement account analysist.

- Fees are low, especially for larger accounts.

- The sign up is fast.

- Access to a financial advisor at the Advisor Access and Financial Advisors levels. Betterment also offers low cost financial planning packages to customers and the public.

- There’s no long term commitment and you’re not moving your assets*, so it’s easy to give Blooom a test drive.

- Blooom investment selections and asset mix are based upon sound investing practice.

Cons

- Blooom isn’t great if you have many investment accounts. When creating your asset allocation, Blooom’s account analysis doesn’t take into consideration assets outside your workplace retirement account. This can lead to an unbalanced asset allocation.

- The initial free account review is general and doesn’t factor in the actual funds and their fee structure offered in your plan. Thus their recommendations and overview are not specifically targeted to your particular situation.

- For smaller account sizes, the annual fee represents a greater percent of AUM (assets under management) than for larger accounts.

- No app at present.

- No week-end customers service.

Blooom Review Wrap Up – Is Blooom Legit?

Blooom’s DIFY or do-it-for-you retirement investment account management is a well-needed service for the the 90 million 401(k) and other workplace retirement account holders. In the most recent report, January 2021, claims that Blooom manages more than $5 billion.

Since Blooom is a registered investment advisor and fiduciary with top level security and a tested product, we can say with confidence that Blooom is legit.

For new through intermediate investors, we recommend Blooom for retirement account management. Advanced investors with several retirement accounts might prefer another robo-advisor like SigFig or FutureAdvisor who also allow you to leave your investments in their existing accounts.

With Blooom, you can work to maximize your retirement account returns for a few bucks per month. That could potentially lead to additional spendable dollars in retirement.

What have you got to lose? Click here and let Blooom give you a FREE retirement account analysis.

Related

- M1 Finance Roth IRA Review

- Wells Fargo Intuitive Investor Review

- Morgan Stanley Access Investing Review

- Rebalance IRA Review

- Betterment vs Acorns Review

*IRA accounts will be managed when in a Fidelity, Schwab, Td Ameritrade or Vanguard IRA account. According to a company representative, “we offer full management at Fidelity, just as we would a 401k if they use Fidelity. We also offer IRA service to Vanguard, TD Ameritrade, and Charles Schwab, but for those they’d get a custom recommendation to implement on their own but we wouldn’t trade on their behalf.

If your IRA is with another financial institution, you can transfer it to Fidelity for Blooom to manage.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable