The Betterment robo-advisor checks all the boxes.

I don’t have an account with Betterment and am not being paid to write this review. See more reviews at the iOS App Store and Google Play Store

You may have heard of Betterment. It’s one of the original robo-advisors and still considered one of the most innovative. You’ve probably seen a lot of Betterment reviews. This one is for you if you’re looking for a comprehensive exploration of the Betterment platform, without actually signing up.

You’ll learn everything you need to make an educated decision about whether to sign up for Betterment or not. You’ll learn about Betterment’s features, pros, cons, fees, returns, whether Betterment is safe and more.

[toc]

*Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Betterment Review

Name: Betterment Review

Description: Betterment is one of the oldest and most respected digital investment managers.

-

Fees

(5)

-

Investment Choices

(5)

-

Ease of Use

(4.5)

-

Tool & Resources

(4.5)

Summary

Betterment is one of our favorite robo-advisors for beginners to advanced investors. Best for:

- Investors seeking goal-based planning

- Sound investment strategy

- Financial advisor access, for additional fee

Pros

- No account minimum ($10 to invest) and low fees

- Diverse investments including smart beta and ESG portfolios

- Cash management

Cons

- No individual stocks

- No real estate funds (REITs)

As a former portfolio manager and university investing instructor, I go beyond the surface to provide an honest appraisal of the advantages and disadvantages of Betterment and arm you with the information to answer the question: “Should I sign up for Betterment?

What is Betterment?

Betterment, launched in 2010 and is one of the earliest digital investment managers, created to compete with human financial advisors. Betterment offers all digital investment management or human financial advisor access, for added fees. A robo-advisor uses computer algorithms to manage your investments. Betterment provides a simple, well-supported, low cost strategy to invest your money in line with financial best practices, and so much more.

Currently, Betterment is the largest independent robo-advisor as ranked by assets under management (AUM).

Betterment Digital offers online computerized investment advice. For investors seeking access to human advisors, Betterment Premium includes access to financial advisors, for an added fee. And, if you’re seeking occasional financial advisor help, they provide several low-fee a la carte financial advisory packages.

The Betterment platform strives to maximize your investment returns at every risk level. That means, if you’re a conservative investor, the Betterment robo-advisor can help you grow your investments while assuming only the level of risk you’re comfortable with.

Betterment provides the cornerstone of smart investing management:

- Diversification

- Automated rebalancing

- Tax-loss harvesting

- Lower fees

And then Betterment adds on extras such as:

- Human financial planners and packages – for added fee

- Impact, socially responsible investing

- Smart beta strategies

- Income only portfolios

- Innovative technology portfolio

- Crypto currency portfolios

Betterment Fees and Features Summary

| Overview | Goals-based digital investment manager with access to financial advisors, for low fees. |

| Minimum Investment Amount | Betterment Digital - $0.00 ($10 to invest) Betterment Premium - $100,000 |

| Fee Structure | Digital-0.25% AUM for accounts worth $20K or more (or with $250/month auto deposit) $4 per month AUM less than $20,000 Premium-0.40% AUM Crypto-1% AUM Cash-No Fee |

| Top Features | Digital and hybrid investment management (with financial advisors). SRI, income, smart beta and Crypto. |

| Contact & Investing Advice | Phone week days and email. |

| Investment Funds | Low fee exchange traded funds from diverse asset classes. Crypto portfolios. |

| Accounts Available | Single and joint taxable brokerage. Roth, Traditional, Rollover and SEP IRA. Trust. |

| Promotions and Website | Free account management special promotion. |

You’ll Benefit from Betterment If You’re Looking for:

- An investment approach that is supported by “years of research and Nobel Prize-winning Modern Portfolio Theory”.

- An investment approach that minimizes taxes.

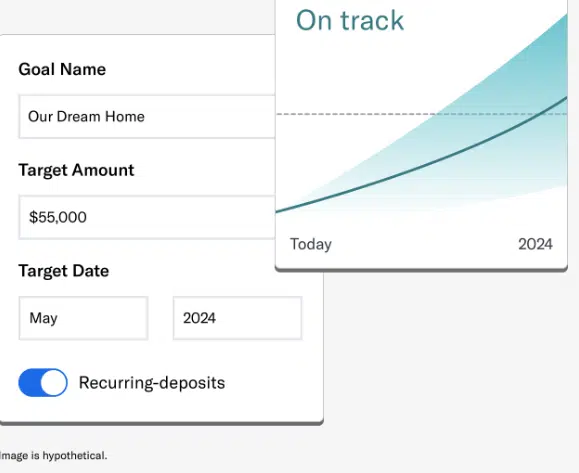

- Top-notch goal setting investment options.

- An opportunity to select a socially responsible portfolio that aligns with your values, uses a smart beta strategy or provides an income stream in retirement.

- Access to human financial advisors, for additional fee.

- High yield cash management and banking, through partner banks.

How Does Betterment Work? Features

Rebalancing

This may be the one universal trait of all robo-advisors. When you first sign up, you answer a few questions about your investment goals and risk level. Based upon your answers, your given a tentative list of investments in certain proportions. This is called your asset allocation.

Rebalancing helps temper the ups and downs of your investment values.

The asset allocation remains constant, until your situation changes or until you decide to change it. Typically, younger investors own more stock funds and a smaller percentage of bond funds. And, older or more conservative investors own greater percentages of bonds and lesser amounts of stocks.

Robo-Advisor Selection Wizard – 4 Question Quiz to Help you Choose a Robo-Advisor

Betterment periodically reviews your investment percentages in each category and rebalances, or sell those funds that have surpassed your allocated amount and buys more of those that have lagged your desired percentage.

Tax Smart Investing

Betterment focuses on keeping taxes low, in both taxable and retirement accounts. They place assets in accounts that will minimize tax payments.

Betterment offers tax-loss harvesting for taxable accounts.

When an investment loses value, Betterment might sell it to offset the increase in taxes from investment gains. This strategy might lower your overall tax bill.

Betterment Retirement Planning

Retirement is one of the top reasons to invest. Start investing $5,000 per year (less than $14 per day) at age 22. If you earn an average 8% average annual return, then at age 62, you’ll have nearly $1.3 million. Of course, this is simply an estimate, there are no guarantees regarding future investment returns. Betterment doesn’t make a one-size-fits all retirement plan, but incorporates your zip code, Social Security and how much to save to meet your future aspirations.

Betterment has a strategy to help you plan for retirement and receive an income stream, once you retire.

- Use Betterment retirement tools to calculate how much money you’ll need in retirement, and how much you need to save and invest to get there.

- The Betterment retirement guide tools will tell you how much to save, which accounts to prioritize, incorporate external accounts to give you a clear path to meeting your retirement goals.

- As life evolves, Betterment helps you update your retirement plan.

- The optional tax coordination helps you save more on taxes too.

The Betterment planning tools help you minimize the fear that you’ll outlive your money, with future projections based on your financial situation.

Betterment retirement planning features answers questions such as:

- Am I saving enough for retirement?

- When can I retire?

- What will my retirement look like if I don’t boost my savings?

- What are the financial implications of moving to a different place for retirement?

- Are there better ways to invest for retirement?

Betterment Checking and Betterment Cash Reserve

The Betterment Checking and Cash Reserve, through partner banks, helps to make Betterment a complete financial management platform.

All banking services are provided through partner banks.

Betterment Checking Features

No-fee checking account and tap-to-pay Betterment Visa Debit Card can make your banking seamless and affordable.

Check out the Betterment Checking Features:

- ATM and foreign fees reimbursed.

- FDIC insured up to $250,000

- Tap-to-pay contactless Visa debit card

- Zero fees

- Mobile app with check deposit

Betterment Cash Reserve Features

The Betterment Cash Reserve account offers high yield cash management, with zero fees. The interest rate will change according to current market rates. Your cash reserve funds are held in program banks that are associated with Betterment.

Check out the Betterment Cash Reserve Features:

- High yield (interest rate) cash account

- Access to cash within 1-2 business days

- No limit on withdrawals

- No minimum balane required

- No fees

- FDIC insurance covering up to $1,000,000 through the Betterment’s program banks.

The current Betterment cash reserve interest rate is 4.50% APY.** The rate will vary, based upon market interest rates.

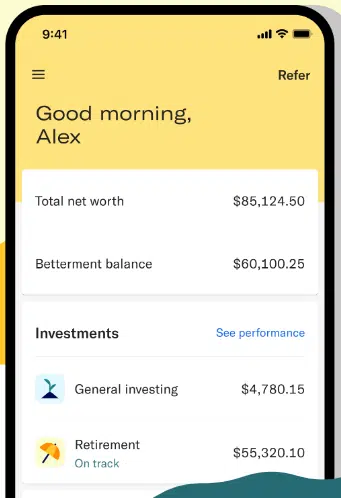

Betterment App

The Betterment app is available for both android and iOS platforms. Not only does the app help you manage your financs, but focuses on your life goals as well. The app matches up well with the desktop platform and receives solid customer reviews.

Betterment app features include:

- Any new goal can be added to your account with the app.

- You can move money efficiently in the app.

- You have the same account performance data on the app as on the web browser.

Betterment is committed to conually improving the app based upon users feedback.

Should I Sign up for Betterment?

The Betterment sign up is fast and easy. Answer a few questions related to your goals, financial status, time frame and risk tolerance and you’ll be up and running in a few minutes. The responses to your initial questions lead to a recommended investment portfolio, which you can change at will. You can also set up multiple portfolios to suit various goals.

Betterment Account Types

If you’re not sure what type of account to open, Betterment offers a brief description of each type.

- Individual and joint taxable

- Traditional, Roth, Rollover IRA

- SEP IRA

- Trust account

- Cash Reserve

- Checking account

Bonus; M1 Finance VS. Betterment – Which Robo-Advisor is Best For Me?

Betterment Fees, Minimums and Features

Fees

Digital:

- $4.00 per month for accounts worth less than $20,000

- 0.25% AUM for accounts worth more than $20,000 or with $250 per month auto deposit.

Premium: 0.40% AUM

Crypto:

- 1.0% AUM per month – plus trading fees for Digital clients

- 1.15% AUM – plus trading for Premium clients

Financial Advice Packages

Prices range from $299 to $399 per financial advice package

Cash accounts (through partner banks) do not charge management fees.

Betterment Digital Minimum and Features

No minimum investment is required, although you’ll need at least $10 to get started.

Betterment Digital Features:

- Low-cost, globally diversified investment portfolios. Your portfolio is designed to maximize your returns at every risk level.

- Automatic rebalancing, back to your preferred percentages invested in each fund.

- Tax-loss harvesting strategies for taxable accounts. Holistic view of all of your accounts, even those outside of Betterment.

- Various investment styles – Core, SRI, Smart Beta, Income and Technology-focused.

Betterment Premium Minimum and Features

Betterment Premium requires a $100,000 minimum investment.

Betterment premium includes:

- All the benefits of Betterment Digital.

- Human financial advice on all investments (for an added fee), within and outside of Betterment accounts. That includes managing 401(k)s, real estate, stocks and more.

- Unlimited access to Certified Financial Planners or CFP® credentialed financial advisors for all life planning decisions that impact your money; retirement, having a child, getting married and more.

Betterment Crypto Portfolios

Betterment Crypto portfolios have no minimum.

The Crypto management fee is 1.0% of AUM.

Betterment Crypto Portfolios

- Universe – Diversified portfolio of 24 digital coins, anchored with 50% invested in Bitcoin and Ethereum.

- Sustainable – Diverse portfolio of digital coins working to reduce energy consumption and lower carbon emissions, with a 42% allocation to Ethereum.

- Metaverse – Diverse portfolio of digital coins strivng to build a network of digital experiences, anchored by a 45% exposure to Bitcoin and Ethereum.

- Decentralized Finance – DeFi coins focused on financial services that bypass the traditional banking system, with 41% exposure to Bitcoin and Ethereum.

Betterment a la Carte Financial Planning Packages

Betterment financial advice packages are designed for specific investor’s goals, for an added fee. You can choose a listed package or create your own.

The Getting Started package is great for newbies who want a quick assessment of their account.

The Financial Checkup package is designed for a thorough investment portfolio review.

The College Planning package is for parents who want help navigating the college planning (and payment) process.

And the marriage planning and retirement planning are as their names suggest.

The Crypto package will help guide you in the navigating the digital currency world.

* The one-time fees for these financial planning meetings range from $299 to $399.

Exchange Traded Fund (ETF) Fees

There is an additional layer of fees, which is always charged by an exchange-traded or mutual fund, at Betterment or anywhere else. Your money is invested in up to 13 diversified exchange traded mutual funds and each one has its own rock-bottom management fee ranging from .09% to .17%. This equates to a fund management average of approximately 15 cents for every $100 you invest.

What Happens When You Transfer Money Into the Betterment Platform?

You won’t start investing until you actually transfer money into the account. Once you set up your transfer, your work is done, and Betterment does the rest.

Your funds are transferred into ‘Betterment Securities’ a regulated investment broker-dealer. The ETFs are bought for your account based upon your previously selected broad asset class categories; stock and bond funds. Betterment takes care of all of the buying and selling for you. The fund choices are well diversified globally. You may change your asset allocation choice at any time.

We suggest setting up an automatic transfer into Betterment so that you will continue to add money regularly into your investment account.

Is Betterment Safe?

Safety means many things. There’s safety from fraud and malfeasance, and then there’s safety from price swings. Since Betterment is a registered investment advisor (RIA), your money is governed by the laws of the Securities and Exchange Commission as well as the Financial Industry Regulatory Authority (FINRA). Your money is as safe as it would be in any other regulated investment account.

Betterment offers the strongest available browser encryption, secure servers, and two-factor authentication. Betterment runs frequent hacker checks and audits of software and systems. All Betterment emails are secure and address you by name. And all Betterment employees pass a criminal background check.

If you’re looking for safety from price swings, that’s a different type of safety. All financial assets will go up and down in price. That’s the price you pay for an opportunity for greater long-term returns. Only bank money market accounts and certificates of deposits lack up and down price swings. But those types of investments don’t offer much long-term growth potential.

For emergency cash or short term needs, the Betterment Cash options will keep your money stable and available for short and intermediate term goals. Cash and securities are protected with FDIC insurance and governed by the SPIC.

Betterment Investment Funds and Strategies

There’s debate surrounding whether more or fewer funds are best. My belief is that as long as your investment portfolio invests in U.S. and international stocks, several types of bonds then your investments are sufficiently diversified. If you own at least four funds from the previous categories, you’ll have sufficient diversification, any more is personal preference.

Betterment’s Core offerings include the following stock and bond funds:

Betterment Stock/Equity Funds

The first ticker represents the main fund. The remaining are used for tax-loss harvesting to avoid the wash sale rule. The following are the funds included in the Core Portfolio. For views of the other portfolio options, visit the Betterment website and click on the “Investing” menu tab.

| Sector | Ticker |

|---|---|

| U.S. Total Stock Market | VTI, SCHB, ITOT |

| U. S. Large-Cap Value | IVTV. SCHV, IVE |

| U.S. Mid-Cap Value | VOE, IWS, IJJ |

| U. S. Small-Cap Value | VBR, IWN, IJS |

| International -Developed Market | VEA, SCHF, IEFA |

| International - Emerging Market | VWO, IEMG, SCHE |

Betterment Bonds/Fixed Income Funds

The first ticker represents the main fund. The remaining are used for tax-loss harvesting to avoid the wash sale rule.

| Sector | Ticker |

|---|---|

| U.S. High Quality Bnds | AGG, BND |

| U.S. Municipal Bonds | MUB, TFI |

| U.S. Inflation-Protected Bonds | VTIP |

| U.S. High-YIeld Corporate Bonds | HYLB, JNK, HYG |

| U.S. Short-Term Treasury Bonds | SHV |

| US Short-Term Investment-Grade Bonds | NEAR |

| International Developed Market Bonds | BNDX |

| International Emerging Market Bonds | EMB, VWOB, PCY |

I like the stock and bond fund choices offered by Betterment and actually own several in my own portfolio (VTI, VBR, and VWO). Betterment’s decision to include “value” funds is based on research that has shown value stocks outperform the market over long periods of time (although not always).

The variety of international and municipal bonds are also good selections for extra diversification.

Betterment’s Socially Responsible Investing, Smart Beta, Income Stream Portfolios

Betterment portfolio choices include several ways to customize your investment strategy.

SRI Impact Portfolios

The Betterment SRI portfolios include 3 portfolios for various types of sustainable investors:

- Broad Impact – Offers increased exposure to companies that rank highly on all ESG or environment, socially responsible, and good governance factors.

- Climate Impact – Increased exposure to companies with lower carbon emissions, focused on green projects and divest from holders of fossil fuel reserves.

- Social Impact – Focus on companies working towards minority empowerment and gender diversity.

Smart Beta Portfolios

Goldman Sachs Smart Beta Portfolios invest in strategies with the possibility of outperforming the broad market, over long periods of time. They will include at least one of these factors:

- Undervalued companies

- History of long term profitability

- Steady returns

- Upward price momentum

– This approach is good for investors who want to attempt to beat the market and are willing to take on a bit higher risk. Read more about Smart Beta Investing in this article.

Target Income Portfolios

* Income Portfolios – These bond portfolios are designed for conservative investors seeking cash flow only, not capital appreciation. The portfolios are completely comprised of bonds, with no allocation to stock ETFs.

Innovative Technology Portfolios

This diversified portfolio, in line with your risk tolerance, adds in the SPDR SPDR Kensho New Economies ETF (KOMP). This is a volatile ETF comprised of small and midcap companies projected to transform the future economy and society. The stock ETF spans the clean energy, robots, virtual reality, blockchain and nanotechnology sectors.

If you choose the Innovative Technology Portfolio, the KOMP ETF will be included along with additional U.S. and international stock and bond ETFs. You can view any portfolio on the Betterment website by navigating to the “Investing” menu tab. This portfolio is suitable for investors who want added exposure to new economy companies.

These investment portfolios can be selected in addition to or instead of your traditional Betterment goal-based portfolio.

Betterment Returns

Betterment’s performance will depend upon which portfolio you’re invested it and the time period of the investments.

For example, if you are in a moderate portfolio with roughly 60% stock funds and 40% bond funds, the overall return of your portfolio will mirror the returns of the underlying ETFs, less a small deduction for the management fee.

We cannot predict your returns because when you invest, the funds within your portfolio, and the amount of time invested within each fund, will drive your performance returns.

Betterment’s performance benefits from the low fee ETFs, along with the low 0.25% management fee. Although, most popular robo-advisors also invest in ETFs with low expense ratios.

When choosing a digital investment manager understand that low fee robo-advisors invest more of your money into the markets, than those with higher fees.

Betterment Customer Service

Customer service is an important feature in today’s digital world. Betterment offers weekday phone customer service, Monday through Thursday, 9am to 6pm ET and Friday 9am to 4pm.

The virtual chatbot is available 24/7.

The FAQ and Help Center cover most of the common questions and serves as a solid resource.

Betterment Pros and Cons

Advantages

One of the things we like are the Betterment fees. They are in the lower tier of the robo-advisor universe. To further support the Betterment fee structure, there is extensive research demonstrating that lower fees lead to greater returns because more of your money is going into the investment markets and less is taken out in administration costs.

The Betterment strategy takes the guesswork out of investing. It is based on the Nobel Prize winning modern portfolio theory which maximizes your returns, for any risk tolerance level. In other words, after you choose your asset allocation, you get the best returns for the lowest volatility.

There are no account minimums, which makes Betterment perfect for the investing beginner. But even experienced investors with large portfolios will benefit from the researched-based investing method along with the low fees.

Betterment optimizes the bond mix for tax-deferred and taxable accounts. In simple language, this means, they work to reduce the taxes you pay on investment income and capital gains, allowing you to keep more of your investment returns. The automated tax-loss harvesting further minimizes taxes and increases overall returns. Betterment claims their tax loss harvesting strategy beats other advisors by about 1 percent.

The access to financial advisors, for reasonable fees – is an affordable way to get human financial advice for a reasonable fee. The a la carte financial planning packages are reasonably priced add ons for help with specific goals.

Betterments Smart Beta and socially responsible funds make this platform attractive to investors seeking to invest with their values or try a different strategy.

The high yield Betterment Cash Reserve (through partner banks) is an important addition for investors with short term goals looking for decent yields that can’t tolerate much volatility in their investment values.

The professionally managed Crypto Portfolios are suitable for a range of digital asset investors.

Disadvantages

For investors looking to buy individual stocks and ETFs, this isn’t the platform for you. If you want a managed portfolio and access to ETFs and stocks, consider M1 Finance.

Betterment doesn’t offer real estate investment trusts (REITs) or other sector funds. They claim their investments are sufficiently diversified. We like the option to invest in real estate for diversification.

Finally, if you already have an existing IRA or brokerage account, you need to liquidate the holdings before transferring the cash into Betterment. According to Betterment, although you may incur tax consequences from selling assets in a non-retirement account, the benefits of investing with Betterment should make up for those losses. Although this factor is true with most robo-advisors except SigFig.

FAQ

Can I trust Betterment?

Betterment is one of the oldest robo-advisors with a large customer base. We expect Betterment to be around for a long time.

Is Betterment good for beginners?

Can I have multiple Betterment accounts?

Is Betterment better than Vanguard?

Vanguard is part of a large investment company. Existing Vanguard customers might prefer to remain with the company.

While Betterment has only one focus – creating the best digital and digital plus human financial advisory product. Betterment is definitely best for small investors due to it’s no minimum investment amount. We also like that all investors can text with financial advisors. Betterment also offers a la carte financial planning sessions, which is great for specific financial questions and planning.

For wealthier investors, Vanguard Personal Advisor Services and Betterment Premium are similar.

Can you lose money at Betterment?

Any investment account has the potential to fall in value, but long term investors typically make money.

Which is the best Betterment Portfolio Strategy?

Is Betterment a Brokerage account?

Betterment Wrap Up

The sound portfolio theory, low fees, and good fund choices make this almost the perfect investment platform.

The addition of financial advisory access for a reasonable fee, smart beta and SRI portfolios is great. The crypto portfolios are designed with several themes and a sensible 1% management fee.

Although other online Betterment reviews suggest this platform might be best for lower net worth investors, we disagree. Any investor seeking low-fee, well-researched investment management should check out Betterment. If you have existing assets in a taxable brokerage account, make sure to investigate the tax implications of switching to Betterment.

One Betterment drawback is its asset allocation assumptions, they might slant towards the aggressive side. We suggest that you look for an online risk tolerance quiz to help you decide the percent invested in stock versus bond funds. Fortunately, you can adjust your asset allocation to suit your preferences.

Even when I was younger, I wasn’t comfortable with allocating more than 60% of my assets into stock investments.

That said, Betterment’s ease of use, no minimum balance requirement, sound investment choices, tax loss harvesting, goal-based objectives make this a good choice for an investor who isn’t interested in managing their own investments.

An important advantage of Betterment is that digital investment platforms give the investor built in discipline so that fear or greed won’t cause you to buy high and sell low.

Betterment Comparison Articles

- Empower vs Betterment

- Betterment vs Ellevest

- Betterment vs Wealthfront vs M1 Finance

- Betterment vs Vanguard vs Wealthsimple

- Betterment vs SoFi Invest

- Betterment vs Fidelity Go

- Betterment vs E*Trade Core Portfolios

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don’t believe is valuable

Methodology

Betterment was reviewed on June 17, 2023 and data and information for this review is from the January 2022 through June 2023 period.

We currently review 31 robo-advisors. All Robo-Advisor Reviews are ranked and rated based upon the entire pool of digital and hybrid investment platforms. The ranking system is not designed to provide favorable or unfavorable responses. The Ranking uses a one through five star system. The four criteria and index to ranking criteria:

- Fees – Robo advisory fees range from free to 1% of AUM. Lower fees receive higher rankings, while higher fees are awarded lower rankings. In general, fees are considered in contrast with other robo-advisors as well as within the sphere of traditional financial advisors.

- Investment Choices – Investment choices range from four funds on up to more than twenty fund choices. Investment choices also span various investment strategy portfolios and access to ETFs and stocks. Robo advisors with greater fund and strategy choices receive higher rankings. Those with fewer options receive lower scores.

- Ease of Use – This category covers the User Experience or UX. Platforms with clear menu items and easy access to the platform features receive higher marks than more obtuse websites and those which are more difficult to navigate.

- Tools and Resources – Platforms with richly populated “Frequently Asked Questions”, Educational articles, Videos, Calculators, and Tools receive the highest marks.

Investors should use the ranking system in conjunction with the written review and their own assessment of the robo advisor’s website to make their own investment management provider decisions.

*Betterment is not a licensed tax advisor. Tax Loss Harvesting+ (TLH+) is not suitable for all investors. Read more at https://www.betterment.com/legal/tax-loss-harvesting and consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature. Investing involves risk. Performance not guaranteed.

**Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. For Cash Reserve (“CR”), Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.